Extent of Need to Reduce Capital Purchases

Grain farms are projected to have lower farm incomes over the next several years than in 2010, 2011, and 2012. Lower incomes then will require many farmers to lower capital purchases more than they did in 2014.

Historical Capital Purchases

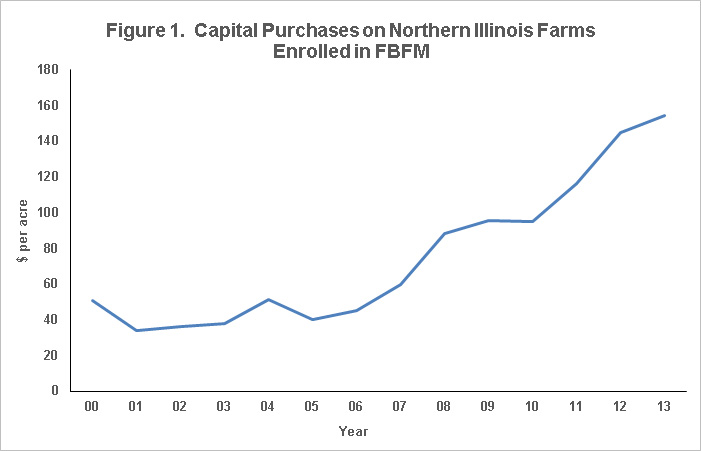

Figure 1 shows average capital purchases on northern Illinois farms enrolled in Illinois Farm Business Farm Management (FBFM). These values are averaged over many grain farms and are stated on a per acre basis. Capital purchases relate to items with lives longer than one-year including machinery, tile and many other drainage improvements, buildings, and grain storage. Per acre values in Figure 1 are for northern Illinois. Similar trends exist in central and southern Illinois.

Between 2000 and 2006, capital purchases were relatively stable averaging $42 per year. Between 2006 and 2013, per acre capital purchases increased reaching a high of $154 per acre in 2013. There are reasons for these increases in capital purchases:

- Net incomes reached higher levels, particularly in 2010, 2011, and 2012. These higher incomes provided funds for capital purchases.

- Higher capital purchases aided in reducing taxable incomes in recent years of high income. Accelerated depreciation methods and section 179 expensing allowed much of the capital purchases to offset taxable income in the years of purchase.

In many cases, the higher capital purchases from 2010 through 2013 were prudent. Farmers had higher incomes and reinvested funds in their farming businesses. This reinvestment came after a relatively long period of lower investments stretch from the late 1990s through 2005. Furthermore, income tax policies encouraged capital purchases.

Capital Purchases in 2015 and 2016

While high levels of capital purchases were prudent in the recent past, capital purchases now need to be lowered on many farms due to lower incomes. Incomes in 2015 are projected to be nearer those of the 2000-05 time period than those for 2010-13 (farmdoc daily December 30, 2014), suggesting capital purchases per acres should average $42 per acre, the typical level from 2000-2005. Returning to capital purchases of $42 per acre would require a $112 per acre reduction from the $154 per acre value in 2013. This $112 reduction would be a 72% decrease in capital purchases.

Farm equipment sales, which make a large share of capital purchases, were reported down in 2014. However, the decrease was not of a 72% magnitude (see here for a discussion of 2014 machinery sale). Therefore, further decreases are likely in 2015.

Historically, reductions in capital purchases often lag reduction in income. This lagged relationship contributed to financial difficulties experienced during the 1980s (Federal Reserve). While a return to the economic difficulties of the 1980s is not likely, there still is a need to reduce capital purchases on many farms.

References

"Analysis & Business Conditions Update: U.S. Tractor Sales 'Normalized' in 2014." Farm Equipment online, posted March 12, 2015, accessed June 22, 2015. http://www.farm-equipment.com/articles/11399-analysis-business-conditions-update

Henderson, J., and N. Kauffman. "Farm Investment and Leverage Cycles: Will This Time be Different?" Economic Review (01612387) 2013 2nd Quarter, p89. https://www.kansascityfed.org/publicat/econrev/pdf/13q2Henderson.pdf

Schnitkey, G. "IFES 2014: 2015 Crop and Income Outlook: Conserve Cash Income." farmdoc daily, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 30, 2014.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.