Crop Insurance Decisions for 2022

The 2022 price discovery period used to determine projected prices and volatility factors for Federally sponsored corn and soybean crop insurance products is completed for areas with a 3/15 sales closing date (SCD). For the majority of the corn belt, the approved Projected Price (PP) for corn is $5.90 and the Volatility Factor (Vol) is .23, and for soybeans, the Projected Price is $14.33 with a Vol Factor of .19. These represent substantially higher prices than in recent years and will result in higher premiums in general and correspondingly higher insured revenue levels.

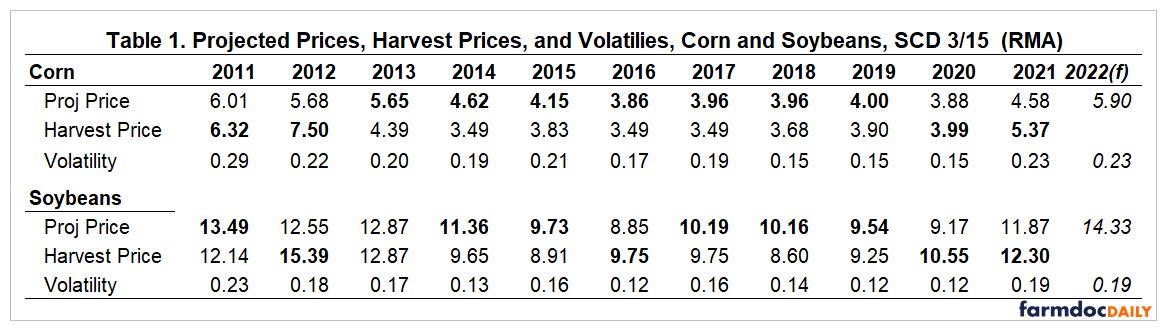

Table 1 below contains Projected Prices, Volatility Factors, and Harvest Prices for the previous 12 years. The Projected Price (PP) and Harvest Price (HP) are used to determine guaranteed revenue based on futures prices, and do not reflect the local cash basis. The Projected Price for corn is determined by averaging the closing December futures price during the trading days of February, and for soybeans by averaging the November Futures closing prices during February. The volatility factors are determined by an average of the most recent five trading days’ implied volatility estimates, scaled for the interval of time from now until the middle of October — the month during which average prices are used to determine Harvest Prices. Years when the HP was greater than the PP are shown in bold.

For corn, the projected price is $1.32 above last year’s PP, and for soybeans $2.46 above the 2021 projected price. The PP for corn is more than $2 higher than in 2020, so for example, 85% coverage on a Trend Adjusted APH policy with 235 bushel would result in $400 more coverage per acre compared to 2020 levels. But, perhaps even more importantly, the current futures price for Dec22 corn at the time of writing was approximately $6.10. Soybean futures for Nov22 are approximately equal to the average price. The projected price for corn is meaningfully below the current trade prices because of the price volatility and increase perhaps due to the Russian invasion of Ukraine. This relationship has important implications for the risk management provided by crop insurance, as the initial coverage levels and premiums are based on PPs rather than futures prices. For policies that include Harvest Price options for guarantee increases, the fall price increase is already partly “in-the-money” as it is more likely that the Harvest Price option will trigger a guarantee increase. The volatility factor summarizes the market’s estimates of the likelihood for price movements of various magnitudes, and has corresponding impacts on premiums paid for Revenue and Harvest Price related products. For both commodities, the Vol factors are unchanged relative to 2021, but with much higher prices which actually results in slightly less relative than in 2021.

Importantly, when current futures prices are above the Projected Prices, there is a lower likelihood for experiencing an insured revenue shortfall because the insured price is somewhat below the market’s estimate of actual value; but the harvest price option increases in relative value as it is then more likely that prices will end the insurance period above the Projected Price. Importantly, the premiums for crop insurance products do not change in response to differences between average futures prices during February and actual futures prices during the sign-up period. In other words, the initial value of RP insurance is increased if the average price during February is above the futures price during the sales period, and the value of RP insurance is decreased if the average price during February is below the futures price during the sales period, but the cost of insurance is unaffected by either case. This fact can substantially influence the net cost of insurance from year to year, and can have a material effect on relative desirability of different products and coverage levels.

