Financial and Risk Management Decisions for 2019

With planning for next year’s crop underway, this article makes suggestions related to financial and risk management for grain farms. Projections for extremely low income in 2019 set the overall backdrop for these decisions. Suggestions include: 1) building working capital in 2018, 2) forgoing investments in capital items, 3) conducting 2018 tax planning, 4) preparing 2019 cash flows, 5) beginning marketing the 2019 crop, 6) discussing the economic situation with landowners, and 7) considering acreage allocations for 2019.

Income Backdrop

Currently, the most significant factor impacting longer-run income outlook on Midwest grain farms is the trade dispute with China. Events associated with this dispute caused large declines in cash and futures prices for both corn and soybeans (see farmdoc daily, October 11, 2018). Cash corn prices fell from near $3.70 in March to $3.20 in October. Cash soybean price fell from near $10 in March to near $8 in October.

Moreover, projection of prices in the future have declined, particularly for soybeans. Cash fall delivery prices for 2019 are $3.70 for corn and $8.90 for soybeans. The $8.90 fall delivery price for soybeans is about $.80 per bushel lower than average prices farmers received from 2013 through the early part of 2017.

Soybean price declines lower expectations for 2019 net incomes on farms, particularly if the trade dispute continues. Current corn and soybean prices, along with cost increases, suggest extremely low returns for 2019 (farmdoc daily, August 7, 2018). While there are a number of events that could change this outlook (farmdoc daily, October 30, 2018), planning for low 2019 incomes seems prudent.

While 2019 incomes are projected to be low, net incomes in 2018 will be above-average on many grain farms. Higher than average incomes in 2018 results from:

- Market Facilitation Program (MFP) payments (see farmdoc daily, August 28, 2018). Farmers will receive MFP payments for crops produced in 2018. Currently, farmers can receive a “first” payment of $.005 per bushel for corn and $.825 per bushel for soybeans. There is a high chance of a second payments on 2018 production at the same level as the first payments. If both payments are made, MFP payments could add about $50 of income per tillable acre on a typical Illinois farm.

- Exceptional yields (see farmdoc daily, September 5, 2018). State-wide yields are projected by the National Agricultural Statistical Service (NASS) at record levels for 2018. Many farms had exceptional yields.

- Pre-harvest hedging. Many farmers priced grain in the spring prior to the decline in prices (see farmdoc daily, October 11, 2018). Hedging will postpone the impacts of lower prices on income into 2019.

While average incomes will be above-average in 2018, a great deal of variability in incomes will exist. Prices farmers receive will vary based on timing of pricing decisions. There are some areas that did not have exceptional yields and some farmers did not price much of the 2018 crop in the spring. The farmers in these situations will face lower income.

Management Decisions

Given this income backdrop, the following suggestions are made.

Build working capital: The above-average incomes in 2018 should be saved and used to build working capital. Any increase in working capital at the end of 2018 will be useful in offsetting low and negative 2019 incomes.

If possible, obtaining a current ratio of 2.0 and having working capital per acre of over $300 per acre seems prudent (see farmdoc daily, October 23, 2018).

Forgo investments in capital items: Building working capital requires eliminating all but the most necessary capital investments.

Conduct 2019 tax planning: Above-average 2018 incomes and low capital investments could result in large 2018 tax liabilities. Most farmers file taxes on a cash basis. A potential way to lower 2018 tax liabilities is to shift 2018 revenue into 2019 by foregoing sales of crop and by delaying the receipt of MFP payments until 2019. Prepaying 2019 expenses in 2018 could also lower 2018 tax liability.

Shifting more than a usual amount of 2018 tax income into 2019 has a downside in that 2019 taxable incomes could be higher than expected. The outlook for significantly lower incomes in 2019 is due to yields at trend levels, lower prices, and higher costs. If this turns out not to be the case, 2019 tax liabilities could be larger than expected (see farmdoc daily, October 30, 2018, for a discussion of items that could change 2019 outlook).

Prepare a 2019 cash flow: Cash flows for 2019 operating year should be prepared. In preparing these cash flows, use cash bids for fall delivery prices and higher costs (see Revenue and Costs for Illinois Crops, for estimates of cost increases). Current prices for 2019 fall delivery are near $3.70 per bushel for corn and $8.90 per bushel for soybeans.

Two sets of yields should be used in cash flow projections

- Five-year average yields, and

- Approved yields from crop insurance records (the yields that have been trend adjusted).

On many farms, the five-year average yields will be higher than the approved yields by 20 or more bushels per acre for corn and 5 or more bushels per acre for soybeans.

On many farms, the five-year yields will result in negative cash flows and some erosion of working capital. The lower approved yields may result in serious cash shortfalls.

