Fertilizer Prices and Company Profits Going into Spring 2023

Fertilizer prices have been on a declining trend in recent months. Declines in natural gas and corn prices likely have led to nitrogen fertilizer price declines. Moreover, stability in fertilizer markets may have been achieved as the Ukraine-Russia war continues. However, any further disruptions within the market, from escalating global tensions to supply chain disruptions, could lead to fertilizer price increases. Recent profit announcements indicate that fertilizer companies had a good profit year in 2022.

Recent Fertilizer Prices

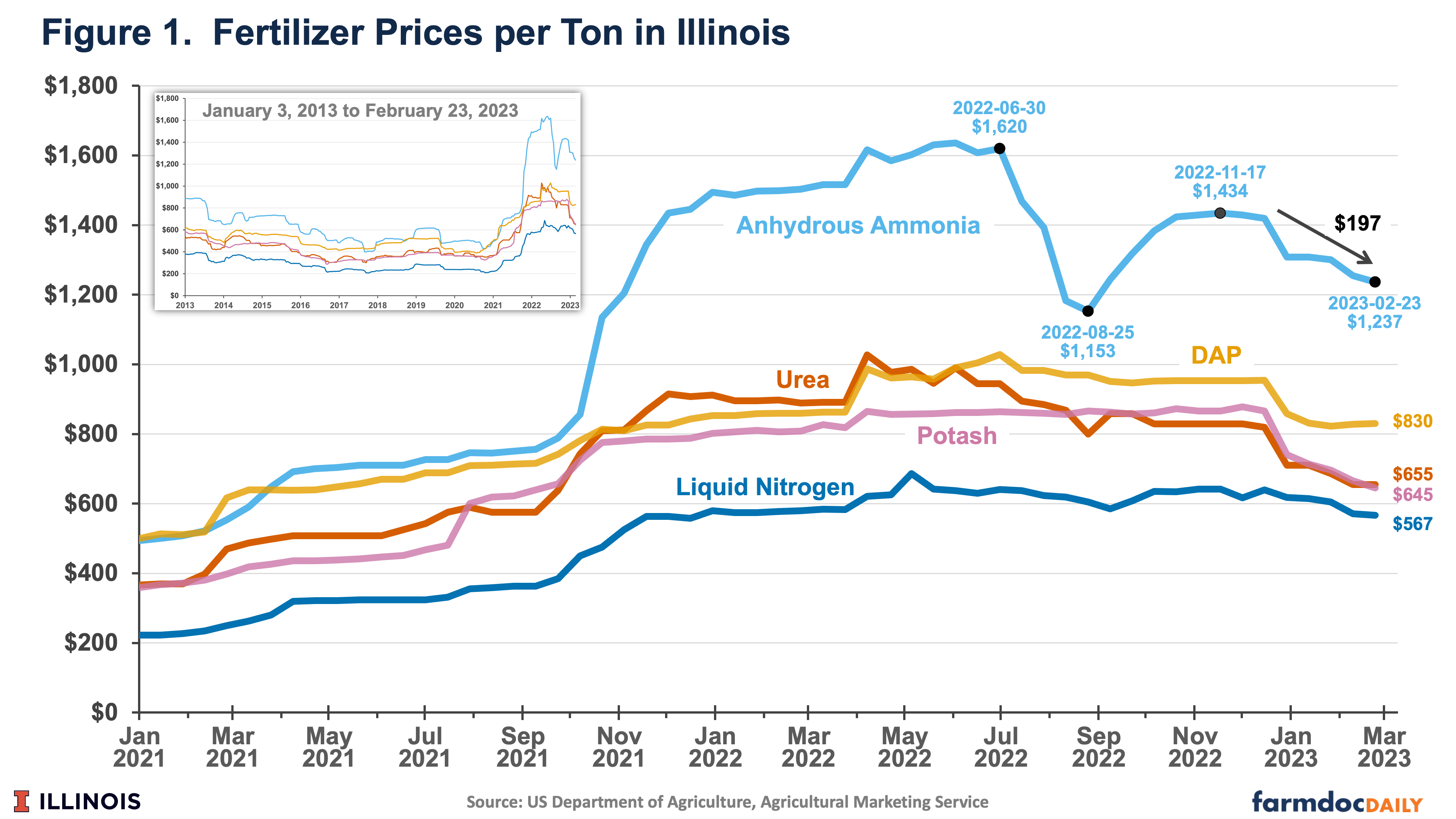

The Agricultural Marketing Service (AMS), an agency of the U.S. Department of Agriculture, regularly reports fertilizer, lime, and diesel fuel prices every other week in the Illinois Production Cost Report. According to this data, anhydrous ammonia prices have steadily declined from $1,434 per ton on November 3rd, 2022 to $1,237 per on February 23rd, 2023 – a decline of $197 per ton or nearly 14% (see Figure 1).

Overall, ammonia prices have exhibited significant volatility since the middle of 2021 (see Figure 1), with that volatility continuing into the planning season for the 2023 crop. At the end of summer 2022, ammonia prices were $1,183 per ton, a low relative to the over $1,400 prices early in the year. Prices then rose during the fall of 2022, reaching $1,434 on November 3 before falling to $1,237 per ton in the most recent AMS report.

Phosphate and potassium fertilizers also have fallen in recent weeks. Diammonium Phosphate (DAP) was over $900 per ton for much of 2022. From a $954 per ton level on December 15, DAP prices have fallen to $830 per ton on February 23 (see Figure 1). Potash prices were over $800 per ton for much of 2022, with an $866 per ton on December 15, 2022. Potash fell to $645 per ton on February 23, 2023.

While fertilizer prices have declined in recent weeks, current prices are still high by historical standards. From 2016 to 2020, anhydrous ammonia prices averaged $518 per ton, $719 lower than the $1,237 price on February 23rd. Similarly DAP prices averaged $454 per ton from 2016 to 2020, $376 lower than the $830 per ton current price. Potash prices average $350 from 2016 to 2020, $295 lower than the $645 per ton current potash price. For corn, these prices are consistent with a doubling of fertilizer costs in 2023 as compared to 2016-2020 averages. Soybean fertilizer costs will have a near double.

Moreover, much of phosphate and potash applications occur in the fall. Those applications, along with fall-applied nitrogen, were made before price declines. In these cases, fertilizer price declines may provide reduced costs for 2024, but will not have an impact on 2023 fertilizer costs.