The question faced each year at this point on the calendar is: How can one sensibly evaluate their crop insurance options for their own case, reflecting current insurance information, current price expectations, and their own farm’s operating conditions? The University of Illinois farmdoc and farmdoc daily programs provide a suite of on-line tools including a farm-level crop insurance premium calculator, a crop insurance evaluator to compare insurance outcomes, and a price distribution tool that allows a user to recover the market’s estimate of future prices and the likelihood for triggering crop insurance guarantee prices. These tools are available at:

https://farmdoc.illinois.edu/crop-insurance

Additionally, there are several recorded farmdoc daily webinars addressing the 2022 crop insurance and related farm program decisions at:

PACE: Post Application Coverage Endorsement

Crop Insurance and Risk Management in 2022

2022 Commodity Program Decision: ARC-CO – PLC Decision Indicator

Enhanced Coverage Option: Return and Risk Results

Evaluating Your Federal Crop Insurance MPCI Options

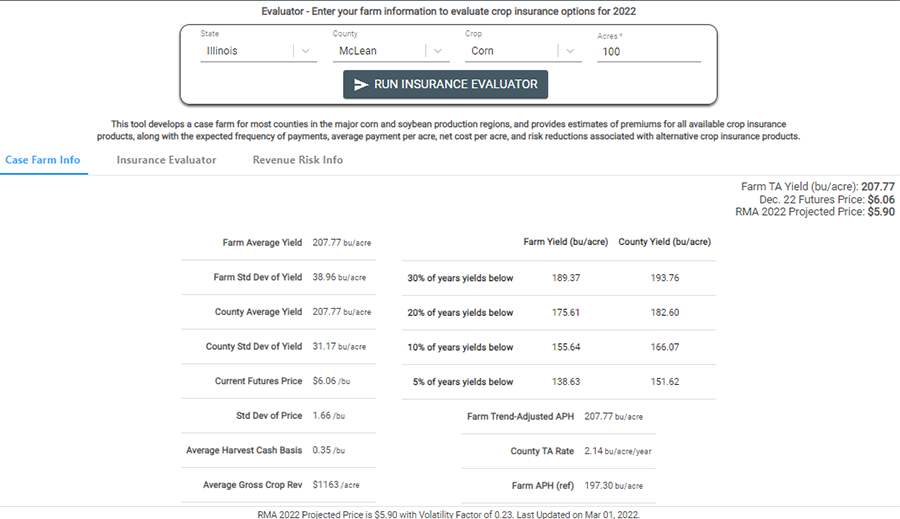

The following materials provide one approach for evaluating the most important crop insurance product and election choices facing corn and soybean producers using the University of Illinois iFARM crop insurance evaluator. The case presented is for McLean County, a large and high yielding county in central Illinois. This case, and similar analyses for approximately 750 other counties throughout 10 states (IL, IN, IA, MI, MN, ND, OH, SD, and WI) largely across the Midwest for both corn and soybeans under both basic and enterprise elections, are available at the farmdoc website in the crop insurance section at: https://fd-tools.ncsa.illinois.edu/evaluator

The tool is free to use as are all the other tools at the site. Importantly, there can be large differences in premiums even over short distances or among contiguous counties, and over the choice of unit and APH endorsement. Thus, while the case farm information provided for each county is helpful in understanding the relationships among choices, it is important to compare to conditions that most closely match your own case. It is also important to carefully discuss final options and decisions with a qualified insurance agent to insure accurate information about the specific costs.

The case farm information shown below is from McLean County, Illinois with starting price and yield conditions shown in the table below. It is assumed that the case farm qualifies for the Trend Adjusted APH endorsement which takes its average Corn APH from about 197 to 208. The case shown is for an enterprise Unit on 100 acres (the online version can be selected for any county/crop of interest and toggled across units, and actual acreage). The county standard deviation of yields is estimated to be about 31.2 bu./acre and the farm yield risk is about 8 bu./acre higher. Some basic risk information is given related to yield risk (e.g., there is a 30% chance that the farm yield will be below 189, and a 1 in 10 chance that the farm yield will be below about 156. At the county level (against which Area Plans of insurance are settled) there is a 30% chance of average yields being below 194, 1 in 5 years or 20% likelihood that yields will be less than about 183 and so on). The average gross revenue (cash basis adjusted) with no insurance is calculated at approximately $1,163/acre. The gross revenue calculation reflects the negative correlation between the yield and prices, as well as simulated local basis conditions and starting prices. The average futures price reflected in the is a result of the process used to model the price distribution implied by the options markets for the settlement period and can differ from current futures prices at any point in time, and importantly is connected to the actual futures prices, not the RMA Projected Price. This number updates regularly as market conditions change as well. Consistent with RMA rules, the APH and Trend APH are rounded to nearest whole bushels, and other features of the indemnity calculations are maintained to comply within RMA rules and procedures. The table below shows a screen shot of the case farm information for McLean County in more detail.

