Expected Price Support Payments for Corn and Soybeans

The current farm bill proposals being debated in the Senate and House continue to include price supports in the commodity title while repealing the current system of direct and countercyclical (DCP) payments. More detailed discussions of the modified price support programs – AMP in the Senate, and PLC in the House – were provided in recent posts (here and here). Today, attention is turned towards comparing the expected payments each program might generate for corn and soybean producers.

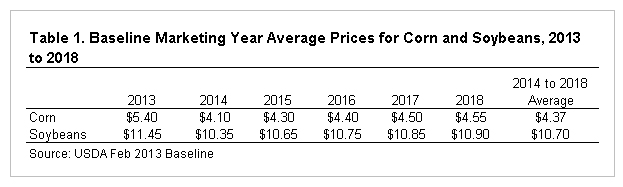

The expected payment levels reported in today’s post rely on actual marketing year average prices from 2008 to 2012 as reported by NASS, and USDA baseline price projections for the 2013 through 2018 marketing years. These baseline prices are provided for corn and soybeans in table 1 below. Over the next farm bill period (2014 to 2018), corn prices are expected to return to the mid $4/bu range, while soybean prices are expected to fall back below $11/bu.

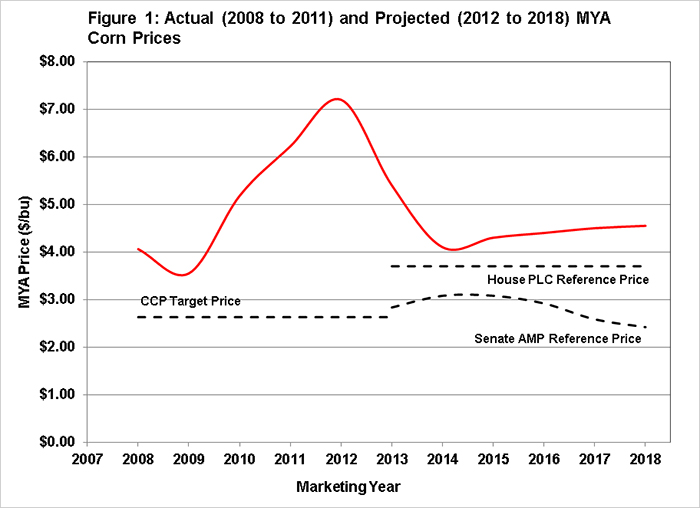

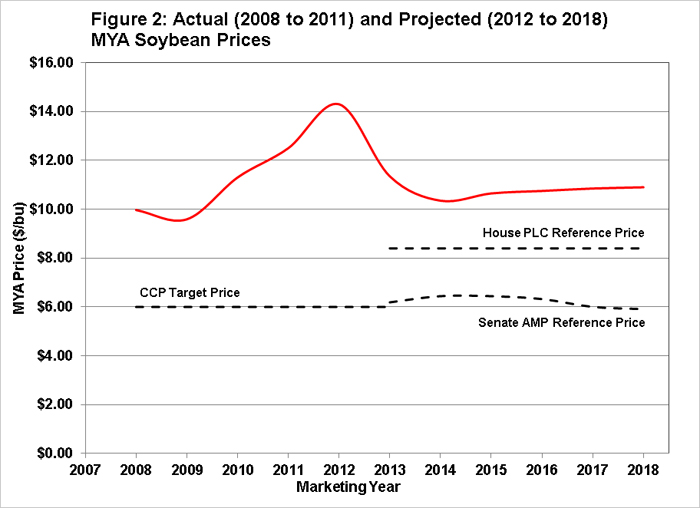

The target price levels upon which current price supports are based equal $2.63/bu for corn and $6.00/bu for soybeans. Producers receive a portion of this target price each year in the form of direct payments – $0.28/bu for corn and $0.44/bu for soybeans. If prices fall below the trigger price (target price less the direct payment rate), producers also receive countercyclical program (CCP) payments. CCP payments reach their limit if prices fall to the commodity’s loan rate ($1.95 for corn, $5.00 for soybeans). DCP payments are tied to a producer’s payment yields and base acreage, both of which are based on historical production.

The AMP and PLC programs would eliminate the fixed portion of the price support system (direct payments), and change the target prices – now referred to as reference prices – for each crop. The PLC program continues the system of legislatively fixed reference prices levels, while AMP would rely on a moving 5-year Olympic average of actual market year prices to set the reference price each year. Based on the price projections in table 1, the reference prices for both corn and soybeans would be above current target price levels throughout the next farm bill period (see figures 1 and 2).

A simple simulation analysis was performed to calculate and compare expected payment levels from current and proposed price support programs. Simulated corn prices were assumed to have a mean (expected price) of $4.37/bushel and a 25% volatility. The expected price for soybeans was set to $10.70 with a 22% volatility. The expected price levels are based on the averages reported in table 1 over the 2014 to 2018 period, and the volatility levels are based on the historical volatility of marketing year average prices for each crop.

Table 2 reports a number of estimates from the price simulations. First, the expected payment levels were calculated for the current DCP program. Each crop would receive its current direct payment rate of $0.28/bu for corn and $0.44/bu for soybeans, thus the likelihood of receiving a payment is 100%. However, given the low trigger prices for countercyclical payments, the likelihood of receiving any CCP program support is virtually zero for both crops. This shows that, given expected price levels and historical volatility, it is extremely unlikely that corn or soybean prices would fall below their CCP trigger levels over the next farm bill period.

The expected payment rate from the Senate AMP program is just over $0.02/bushel for corn, with the likelihood of a payment being triggered of 7.5%. The likelihood that the AMP payment rate would exceed current direct payment support for corn is just 3.4%. In other words, there is a 3.4% chance that corn prices could fall below $2.72/bu (3.00-0.28 = 2.72) over the next farm bill period. Expected AMP payments for soybeans are less than $0.01/bushel with just a 1% probability of occurring. The likelihood that AMP payments for soybeans would be greater than the current direct payment rate is just 0.06%. This would require the soybean price to fall below $5.96/bu (6.40-0.44 = 5.96).

For the House PLC program, expected payment levels increase due to the higher reference price levels for corn and soybeans. The PLC reference price of $3.70 for corn implies an expected payment rate of just over $0.14/bushel, with payments being triggered with a 28.3% probability. A PLC payment for corn greater than $0.28/bu occurs with an 18.3% probability. Expected PLC payments for soybeans, based on an $8.40/bu reference price, would be just over $0.13/bu. PLC would trigger payments for soybeans with a 15.3% probability, and the likelihood that payment levels would be greater than $0.44/bu is 10.4%. For PLC payments to exceed current direct payment rates, corn prices would have to fall below $3.42 (3.70-0.28 = 3.42) and soybean prices would have to drop below $7.96/bu (8.40-0.44 = 7.96).

Summary

The modified price support programs in the Senate and House farm bills eliminate the fixed payment portion (direct payments) of the current DCP programs while increasing price support levels. Both the Senate AMP and House PLC programs lead to reduced expected support levels, but it is possible that prices could fall low enough to generate payments which exceed the current levels of direct payment support for both crops. Thus, while the PLC and AMP programs result in expected savings, the programs do create exposure to potentially larger outlays by raising price support levels.

The estimates reported here are based on specific assumptions regarding expected price levels and volatilities for corn and soybeans. Changes to those assumptions would lead to different estimates.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.