Comparing Corn Production Direct Costs: United States vs. Brazil

The direct costs associated with corn production in Mato Grosso have increased since 2016, consistent with the direct costs of corn production in Illinois (see farmdoc daily, September 26, 2023). Direct costs in Brazil surged to record levels for the 2022/2023 crop season, but projections indicate a decline for the 2023/2024 crop season, which is also in line with cost projections for Illinois. Our first article of 2024 compares trends in the direct costs associated with corn production in major agricultural regions of Brazil and the United States, the world’s largest corn exporters.

On a per acre basis, direct costs for corn have been higher in the United States relative to Brazil. However, adjusting for differences in corn yields by examining costs on a per bushel basis illustrates a cost advantage for Illinois producers that has been primarily driven by higher fertilizer costs in Mato Grosso.

Data and Procedures

The data in this article are from the Illinois Farm Business Farm Management (FBFM) Association and the Mato Grosso Institute of Agricultural Economics (IMEA). In addition, average corn yields for Mato Grosso used to calculate costs on a per bushel basis come from the National Supply Company (Conab), Brazil’s agency for food supply and statistics. Direct costs in Illinois and Mato Grosso include the cost of production inputs, such as fertilizers, seeds, pesticides (herbicides, insecticides, fungicides), and costs associated with drying, storage, and crop insurance.

Data from Mato Grosso correspond to the second corn crop, known as safrinha, planted in January and February immediately after the first-season soybean harvest. Currently, the safrinha crop accounts for about 75% of total corn production in Brazil. Brazil contains two distinct areas for the production of corn: the traditional Southern and Southeastern agricultural producing regions and the Center-West agricultural region, mainly the State of Mato Grosso, the largest producer of corn in Brazil.