The following table shows information grouped by type of policy across coverage levels. There are three blocks of results with the left-side collection related to Revenue Protection (RP) policies (by far the most commonly purchased), the center block corresponding to RP-Harvest Price Exclusion or RP-HPE policies, and the right side set for Yield Protection or YP policies. The table has information for each type of policy with each row corresponding to a different coverage level from 50% to 85%. The County-level products shown in a following table are calculated assuming maximum protection levels in all cases, and maximum protection factor of 1.2 for Area products. For each insurance policy choice, there are five columns that show:

- the Farmer-Paid Premium per Acre (Est Premium) – gives the costs of the product for a representative case. An 85% RP policy has a $31.38 per acre premium (this level is mush higher than the premium compared to policies a year ago due to higher PPs, Vols, and APH).

- the Average Payment per acre (Avg Payment) – gives the average expected payment from the insurance product. The average payment for 85% RP is $73.95 per acre. Over time, payment from the product will equal this value. Some years payments will equal $0, and some years the payments be higher. The average of all those payments equals $73.95 for an 85% RP policy.

- the Frequency that the policy makes a payment (Payment Frequency) – gives the percent of time the policy will make a payment. For 85% RP policies, the frequency of payments is 39.8%, meaning that this policy will pay slightly more than one-third of the time.

- the Net Cost of insurance – gives estimated premium minus average payments. Over time, this value represents the “cost” of the insurance policy. Negative costs indicate that the policy payments should be expected to exceed the farmer-paid premium. All costs in this column are negative for McLean County – in other words, given the subsidy premium, farmers will make more than they spend through time from crop insurance. The 85% RP policy has a -$42.57 net cost (or $42.57 expected gain) because of the significant Federal-assistance provided for crop insurance premiums.

Enterprise Unit policies shown in the table above cost less than Basic unit policies because of the slightly lower risk represented, and lower premium rates (Enterprise units have the greatest subsidy). To understand the items in the table, consider 85% policies (bottom row) and note that the base guaranteed revenue is approximately $1,043/acre = 208bu x $5.90PP x .85coverage. The Average Gross Revenue per acre shows the final average outcome with each level and type of insurance, comprised of crop revenue plus insurance proceeds if any less premiums in this case equaling $1,205/acre. The Net Cost of Insurance is a particularly important feature to understand. Federal crop insurance policies are intended to be rated to pay back all premiums on average. However, they are also subsidized to encourage producer participation, and to account for imprecision in ratings. Thus, on net, they should pay back more than the farmer-paid premium. A negative net cost shows the benefit of insurance directly. In the 85% case shown, the policy will actually pay farmer $42.57 more than the premium cost per year, on average, while RP-HPE pays back $32.27 more and YP pays back $23.02 more than the premium cost per year on average.

Under the RP case, if Harvest Prices at the end of the insurance period are higher than $5.90, the guaranteed revenue is adjusted to the higher price. Under RP-HPE policies, the guarantee is fixed and does not increase if the Harvest prices increase. The RP-HPE policy in the center block would have a premium cost of $16.90/acre, and the YP policy (right side block) would be $9.25/acre under enterprise unit coverage.

Other rows in the table have comparable information for different coverage levels. As can be seen, scaling back coverage levels can result in substantially lower premiums both because of the lower implied revenue or yield covered, and the lower likelihood of triggering the insurance. The subsidy rate for lower coverage policies is higher than for higher coverage policies with an intent to roughly equalize the dollar value of the subsidy per acre.

Next, the table below shows comparable results, but for County Level or Area products, again for McLean county. These are calculated assuming maximum elected coverage factors.

