farmdoc and farmdoc daily: Farm Real Estate Markets – 20 Years and Growing

This is the ninth in a series of articles celebrating the 20th anniversary of farmdoc. A list of all nine articles in the series and authors can be found at the end of this article.

As part of the 20th Anniversary of the farmdoc program, we are highlighting several of the central themes that have persisted through time and are identifying some of the ways in which the farmdoc program has responded to, and continues to contribute to the ability for producers, investors, and ag-sector participants to improve their business decisions.

The purpose of today’s post is to provide a brief retrospective of some of the activities in the farmdoc program related to farmland and farmland rental markets, and to provide a signal toward future activities for which we have adopted the tagline: “Advancing Farmland Markets through Research and Information”.

As a result of the central role farmland plays in most agricultural operations, there is considerable interest in the fundamental market forces which impact farmland sales and rental markets among farmers, landowners, and agricultural lenders. Interest in farmland markets is also very strong in the investment community as farmland has demonstrated remarkably resilient investment characteristics of positive correlation with inflation, and low or negative correlation with equity returns; and thus it provides very desirable diversification benefits. And, for context, it is also important to be able to overlay farmland markets with other features of the broader economy that change through time and affect evaluations of the relative performance of farmland and rental markets. This has led the farmdoc project to also develop strong repositories of historic data on other features affecting farmland markets and to provide a broad set of tools and data resources supporting those in the sector. The farmdoc project also has developed several exceptionally strong and notable connections to stakeholder groups that we will use to organize some of the remaining materials. But first, some context.

Farm Real Estate as an Asset Class – a Brief Summary

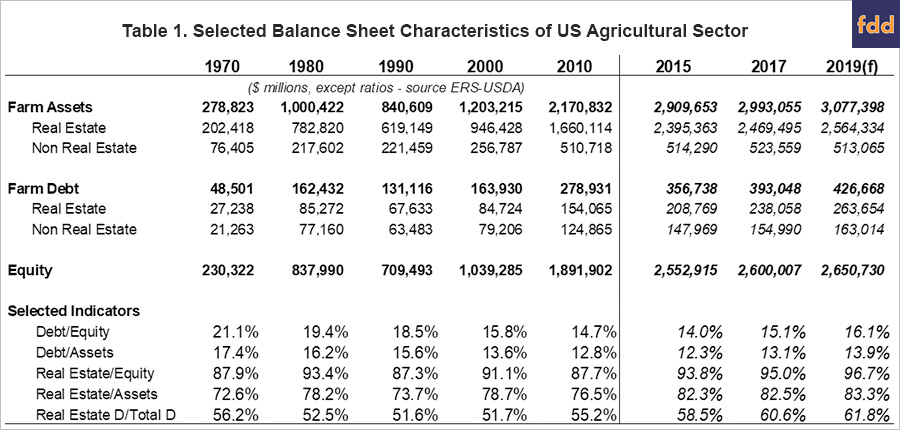

Part 1. Farmland occupies a central role in the U.S. ag sector balance sheet with current value in excess of $2.5 trillion accounting for more than 83 percent of all assets on the farm sector balance sheet (USDA-ERS, 2019). Table 1. shows summary information about the US ag sector through time (also available in more complete form back to 1960 with farm numbers, lender shares, and other related data sourced from USDA and related sources at our website: https://farmland.illinois.edu/tools-and-data/ at the tool titled “US Ag Sector Balance Sheet Data..” . Numerous other tools supporting farmland markets are also available in that section including a utility to compare State Level Values and Returns, a Farmland Indexing utility, a model to show Farmland Correlation by holding interval, and a visualization tool to examine Returns to Alternative Investments).

Part 2. Farm Incomes: “Farmland is worth what it can earn” is a quote that we would tend to attribute most directly to Professor Peter Barry – one of the true pioneers in developing formal modeling methods to better understand farmland markets. As early as the 1980s, he was instrumental in developing a view that considered farmland in the context of other investments, and began to introduce the notion that financial theory applies to all asset markets, not just to exchange traded equities and debt securities. (as an important sidebar, professors Peter Barry, Chet Baker, Dave Lins, Tom Frey, Paul Ellinger, and several others dating all the way back to the formation of the first and original institutions in the Farm Credit System attributed to UI faculty member H.C.M. Case; each made monumental contributions to the area of agricultural finance. farmdoc in general, and the farmland markets section could not exist without the broad and solid foundation laid at the University of Illinois by the true pioneers in ag finance).

