ARC-CO: Background, Payments, and Perspectives for Corn

We provide background and county-level payments for Agricultural Risk Coverage at the county level (ARC-CO) for corn. Payments are shown after the 2018 Farm Bill was implemented in 2019 and continuing to 2021. The 2018 Farm Bill will expire on September 30, 2023, and work towards a 2023 Farm Bill is underway. We compare ARC-CO payments to payments from PLC, the alternative program. Finally, commentary is provided on potential program changes under the next farm bill. Focusing changes on ARC-CO has more benefits to managing risk for corn than increasing reference prices for PLC.

Background

ARC-CO is one of three choices farmers can make for receiving commodity title payments for Farm Service Agency (FSA) farms. Other alternatives are Price Loss Coverage (PLC) and ARC at the individual farm level (ARC-IC). Details of those three programs are provided in three farmdoc daily articles: ARC-CO (farmdoc daily, September 17, 2019), PLC (farmdoc daily, September 24, 2019), and ARC-IC (farmdoc daily, October 29, 2019).

Most farmers either choose ARC-CO or PLC, with the choice heavily influenced by expected payments from the programs. The 2018 Farm Bill allowed farmers to change decisions periodically throughout the life of the bill. The first decision had to be made by March 15, 2020, when farmers made program selection for 2019 and 2020, with decisions having to remain the same for FSA farms and crop combinations for both 2019 and 2020. Farmers had a reasonable idea of 2019 yields and prices by that deadline. As a result, expected returns from the 2019 program likely substantially influenced enrollment decisions. After 2020, farmers could change the decision before the annual March 15 deadline. For example, March 15, 2021 was the decision deadline for the 2021 production year.

The proportion of corn base acres in each program enrolled per commodity title program was:

- 2019 and 2020: 75% in PLC, 19% in ARC-CO, and 6% in ARC-IC.

- 2021: 51% in PLC, 48% in ARC-CO, and 1% in ARC-IC.

- 2022: 39% in PLC, 60% in ARC-CO, and 1% in ARC-IC.

During the 2018 Farm Bill, the percentage of corn acres enrolled in ARC-CO has grown. Rising MYA prices for corn made expected payments from PLC decrease relative to ARC-CO. More acres may have been enrolled in ARC-CO except for a commodity title program requirement of being in PLC to purchase of Supplementary Coverage Option (SCO). SCO is a crop insurance product providing county coverage above farm-level coverage (see farmdoc daily, February 17, 2014). Reasons to require PLC for the purchase SCO are difficult to rationalize and would be good to drop in the next farm bill.

In 2019 and 2020, 6% of acres were enrolled in ARC-IC. The wet spring in 2019 led to large amounts of prevented planting. The joint sign up for 2019 and 2020 years happened after 2019 resulting in more information about potential commodity program payouts for that decision timing. Farms that were prevented from planting any crops received large ARC-IC payments. This information about payments was one of the factors attributed to higher enrollment in ARC-IC (see farmdoc daily, February 4, 2020). Enrollment in ARC-IC fell after 2020 to its usual rate of approximately 1%.

ARC-CO

ARC-CO is a crop-specific county revenue program. ARC-CO triggers payments when county revenue exceeds 86% of benchmark revenue. Benchmark revenue equals the benchmark price times the benchmark yield. The payment rate equals 86% of benchmark revenue minus county revenue when county revenue is below 86% of the benchmark revenue. The payment rate is capped at 10% of the county benchmark revenue. Payments per base acre then equal 85% of the payment rate.

Some important definitions are:

County Revenue: County revenue equals county yield times market year average (MYA) price. County yield is calculated by the Farm Service Agency (FSA), with the default data source from this calculation being crop insurance yields from the Risk Management Agency (RMA). For corn, the MYA price is an average cash price across the U.S. for a marketing year from September to August. Figure 1 shows yearly MYA prices for corn from 2013 to 2022. The 2022 price is preliminary, as the marketing year for corn has not ended. MYA prices have increased during the later years, from 3.56 in 2019 to $4.52 in 2020 and $6.00 in 2021. The 2022 MYA price estimate of $6.60 is from the April 2023 World Agricultural Supply and Demand Estimates (WASDE) report.

