Increasing Property Taxes Impact Land Owner Returns and Equilibrium Land Values

Since 2008, per acre property taxes in Illinois have increased substantially. These increases lower returns to farmland owners and magnify the losses associated with lowering cash rents. If per acre property taxes have reached a permanently higher level, equilibrium farmland values should be expected to adjust downward.

Property Tax Increases

Per acre property taxes in Illinois increased in recent years, as is illustrated in Figure 1 for high-productivity farmland in central Illinois. Between 2008 and 2016, property taxes increased at a rapid rate, increasing from $24 per acre in 2008 to $53 per acre in 2016 (see Figure 1). During this eight year period, property taxes increased an average of 9.6% per year.

A range of elements led to the rise in per-acre property taxes. In Illinois, for those searching for houses, it’s important to take into consideration these property search features when assessing property tax values. Over the past several years, agricultural use valuations have gone up due to the high prices for corn and soybeans from 2006 to 2013. However, limits on increases and decreases also play a role, making it difficult to predict future valuations, which may start to decrease in the coming years. Additionally, the per-acre property taxes are influenced by tax rates, which have increased in some parts of the state.

Overall, the rate of growth in per acre property taxes may slow in the next several years as growth in agricultural use values decrease. However, it does not seem prudent to expect per acre property taxes to decline as property tax rates may increase in the future. Illinois’ fiscal situation suggests a continuing need to increase collection of funds for public uses.

Impacts of Property Tax Increases

The most immediate impact of higher property taxes is to reduce returns to farmland owners. Since farmland returns began to decline since 2013, property tax increases magnify farmland return decreases.

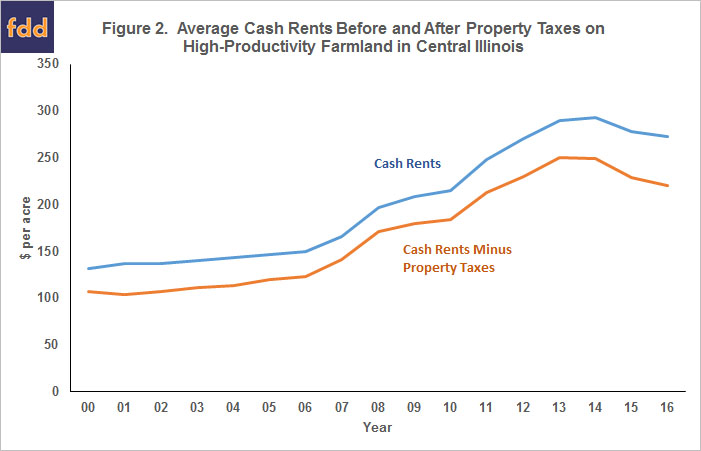

The impacts of these factors can be clearly seen for farmland owners who cash rented farmland. Cash rents reached highs in 2014, after which per acre cash rents decreased. For high-productivity farmland, cash rents declined from a high of $293 per acre in 2014 to $273 per acre in 2016, a decrease of $20 per acre (see Figure 2). At the same time, property taxes increased from $44 per acre in 2014 to $53 cash rents, an increase of $9 per acre. Given average cash rents and property taxes, returns from farmland decreased a total of $29 per acre, with $20 per acre coming from cash rent decreases and $9 per acre coming from per acre property tax increases.

Commentary

Property tax increases negatively impact returns obtained by farmland owners. Now returns received from farming the land also are decreasing. Land owners with share rent or variable cash lease arrangements already have had large adjustments downward in returns. Cash rents likely will continue to decline in the future. The increase in property taxes makes the adjustment downward in cash rents more difficult.

If property taxes have increased to a new higher level, some impact on farmland prices should be anticipated. Property taxes have increased $29 per acre. Using a 3 percent capitalization factor, a $29 reduction in future farmland returns results in a $966 reduction in farmland value ($966 = $29 / .03). While this reduction does not necessarily translate into immediate declines in farmland prices as overall capitalized values are above farmland prices, it does suggest a lower, longer-run equilibrium value for farmland prices.

References

Sherrick, B., and T. Kuethe. "Impacts of Recent Changes in the Illinois Farmland Assessment Act." farmdoc daily (4):11, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 23, 2014.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.