Historic and Projected Cash Rents as Percentages of Crop Revenues

Cash rent as a percentage of crop revenue sometimes is used as a benchmark for setting cash rents. These percentages were higher in 2000-2005 than from 2006-2013. If cash rents do not decrease in 2015, projections indicate that 2015 cash rents percentages will be near 2000-2005 levels. At those levels, however, farmers are projected to have losses. Lowering rents to levels where farmers have no losses results in projected cash rent percentages near 2006-2013 levels.

Historic Cash Rents as Percentages of Revenues

Cash rents as percentages of corn crop revenues are shown in Figure 1 for the years from 2000 through 2013 for northern, central, and southern Illinois, with central Illinois further divided into two categories: one for farmland of high-productivity and one for farmland with low productivity. As can be seen in Figure 1, cash rent percentages for the regions generally track each other, with southern Illinois having a lower value than the other three regions in most years. Percentages in southern Illinois are more variable than other regions, because crop revenue is more variable in southern Illinois than in other regions.

Cash rents as percentages of corn revenues averaged higher in the early 2000s than later in the period. Take northern Illinois as an example, cash rent as a percent of corn revenue averaged 37% for the years from 2000 to 2005. From 2006 to 2013, cash rent as a percent of gross revenue averaged 23%. Higher commodity prices were higher from 2006 through 2013, leading to higher crop revenues. Cash rents did not increase as fast as the gross revenue increases, leading to lower cash rents as percentages of crop revenues. Cash rents have been increasing in 2012, 2013, and likely will increase in 2014, leading to increases in cash rents as percentages of corn revenues.

Due to lower crop revenues, cash rents percentages typically are higher for soybeans than for corn. In northern Illinois, crop revenues as percentages of soybean crop revenues averaged 51% from 2000 to 2005 and 32% to 2006 to 2013 (see Table 1).

Cash Rents Percentages and Farmer Returns for 2015

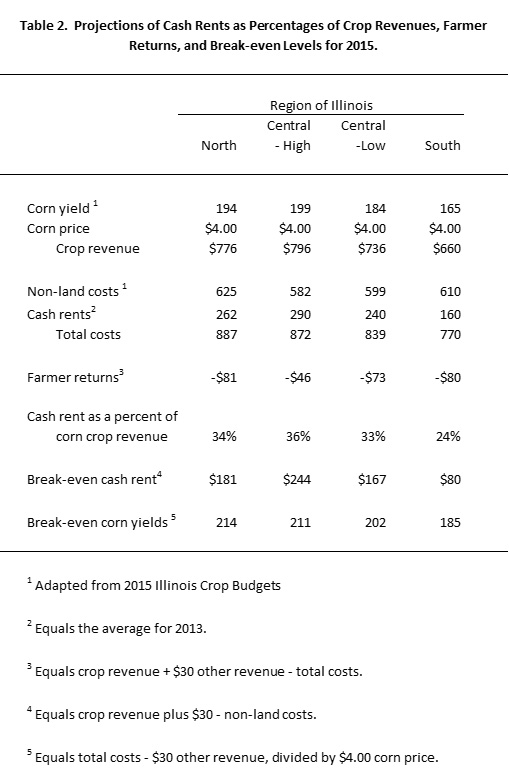

Estimates of 2015 cash rent percentages for corn are shown in Table 2. This table also shows estimates of farmer returns, break-even cash rents, and break-even corn yields. Calculations are given for the four regions, with discussion below given for northern Illinois.

In northern Illinois, the expected corn yield from the 2015 Illinois Crop Budgets (as of August 12, 2014, farmdoc website) is 194 bushels per acre. A projected crop price of $4.00 per bushel gives crop revenue of $776 per acre. The $4.00 corn price is slightly above the price implied by August 11th closing prices of Chicago Mercantile Exchange contracts expiring in 2015 and 2016. Non-land costs are estimated at $625 per acre and the 2013 average cash rent is $262 per acre, giving total costs of $887 per acre. Based these revenues and costs, the farmer return is -$81 per acre ($776 crop revenue + $30 of other revenue – $887 total costs). These large negative numbers illustrate the need for cash rent decreases from 2013 levels (farmdoc daily, July 22, 2014).

For this example, cash rent as a percent of corn revenue is 34%, roughly the same percentage as for the 2000-2005 period. If no decreases in cash rents occur, cash rents percentages are back to the previous level before the commodity price increases occurring in the mid-2000s. These levels, however, results in negative farmer returns, largely because of non-land cost increases that have occurred since 2000 (farmdoc daily, June 3, 2014). Hence, the using percentage averages from 2000-2005 may not be appropriate for setting cash rents in 2015.

For the farmer return to be $0, the cash rent has to decrease to $181 per acre, as indicated on the break-even cash rent rents in Table 2. This is a reduction from the 2013 average cash rent of $81 per acre ($262 cash rent for 2013 – $191 break-even cash rent). Note that this does not include any return for the farmer, suggesting further decreases are needed for positive farmer returns. Moreover, calculations in Table 3 do not include soybean returns. Inclusion of soybeans in a rotation often reduces break-even cash rents. The $181 break-even rent is 23% of crop revenue, near the average of the 2006-2013 time period.

Obviously, corn yields and corn prices for 2014 are not known. A higher corn yield would increase revenue. In northern Illinois, a corn yield above 214 bushels per acre would give a positive farmer return. However, a yield of this level likely would result in large supplies leading to lower corn prices, as is occurring this year.

Summary

Cash rents as percentages of crop revenues are projected to increase in 2015 near average levels for 2000-2005. These levels will result in farmer losses due to higher non-land costs from early 2000 levels. The negative returns point to the need for adjustment downward in costs, including cash rents. The size of negative projected returns also suggests that decreases from average cash rents are needed given current projections of 2015 revenues and costs.

References

Schnitkey, G. "Crop Budgets, Illinois, 2015." Department of Agricultural and Consumer Economics, University of Illinois, July 2014.

Schnitkey, G. "Non-Land Costs for Corn Increased in 2013." farmdoc daily (4):102, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 3, 2014.

Schnitkey, G. "Renegotiating Cash Rents Down for 2015." farmdoc daily (4):136, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 22, 2014.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.