Total Direct Costs

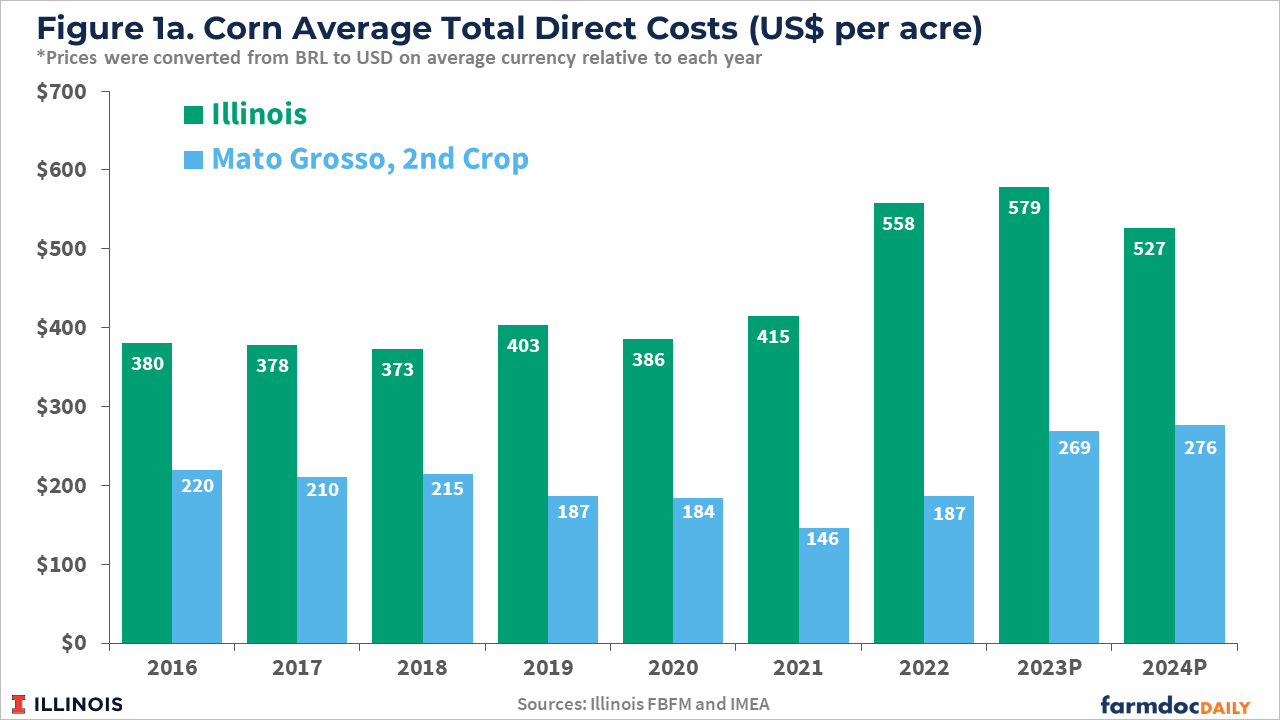

Total direct costs for the second crop in Mato Grosso have increased from $220 in 2016 to $269 per acre in 2023, an average annual growth rate of 2.9%. Meanwhile, from 2016 to 2023, total direct costs for corn production in central Illinois have increased from $380 to $579 per acre, an average annual growth rate of 6.2% (see Figure 1a). Total direct costs are projected to decline in central Illinois for the 2024 crop year, led by projected declines in fertilizer costs from 2023. In contrast, total direct costs are projected to increase by 3% for the 2024 corn crop in Mato Grosso.

