2014 Crop Safety Net Decision: Key Considerations

Overview

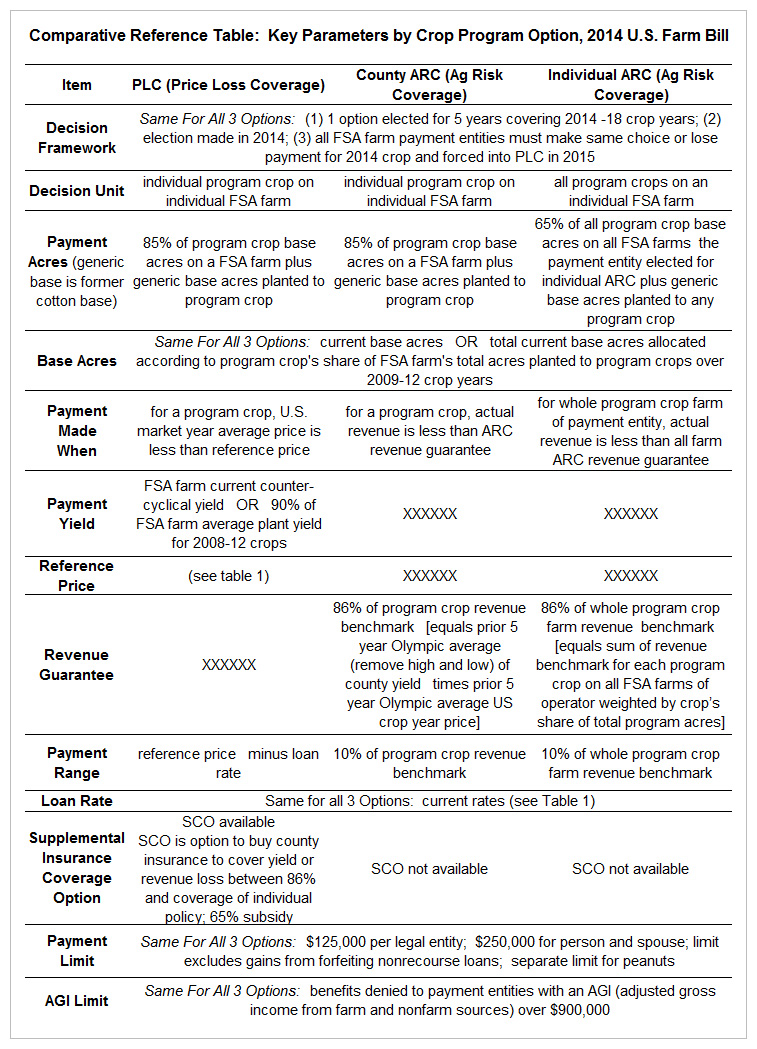

This post builds upon the recent farmdoc posts, “2014 Farm Bill Farm Safety Net: Summary and Brief Thoughts” by Carl Zulauf (available here) and “Evaluating Commodity Program Choices in the New Farm Bill” by Jonathan Coppess (available here). The focus is considerations in choosing among the three crop safety net options: (1) Price Loss Coverage (PLC) – a target price program; (2) county Agricultural Risk Coverage (ARC) – a county revenue program, and (3) individual ARC – an individual farm revenue program. A reference table at the end of this article contains a brief, comparative list of key program parameters for each option.

Considerations

- The decision, to be made in 2014, covers 5 crop years, 2014-18. It is not a one year decision.

- Payments are made on historical base acres, not current planted acres.

- Operators can keep the current distribution of base acres among program crops or update the distribution to reflect the distribution of acres planted to program crops over 2008-12. The distribution closer to the distribution of expected 2014-18 planted acres will reduce the chance a crop’s revenue will be less than the cost of production due to potential government payments.

