The 2019 Market Facilitation Program

The U.S. Department of Agriculture has released payment rates and additional details for the 2019 Market Facilitation Program (MFP). Compared to 2018, the 2019 MFP will pay on more crops and have higher payment rates per acre. Payment limits are higher in 2019. The MFP is designed to aid producers dealing with the price impacts of trade disputes. It is not targeted at providing relief from wet spring weather, delayed planting, and prevent planting. As a result, payments will not necessarily be correlated with delayed and prevent planting. Even given higher 2019 MFP payments, returns in areas impacted by wet weather are projected to be extremely low. For Northern Illinois, corn and soybean returns are projected to be the lowest since 2000 when consistent data become available. Northern Illinois was extremely impacted by wet weather, delayed planting, and prevent planting. Low returns likely will predominate in other areas hard hit by wet weather as well, including areas of Ohio and Indiana. Without MFP payments, incomes on grain farms would be much lower in 2019.

2019 MFP Per Acre Payment Rates for Non-Specialty Crops

Two types of MFP payments will be made in 2019 on non-specialty crops:

- Planted acres in MFP-eligible crops (corn, soybeans, wheat, alfalfa hay, barley, canola, crambe, dry peas, extra-long staple cotton, flaxseed, lentils, long grain and medium grain rice, mustard seed, dried beans, oats, peanuts, rapeseed, rye, safflower, sesame seed, small and large chickpeas, sorghum, sunflower seed, triticale, temperate japonica rice, and upland cotton).

- Prevent plant acres if MFP-eligible cover crops have been planted by August 1st.

MFP Payments on Planted Acres: Within a county, all acres planted to MFP-eligible crops will receive the same per acre rate. As an example, take two farmers in one county. The first farmer plants 75 acres of corn and 25 acres of soybeans for a total of 100 acres in MFP-eligible crops. A second farmer plants 50 acres of corn and 50 acres of soybeans for a total of 100 acres in MFP-eligible crops. Both farmers will receive the same total payments because both farmers planted 100 acres in MFP-eligible crops.

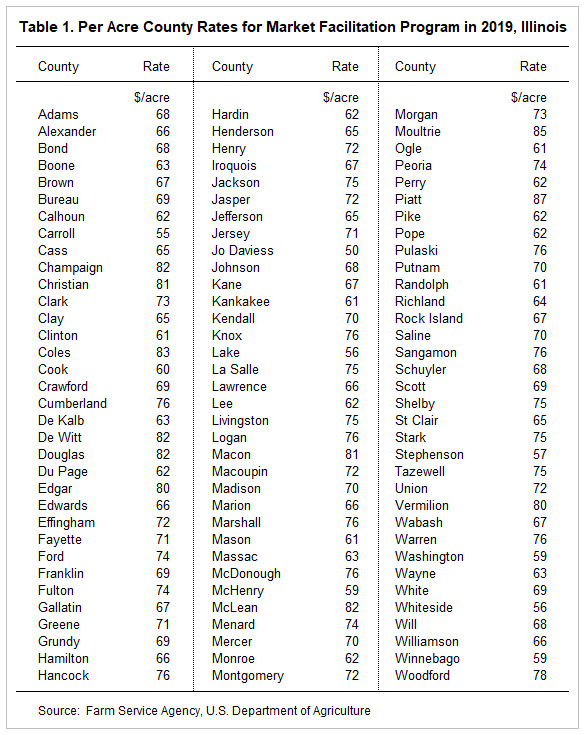

MFP payments for planted acres in Illinois range from a low of $53 per acre in Jo Daviess County to a high of $87 per acre in Piatt County (see Table 1). Central Illinois counties tend to have higher payment rates than northern and southern Illinois. In recent years, many counties in central Illinois have had higher yields than northern and southern counties, likely contributing to higher payment rates. Furthermore, central Illinois farmers tended to plant a higher proportion of their acreages to soybeans as compared to northern Illinois farms. Using 2018 rates as a guide, soybean acres likely contribute more to a per acre MFP payment than do corn acres. Lower percentage of acres in soybeans is likely a contributing factor in lower per acre MFP payments for northern Illinois as compared to central Illinois.