Reasons for Falling Prices

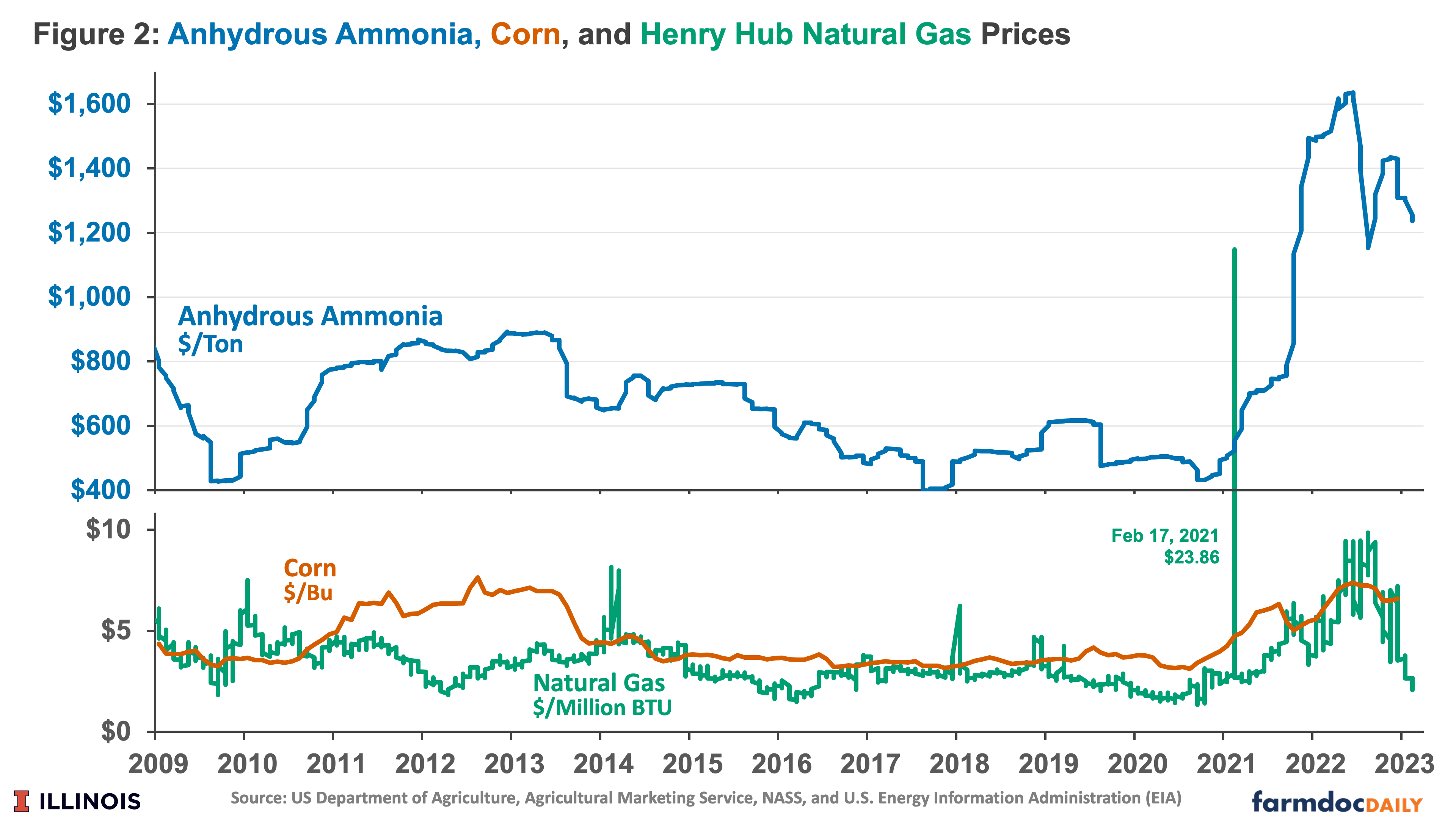

Anhydrous ammonia prices are fundamentally related to corn and natural gas prices (farmdoc daily, June 14, 2016, December 14, 2021). For example, from 2008 to 2023, monthly anhydrous ammonia and corn prices have a .74 correlation coefficient, and anhydrous ammonia and natural gas prices have a .64 correlation coefficient.

In recent weeks, natural gas and corn prices have fallen (see Figure 2). Natural gas prices at the Henry Hub were $8.81 per million BTUs in August 2022, the highest since July 2008. From $8.81, natural gas prices have fallen to $3.20 per million BTUs in January 2023. Chicago Mercantile Exchange Henry Hub, natural gas prices point to natural gas prices in the mid-$2.00 range to the high-$3.00 range for the remainder of the year. A very mild heating season led to reduced natural gas consumption for heating, placing downward pressures on natural gas prices (EIA, Short-term Energy Outlook)._ Moreover, the production of natural gas has increased in the U.S. to record levels (U.S. Energy Information Administration, December 9, 2022).

National monthly corn prices also have decreased in recent months. The monthly average corn price reported by the National Agricultural Statistical Service averaged over $7.09 in September 2022, falling to the mid-$6.00. While still high, reductions in corn prices likely have had a negative impact on nitrogen prices.

Moreover, the world appears more settled in recent weeks. Much of ammonia price volatility has been due to Covid-induced supply issues and the Ukraine-Russia conflict. Natural gas is a key ingredient in nitrogen fertilizers, and Russia supplies much of the natural gas for Eastern Europe and Germany. Russian supply has been significantly reduced since the beginning of the Ukraine-Russia conflict. Concerns were that consumers would not have enough gas to heat homes, and nitrogen fertilizer production from Europe could be seriously restricted. Germany and Europe are weathering natural gas reductions better than expected (see natural gas tracking in Der Spiegel). In particular, Germans have reduced natural gas consumption, and increased imports of liquified natural gas (LNG) at rates faster than expected. As a result, the amount of natural gas in storage — a key measure of resilience to shocks — is at 71% of full capacity, above levels in the recent two years.