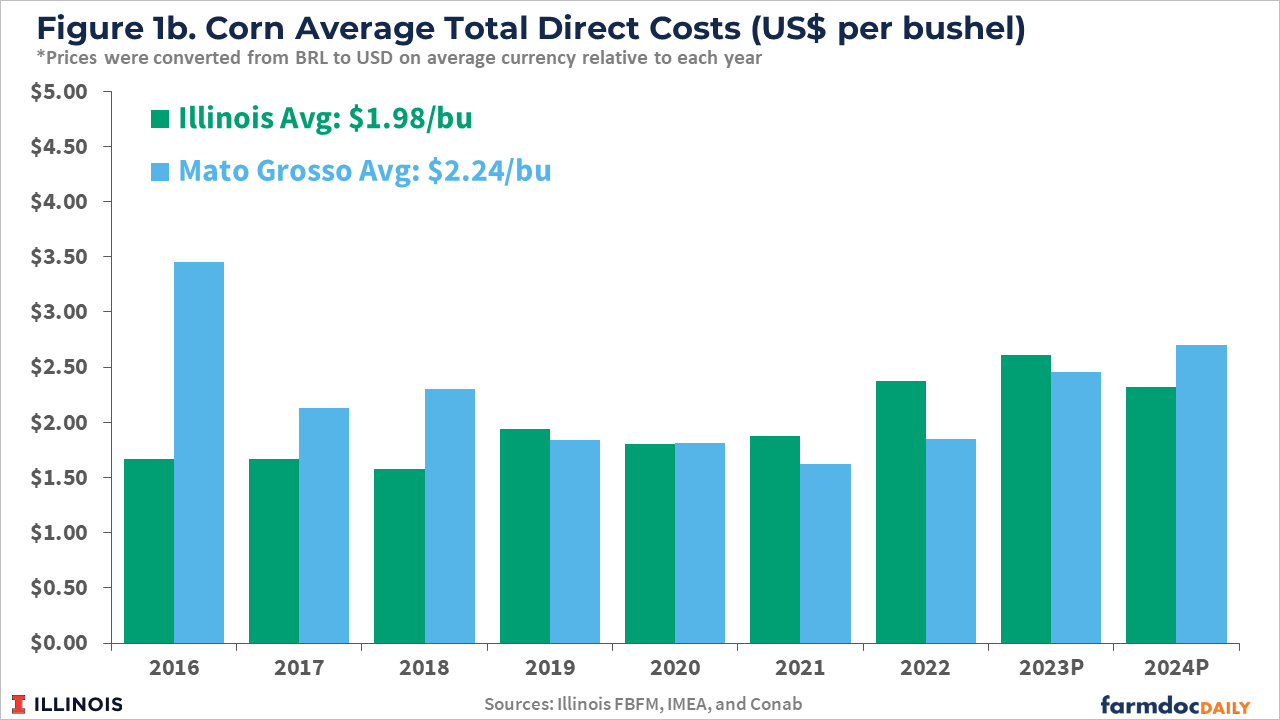

Overall, the direct costs to produce corn in Mato Gross have been lower on a per acre basis than in Illinois since 2016. However, Brazil does not achieve the same corn yields as the United States (see farmdoc daily, January 12, 2022). For example, the average corn yields from 2016 to 2022 in Mato Grosso and central Illinois were 93 and 224 bushels per acre, respectively. Figure 1b reports the total direct cost figures for both regions on a dollar per bushel basis. By this measure, the total direct costs for corn production in both regions has been much more comparable with central Illinois averaging $1.98/bu and Mato Grosso averaging $2.24/bu.

Fertilizer Costs

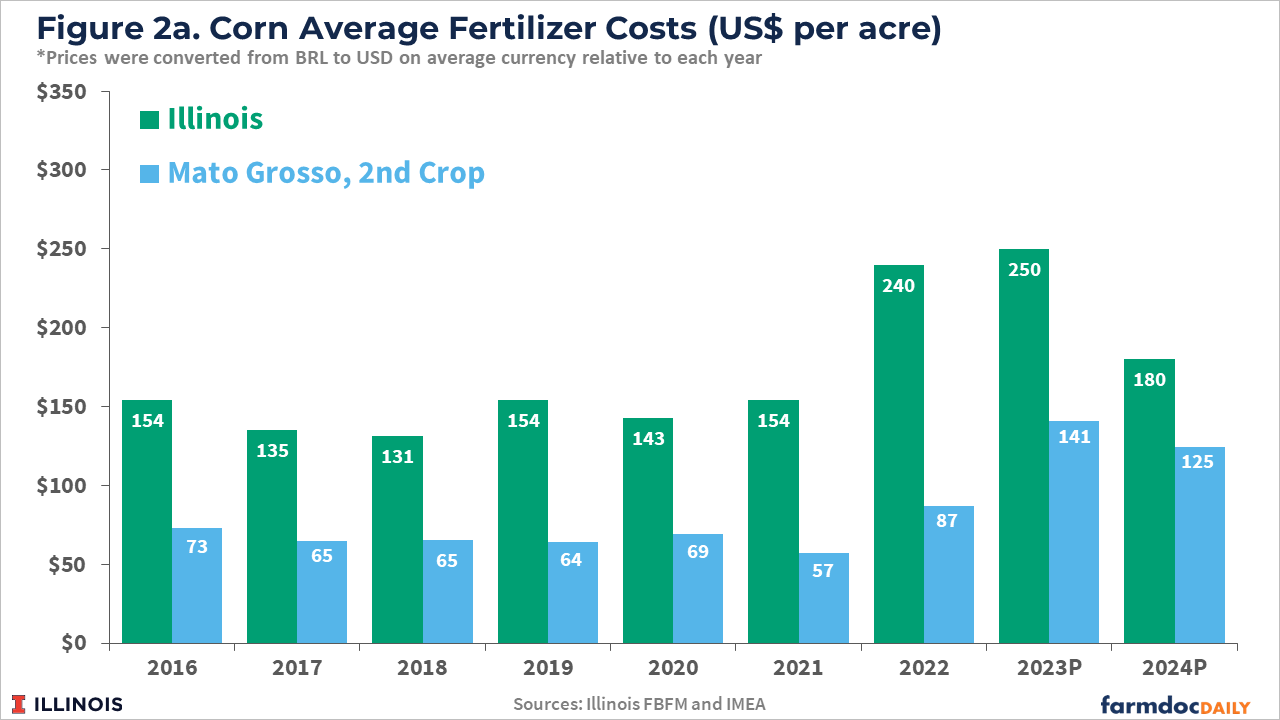

Fertilizer costs for second crop corn in Mato Grosso increased from $73 per acre in 2016 to $141 per acre in 2023. In the same period, fertilizer costs for corn production in central Illinois have increased from $154 to $250 (see Figure 2a). Similar to Illinois, fertilizer costs reached record levels for the 2023 crop in Mato Grosso, but a significant decline is expected for the 2024 crop.