- Table 1 presents key prices for the crop safety net decision, including the U.S. loan rate, PLC reference target price, and current estimate of the U.S. 2013 crop year price,. An estimate of the implied ARC price also is provided for the 2014-2018 crop years. The estimate assumes the current expected price for the 2013 crop year continues through the 2018 crop year. The 2013 price is the midpoint of the price range reported in the February 2014 World Agricultural Supply and Demand Estimates (WASADE) (see here). The ARC implied price is 86% (ARC’s coverage level) times the Olympic average (removes high and low price) for the five preceding crop years.

- Note, ARC is a revenue program. Thus, ARC’s implied price is only a rough, simple indicator of potential payments. Above normal yields reduce the chance of ARC payments, hence ARC’s implied price. Below normal yields increase the chance of payments, hence ARC’s implied price.

- In Table 1, the relationship between the PLC reference price and the estimated ARC implied price for 2014-18 differs notably by program crop. This difference suggests payment entities may choose different programs for different crops, a feature allowed in PLC and county ARC but not in individual ARC. Thus, operators may want to consider diversification of program choice as a risk management strategy.

- Expectations about prices over the 2014-18 crop years will likely be an important consideration. Expectation that market price will stay above the PLC reference price in most years will likely lead to an initial look at ARC. In contrast, expectation that market price will be below the PLC reference price in most years will likely lead to an initial look at PLC.

- Because 2009 was a low price year and an Olympic average discards the high and low prices, ARC’s implied price will not change much in 2015 compared with 2014. Moreover, ARC’s implied price in 2016 does not change by much and often increases if the 2013 crop year price continues during the 2014 and 2015 crop years (see Table 1). Thus, ARC may provide more risk protection than expected. However, if market prices decline notably in 2014 and 2015 from current levels, ARC’s implied price will decline notably by 2017 and 2018. This discussion underscores the importance of expectations about the path of prices through 2018.

- PLC’s reference price provides a potential floor on a crop’s per unit revenue because PLC makes price deficiency payments if market price is between the reference price and loan rate.

- The last three bullet points suggest that a key decision factor may become the prices for the 2014 crops during the last week of program sign-up.

- A second key decision factor may become the known yield of a 2014 crop harvested before the sign-up deadline as well as expected yields of 2014 crops yet to be harvested.

- Payment limits could be a bigger issue than in the past because risk management programs can make large payments when a risk occurs. Moreover, these years are never known in advance and these payments may be needed due to the low revenue resulting from the occurrence of a risk. It is worth underscoring that peanuts has a separate payment limit but all other program crops have a combined, single limit of $125,000 per payment entity.

- The Supplemental Insurance Coverage Option (SCO) is available only to crops in PLC. The county-based SCO could be an important consideration is this decision, but individual farm insurance is more specific to an individual farm’s risk than is county insurance. Moreover, SCO’s subsidy rate of 65% exceeds the subsidy rate for the commonly-chosen enterprise insurance only at the 85% coverage level (53% subsidy). When combined, these considerations suggest that the use of SCO could be limited to the 80% to 86% range of insurance coverage.

- Individual ARC is in essence a whole program crop farm safety net for all FSA farms that an individual payment entity elects into individual ARC. Because of this feature and because payment will be made on only 65% of base acres, it seems reasonable to speculate that individual ARC may be most attractive for relatively small farms with contiguous acres in a microclimate and soil profile not representative of the county and in areas with variable yields.

Summary

The 2014 farm bill encourages farmers to think strategically about their farms through at least 2018. An important strategic risk management question is the ability of a farm to withstand multiple years of low farm prices and revenue. Managing multiple-year risk involves a set of interrelated considerations, including the expected path of prices and revenue until 2018. The multiple year nature of this assessment points to the value of consulting decision calculators.

This publication is also available at http://aede.osu.edu/publications.

Appendices

[button type="primary" size="small" href="https://farmdocdaily.illinois.edu/pdf/2014_farm_bill_comparative_reference_table.pdf"]

Download a PDF copy of this table

[/button]

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.