More on the Competitive Position of Ethanol as an Octane Enhancer

In a farmdoc daily article of February 3, 2016 we analyzed the competitive position of ethanol in gasoline blends as an octane enhancer. This analysis was motivated by the recent rise of ethanol prices above gasoline prices. To assess any changes in the competitive position of ethanol in gasoline blends, the price of the “aromatics,” benzene, toluene, and xylene, were analyzed relative to the price of ethanol. These compounds have octane ratings generally similar to that of ethanol and have a long history as octane enhancers in gasoline blends. Despite the recent increase in ethanol prices relative to gasoline, we found that ethanol prices were still below the price aromatics. However, the gap between the price of aromatics and ethanol has narrowed considerably over time. The purpose of this article is to investigate the breakeven conditions that would drive the gap to zero and eliminate the competitive advantage of ethanol as an octane enhancer.

Analysis

We begin by reviewing the weekly ratio of wholesale ethanol and CBOB gasoline prices at the U.S. Gulf over January 4, 2013 through February 12, 2016. The source for the ethanol and CBOB price data is OPIS. Figure 1 shows that the ratio in the last two weeks has soared above 1.8, a level exceeded only during the throes of the Great Recession in late 2008 and early 2009. This, of course, is not surprising given the continued declines in crude oil and gasoline prices during recent weeks. Figure 2 shows the average aromatics price (average of benzene, toluene, and xylene prices) and ethanol price at the Gulf over January 4, 2013 through February 12, 2016. Bloomberg is the source of the aromatics price data. Despite the soaring ratio between wholesale ethanol and CBOB gasoline prices, ethanol remains cheaper than the average aromatics price. However, Figure 2 indicates that the gap between the two competing sources of octane continues to narrow, reaching $0.30 per gallon in the last two weeks. As Figure 3 demonstrates, the gap was smaller than recent observations only for a very brief period in March 2014 and then again in November-December 2014.

Given the narrowness of the gap between wholesale ethanol and aromatics prices, it is interesting to consider the conditions that would cause the gap to disappear entirely. The first and most obvious possibility is a further decline in the price of crude oil that drives the price of aromatics below the price of ethanol. This can be quantified with the aid of Figure 4, which shows the relationship between spot WTI crude oil prices and the average aromatics price at the Gulf over January 2013 through February 12, 2016. The source for the crude oil prices is the EIA. As expected, the variation in the price of crude oil explains a high proportion, 91.26 percent, of the variation in the average aromatics price. What we want to do is compute the price of crude oil that causes the price of aromatics to equal the price of ethanol. For example, on February 12, 2016 the average price of aromatics was $1.76 per gallon and the price of ethanol was $1.46 per gallon. Assume the price of ethanol is constant and then set y in the regression equation in Figure 4 to $1.46 as follows, 1.46 = 0.034 x + 0.7261. Then solve for x, which is the price of crude oil. This turns out to be $21.58 per barrel. So, based on the relationship shown in Figure 4, the price of crude oil has to drop to $21.58 before the average aromatics price would equal the current price of ethanol. This would be a drop of almost $10 per barrel, or about one-third, from the already depressed price of crude oil.