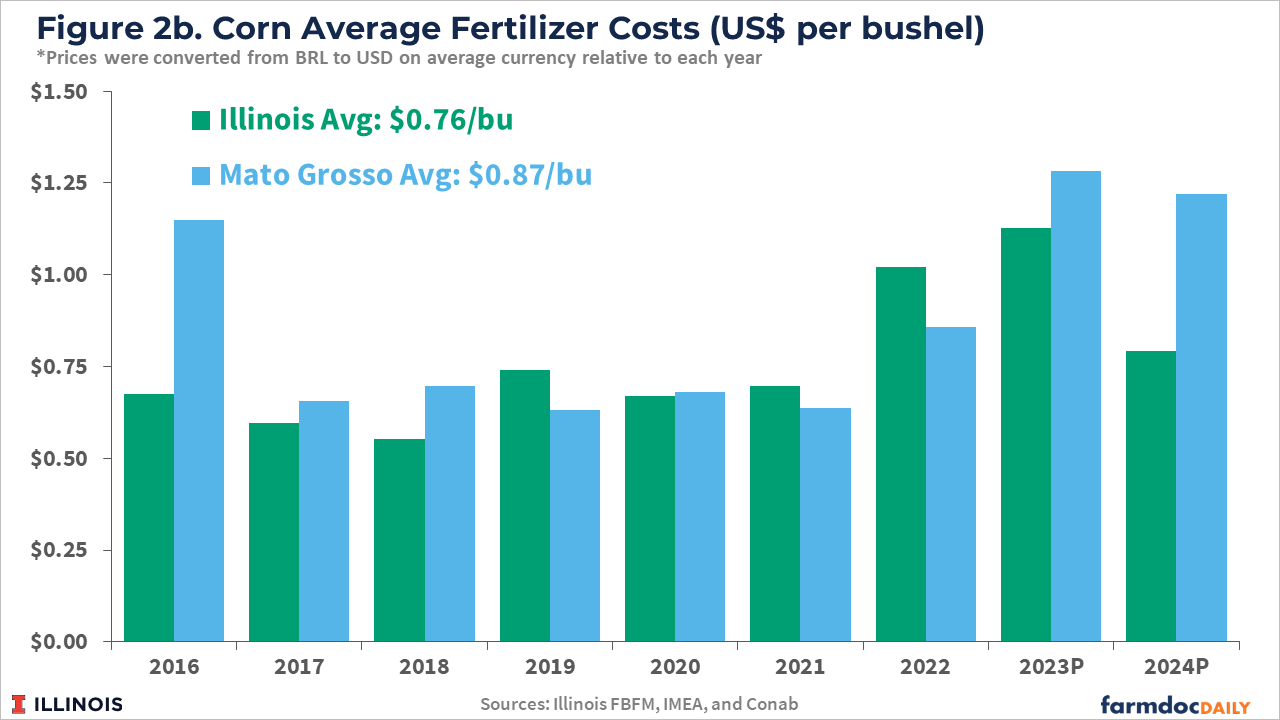

On a per bushel basis, there has been an average cost advantage in central Illinois compared with Mato Grosso (see Figure 2b). The cost of fertilizers in central Illinois has averaged $0.76/bu since 2016, while in Mato Grosso the average cost has been higher at $0.87/bu. Compared to the United States, high prices and volatility in global fertilizer markets have more negatively impacted Brazilian farmers due to currency fluctuations in recent years and heavy reliance on fertilizer imports. Brazil imports 94% of its potassium, 76% of its nitrogen – used heavily on corn fields – and 55% of its phosphorus (see farmdoc daily, March 17, 2022).

