Farm Loan Interest Rate Trends by Major Lender Groups

Related Podcast: Navigating Farm Loan Interest Rates[1][2],[3]. Medians are reported instead of averages to mitigate the influence of outliers in the data. To aid in interpreting the data, we also estimated whether interest rates for each debt type in each year were statistically different across lenders.[4] The interest rates reported in this analysis do not explicitly control for differences in borrower risk or funding costs but do provide novel insights into broad trends observed during the past 15 years.

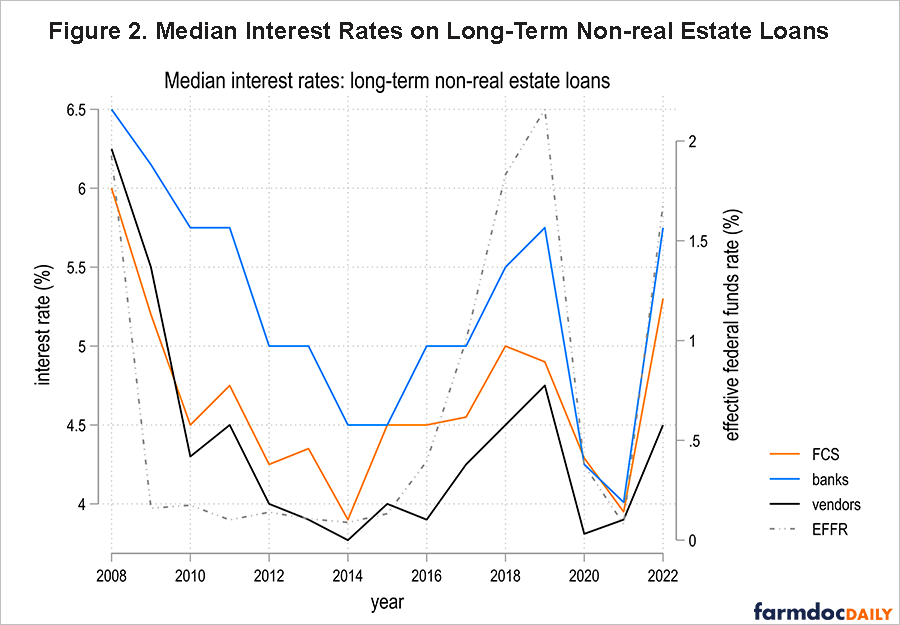

Figures 1 and 2, [5] points. For FCS and banks, the average difference in median interest rates is 52 basis points. However, this difference narrowed in recent years. Interest rates were not statistically different between banks and FCS lenders for four out of six years between 2017 and 2022. This may be related to the relatively low interest rate environment prior to March 2022. The number of vendor observations in this category is relatively low, and interest rates charged by vendors are not statistically distinguishable from rates charged by other lenders in most years.

Figures 1 and 2, [5] points. For FCS and banks, the average difference in median interest rates is 52 basis points. However, this difference narrowed in recent years. Interest rates were not statistically different between banks and FCS lenders for four out of six years between 2017 and 2022. This may be related to the relatively low interest rate environment prior to March 2022. The number of vendor observations in this category is relatively low, and interest rates charged by vendors are not statistically distinguishable from rates charged by other lenders in most years.

marketing or pricing strategy, and when it comes to machinery lending, equipment dealers and manufacturers have several advantages[6]

marketing or pricing strategy, and when it comes to machinery lending, equipment dealers and manufacturers have several advantages[6]

