IFES 2014: 2015 Crop and Income Outlook: Conserve Cash Income

This is a presentation summary from the 2014 Illinois Farm Economics Summit (IFES) which occurred December 15-19, 2014 at locations across Illinois. A complete collection of presentations including PowerPoint Slides (PPT), printable summaries (PDF) and interviews are available here.

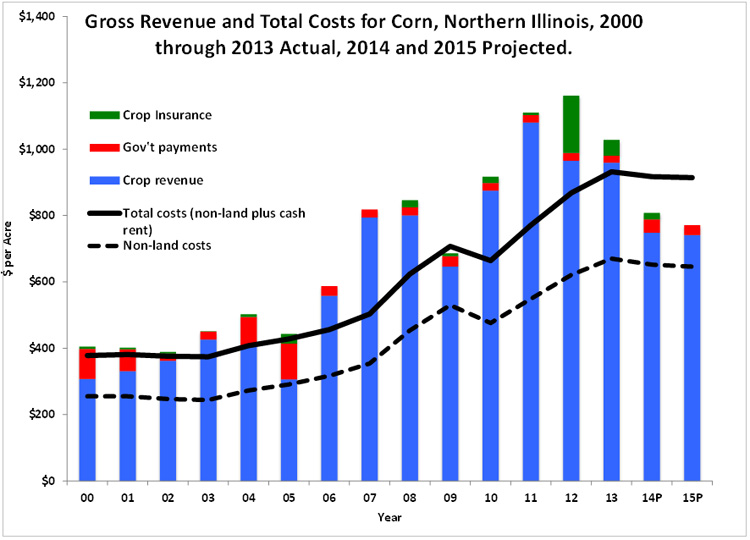

Many Illinois farmers have had exceptionally high yields in 2014. Even given these high yields, gross revenues will be lower in 2014 than in 2010 through 2013 because of lower grain prices. Gross revenues in 2014 are projected to be below total costs. Similarly, 2015 gross revenue is projected to be below 2015 costs.

Crop Revenue Projections

Projections are given for northern Illinois farms using historical data from Illinois Farm Business Farm Management (FBFM). For northern Illinois, a corn yield of 220 bushels per acre is projected for 2014. The 2014 yield is considerably higher than yields in previous years: 177 bushels per acre in 2011, 143 bushels per acre in 2012, and 204 bushels per acre in 2013. Countering high yields are lower commodity prices. A $3.40 corn price is used in 2014 projections, well below averages for 2011 through 2013.

Given a 220 bushels per acre yield and $3.40 corn price, crop revenue is projected at $748 per acre. The $748 per acre revenue is $253 below the $1,001 average for the years from 2011 through 2013.

The 2015 projected yield is 195 bushels per acre, a projection below the exceptional 2014 yields. A $3.80 per bushel corn price is projected for 2015, $.40 higher than the 2014 projected price. These estimates result in crop revenue of $741 per acre, roughly the same level as 2014 crop revenue.

Cost Estimates and Net Incomes

At this point, input prices have not decreased much. Non-land costs for corn were $670 per acre in 2013. Non-land costs are projected at $652 per acre in 2014 and $646 per acre in 2015. Given lower gross revenues and only slightly lower costs, net incomes are projected lower in 2014 and 2015. Grain farms enrolled in Illinois FBFM had an average income of $127,000 per farm in 2013. Net incomes in 2014 are projected much lower, well below $100,000 per farm. At this point, net incomes for 2015 are projected below 2014 average net incomes.

Adjustments

Lower incomes suggest four responses.

- Lower or eliminate capital purchases: Capital purchases exceeded $100 per acre from 2011 through 2013. Now machinery purchases need to be reduced due to lower cash flows.

- Lower fertilizer and seed costs: Taken together, fertilizer and seed costs account for 46% of non-land costs for corn and 34% of non-land costs for soybeans. Over the last several years, these costs have risen dramatically. In central Illinois, fertilizer costs rose from $82 per acre in 2006 to $193 in 2013, an increase of $111 per acre. Seed costs increased from $45 per acre in 2006 to $114 per acre in 2013, an increase of $69 per acre.

As of fall 2014, fertilizer and seed prices had not decreased from 2013 levels. It seems prudent to evaluate whether fertilizer amounts can be lowered and whether lower priced hybrids and varieties can be planted. - Lower cash rents: Average cash rent levels are above those that can be supported by current returns projections. In many cases, cash rents need to be lowered in response to return reductions. If cash rents cannot be lowered, it may be prudent to no longer farm a piece of farmland. If return projections hold, significant losses in 2015 could cause the financial position of farms to deteriorate.

- Reduce other cash flows: There may be a need to reduce other cash flows. In particular, an evaluation of family living expenditures may be needed as family living expenditures have increased in recent years.

Additional Resources

- The slides for this presentation can be found at:

- http://www.farmdoc.illinois.edu/presentations/IFES_2014

- For current farm management information:

- http://www.farmdoc.illinois.edu/manage/index.asp

- Schnitkey, G. “Cash Deficits Projected for Corn in 2014 and 2015.” farmdoc daily (4):206, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 24, 2014.

- Schnitkey, G. “Projected Corn Gross Revenues Down in 2014 and 2015.” farmdoc daily (4):203, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 21, 2014.

- Schnitkey, G. “Revenue and Costs for Corn, Soybeans, Wheat, and Double-Crop Soybeans, Actual for 2007 through 2013, Projected 2014.” Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 2014.

- Schnitkey, G. “Revisions to the 2014 Crop Budgets Indicate Need to Conserve Cash.” farmdoc daily (4):183, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 23, 2014.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.