ARC vs. PLC: Their Different Policy Objectives and the Design of Commodity Programs

Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC) are both commodity programs but their policy objectives differ. PLC provides assistance when prices are low. ARC provides assistance when transitioning from periods of high to low income. Different objectives are consistent with the low relationship between ARC and PLC payments per base acre over the 2014-2020 crop years. The different objectives also suggest a new commodity program design is possible. Specifically, ARC would be the program in effect when market year price exceeds the reference price and PLC would be the program in effect when market year price is below the reference price. This new design eliminates the need for farms to choose a program. Historical analysis suggests it would not increase Federal budgetary cost. The difference in policy objectives between ARC and PLC has become increasingly important since 2020 as the US crop sector appears to have entered a multiple year period of higher income. ARC’s support level will increase and thus its assistance will become more meaningful when crop income and prices decline.

PLC Policy Objective

PLC is a low national price assistance program, where low is defined as prices below a reference price set by Congress. It is the latest version of programs designed to protect farmers from the financial consequences of low prices, an objective dating to farm programs initiated during the Great Depression of the 1930s. Assistance was initially provided by putting a floor under market price operationalized by moving market supplies into public stocks. Assistance is now provided as cash payments to farmers based on the difference between market year price and reference price.

ARC Policy Objective

ARC provides assistance when a period of low farm income replaces a period of high farm income. Transition assistance was first authorized in the 2008 farm bill or at the beginning of the 2007-2013 period of farm prosperity. Its motivation was a lesson of the farm financial crisis of the 1980s: assistance needs to be provided early to dampen potential consequences of a return to lower returns. ARC’s assistance is based on an Olympic average of observed yields and market prices over the 5 crop years that proceed the prior crop year. For the current 2021 crop year, this calculation window is the 2015-2019 crop years. Thus, ARC provides assistance only if revenue has been high on average for a 5 year period after eliminating the high and low revenue years. ARC assistance gives farms a longer adjustment period but, since the Olympic average will decline as the calculation window moves, farms must still adjust to lower income.

ARC vs. PLC Payments per Base Acre

The different policy objectives of PLC and ARC imply that payment per base acre by one program should not highly explain payment per base acre by the other program. Over the 2014-2020 crop years, the variation in ARC-CO (ARC – county version) payment per base acre explains only 34% of the variation in PLC payment per base acre (see Figure 1 and Data Notes 1 and 2). An observation is a program’s payment for a given program commodity and year. Such observations number 157. However, this analysis excludes the 79 or 50% of observations with no PLC payment. In these years no relationship will exist with ARC-CO payment per base acre since each observation has the same PLC payment, $0 per base acre. The same finding of low relationship between ARC-CO and PLC payments per base acre was reported in a farmdoc daily article of November 9, 2017 that examined payments for the 2014-2016 crop years.