Plans should be made on how to deal with the resulting cash flow from only obtaining the APH approved yields. If enough working capital exists, operating notes can be maintained at current levels. Otherwise, contingency plans that may involve refinancing debt and selling assets need to be considered.

Begin marketing the 2019 crop: Futures prices on Chicago Mercantile Exchange (CME) contracts for fall delivery are near $4.00 per bushel for corn (December contract) and $9.35 per bushel for soybeans (November 2018). Current basis between fall futures contracts and cash delivery prices is large. Current cash prices for fall delivery are near $3.70 for corn and $8.90 for soybeans.

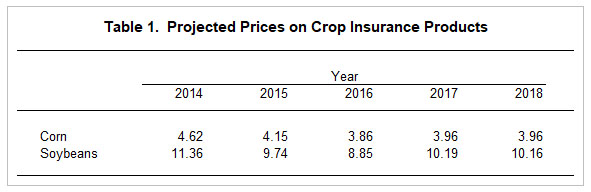

Pricing some of the 2019 crop should begin: Current CME futures prices on the December 2019 contract can be compared to projected prices for crop insurance in recent years. These projected prices are based on settlement prices of December contracts and are comparable to the December 2019 CME price. For corn, current futures prices are near levels that have occurred in recent years. A $4.00 future price for 2019 would be slightly above recent projected prices: $3.86 in 2017, $3.97 for 2017, and $3.96 for 2018. Over the past five years, the projected price averaged $4.11 per bushel.

For soybeans, the current $9.30 price level on the November 2019 contract is well below the projected price levels in recent years. Projected prices for crop insurance from 2014 through 2018 have averaged $10.06. Projected prices were $10.19 in 2017 and $10.16 in 2018.

Pricing soybeans at levels below those in recent years may be physiologically difficult. Many farmers have a hope that the trade dispute with China will end and soybean prices will rebound. This is a real possibility. However, there are possibilities were soybean prices could be lower. One scenario which will result in lower prices is a continuation of the 25% tariff on U.S. soybeans moving into China, good yields in South America, and another excellent yielding year in the United States. There are significant down-side price risks for soybeans, suggesting that a modest level of pricing grain may be prudent.

Discuss the economic situation with landowner: The trade dispute with China has considerably darkened the price outlook for the future. Farmers may have built soybean prices in the high $9 range into longer-run budgets. Until a resolution to the trade dispute occurs, building soybean price expectations around $9 per bushels seems prudent (see farmdoc daily, August 2, 2018 for more of a discussion).

Many landowners may wish to maintain cash rental arrangements. Preparing the landowner for a possible decline is warranted. Use of variable cash leases in this situation seems appropriate.

Consider 2019 allocations to corn and soybeans: Budgets for 2019 likely will indicate that corn will be more profitable than soybeans in 2019. This may not suggest shifting acres, particularly for those farms that have a well-established rotation. If switching is being considered, hedging more than a usual amount of corn production may be warranted. If there are large shifts from corn to soybeans, corn prices could decrease.

Summary

The above management responses are defensive and are built on an expectation of longer-run lower prices caused by a continuing trade disputes with China. In addition, cost increases play a role in the management suggestions. Obviously, expectation of low incomes can turn out to be incorrect for a variety of reasons. Still, conserving cash flow now seems to have little downside for most farmers if 2019 incomes turn out to be better than expected.

References

Schnitkey, G. and K. Swanson. "What Could Change the 2019 Corn and Soybean Return Outlook?" farmdoc daily (8):200, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 30, 2018.

Schnitkey, G. and K. Swanson. "Incidence of Financial Stress on Illinois Grain Farms." farmdoc daily (8):196, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 23, 2018.

Swanson, K., G. Schnitkey, and J. Coppess. "Reviewing Prices and Market Facilitation Payments." farmdoc daily (8):188, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 11, 2018.

Schnitkey, G. "Exceptional 2018 Corn and Soybean Yields and Budgeting for 2019." farmdoc daily (8):165, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 5, 2018.

Schnitkey, G., J. Coppess, N. Paulson, K. Swanson and C. Zulauf. "Market Facilitation Program: Impacts and Initial Analysis." farmdoc daily (8):161, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 28, 2018.

Schnitkey, G. "Corn and Soybean Budgets for 2018 and 2019: Low Returns Ahead." farmdoc daily (8):146, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 7, 2018.

Schnitkey, G. and C. Zulauf. "Setting 2019 Cash Rents with Price Uncertainty due to Trade Disputes." farmdoc daily (8):143, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 2, 2018.

Schnitkey, G. "Revenue and Costs for Illinois Grain Crops, Actual for 2012 through 2017, Projected 2018 and 2019." Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 2018.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.