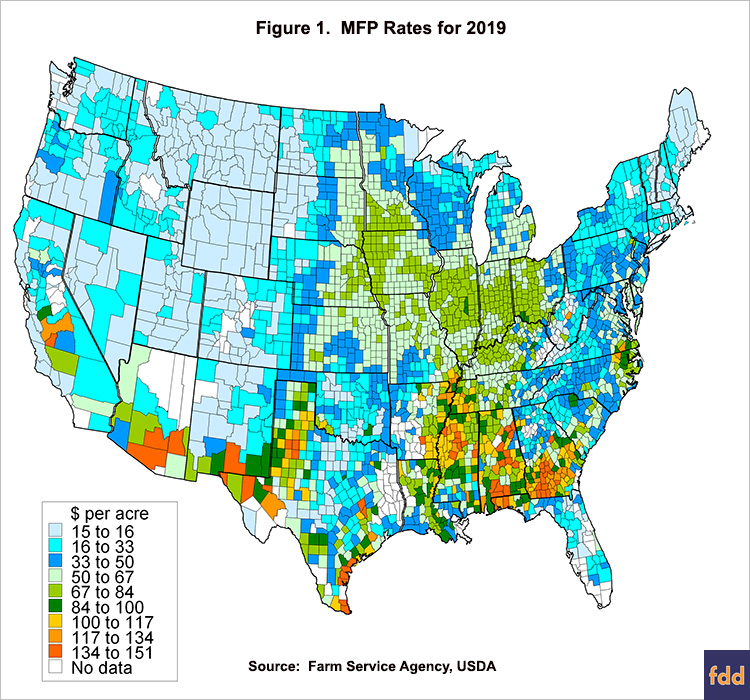

Per acre rates in Illinois are typical of the corn belt where most counties have rates between $50 and $100 per acre (green shaded counties in Figure 1). Note that these payments will not be correlated with wet and delayed planting. While the payments from MFP will be extremely useful to farms impacted by wet weather, the program is targeted at mitigating price impacts from the ongoing trade disputes. In 2018, MFP payments were made on bushels (or pounds) produced. The fact that payments are not targeted to actual production in 2019 is useful to areas severely impacted by wet weather as production is likely to be low in those areas.

Counties in the western United States, upper Midwest, and eastern seaboard tend to have rates below $50 per acre (blue shaded counties in Figure 1). Many western counties have payment rates at $15 per acre, the minimum 2019 payment rate. Payment rates over $100 per acre are concentrated in Georgia, Alabama, Mississippi, Arkansas, Texas, and Arizona. Cotton acreage likely played a role in higher rates. In 2019, cotton acres averaged 52% of all MFP-eligible acres in counties with rates over $100 per acre. Peanut acreage could also play a role in higher payments.

MFP Payments on Prevent Plant Acres: A $15 per acre payment will be made to prevent plant acres planted to MFP-eligible cover crops. To be eligible for the $15 per acre MFP payment, a cover crop must be planted by August 1. The cover crop must meet crop insurance requirements.

Other Facts about the 2019 MFP Program

Written regulations have been released by FSA. The following facts have been obtained from press reports and the MFP website maintained by the FSA:

- Sign-up begins July 29. Farmers can now sign up for MFP payments at the FSA office. Signup will end December 6, 2019. Signing up any time before the middle of August likely will result in the same timing of the first payment (see next point).

- MFP payments will be received in three tranches, with only the first guaranteed. The first will occur beginning in middle August, the second later in 2019, and the third will be in 2020.

- The first payment will be the higher of 50% of the per acre rate or $15 per acre. For an $80 per acre payment rate, the first payment will be $40 per acre.

- For a Farm Service Agency (FSA) farm, payment acres in 2019 cannot exceed plantings of MFP-eligible crops in 2018. As we interpret the regulation, farmers who are farming more FSA farms in 2019 as compared to 2018 will receive payments on all farm acres as long as eligibility and payment limits are met.

- Besides non-specialty crops, payments will be received for:

- Milk for dairy producers in business on June 1, 2019 ($.20 per cwt based on production history),

- Hogs ($11 per head based on hogs owned on a day selected by the producer between April 1 and May 15),

- Nuts ($146 per acre),

- Cranberries ($.03 per pound at 21,371 pounds per acre),

- Ginseng ($2.85 per pound at 2,000 pounds per acre),

- Fresh sweet cherries ($.17 per pound at 9,148 pounds per acre), and

- Table graphs ($.03 per pound at 20,820 pounds per acre).

Payments on specialty crops will be made on acres bearing crops.

- To be eligible, a person’s adjusted gross income must 1) average less than $900,000 for tax years 2015, 2016, and 2017 or 2) derive 75% or more of adjusted gross income from farming or ranching. Individuals must have a farm number with FSA and be in compliance with “Highly Erodible land and Wetland Conservation” regulations.

- Payment limits are:

- $250,000 per person/entity for non-specialty crops (those crops listed in “2019 Per Acre Payment Rates section of this paper),

- $250,000 per person/entity for milk and hogs,

- $250,000 per person/entity for specialty crops (nuts, cranberries, ginseng, sweet cherries, and table grapes),

- Total payments across non-specialty crops, milk and hogs, and specialty crops cannot exceed $500,000 per person/entity.

