Evaluating Payments from Margin Protection with Harvest Price Option

In this article, historical payments from Margin Protection are estimated and compared to Area Revenue Protection. Both insurance contracts have the harvest price option. The example is for corn in Sangamon County Illinois from 2000 to 2016. Due to limits on cost data, only payments resulting from changes in yields and commodity prices are compared. The example suggests overall payments between Margin Protection and Area Risk Plan likely will be highly correlated but payments in any given year can vary from one another. In this article, we do not consider reductions in Margin Protection payments if purchased along with another insurance product.

Expected Margin Calculation under Margin Protection (MP)

More detail on Margin Protection insurance is provided in two previous farmdoc daily articles (September 8, 2017 and September 12, 2017). In brief, Margin Protection payments are based on an expected margin, which equals:

- Expected revenue – expected costs.

Table 1 shows the calculation of expected margin for a Sangamon County, Illinois corn example. Note that the parameters for this example were taken from the Margin Protection website on September 18th. Discovery periods for prices are over. Thus, prices should be close to final. However, expected yields for 2018 corn were substantially revised on September 14th. In Table 1, the 2018 expected yield for Sangamon County is 197.2 bushels per acre, up by 6.6 bushels from the prior value of 190.6 bushels per acre. A 197.2 versus 190.6 expected yield will have large impacts on guarantees. Expected yields for 2018 are not final and could change from the value used in this article. Note, for some counties, the September 18th revision reduced their estimated 2018 expected yields by a substantial amount.

In the example shown in Table 1, expected revenue is $783 per acre, expected costs are $307 per acre, and the expected margin is $476 per acre. Farmers choose a coverage level from 70% to 95%, in 5% increments. One minus the chosen coverage level is multiplied by the expected revenue and subtracted from expected margin to give a trigger margin A 90% coverage level would result in a trigger margin of $397 per acre ($476 – 783 expected margin x (1 – 0.90 coverage level)). A payment will occur when harvest margin is below the trigger margin.

The same formula is used when calculating the harvest margin but six yields / prices are updated to reflect their value during the final discovery period. The six items that can change are noted in red in Table 1 and include:

- County yield will replace expected yield. County yield will be released by RMA in the spring of 2019 and are the same yields as used by the Area Risk Protection Insurance (APRI) policy.

- Harvest price will replace expected price. The harvest price is the average for the December 2018 Chicago Mercantile Exchange corn contract during the month of October 2018.

- Urea price will be based on CME settlement prices during April 2018 (May contract of UFN),

- DAP price will be based on CME settlement prices during April 2018 (May contract of DFL),

- Diesel price will be based on MYMEX settlement prices during April 2018 (May contract of ULS), and

- Interest rate will be based on CME settlement prices for 30 day Fed fund contract during April 2018 (October contract of FF).

Note that none of these six values are farm yields, farm output prices, or farm input prices.

In the following section, variability in the input prices are illustrated. This then is followed by an example of how yields and corn prices have varied over time.