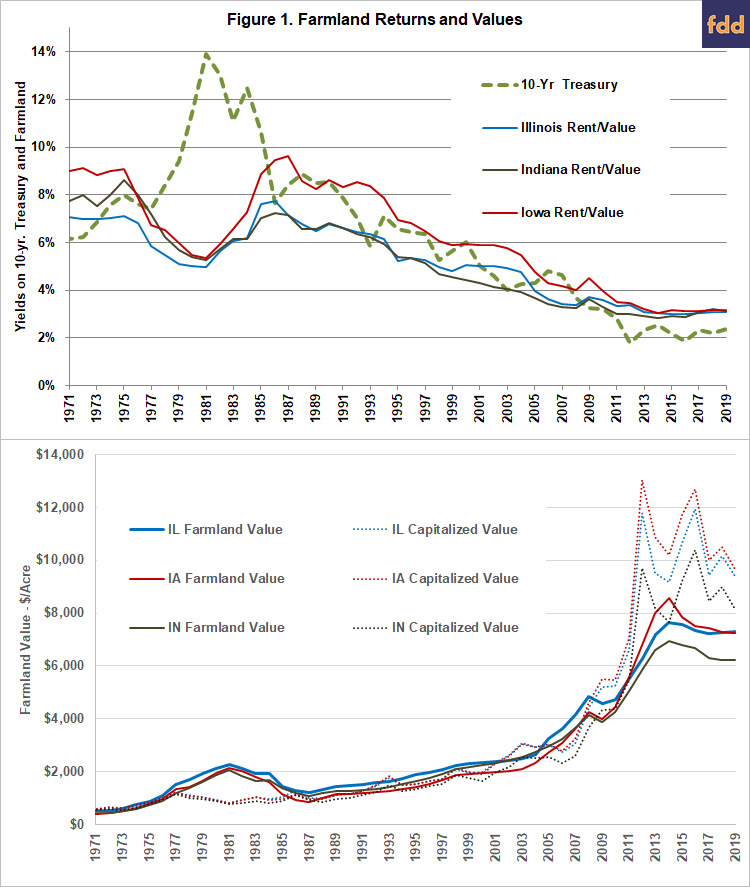

One way to summarize the performance of farmland as a financial asset is to view rental rates as a form of income to a land owner, and to simply see how it has in fact fared as an investment. Figure 1 below does so for a few states in the Midwest in two complementary forms. The top panel shows the yields on a 10-year Treasury investment along with rental returns for farmland in the Midwest. The bottom panel shows the capitalized values of rent – in other words, what farmland prices would be if returns were required to equal the 10-year Treasury rates – along with actual prices. What is notable is that the only stark departure where farmland appears overpriced relative to its fundamentals (which are relative to broader market yields) was in the early 1980s when a debt-side farm crisis fueled a run up and then collapse of farmland values. Several articles in the farmland section of farmdoc daily have developed these ideas much more completely through time, but a summary of the general findings is that farmland markets do largely behave as predicted by financial theory, but they do react more slowly and more smoothly due to their longer income cycles than do other financial investments. In the lower panel, the departure from the cap-rate that is evident over more recent periods is largely viewed as a result of quantitative easing efforts and low interest rates to which farmland markets have demonstrated somewhat muted responses. These are just examples of the types of analyses that have appeared in the farmdoc daily and farmdoc projects through time.

Part 3: Farmland as an asset class and the financialization/professionalization of farming:

While not part of the original farmdoc effort, it is also notable that the NCREIF Farmland Index reporting system that serves as the largest and most commonly referenced measure of farmland investment performance (by region, crop type, management type, etc.) was developed and verified at the University of Illinois, and we continue to provide leadership and support of that activity (original members included professors David Lins, Bruce Sherrick, and Cheryl DeVuyst). The index which now is comprised of over 900 properties and $10 billion in asset values remains supported by farmdoc personnel and serves as an important two-way connection to both the investment and research communities for consistently accounted measures of return to farmland investments. We continue to serve on the research and education committees of NCREIF and recently began a quarterly webinar series to document the “state of ag” and to highlight current issues impacting farmland investments.