Seed Costs

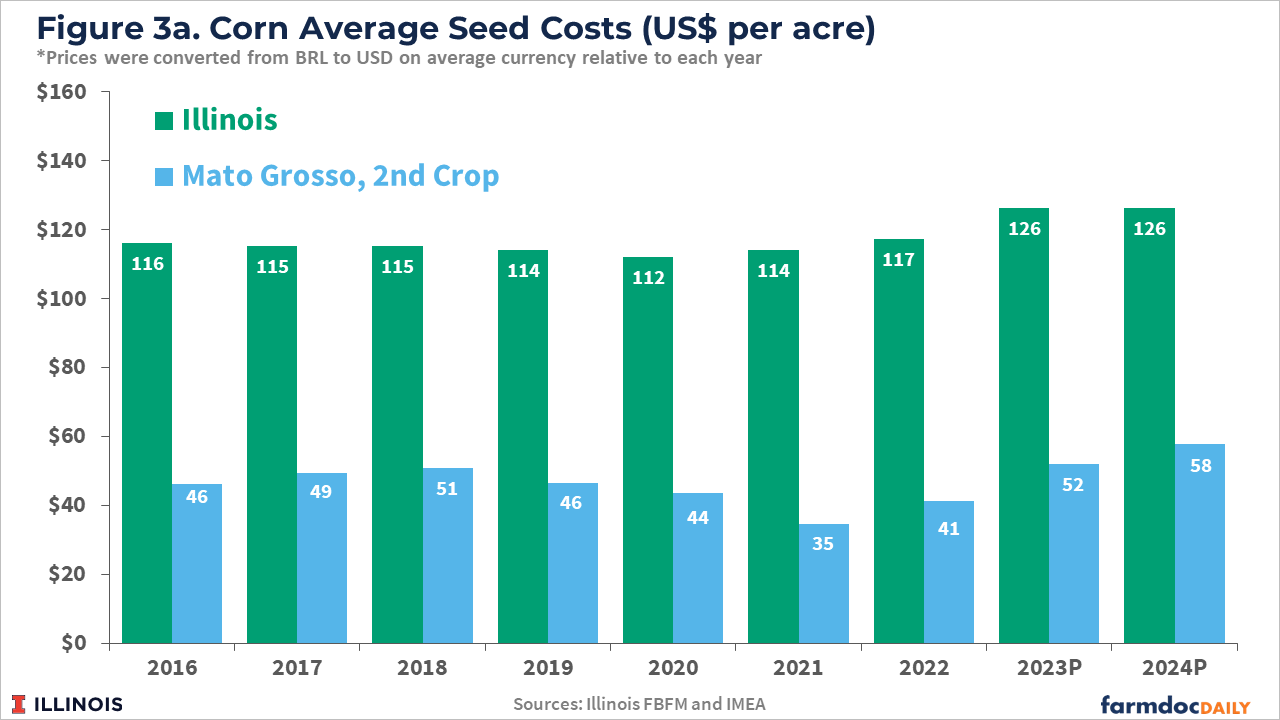

Corn seed costs in Mato Grosso have increased from $46 per acre in 2016 to $52 per acre in 2023. In central Illinois, from 2016 to 2023, seed costs for corn increased from $116 to $126. Seed costs have been relatively flat in recent years in both Brazil and the United States (see Figure 3a). Per acre seed costs in Illinois have consistently been higher than in Mato Grosso. The difference is not due to the use of non-GM seed. In Brazil, genetically modified seed was used on 95% of the corn acres planted in the 2022/23 crop year, virtually the same as in the United States (Swanson, 2023).