Input Prices and Costs

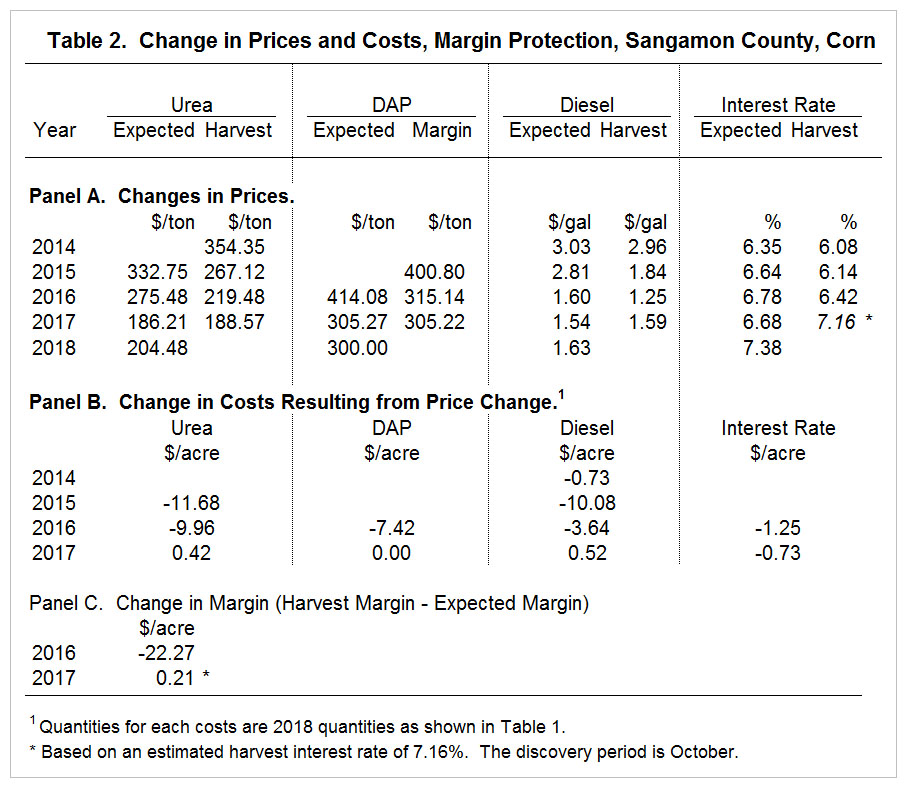

Panel A of Table 2 shows how input prices would have varied from 2014 to 2017. Also listed are 2018 expected prices. Unfortunately, long time series of consistent urea and DAP prices do not exist. Specification of fertilizer contracts have changed over time resulting in inconsistent price series. The urea and DAP contracts that Margin Protection currently uses are thinly traded. Total trades during the discovery period (August 15 to September 14) for the urea contract were 0 in 2014, 15 in 2015, 15 in 2016, and 0 in 2017. No trades have occurred in the DAP contract during the August 15th to September 14th period from 2014 to 2016. When trades do not occur, the exchange has rules for setting settlement prices, which then go into the calculation of expected and final prices for Margin Protection. While unlikely, a concern could be that a few trades could have a dramatic impact on expected or final prices. Price movements could increase or reduce the chances of Margin Protection making payments.

Impact of each price change on the margin is calculated using quantities specified in the margin contract for Sangamon County, Illinois (Panel B of Figure 2). For example, the urea price movements would have resulted in these changes in per acre cost: $11.68 decrease in 2015, $9.96 decrease in 2016, and $0.42 increase in 2017.

Based on changes in all prices, cost per acre decreased by $22.27 in 2016 and by $0.21 in 2017 in Sangamon County (see Panel C of Table 2). A reduction in costs means a larger decline in revenue would have to occur before Margin Protection would make a payment

Overall, one would expect that changes in costs will be relatively small over time. A change of around $30 per acre or less likely will be typical. But in any given year the changes could be larger. Again, cost decreases over the contract period for an input would reduce any Margin Protection insurance payments. Cost increases over the contract period for an input would increase any Margin Protection insurance payments.

The Role of Differences in Corn Price

A historical backcast of Margin Protection with the harvest price option (MP-hpo) are shown for corn in Sangamon County in Table 3. Importantly, these insurance payments are calculated given that prices of costs stay the same. As noted in the previous section, cost decreases would reduce payments and vice versa. MP-hpo payments are shown for 90% and 95% coverage levels. Also shown for comparison purposes are Area Risk Protection (ARP) at the 90% coverage level. The payments in Table 3 are calculated for a 1.0 protection factor for MP-hpo and ARP.

The differences in projected prices used by MP-hpo and ARP impacts payments from the two products. If the MP-hpo projected price is above the ARP projected price, MP-hpo is more likely to make payments than ARP. The opposite is true as well. The MP-hpo projected price for corn is based on settlement prices from August 15th to September 14th while the ARP projected price for corn is based on settlement priced during February. As expected, on average these two prices are close to one another. From 2000 to 2016, the MP-hpo projected price averaged $3.79 per bushel vs. the average ARP projected price of $3.82. However, the difference can be large in a specific year. Projected price was higher for MP-hpo in the following years, resulting in higher simulated payments for MP-hpo:

- 2005: MP-hpo projected price was $2.59 compared to a $2.32 ARP projected price.