Effective Reference Price: The effective reference price is used as a minimum in calculating the ARC-CO benchmark prices. The effective reference price also is used in the calculation of PLC payments. The effective reference price begins with the calculation of the Olympic average of the five previous prices, lagged one year. If 85% of the Olympic average price is above the $3.70 statutory reference price, the effective reference price will equal 85% of the Olympic average. However, the effective reference price is capped at 1.15 times the statutory reference price, or $4.26 for corn. The 2023 effective reference price considers the following five prices:

- 2017: $3.36

- 2018: $3.61

- 2019: $3.56

- 2020: $4.53

- 2021: $6.00

The low price ($3.36 in 2017) and high price ($6.00 in 2021) are eliminated, and 85% of the resulting average is $3.31 (.85 x (3.61 + $3.56 + $4.53) / 3). Because $3.31 is below the $3.70 statutory reference price, the effective reference price for 2023 is $3.70, the statutory reference price.

Benchmark Price: The ARC benchmark price is the Olympic average price of the five previous years of price lagged one year, with a minimum price for each year being the effective reference price. The 2023 ARC benchmark price is $3.90, based on the following prices:

- 2017: $3.70 (the 2017 price of $3.36 is below the $3.70 effective reference price

- 2018: $3.70 (the 2018 price of $3.61 is below the $3.70 effective reference price

- 2019: $3.70 (the 2019 price of $3.56 is below the $3.70 effective reference price

- 2020: $4.53

- 2021: $6.00

A $3.70 low price and the $6.00 high price are eliminated, and the average of the three remaining prices is $3.90 (($3.70 + $3.70 + $4.53) / 3).

Benchmark yield: The ARC benchmark yield is again based on the five previous yields, which are lagged one year. The 2023 benchmark yield uses yields from 2017 to 2021, the same years used in the effective reference and benchmark price calculations. The minimum yield used in a calculation is 80% of the t-yield. All yields are trend adjusted.

The benchmark yield is county specific. However, we can calculate how far a yield had to be below the benchmark yield to trigger payments. In 2019, county yields had to be below 88% of the benchmark yield before an ARC-CO payment was triggered (see Figure 1). Because of higher MYA prices, larger yield declines are needed in 2020 through 2022: below 69% of benchmark yield in 2020, below 52% in 2021, and below 47% in 2022. Note the yield decline needed to trigger payments for 2022 is still an estimate based on the projected $6.60 MYA price for 2022.

Price Loss Coverage

PLC is a crop-specific fixed price support program that triggers payments if the marketing year average (MYA) price falls below the commodity’s effective reference price. For 2019, the MYA price of $3.56 was below $3.70. The 2019 payment rate equaled $.14 per bushel ($3.70 effective reference price – MYA price). Each FSA farm has a PLC yield, which remains fixed over the time period of a farm bill. Across all farms, the average PLC yield is about 143 bushels per acre. Payments per base acre for a farm with a PLC yield of 143 bushels per acre in 2019 would have been 85% x $.14 x 143, or $17 per acre.