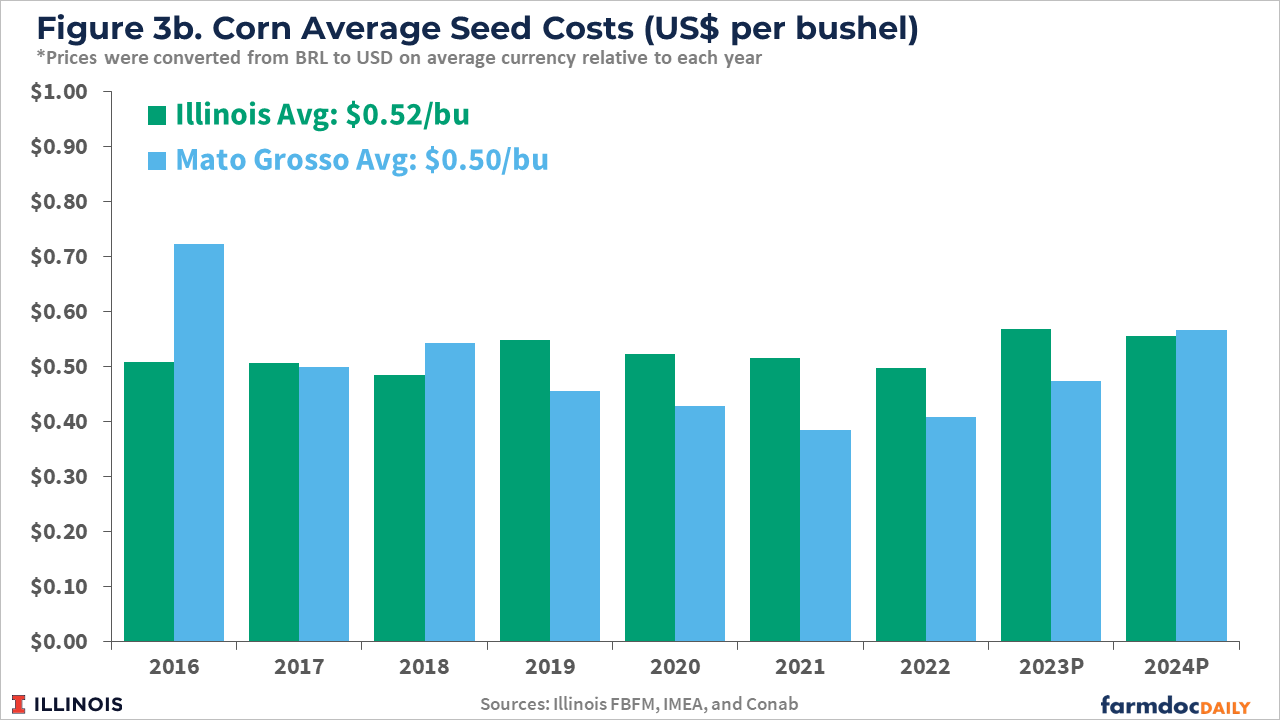

Seed costs on a per bushel basis have been very comparable since 2016 in central Illinois and Mato Grosso (see Figure 3b). The per bushel cost of seed has averaged $0.52 in central Illinois and $0.50/bu in Mato Grosso.