- 2009: MP-hpo projected price was $6.10 compared to a $4.04 ARP projected price.

- 2013: MP-hpo projected price was $6.51 compared to a $5.65 ARP projected price.

- 2014: MP-hpo projected price was $5.08 compared to a $4.62 ARP projected price.

The converse also has occurred. Projected price was higher for ARP in the following years, resulting in higher simulated payments for ARP:

- 2000: MP-hpo projected price was $2.48 compared to a $2.51 ARP projected price.

- 2001: MP-hpo projected price was $2.34 compared to a $2.46 ARP projected price.

- 2004: MP-hpo projected price was $2.43 compared to a $2.83 ARP projected price.

- 2008: MP-hpo projected price was $3.11 compared to a $5.40 ARP projected price.

- 2010: MP-hpo projected price was $3.71 compared to a $3.99 ARP projected price.

- 2011: MP-hpo projected price was $4.46 compared to a $6.01 ARP projected price.

Over time, one would expect the impact of the differences due to different price discovery periods to even out. To take advantage of this difference, a farmer would in essence need to be able to profitably trade the price of the crop. In other words, for 2018, the farmer would need to be able to accurately forecast by September 30, 2017 the change in the CME December 2018 corn price between August-September 2017 and February 2018.

Also note that payments will differ between MP-hpo and ARP in years in which the guarantee prices are the same for the two products. This is most likely to occur in years when the harvest price is above the MP-hpo and ARP projected prices. In these cases, guarantee revenue is the same between both products. In those years, ARP payments will be as least as great as the MP-hpo at the same coverage level. This occurs because of differences in payments mechanisms between the two products. Between 2000 and 2016, this situation caused differences in payments in two years:

- 2010: The harvest price was $6.32 and both projected prices were below the harvest price. At the 90% coverage level, ARP had an $87 per acre payment compared to $62 per acre for MP-hpo at the 90% level.

- 2012: The harvest price of $7.50 was above both projected prices. At the 90% coverage level, ARP had a $382 payment at the 90% coverage level compared to a $275 per acre payment for MP-hpo.

From 2000 to 2017, average simulated payments were $50 per acre for ARP at the 90% coverage level, $56 per acre for MP-hpo at the 90% coverage level, and $80 per acre MP-hpo at the 95% coverage level. Again, these do not consider any cost changes that may have occurred during those years. Also note that higher payments from MP are primarily driven by two years: 2009 and 2013. In both of those years, projected price was over $0.80 per bushel higher for MP-hpo than ARP: $2.06 in 2009 ($6.10 MP hpo projected price minus $4.04 ARP projected price) and $0.86 in 2014 ($6.51 MP hpo projected price minus $5.65 ARP price). It is possible that a similar decrease could happen for 2018, but the margin price of $3.79 suggests that a decline of those magnitudes is less likely.

Summary

Over time, payments from ARP and MP-hpo likely will be highly correlated, but could vary notably in any given year. Moreover, changes in expected costs likely will be relatively small in most years. However, in any given year, costs could change significantly thereby impacting MP-hpo payments.

One reason an ARP user may switch to MP-hpo is that its projected price is set earlier than for ARP. As shown above, setting the price earlier will have advantages in some years. However, it is difficult to predict which years that advantage will exist.

This article considers only the case of using Margin Protection as a stand along insurance contract. The case of using Margin Protection in conjunction with a COMBO product was discussed in the September 12 farmdoc daily article.

References

Schnitkey, G. "Margin Protection Insurance." farmdoc daily (7):165, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 8, 2017.

Schnitkey, G., and C. Zulauf. "Should Users of Revenue Protection Add Margin Protection?" farmdoc daily (7):167, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 12, 2017.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.