These features are not only noted at farmdoc. Biff Ourso, Nuveen’s head of real assets, recently delivered a keynote at an investing conference under the title of “Farmland is an Asset Class…Now What?” which pointed out the key structural and fundamental features in which farmland markets exist. Atomistic ownership, thin markets, connections to government programs, systemic risk features (i.e., weather events), and exposure to foreign trade effects provided an intriguing “green screen” behind the asset class against which numerous projections can be made. Thus, while the long-term thesis around growing populations, growing incomes, and performance as a diversification asset remain valid, changes continue to occur with potential to dramatically alter the historic nature of farmland markets. Among the “headline level issues” are the impacts of growing requirements for production methods and verification of practices that convey preferred attributes to consumers; awareness of implications (both pro and con) for carbon footprint impacts of animal and intensified ag production; increased international integration; sophistication of technology used in production; urban/rural interface issues; and capital market sophistication that can “handle” uniqueness of ag assets including the role in ESG driven investment strategies. And all this is resolving in a market with only about 1% annual turnover under independent arm’s-length transactions. What is clear is that these issues will increasingly drive both pricing and the structure of ownership and control going forward, and will result in continued evolution of the stakeholders for the farmland information at farmdoc, and we will continue to provide leadership and service to those involved.

Some Highlighted farmdoc Responses

Over the 20-year history of the farmdoc project, farmland markets have experienced multiple transitions. The era of low, but relatively stable commodity prices in the 1990s and early 2000s coincided with stable to moderately increasing land values and rental rates. The commodity price and farm income boom from the mid-2000s to 2013 coincided with more rapidly rising farmland values and rental rates. Lower commodity prices since 2013 have resulted in stable to moderate declines in farmland values and rental rates relative to market peaks. Each of these eras have introduced unique challenges for farmers, landowners, and lenders, and each has to some degree influenced the nature of the response that have had the greatest impacts.

One obvious and significant contribution with practical significance is to provide independent and impartial support for both landowners and renters as a significant portion of farmland in the U.S. (roughly 40 percent of all cropland and pasture) is operated under some form of rental or lease agreement. The rental rates and other design features of farmland leases have important implications for both farm operators and farmland owners and there are numerous resources on farmdoc and dozens of archived articles on farmdoc daily in the “farmland prices and rents” category documenting current lease trends and values. Links to frequently used Leasing Forms and Leasing Facts on farmdoc have been accessed hundreds of thousands of times over the years, and continue to serve as basic templates for vast numbers of lease contracts across a wide portion of the country. To simplify many of the incredibly complex issues related to the financial implications of lease terms, and to evaluate the financial implications of farmland purchase (including financing options, crop budgets, investment horizons, and other features) we have also developed a suite of tools within the FAST (Financial Analysis and Solution Tools) section of the farmdoc project that directly support farmland market participants. A partial list (with links to access at the website) includes:

Members of the farmdoc team also use these tools to do external programming and hold seminars focused on the use of the suite of FAST tools more broadly, and also provide support to the lending community with the same outreach activities.

Some Other Responders

One of the most notable elements of the farmland-market related activities in farmdoc is the deep connections with and service to other groups that share common interests and overlaps with the stakeholder groups. Space prevents even a modest listing, but a couple of examples will help make the point that this section of the project has become an important network structure for others in the industry as well.

ISPFMRA: In Illinois, we are fortunate to have one of the strongest, and most active chapters of the ASFMRA in the Illinois Society of Professional Farm Managers and Rural Appraisers. We interact with them directly, serve on their executive teams, and most importantly, leverage their extensive network to complete and publish what is now perhaps the longest running and most extensive survey of actual farmland transactions, with professionally evaluated explanations of regional trends. The annual publication provides direct evidence of the actual movements in professionally managed farmland lease terms, and provides unbiased information about farmland transactions as screened for legitimacy by dozens of professional teams around the state. From this publication, the public can both locate proximate professional resources if interested in buying or selling land, and can identify local market conditions that most closely affect them.