Pesticide Costs

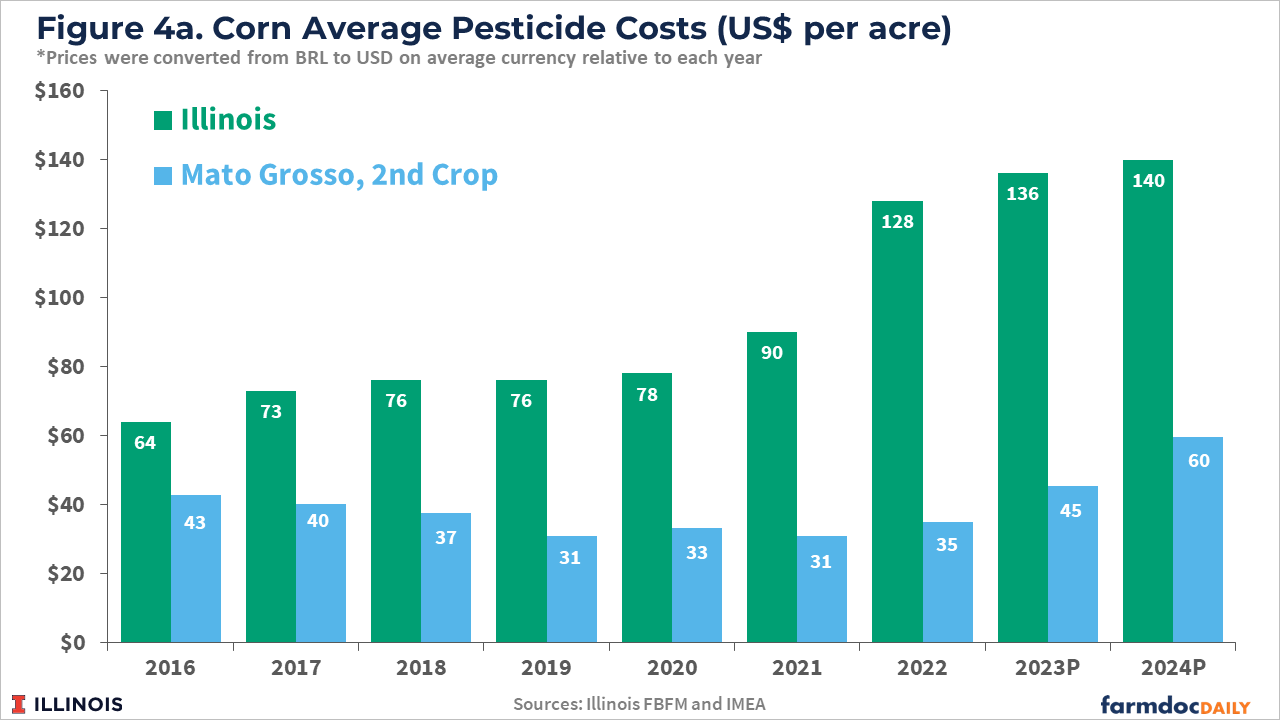

Pesticide costs for soybeans in Mato Grosso have increased from $43 per acre in 2016 to $45 per acre in 2022. In comparison, pesticide costs for corn production in central Illinois have increased from $64 in 2016 to $136 in 2023. As with fertilizers and seed, per acre pesticide costs in Illinois have consistently been higher than in Mato Grosso (see Figure 4a). Pesticide costs in both central Illinois and Mato Grosso have experienced large relative increases in recent years.