ARC-CO Payments from 2019 to 2022

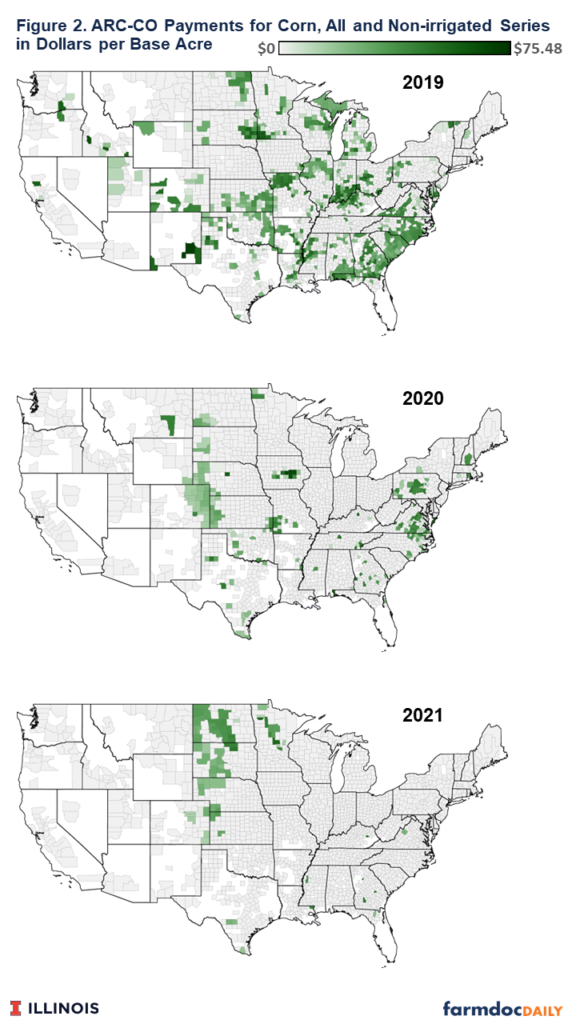

Figure 2 shows three maps of ARC-CO payments, reported on a per base acre basis. Each county either has a yield series for 1) “All” or 2) non-irrigated and irrigated yields. Figure 2 shows payments for the type “all” or “non-irrigated” for each county.

In Figure 2, one map shows payments for 2019, the first year after the passage of the 2018 Farm Bill, another for 2020, and another for 2021. A map is not shown for 2022, as the marketing year has yet to end. FSA also has yet to release yields for 2022. Therefore, we estimated ARC-CO payments using county yields released by the National Agricultural Statistical Service and a $6.60 MYA price, the most recently estimated for 2022. Under those assumptions, no county would be projected to receive ARC-CO payments for 2022.

2019: In 2019, the MYA price was $3.56, below the $3.70 ARC-CO benchmark price. The county yield had to be below 88% of the benchmark county yield for ARC-CO to make a payment. In 2019, 35% of the counties received an ARC-CO payment. Many of those counties, particularly in the Midwest, had reduced yields due to wet weather during the spring. ARC-CO also made payments in various counties from Virginia through North and South Carolina, Georgia, and Alabama.

In 2019, PLC made payments because the $3.56 MYA price was below the $3.70 effective (and statutory) reference price. On corn, PLC made an average payment of $15 per base acres on the 72 million corn acres enrolled in PLC.

2020: In 2020, the MYA price was $4.53, well above the $3.70 ARC-CO benchmark price. County yields had to be below 69% of the benchmark yield to trigger payments. ARC-CO payments occurred in 8% of the counties, with some of those counties being clustered. The western Great Plains (western North Dakota, South Dakota, Nebraska, Kansas, and Colorado) had a band of counties that had payments. Drought was prevalent in this area. Payments also occurred in Pennsylvania, Virginia, and North Carolina. The Derecho storm that impacted Iowa resulted in lower yields, and payments occurred in a band of counties in central Iowa.

PLC did not make payments.

2021: In 2021, the MYA price was $6.00, a high price from a historical perspective. The $6.00 price was well above the 2023 ARC-CO benchmark price of $3.70. County yield had to be below 52% of the benchmark yield before payments were made. Payments occurred in the Great Plains, particularly in North and South Dakota, Nebraksa, and Kansas. Payments also occurred in Minnesota. Drought persisted in many of these areas.

PLC did not make payments.

Commentary

Low revenue is typically a better indicator of the potential for stress than low prices. Low prices can be countered by higher yields, resulting in similar or higher revenue. As a result, ARC-CO is a superior program for targeting potential financial deterioration than PLC.

ARC-CO payments for 2019, 2020, and 2021 illustrate that low revenues can be geographically dispersed. In each year from 2019 through 2021, some counties triggered ARC-CO payments. Moreover, that payment occurred even in 2020 and 2021 when MYA prices were above benchmark prices and PLC did not make payments. The fact that payments occur suggests that revenues can be low, and financial stress has the potential to occur, even in years when prices are relatively high.