FBFM: In addition to an incredibly strong professional farm management community in Illinois, we also benefit immeasurably from access to what we regard as the nation’s best Farm Business-Farm Management organization (admittedly a biased view, intentionally so perhaps, from having a 20-year shared history). FBFM has, as noted in an earlier posts this week, provided the gold-standard in farm-level records and has served as the background data source for literally dozens of projects, and ongoing series published at farmdoc. Brad Zwilling, Dwight Raab, Dale Lattz, and numerous others have made immeasurable contributions to the understanding of rental market trends and land values in the state, and farmdoc reflects verified expertise as a result of that interaction. Simply put, the Illinois FBFM has the most accurate and complete set of farm-level production records ever assembled, and the farmdoc team has both benefitted from, and contributed to that resource as well.

TIAA-CREF/TIAA/TIAA-Nuveen: TIAA-CREF is generally viewed as providing the initial business case for successful development of a public investment platform for agricultural investments (earlier pioneers including Murray Wise, and others are not being ignored). After a series of carefully sequenced moves to establish an acquisition and management structure, they quickly grew to over $1 billion by 2010 and around that time began to note the need to promote independent and broadly available research and data sets supporting the industry as well. Over the following years, TIAA-CREF underwent several growth epochs, fund launches, name changes (dropping CREF, merging with Nuveen), and expansions to other areas in natural resource and agricultural investing while developing an international portfolio of agricultural properties. What has not changed is their deep commitment to supporting independent research on issues affecting the asset class. As a result, TIAA provided support to develop the TIAA Center for Farmland Research – a wholly independent research center at the University of Illinois, with a focus on farmland and issues affecting agriculture. The TIAA Center in turn provides support to farmdoc as well and symbiotically promotes the program that will allow research related to farmland markets, at the institution that has been among the most active, to be able to maintain that distinction indefinitely.

Summary Observations

Members of the farmdoc team have consistently provided documentation of trends in farmland valuation, farmland rental rates, and lease design as well as analysis to aid stakeholders in decision making. The factors affecting farmland values and rental rates have received a considerable amount of attention in other parts of the program as well as the same factors that affect farmland markets permeate every other element of the agricultural sector. These include standard demand and supply fundamentals ultimately impacting the returns to traditional crop production, as well as potential returns from alternative land uses and other factors such as development pressure and increasing outside investment activity. These all exist in an evolving regulatory framework, with changing consumer demands, uncertain international trade relationships, morphing government programs, and constant technological innovations. While these will each continue to change through time, the need for continued documentation, analysis and provision of tools for independent analysis will always be relevant, and we expect to continue to Advance Farmland Markets through Research and Information.

Visit farmdoc and related farmland focused sections on the web at:

- https://farmdoc.illinois.edu/

- https://farmland.illinois.edu/

- https://farmdocdaily.illinois.edu/category/areas/farmland-prices-and-rents

farmdoc daily 20th Anniversary Celebration Series

Irwin, S. “farmdoc at 20: How Did We Get Here and What Have We Learned?” farmdoc daily (9):163, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 3, 2019.

Hubbs, T. “Grain Price Outlook: farmdoc Twentieth Anniversary.” farmdoc daily (9):164, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 4, 2019.

Sherrick, B. and G. Schnitkey. “farmdoc and farmdoc daily Crop Insurance Contributions – 20 years and Counting.” farmdoc daily (9):165, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 5, 2019.

Coppess, J., C. Zulauf, N. Paulson and G. Schnitkey. “Farm Policy Perspectives: 20th Anniversary of the farmdoc Project.” farmdoc daily (9):166, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 6, 2019.

Schnitkey, G., D. Lattz, P. Ellinger, B. Sherrick and R. Batts. “Farm Management in farmdoc.” farmdoc daily (9):167, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 9, 2019.

Irwin, S. and D. Good. “Biofuels Markets and Policy: 20th Anniversary of the farmdoc Project.” farmdoc daily (9):168, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 10, 2019.

Baylis, K. and J. Coppess. “Farmdoc 20 Year Retrospective on Agricultural Trade (In Chart Form).” farmdoc daily (9):169, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 11, 2019.

Endres, A., D. Uchtmann and G. Hoff. “Law and Taxation: A Retrospective of 20 Years.” farmdoc daily (9):170, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 12, 2019.

Paulson, N. and B. Sherrick. “farmdoc and farmdoc daily: Farm Real Estate Markets – 20 Years and Growing.” farmdoc daily (9):171, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 13, 2019.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.