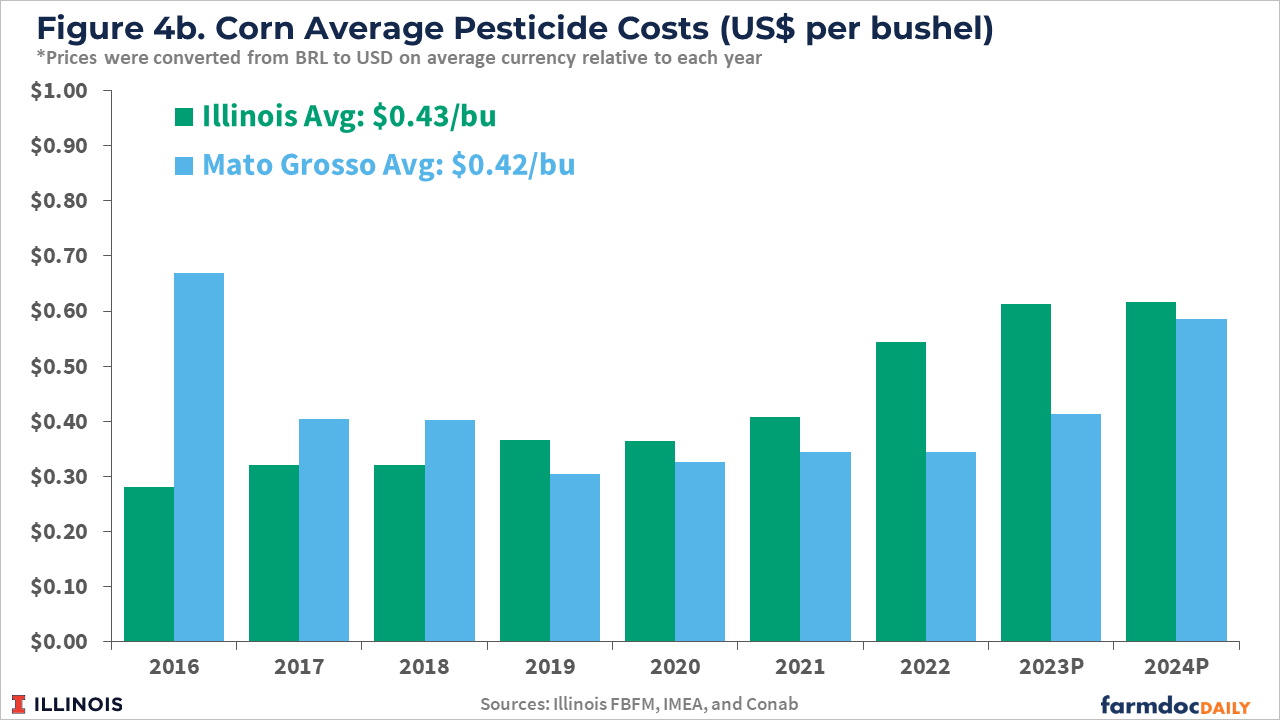

Average per bushel pesticide costs have been very similar across both regions. The average pesticide cost in central Illinois since 2016 is $0.43/bu, while the average for Mato Grosso has been $0.42/bu (see Figure 4b). Similar to Illinois, the increases in pesticide costs in Mato Grosso are likely associated with developing weed resistance as well as higher corn prices, which provide a greater economic justification for the applications of chemical pest controls (see farmdoc daily, September 26, 2023).

Conclusion

The direct costs of corn production in Mato Grosso, the largest corn producing State in Brazil, have experienced similar increases since 2016, similar to Illinois. Direct costs in Mato Grosso surged to record levels for the 2023 corn crop, but projections indicate a decline for the 2024 corn crop, also in line with cost projections for Illinois.

On a per acre basis, total direct costs and the costs associated with fertilizer, seed, and pesticide inputs have been consistently lower in Mato Grosso compared with central Illinois. However, a significant yield differential exists with central Illinois achieving corn yields that are often more than double those of the second crop corn producted in Mato Grosso. While the average yield of corn through growing areas in Brazil has grown over the past few decades, productivity continues to lag far behind corn yields in the United States.

When comparing direct costs on a per bushel of production basis, an average cost advantage exists for central Illinois compared with Mato Grosso since 2016. This cost advantage is driven by higher per bushel fertilizer costs in Mato Grosso, as well as higher post-harvest costs of drying and storage. In contrast, both seed and pesticide costs have been much more similar for central Illinois and Mato Grosso over the past nine crop years.

Acknowledgments

The authors would like to acknowledge that data used in this study comes from farms across the State of Illinois enrolled in the Illinois Farm Business Farm Management (FBFM) Association and farms across the Mato Grosso Institute of Agricultural Economics (IMEA), in Brazil. Without their cooperation, information as comprehensive and accurate as this would not be available for educational purposes. For more information, please visit the FBFM website www.fbfm.org and the IMEA website at www.imea.com.br.

References

Colussi, J., G. Schnitkey and C. Zulauf. "War in Ukraine and its Effect on Fertilizer Exports to Brazil and the U.S." farmdoc daily (12):34, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 17, 2022.

Paulson, N., G. Schnitkey, C. Zulauf, J. Colussi and J. Baltz. "The Rising Costs of Corn Production in Illinois." farmdoc daily (13):175, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 26, 2023.

Swanson, K. Analysis and Comparison of Corn Production in Brazil and the United States. National Corn Growers Association (NCGA). July 2023 Report. https://dt176nijwh14e.cloudfront.net/file/618/Brazil%20white%20paper.pdf

Zulauf, C., J. Colussi and G. Schnitkey. "Comparing Brazilian (1st and 2nd Crops), American, and Argentine Corn Yields." farmdoc daily (12):5, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 12, 2022.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.