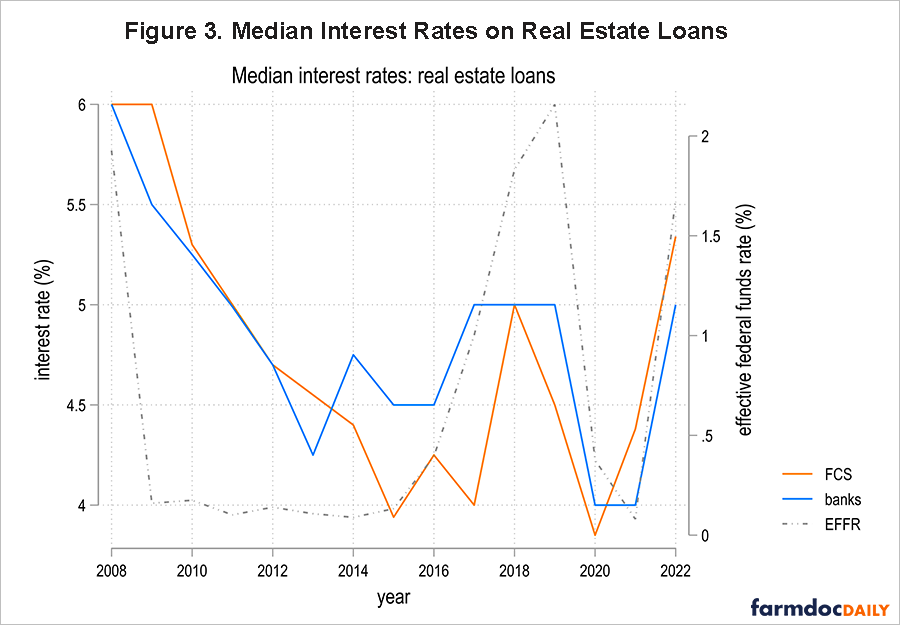

Median interest rates on real estate loans issued by FCS lenders and banks are shown in Figure 3[7]tax and other[8] Likewise, banks may benefit from access to the secondary market — for example, competitive rates provided by Farmer Mac and other secondary lenders.

Conclusion

[9]. In the next article in this series will compare median interest rates across regions, lenders and loan types.

Disclaimer: The findings and conclusions in this presentation are those of the authors and should not be construed to represent any official USDA or U.S. Government determination or policy.

Acknowledgements: This work was supported in part by effort from the Rural and Farm Finance Policy Analysis Center (RaFF) at the University of Missouri. The Rural and Farm Finance Policy Analysis Center (RaFF) at the University of Missouri aims to help policymakers and stakeholders understand rural economic and financial conditions and trends and explore how existing and proposed policies affect rural and farm finances. Alice Roach provided feedback and editorial support.

Notes

[1] ARMS data are confidential. USDA and other researchers have limited access. In the case of refinanced debt, ARMS treats the loan origination year as the year in which refinancing occurred. The survey typically asks for detailed information on an operation’s five largest loans. We cannot differentiate this loan data into fixed rate and variable rate loan categories over the entire study period.

[2][3] During the observed period, the total number of observations varied by lender category; 37,571 bank observations, 17,829 FCS observations and 7,041 vendor observations. Other lender types had fewer observations and thus were not included in this analysis.

[4][5] 100 basis points is 1 percentage point; for example, an increase in interest rates from 3% to 4% would be an increase of 100 basis points.

[6][7] Due to the low amount of real estate lending by vendors reported in ARMS, we omit providing interest rate estimates for this group. Real estate debt includes the operator’s dwelling.

[8] FCS lenders are structured as cooperatives. Thus, borrowers become cooperative members and are eligible to receive annual patronage payments. The net cost of borrowing from an FCS lender would account for interest rate and patronage payments.

[9] Our analysis uses data that is restricted to newly originated debt in the survey year. The interest rate data we present should be interpreted as trends rather than official estimates.

References

Federal Reserve Bank of Kansas City, Survey of Terms of Lending to Farmers and Federal Reserve Bank of Kansas City. 2023. Available online: Ag Finance Updates - Federal Reserve Bank of Kansas City (kansascityfed.org)

Federal Reserve Bank of New York, Effective Federal Funds Rate [EFFR]. 2023. Available online: Effective Federal Funds Rate (EFFR) | FRED | St. Louis Fed (stlouisfed.org)

U.S. Department of Agriculture, Economic Research Service (USDA-ERS). 2023. “U.S. and State Farm Income and Wealth Statistics.” Available online: USDA ERS - Data Files: U.S. and State-Level Farm Income and Wealth Statistics

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.