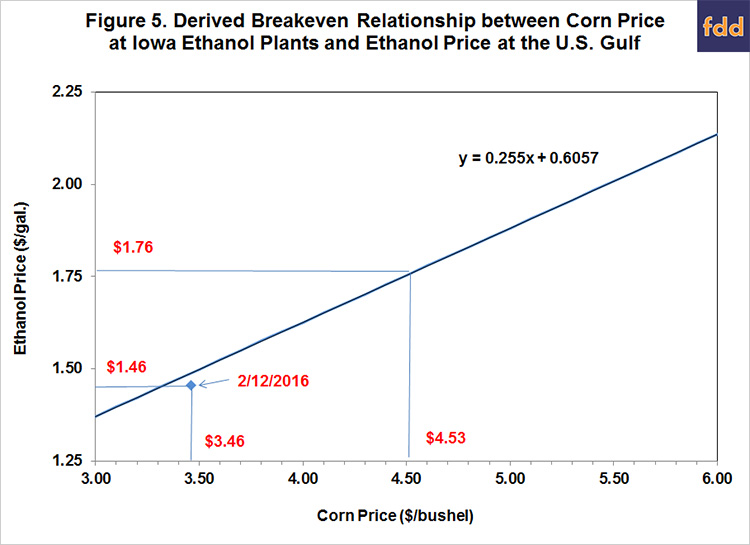

The second way that the gap between the price of aromatics and ethanol could be eliminated is for the price of ethanol to rise to the level of the price of aromatics. In other words, rather than the price of aromatics dropping from $1.76 to $1.46 holding the price of ethanol constant, the price of ethanol could rise from $1.46 to $1.76 holding the price of aromatics constant. We argued in a recent farmdoc daily article (January 13, 2016) that corn prices in the short-run tend to drive ethanol prices when the RFS conventional ethanol mandate exceeds the E10 blend wall, as is currently the case. So, the question is how much does the price of corn have to increase in order to drive the price of ethanol up to the average price of the aromatics. This can be quantified with the relationship shown in Figure 4 between the weekly price of corn at Iowa ethanol plants and the price of ethanol at the Gulf.

The relationship in Figure 4 is based on the representative Iowa ethanol plant model that we have used to track ethanol production profits the last several years (e.g., March 5, 2015; January 6, 2016). In order to derive the relationship, the price of all variable inputs except corn and the price of corn oil are set to the levels observed on February 12, 2016. The DDGS price is assumed to be the same price per pound as the corn price on February 12. Then, profit after all variable and fixed costs is assumed to be zero and the relationship between the price of corn and price of ethanol is derived. Since the plant model is calibrated to Iowa prices, a transportation differential between Iowa and the Gulf of $0.17 per gallon of ethanol is added to the original intercept. Given that a zero-profit condition in imposed, any points above and to the left of the line in Figure 5 represent profits; likewise, points below and to the right of the line represent losses. For perspective, the combination of actual prices for corn and ethanol on February 12, 2016 are shown on the chart. This data point is slightly below the line, indicating small losses for the representative ethanol plant at the present time (about -$0.03 per gallon).

Now, hold the price of aromatics constant and set y in the equation shown in Figure 5 to $1.76 as follows, 1.76 = 0.255 x + 0.6057. Then, solve for x, the price of corn, which turns out to be $4.53 per bushel. So, based on the relationship shown in Figure 5, the price of corn has to rise to $4.53 before the price of ethanol would equal the current average price of the aromatics. This would be an increase of just over $1 per bushel, or about 30 percent. As we noted in our article on February 3, it would likely take a significant production shortfall in the 2016 U.S. corn crop to elicit this type of price increase. Historically, poor summer growing conditions for corn, mainly drought, have occurred about 15 percent of the time.

Implications

The competitive advantage of ethanol as a source of octane in gasoline blends has been eroded considerably by the precipitous drop in crude oil prices. Specifically, the gap between the price of the “aromatics,” benzene, toluene, and xylene, and ethanol has narrowed to about $0.30 per gallon. These compounds have octane ratings generally similar to that of ethanol and have a long history as octane enhancers in gasoline blends. We show that crude oil prices dropping into the low $20s per barrel would drive aromatics prices low enough to eliminate the current gap between aromatics and ethanol prices. Likewise, corn prices increasing to around $4.50 per bushel would drive ethanol prices high enough to eliminate the current gap. These represent the range of market conditions most likely required to erode the current competitive advantage of ethanol as an octane enhancer in gasoline blends. It is important to emphasize that these are only rough estimates of the bounds because refinery blending economics for gasoline are complicated due to the differing array of characteristics of alternative blending components and regulatory requirements to produce “spec” gasoline. As just one example, ethanol has chemical characteristics that may be beneficial, like octane, but others that are detrimental, like vapor pressure. Energy companies have developed sophisticated mathematical refinery models to determine optimal blends of the various gasoline components given prices and technical specifications, and these models are required for a complete analysis of the competitive position of ethanol.

References

Irwin, S. "The Profitability of Ethanol Production in 2015." farmdoc daily (6):3, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 6, 2016.

Irwin, S. "2014 Really Was an Amazing Year for Ethanol Production Profits." farmdoc daily (5):41, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 5, 2015.

Irwin, S. and D. Good. "The Competitive Position of Ethanol as an Octane Enhancer." farmdoc daily (6):22, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 3, 2016.

Irwin, S., and D. Good. "The New Upside-Down Relationship of Ethanol and Gasoline Prices." farmdoc daily (6):8, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 13, 2016.

U. S. Energy Information Administration. "Petroleum & Other Liquids: Spot Prices." Released February 10, 2016, accessed February 17, 2016. https://www.eia.gov/dnav/pet/pet_pri_spt_s1_d.htm

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.