The County Level Policies begin with 70% coverage options and range to 90% unlike farm-level policies that have maximums of 85%. The highest coverage ARP policies also have the highest expected average premiums and payments due to the protection factor allowing a 1.2 scaling of payments to help offset the farm-to-county basis risk that remains due to imperfect correlation between the farm and the county yields. In other words, the payments may occur when not needed, and not occur in years where they are more needed to offset low on-farm revenues. ARP policies have the highest payments through time, but can result in fairly low risk protection as a result. Finally, shown in the right hand block, the Area Yield Protection policy is triggered directly by the county yield shortfall from its guaranteed fraction of the county’s expected yield, but paid as a limited fraction of the shortfall. It again shows fairly high payments, but can result in limited risk protection because of the possibility of localized yield disruptions, and thus a farm could have very low yields but not receive any payments at all because the county yields were relatively unaffected.

While the materials above provide a great amount of information about the expected performance of different insurance policies and coverage levels, they focus primarily on the average through time in each case. However, it is also important to understand the impact of insurance on the likelihood of experiencing particularly low revenues. For example, one might be most interested in which insurance allows a farmer to most consistently cover cash rent plus all variable costs, or do the best job of offsetting particularly low revenue outcomes under hedged production, and so on. One way to begin to understand this type of impact is to examine the Revenue Risk and associated revenue levels and their associated probabilities. This type of information is often termed VARs or “Values at Risk” under different insurance contracts. These results are shown in the Revenue risk tab, a screen shot of which is provided below for the McLean county case farm being examined. The results are summarized first in graphical form and also tabulated in terms of the likelihoods of achieving different target revenue levels.

To understand the impact on risk reduction by different insurance policy, the graph tabulates the likelihood of achieving different gross revenue levels (bottom axis) against the probability of occurrence (vertical axis). Because distributions with higher likelihood of higher revenue are preferred, lines to the bottom and right are preferred to those above and to the left in this graph. The blue line provides the possible revenue outcomes with no insurance. The entries above the graph give specific percentile and revenue pairs at the 1%, 5%, 10%, and 25% revenue levels. For example, there is about a 25% chance of revenue with no insurance being below $931 without insurance, and a 5% or 1 in 20 year chance of revenue being below $689/acre with no insurance.

Purchasing insurance has two types of consequences on the revenue distribution — first, it shifts the whole schedule left by the amount of the premium. Then, it adds back payments to outcomes covered by insurance, there by shifting specific portions of the revenue distribution back to the right. Ideally, insurance should make payments when revenue is lowest and not make payments when revenue is highest resulting in an overall shift in the revenue distribution to the right at lower revenue levels, and resulting in lower revenues when only premiums are paid and no indemnities are paid (top portion of the curves are not shown in the graph, but would be shifted to the left of the no-insurance case). As can be seen in the graph, ARP at a 90% coverage level shifts the distribution to the right by its large average payments, but does little to cut off the severe low revenue outcomes. YP (green) has almost a slight effect compared to no insurance, moving the revenue distribution to the right, but still not cutting off the low revenue tail risk. RP 85% and RP-HPE 85% (largely hidden behind the RP line) do the best job of “cutting off the tail” of the revenue distribution with minimum revenues of roughly $968 or more, guaranteed in most cases. The group products in general are interesting in that they pay back more than premiums over a large range of revenues, but do not protect against particularly severe revenue shortfalls. Further, in years with high crop revenue they actually cost the most in terms of total revenue due to their higher initial premiums.

Similar patterns to these results occur with soybeans, although with more muted cost magnitudes, and in many locations with relatively less valuable Area Protection options. Soybean average gross revenue is shifted upward relative to last year by a far greater amount than in the case of corn due to the higher market prices (and given the different costs of putting in the crop are much more attractive for insurance this year than in recent past years). While the presentation used McLean county for illustration, cases covering the majority of counties in the corn belt are provided at the farmdoc website.

Crop insurance is correctly viewed as providing the cornerstone for active risk management programs, and its importance is elevated in environments with higher input costs, higher commodity costs, and greater price volatility. The differences in underlying rates and starting price and volatility conditions can substantially impact the relative performance of the alternatives from year to year, and across different operations within a given year. The iFARM Crop Insurance Tools are intended to provide producers with insights needed to make informed crop insurance decisions most suitable for their own operations.

Note: The views expressed herein are solely the authors’ opinions and do not necessarily reflect those of entities with whom professionally affiliated. All errors and omissions are the author’s alone.

Visit the crop insurance tools section of farmdoc on the web at:

https://farmdoc.illinois.edu/crop-insurance

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.