Rising Overhead Costs Driven by Labor and Interest

Recent articles have illustrated and analyzed the rising costs of crop production since 2000, using data from central Illinois corn and soybean producers to illustrate. We’ve discussed increases in direct input costs for both corn (see farmdoc daily, September 26, 2023) and soybeans (see farmdoc daily, November 14, 2023) as well as increasing power costs associated with corn production (see farmdoc daily, December 5, 2023). Today’s article shifts focus to the overhead costs associated with corn production, specifically labor and interest costs, with implications for the 2024 crop year and beyond.

Overhead Costs Show Consistent Increase Over Past 20 Years

Figure 1 reports average overhead costs on corn acres on high-productivity farmland in central Illinois from 2000 to 2022. The figures are based on data from cooperating farmer members of the Illinois Farm Business Farm Management Association (IL FBFM). Projections for the 2023 and 2024 crop years come from the August 2024 release of Illinois crop budgets and historical revenue and costs for Illinois grain crops. Overhead costs include those associated with 1) hired labor and non-land interest (depicted in blue in Figure 1) and those associated with 2) building repair and depreciation, insurance (other than crop insurance), and miscellaneous overhead (depicted in orange in Figure 1).

Overhead costs averaged $50 per acre for the 2000 crop year, tracking down to $40 per acre in 2004 due mainly to falling interest costs reflecting declining interest rates over that period. Over the next 18 years, overhead costs increased consistently, more than doubling to $83 per acre in 2022. Overhead costs are expected to be higher in 2023 and, in contrast with direct input and power costs, are projected to increase again, potentially surpassing the $100 per acre mark, in 2024.

On a relative basis, overhead costs have averaged 8.5% of crop revenues from 2000 to 2022, and 7.4% of crop revenues from 2006 to 2022. Projected overhead costs for 2024 would exceed both averages at more than 9% of expected crop revenues.

