IFES 2012: Crop Insurance – 2012 Performance and Updates for 2013

This is a presentation summary from the 2012 Illinois Farm Economics Summit (IFES) which occurred December 10-14, 2012 at locations across Illinois. Summaries and MP3 podcasts of all presentations will be republished on farmdoc daily. The ‘Presentations’ section of the farmdoc site has PDF presentation slides and MP3 podcasts from all presenters here.

Though final numbers will not be known until early 2013, crop insurance policies resulted in very large indemnity payments over a large region of the Corn Belt for both corn and soybeans for the 2012 crop. Policies that included the harvest price option benefitted significantly from the increased harvest prices (corn = $7.50 and soybeans = $15.39) relative to March projected prices (corn of $5.68 and soybeans of $12.55), and the resulting increased guarantees. Producers without claims benefitted from the higher market prices that accompanied the lower production due to drought. The Risk Management Agency has announced several important changes to available crop insurance programs for the 2013 crop year as well and these will be identified and discussed including substantial changes to group policies, extensions and expansions of the Trend Adjusted APH endorsement, impacts of rerating, and the likely impact of the payouts from this year’s policies.

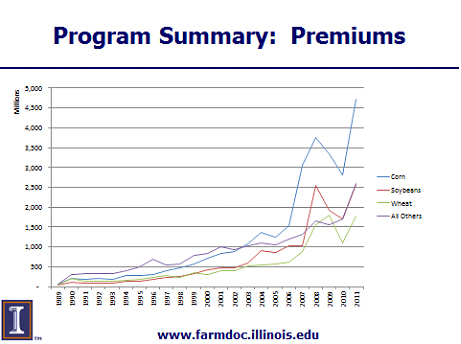

This session will begin with an assessment of the extent and types of coverage utilized by farmers in 2012, and will examine the relative performance of alternative crop insurance products available from RMA. Overall program composition and premium shares continue to move toward corn and soybeans driven largely by higher commodity values.

Expected costs of insurance by product given current market conditions will be examined and compared using the crop insurance decision tool available at the farmdoc website. Impacts of the re-ratings show that the majority of the state will experience lower rates for corn and all the regions of the state will experience lower rate

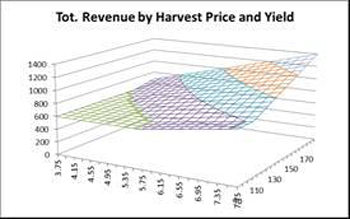

s for soybeans in 2013 despite the losses from the 2012 drought. The impact of higher starting prices and of potentially higher volatility factors will be shown. One impact of the drought is that it appears that projected prices will be relatively high next Spring resulting in high levels of insurable revenue.

The expansion of the Trend Endorsement is explained and documented and integrated into the iFARM crop insurance evaluator (available at the farmdoc website). The simulator can be used to show how the alternative products would be expected to perform in terms of net cost of insurance, frequency of payment, degree of relatedness to revenue, and effectiveness at preventing low revenues for specific farm conditions under possible yield and price outcomes.

Importantly, numerous additional “shallow loss” and supplemental yield, price, and revenue programs are being discussed as part of the farm bill negotiations. The relationship to traditional crop insurance will be discussed along with guidance for evaluating the alternatives that are currently being debated.

Overall, the session should improve your understanding of new programs and features, and help develop an accurate understanding of your own crop insurance alternatives to best manage relevant risks.

The farmdoc crop insurance section contains premium calculators, payment evaluators, and other tools to help farmers evaluate their crop insurance alternatives. Final premium impacts depend on the projected price and volatility factors that will not be final until March 2013.

Additional Resources

- The slides for this presentation can be found at:

- http://www.farmdoc.illinois.edu/presentations/IFES_2012

- Risk Management Agency website:

- http://www.rma.usda.gov/

- farmdoc Crop Insurance Section :

- http://www.farmdoc.illinois.edu/cropins/index.asp

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.