In recent years, there has been an interest in providing disaster assistance programs that provide expanded coverage above farmer crop insurance purchases. For example, the WHIP+ and ERP programs increased coverage levels above crop insurance purchases (see farmdoc daily, June 6, 2022). Given that ARC-CO targets payments based on revenue, improving ARC-CO by increasing the coverage level above 86% or allowing ARC-CO payments to exceed 10% of maximum revenue could potentially substitute for crop disaster assistance programs.

There have been discussions of increasing statutory reference prices for PLC. Driving this proposal is the increase in costs of production for all crops. For example, break-even prices for corn have increased from the mid-$3.00 per bushel in the mid-2010s (see farmdoc daily, December 21, 2021) to the mid-$5.00 range in 2022 (see farmdoc daily, April 11, 2023). Meaningfully increasing reference prices to cover costs is a potentially costly policy, particularly given the prices currently projected by the Congressional Budget Office. Nor would it necessarily seem advisable since it assumes that future costs can be predicted a substantial degree of accuracy.

However, ARC-CO benchmark prices and guarantees will increase over time if market prices continue near their current levels. For example, the 2024 benchmark price would be $4.92 per bushel if the 2022 MYA price is above $6.00 and 2018 Farm Bill provision extend into 2024. The 2018 Farm Bill provisions could extend into 2024 if the 2018 Farm Bill is extended, or a new farm bill comes into existence that has the similar provisions as the 2018 Farm Bill. For corn, a more beneficial approach to improve risk bearing is to improve the payments potentially made by ARC-CO, such as increasing the current 10% cap on payments or the payment factor of 86%.

Improving ARC-CO also has the advantage of incorporating yields in the calculation and adjusting the price portion of the revenue protection as price environment changes without limitation, such as the cap on effective reference and static statutory reference price. If prices remain at current levels, ARC-CO guarantees will adjust up to those levels. On the other hand, a decline in MYA prices will lead to lower benchmarks in the future and transition support. In a declining price environment, farmers will be provided counter-cyclical support, but will have to adjust to the lower price environment. On the other hand, reference prices are set in statute and policy makers must determine appropriate levels, a prospect that is difficult, if not impossible, in the ever-changing agricultural landscape (see farmdoc daily, July 6, 2022).

We will share a similar analysis comparing farm commodity programs for soybeans and wheat in future weeks.

References

Good, D. "Who’s Right about Corn Prices?" farmdoc daily (4):29, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 17, 2014.

Schnitkey, G., C. Zulauf, K. Swanson, J. Coppess and N. Paulson. "The Price Loss Coverage (PLC) Option in the 2018 Farm Bill." farmdoc daily (9):178, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 24, 2019.

Schnitkey, G., C. Zulauf, N. Paulson and J. Baltz. "Risks for 2023 Grain Farm Returns." farmdoc daily (13):67, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 11, 2023.

Schnitkey, G., C. Zulauf, R. Batts, K. Swanson, J. Coppess and N. Paulson. "ARC-IC: Payment Examples and Revised 2019 ARC-IC Payment Calculator." farmdoc daily (10):20, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 4, 2020.

Schnitkey, G., J. Coppess, N. Paulson, C. Zulauf and K. Swanson. "The Agricultural Risk Coverage — County Level (ARC-CO) Option in the 2018 Farm Bill." farmdoc daily (9):173, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 17, 2019.

Swanson, K., G. Schnitkey, C. Zulauf, J. Coppess and N. Paulson. "The Continuation of Disaster Programs in U.S. Agriculture: Emergency Relief Program." farmdoc daily (12):83, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 6, 2022.

Zulauf, C., B. Brown, G. Schnitkey, K. Swanson, J. Coppess and N. Paulson. "The Case for Looking at the ARC-IC (ARC-Individual) Program Option." farmdoc daily (9):203, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 29, 2019.

Zulauf, C., G. Schnitkey, K. Swanson, J. Coppess and N. Paulson. "2024 Farm Bill Dilemma, 1981 Farm Bill, and 2018 Farm Bill Price Support Adjustments." farmdoc daily (12):101, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 6, 2022.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.