Hired Labor and Non-Land Interest Costs

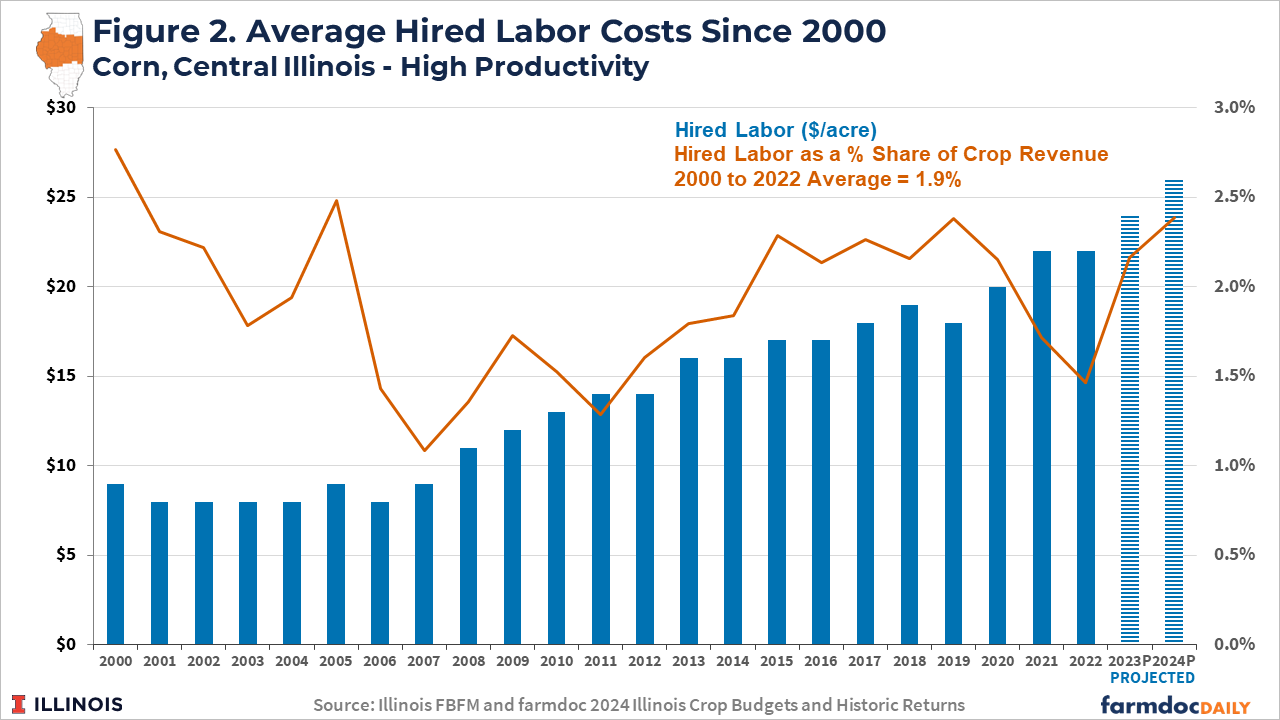

Costs associated with hired labor and non-land interest comprise a significant component, roughly half, of total overhead costs. Figure 2 reports hired labor costs, in dollars per acre and as a revenue share, since the 2000 crop year.

After being relatively flat from 2000 to 2006, hired labor costs have increased consistently since the 2006 crop year. This trend is consistent with the labor market challenges facing nearly all industries in the U.S. The overall labor force participation rate has declined since the late 1990s; nominal wages have been steadily increasing since the early 1970s, and real wages have exhibited faster increases over the past decade compared with the previous three decades. These labor market characteristics, coupled with more recent policy actions, do not suggest a reversal in the trend toward rising labor costs in the short- or medium-term. The farmdoc daily article from January 6, 2022 provides a more detailed discussion of these U.S. labor market issues.

Hired labor costs have averaged 1.9% crop revenues since 2000. The combination of lower prices and revenues and higher labor costs relative to the 2021 and 2022 crop years suggest relative labor costs which are expected to be above that longer-term average of 1.9% for both 2023 and 2024.