Overall, the Ukraine-Russia conflict seems to have been built into market expectations. Given current expectations, anhydrous ammonia prices near $1,000 per ton into spring are consistent with usual historical relationships with corn and natural gas prices. Furthermore, any escalation in Ukraine-Russia tensions or other supply disruptions could lead to upward swings in prices.

Fertilizer Company Profits

In recent weeks, publicly traded fertilizer companies have announced 2022 financial results:

- C.F. Industries Holding, Inc is an American company publicly traded on the New York Stock Exchange (ticker symbol: C.F.) that is a major nitrogen manufacturer. In its earnings report release for the fourth quarter of 2022, 2022 adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) was $5.9 billion, a more than doubling of the earnings level of $2.7 billion in 2021.

- Nutrien Ltd is an American publicly traded company on the New York Stock Exchange (ticker symbol: NTR). Nutrien’s net earnings were $7.7 billion in 2022, a more than doubling of earnings of $3.2 billion in 2021 (see the 4th Quarter of 2022 earning presentation).

- The Mosaic Company is listed on the New York Stock Exchange (ticker symbol: MOS), whose activities center around potash and phosphate fertilizer. Adjusted EBITDA was $6.2 billion in 2022, a 72% increase from $3.6 billion in 2021(see its earning presentation).

Increases in these companies’ profits have much to do with the Ukraine-Russia conflict. The Ukraine-Russia conflict reduced supplies of fertilizers, primarily from Russia and Europe. That reduction in supply then led to higher fertilizer prices. The above three companies had less disruption of supplies but much higher prices, resulting in higher profits. In essence, fertilizer is a commodity that has relatively inelastic demand. Reductions in total supply result in higher prices, and higher returns for producers.

Those returns likely will not continue in the future. As market conditions return to a new normal, perhaps in 2024, fertilizer company profits likely will return to a lower level. The current period may be like the years around the 2008 financial crisis. Many fertilizer companies had above-average returns in 2008, with a return to lower incomes in the years following 2008.

Summary

Fertilizer prices have come down. Continued downward pressure could continue into spring, but fertilizer prices remain above historical averages. As a result, fertilizer costs on farms will be high. Some stability may be returning to fertilizer markets, but that stability is fragile.

References

2022 Fourth Quarter and Full Year Financial Results, CF Industries Holdings, Inc. February 15, 2023. https://cfindustries.q4ir.com/news-market-information/presentations/presentation-details/2023/Q4-2022-Earnings-Presentation/default.aspx

Nutrien Q4 2022 Results Presentation, February 15, 2023. https://nutrien-prod-asset.s3.us-east-2.amazonaws.com/s3fs-public/2023-02/Nutrien%20Q4%202022%20Presentation%20FINAL.pdf

Schnitkey, G. "Anhydrous Ammonia, Corn, and Natural Gas Prices Over Time." farmdoc daily (6):112, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 14, 2016.

Schnitkey, G., N. Paulson, C. Zulauf, K. Swanson and J. Baltz. "Nitrogen Fertilizer Prices Above Expected Levels." farmdoc daily (11):165, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 14, 2021.

U.S. Energy Information Administration. “U.S. Dry Natural Gas Production Set Monthly Records in 2022; We Forecast an Annual Record.” December 9, 2022. https://www.eia.gov/todayinenergy/detail.php?id=54959

U.S. Energy Information Administration. Short-Term Energy Outlook, February 2023. https://www.eia.gov/outlooks/steo/pdf/steo_full.pdf

USDA, AMS Livestock, Poultry and Grain Market News. Illinois Production Cost Report (Bi-weekly), GX_GR210. https://mymarketnews.ams.usda.gov/viewReport/3195

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.