2019 MFP Compared to 2018 Program

The 2019 program differs from the 2018 program in significant ways. The 2018 program made payments on production of the following impacted crops: corn ($.01 per bushel), soybeans ($1.65 per bushel), cotton ($.06 per pound), sorghum ($.86 per bushel), and wheat ($.14 per bushels). For 2019, number of MFP-eligible crops increased. Within a county, the per acre rate in 2019 does not vary with MFP-eligible crops or with production per acre. The 2018 payment was based on production. Payment limits are higher for 2019 than for 2018.

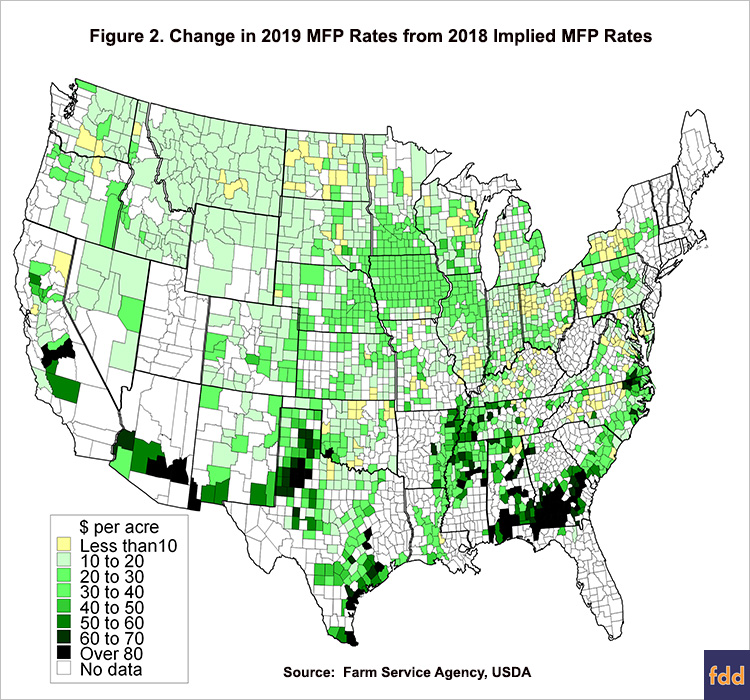

To compare overall payment levels from the 2018 and 2019 programs, implied per acre payment rates for 2018 were calculated for all counties using National Agricultural Statistical Service (NASS) data. For counties having complete NASS data, NASS acreage of 2018 MFP-eligible crops were multiplied by yields per acre times the 2018 payment rates. Within the county, the sum of all payments to 2018 MFP-eligible crops where divided by 2018 acres of 2019-MFP-eligible crops. Doing so gives implied 2018 rates that can be easily compared to 2019 rates. For example, many Illinois farms in 2018 had $1 per acre in MFP payment on corn and $120 per acre payment on soybeans. If there were equal acres of corn and soybeans in 2018, the implied 2018 payment rate calculated using the above procedures is $60.50 per acre. This calculation for 2018 payment rates provides a figure that places 2018 payments on a basis that can be directly compared to 2019 county rates.

Overall, payment rates are higher in 2019 as compared to 2018 (see Figure 2). For Illinois, payment rates average $21 per acre higher in 2019 as compared to 2018. Similar values exist over much of the corn belt. Higher increases exist in some southern counties, with those higher increases strongly correlated to counties with over $100 per acre payment rates in 2019.

Impacts on 2019 Returns

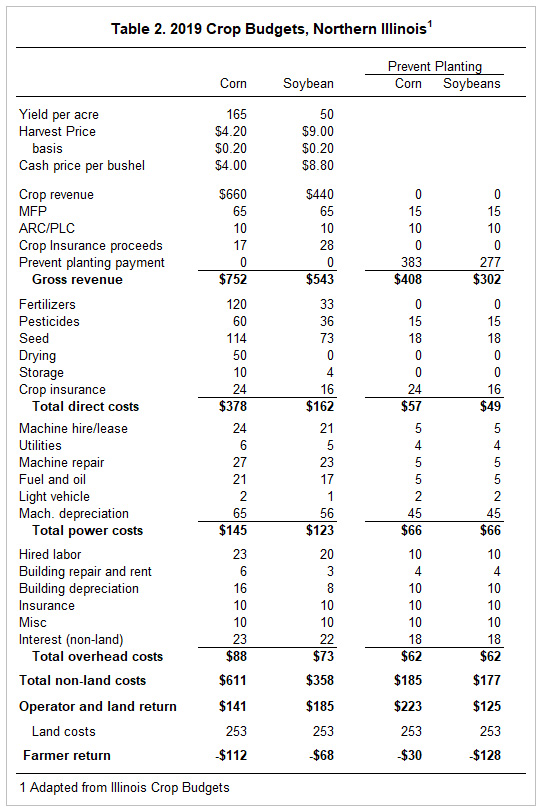

Projections of 2019 returns were released for northern Illinois in a July 2nd farmdoc daily article. In that release, MFP payments were included at estimated rates of $50 per acre for planted corn and soybeans, and $30 per acre for prevent plant acres. Based on last week’s MFP release, MFP payments were increased from $50 to $65 per acre, which will increase farmer returns by $15 per acre (see Table 1). MFP payments on prevent plant acres were decreased from $30 per acre to $15 per acre, which will decrease returns on prevent plant acres by $15 per acre. In these budgets, cover crops are assumed to be planted on prevent plant acres. In addition to MFP rate changes, price of corn was lowered. Cash corn price was lowered from $4.20 to $4.00 per bushel, which decreased corn returns by $34 per acre.