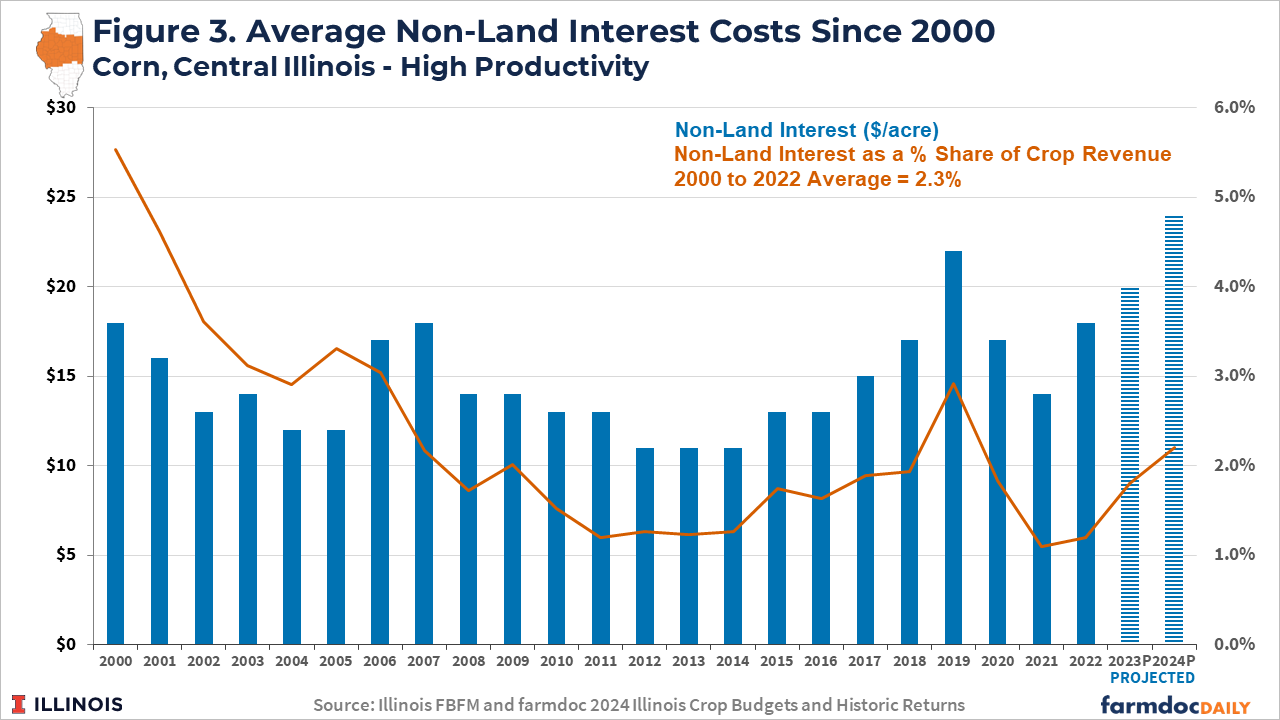

Non-land interest costs on central Illinois corn acres, shown in Figure 3, have varied and shown less evidence of a consistent trend since 2000. Changes in interest costs over time closely follow the pattern of U.S. interest rates and U.S. monetary policy over that timeframe. Declining interest costs in the early 2000s, the late 2000s into the early 2010s, and from 2019 to 2021 reflect periods of the Fed lowering interest rates in response to recessionary periods following the dot-com bubble, the housing marketing crisis, and the Covid pandemic, respectively. Rising interest costs have similarly occurred during corresponding periods of increasing interest rates, most recently with the Fed’s decision to raise rates to combat inflation since March of 2022.

On a relative basis, the interest cost share of crop revenues averaged 2.3% from 2000 to 2022, and has generally trended down during that period. Recent rate increases have resulted in expectations for relative interest costs to increase back above 2% for 2024 but remain below the longer term average of 2.3%.

Interest costs will continue to, at least partially, reflect U.S. monetary policy and interest rate markets. In its most recent action on December 13th, the Fed chose to pause any further interest rate hikes and signaled that as many as three interest rate reductions could occur in 2024 (see here, here, and here for coverage), providing some optimism for future interest expenses. However, the timing of those reductions, if they occur, are not likely to significantly impact interest expenses for the 2024 crop season. Reductions would be more likely to materialize in shorter-term borrowing and operating lines for the 2025 crop year.

Discussion

Similar to direct input and power costs, the overhead costs associated with corn production in Illinois have been trending upward over the past 20 years, more than doubling from 2004 to 2022. Further increases in overhead costs are expected for the 2023 crop year and, in contrast with direct and power costs, overhead costs are projected to increase again in 2024.

Hired labor and non-land interest make up roughly half of total overhead costs and both categories have been drivers of increasing trends in the last two decades. Labor costs have risen consistently since the mid-2000s, reflecting broader labor market trends in the U.S. Interest costs have largely tracked trends in interest rates driven by U.S. monetary policy. While interest costs may decline for the 2025 crop year with the Fed signaling potential rate cuts in 2024, labor market challenges seem likely to continue to drive labor costs higher for producers in the future.

Acknowledgment

The authors would like to acknowledge that data used in this study comes from farms across the State of Illinois enrolled in the Illinois Farm Business Farm Management (FBFM) Association. Without their cooperation, information as comprehensive and accurate as this would not be available for educational purposes. FBFM, which consists of 5,000 plus farmers and 65 professional field staff, is a not-for-profit organization open to all farm operators in Illinois. FBFM field staff provide on-farm counsel with computerized recordkeeping, farm financial management, business entity planning and income tax management. For more information, please contact the State Headquarters located at the University of Illinois Department of Agricultural and Consumer Economics at 217-333-8346 or visit the FBFM website at www.fbfm.org.

References

Paulson, N., G. Schnitkey, C. Zulauf, J. Colussi and J. Baltz. "The Rising Costs of Corn Production in Illinois." farmdoc daily (13):175, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 26, 2023.

Paulson, N., G. Schnitkey, C. Zulauf and J. Colussi. "The Rising Costs of Soybean Production in Illinois." farmdoc daily (13):208, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 14, 2023.

Paulson, N., G. Schnitkey, J. Colussi and C. Zulauf. "Implications of Rising Power Costs for 2024." farmdoc daily (13):220, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 5, 2023.

Zulauf, C., G. Schnitkey, N. Paulson and K. Swanson. "US Labor Market and Labor Wage Inflation." farmdoc daily (12):1, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 6, 2022.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.