Federal Crop Insurance’s Role in Production Loans

In a previous post, we outlined the link between Federal Crop Insurance (FCI) participation and farm debt use. This post reviews the trends in operating loans and variable cash expenses over the past decade and delves deeper into operating loans and FCI participation.

Data

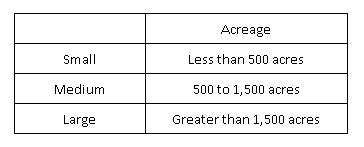

The analysis below is based on data from the USDA’s Agricultural Resource Management Survey (ARMS). We limit our analysis to farms with over $250,000 in sales and farms for which the primary operator’s principal occupation is farming (or “farm businesses” in USDA nomenclature). We further limit our sample to farm businesses that specialized in field crop production, including: wheat, corn, soybeans, sorghum, rice, tobacco, cotton, peanuts, other cash grains, and oilseeds. In other words, we limit our analysis to farms that are most likely to participate in FCI. The survey respondents represent a population of approximately 228,000 farm businesses, and these farms can be further classified into three categories by acreage:

Operating Loans and Variable Cash Expenses

In 2011, roughly 92 percent of operating loan debt was held by field crop farm businesses that participated in FCI. Crop Insurance may specifically play a role in access to operating credit, especially in an environment of increasing farm expenses. Operating credit includes all production loans repaid within the last year, as well as all outstanding production loans.

Operating loans and variable expenses have both increased over the past decade. From 2003 to 2011, variable expenses increased by 124 percent. During the same time period, operating loan debt expanded by 84 percent. While operating loans were not used to cover all of the increasing variable expenses, they appear to have played a key role. Figure 1 also reveals that while total operating loan debt rose throughout the decade, two-thirds of this debt was consistently paid back before the end of the year.

Operating Loans and Federal Crop Insurance

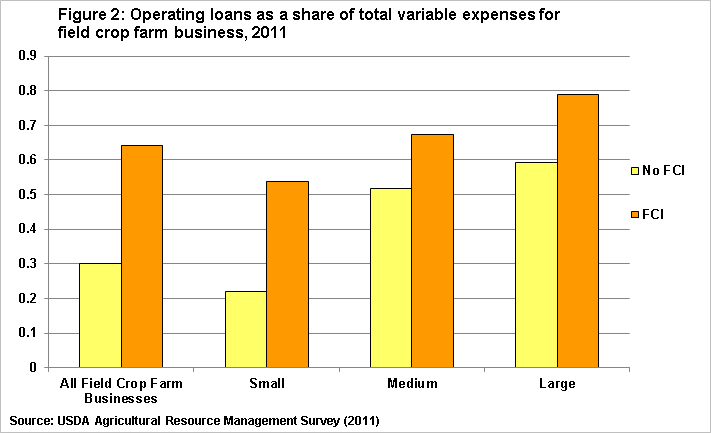

In general, field crop farm businesses have reacted to rising variable expenses by increasing operating loans, but farms that participate in FCI differ from those that do not participate. Given that farms with FCI hold a vast majority of operating debt, it is not surprising that operating debt amounts to more than half of variable expenses for FCI participants. For all field crop businesses with FCI coverage, operating loans equal on average, 64 percent of variables expenses compared to 30 percent for field crop farm businesses that do not have any acres covered by FCI.

The ratio of operating loan debt to variable expenses also varies by farm size. The ratio of operating loans to variable expenses is larger for large farms with and without FCI than it is for smaller farms. Operating loans for large-acreage farms with FCI are 79 percent of variable expenses and 59 percent for large-acreage farms without FCI. For the small acreage class, operating loans are much more important to farms with FCI coverage, comprising 54 percent of variable costs compared to 22 percent for small farms without coverage.

Summary

In an environment of rising variable costs, field crop farm businesses have increased operating loan debt; however the percent of operating loan debt repaid by the end of the year has remained fairly stable. Operating debt use varies based on FCI participation. For farms participating in FCI, operating loans account for a greater share of annual variable expenses. This share rises on average as farm size increases regardless of FCI participation.

The views expressed are those of the authors and should not be attributed to ERS or the USDA.

References

Farm Debt Use by Farms with Crop Insurance http://www.choicesmagazine.org/choices-magazine/theme-articles/current-issues-in-risk-management-and-us-agricultural-policy/farm-debt-use-by-farms-with-crop-insurance

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.