For planted crops, farmer returns are projected at -$112 per acre for corn and -$68 per acre for soybeans (see Table 2). Without MFP payments, those returns would be $65 lower. For prevent plant acres, prevent plant returns are -$30 per acre for corn and -$128 per acre for soybeans. Without MFP payments, prevent plant returns would be $15 per acre lower.

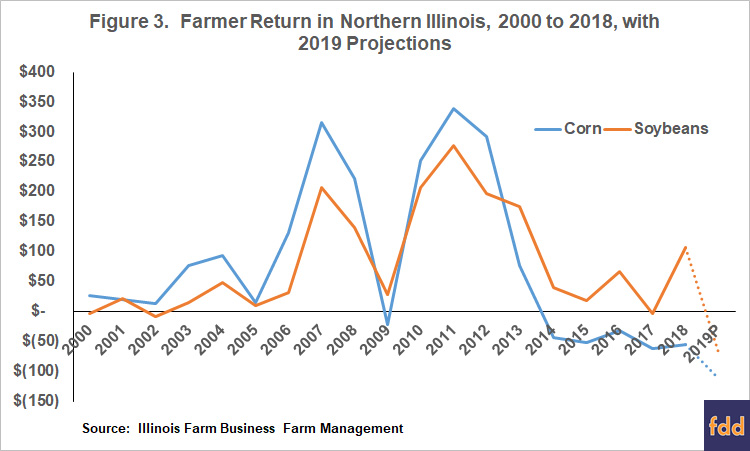

Projected corn and soybean returns for 2019 are much lower than any in recent years (see Figure 3). The 2019 return for corn of -$112 per acre is $57 lower than the -$56 per acre return for 2018. Since 2000, the lowest corn return occurred in 2017 when returns were -$61 per acre. Even with MFP payments of $65 per acre, the 2019 projected corn return is $51 per acre lower than any return since 2000. The 2019 projected return for soybeans of -$68 per acre is $175 per acre lower than the $106 return in 2018. Since 2000, the lowest soybean return was -$8 per acre, occurring in 2002. Projected 2019 soybean returns are $60 per acre lower than any other return since 2000.

Returns would be significantly lower without MFP payments, or if only the first tranche, the only tranche guaranteed, of MFP payments is paid out. Returns could increase in budgets because of price increases, yield increases, or payments from the ad hoc disaster assistance program. Possibilities for all those exist. Still, returns for 2019 in northern Illinois are projected to be very low. Northern Illinois has been hard hit by wet weather this spring. Other areas may be less hard hit. Currently, central Illinois has prospects for higher yields than northern Illinois. As a result, return projections for central Illinois are not as dire as for northern Illinois (See farmdoc daily, July 23, 2019)

Commentary

MFP payments will provide much needed cash flow for farms suffering from low prices as a result of trade disputes. While 2019 MFP payments likely will be higher than 2018 payments, returns in 2019 likely will be lower in 2018, particularly in areas heavily impacted by wet weather, delayed planting, and prevent planting. The MFP program is not targeted for those areas, rather focused on mitigating the impact of price declines from trade disruptions.

A single decision still exists for some farmers that could influence MFP payments for a farm. Many farmers have prevent plant acres that have not been seeded to a cover crop. In these situations, a farmer could plant a cover crop by August 1 to receive $15 per acre in MFP payments. Seed and planting costs of cover crops will exceed $15 per acre on the vast majority of farms. Planting now in the heat of the summer may not be advisable, particularly if cool season cover crops such as oats are being planted. For a failed cover crop, there likely will not be any benefits other than the $15 per acre MFP payment. The risks of a failed planting could outweigh rushing the planting of cover crops on many farms. Those risk and returns need to be weighed quickly.

References

Swanson, K. and G. Schnitkey. "MFP Impact on 2019 through 2023 Incomes and Financial Positions." farmdoc daily (9):134, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 23, 2019.

Schnitkey, G., K. Swanson, C. Zulauf, J. Coppess and R. Batts. "2019 Northern Illinois Crop and Prevent Plant Budgets in July." farmdoc daily (9):122, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 2, 2019.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.