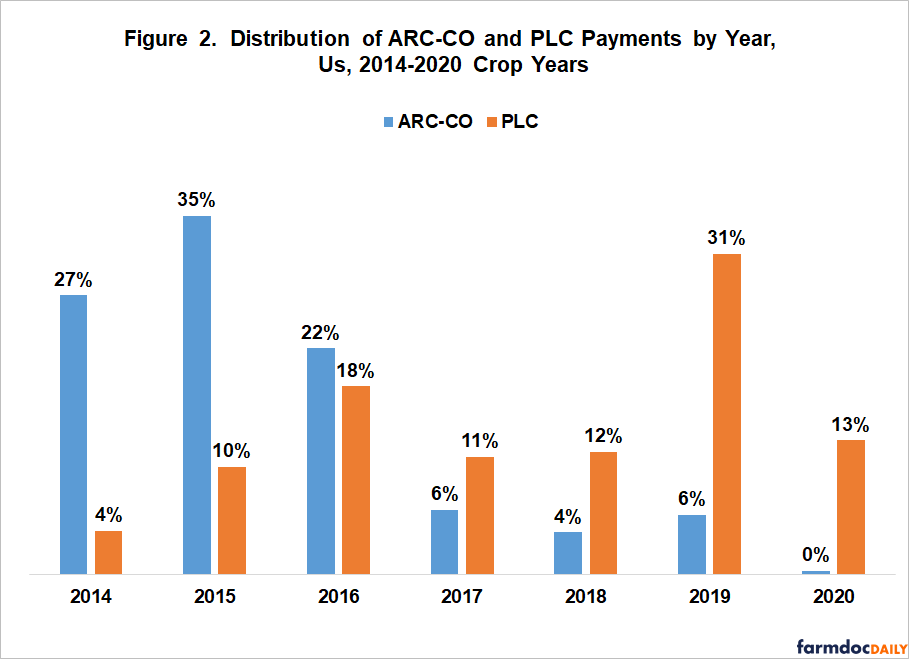

Distribution of ARC and PLC Payments by Year

The different policy objectives also imply that ARC-CO and PLC payments should be distributed differently over the years that followed the 2007-2013 period of prosperity. As expected given its objective of transition assistance, 83% of ARC-CO payments occurred in 2014-2016 (see Figure 2). In contrast, 67% of PLC payments occurred in 2017-2020. ARC-CO payments during 2014-2016 accounted for 42% of all ARC-CO plus PLC payments over 2014-2020. The ARC-CO payments are likely one of the reasons no farm financial crisis followed the 2007-2013 period of farm prosperity unlike the 1974-1980 period of farm prosperity.

New Commodity Program Design

The conceptual differences between ARC and PLC suggest a new simple, straightforward commodity program design: ARC would be the program in effect during years that market year price exceeds or equals the reference price and PLC would be the program in effect during years that market year price is below the reference price. Imposing this policy design on observed payments for the 2014-2020 crops and using ARC-CO plus PLC base acres resulted in an estimated $35.2 billion in ARC-CO plus PLC payments.

Another new design option being discussed is to pay the higher of ARC-CO or PLC payment per base acre each year. If this design had existed during the 2014-2020 crop years, ARC-CO plus PLC payments are estimated to have totaled $38.8 billion or 10.2% higher than commodity program payments based on the difference between market year price and reference price ($38.8 / $35.2).

Analysis in a January 26, 2022 farmdoc daily article found that the ARC-CO / PLC program decisions made for crop years 2014-2018 and 2019-2020 by farmers resulted in payments that were 7.2% lower than payments based on the higher of ARC-CO / PLC payments over these two decision periods . Assuming that farmers’ share of maximum payments not captured remains the same, multiplying $38.8 billion times (100% – 7.2%) equals $36.0 million. The latter value is an estimate of payments that would have been made in 2014-2020 if farmers made a program decision every year, as under farm bill provision in effect beginning with 2021 crop year. Payments of $36.0 billion are similar to the $35.2 billion in estimated payments if farmers received PLC payments when market year price was below the reference price and ARC-CO payments when market year price was above or equal to the reference price.

Summary Observations

ARC and PLC have different objectives. PLC provides assistance for low prices. ARC provides assistance when income is transitioning from a period of high income to a period of low income.

The difference in policy objectives has become increasingly important since 2020 as the US crop sector appears to have entered a multiple year period of higher income. ARC’s support level will increase and thus its assistance will become more meaningful when crop income and prices decline.

A program design that reflects this difference in objectives is for PLC to be the program in effect for a crop year in which market year price is less than a crop’s reference price with ARC the program in effect for a crop year in which market year price exceeds the crop’s reference price.

Analyses using observed payments for the 2014-2020 crop years suggest payments and thus cost of this proposed commodity program design would be similar to the current commodity program design in which farmers choose between ARC and PLC.

The proposed commodity program design would eliminate the need for farmers to make a program decision, thus reducing resource and time demands on both farmers and Farm Service Agency staff.

Data Notes

- A third program option is ARC-IC, a farm version of Agriculture Risk Coverage. ARC-IC’s highest share of US base acres was 3.9% during the 2019 and 2020 crop years. ARC-IC’s share during the 2014 farm bill sign up for the 2014-2018 crop years was 0.9%.

- Payments made to program commodities planted on generic base acres for the 2014-2017 crop years are excluded. These payments were to upland cotton base acres, not to a program commodity base acres. Upland cotton was not a program commodity during these crop years.

References

Zulauf, C., G. Schnitkey, N. Paulson and K. Swanson. "How Well Have Farmers Done in Choosing Between ARC-CO and PLC." farmdoc daily (12):11, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 26, 2022.

Zulauf, C., G. Schnitkey, J. Coppess and N. Paulson. "Are ARC-CO and PLC Substitute Programs?." farmdoc daily (7):207, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 9, 2017.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.