ARC and PLC Payment Prospects for 2023 and 2024

Recent farmdoc daily articles have discussed the impact of declining prices on corn and soybean return projections in Illinois (see farmdoc daily, July 30, 2024) and the prospects for crop insurance payments to cover revenue losses (see farmdoc daily, August 6, 2024) in 2024. To summarize, corn and soybean price declines through July have led to even lower farmer return projections than in crop budgets released in June. However, current expectations for good to excellent crop yields, despite lower prices, suggest that significant crop revenue insurance payments are unlikely for the 2024 crop year.

Today’s article shifts the focus to the commodity programs administered by USDA’s Farm Service Agency (FSA) – Ag Risk Coverage (ARC) and Price Loss Coverage (PLC). We discuss how current estimates and projections for marketing year average (MYA) prices for 2023 and 2024 impact prospects for payments from the ARC and PLC programs in both years. Overall, farmers in Illinois should not expect commodity title payments for 2023 production which, for corn and soybeans, would occur in October of 2024. There is greater potential for commodity program payments associated with 2024 production, but much could still change over the course of the marketing year.

Background

For 2023 and 2024 crops, farmers had three commodity program options to choose from as part of the 2018 Farm Bill:

- Price Loss Coverage (PLC) is a crop-specific fixed price support program that triggers payments if the marketing year average (MYA) price falls below the commodity’s effective reference price. Payments are made using a PLC yield on 85% of historical base acres (see farmdoc daily, September 24, 2019)

- Agricultural Risk Coverage at the county level (ARC-CO) is a crop-specific county revenue program. ARC-CO triggers payments if actual revenue (MYA price times county yield) falls below 86% of the benchmark revenue (product of benchmark price and trend-adjusted historical yield for the county). Payments are made on 85% of historical base acres (see farmdoc daily, September 17, 2019)

- Agricultural Risk Coverage at the individual level (ARC-IC) is a farm-level revenue support program. Like ARC-CO, payments are triggered if actual revenue falls below 86% of the benchmark. If an FSA farm unit is enrolled in ARC-IC, information for all commodities planted in 2023 is combined together in a weighted average to determine benchmark and actual revenues. If a farmer enrolls multiple FSA farms in the same state, all farm units are combined in determining the averages for actual and benchmark revenues. Payments are made on 65% of historical base acres (see farmdoc daily, October 29, 2019).

We focus today on the PLC and ARC-CO programs as they represent the vast majority of base acre enrollment (1% of corn base acres were enrolled in ARC-IC for 2024, less than 1% of soybean and wheat base acres were enrolled in ARC-IC for 2024).

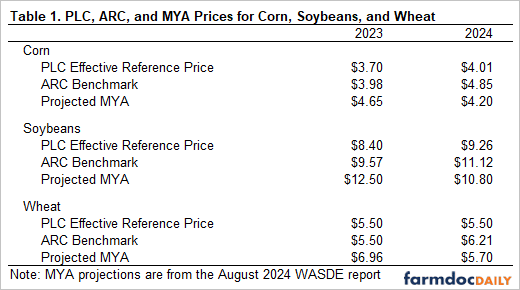

Table 1 shows the effective reference and ARC benchmark prices for corn, soybeans, and wheat for 2023 and 2024. Also included in table 1 are the most recent estimates for 2023 MYA prices and current projections for 2024 MYA prices.

ARC and PLC Payments for 2023

The 2023 marketing year for wheat ended on May 31st and PLC and ARC payment rates have been published by FSA. The marketing year for corn and soybeans does not end until August 31st, so payment rates remain estimates based on information currently available. ARC and PLC program data is provided by FSA here.

Wheat’s 2023 MYA price is $6.96 per bushel, well above the $5.50 effective reference price where PLC support would be triggered and the $5.50 benchmark price for ARC. County yields would need to be below 68% of benchmark levels to trigger ARC-CO payments for 2023. No Illinois counties had average yields reported in the FSA data that were low enough to trigger ARC-CO payments for wheat for 2023.

Corn’s MYA price for the 2023 marketing year is currently projected at $4.65/bu., well above the $3.70 effective reference price. The current 2023 MYA projection for soybeans of $12.50/bu. is also well above the $8.40 effective reference price. Thus, no PLC payments are expected to be triggered for corn or soybeans for 2023.

The 2023 ARC benchmark prices for corn and soybeans are both higher than their effective reference prices: $3.98 for corn and $9.57 for soybeans. The $4.65 MYA projection for corn is 17% above the ARC benchmark (4.65/3.98 = 1.17) while the $9.57 projection for soybeans is 31% above its ARC benchmark. Given ARC-CO’s 86% coverage level, this means county yields would need to be below benchmark levels for ARC-CO payments to be triggered.

For corn, the county yield would need to be below 74% of benchmark. For counties where FSA is currently reporting a 2023 yield for corn, only Hardin County would have a yield loss large enough to trigger an ARC-CO payment for corn. If the $4.65 MYA price projection holds, 2023 corn in Hardin County, Illinois would receive roughly a $10 per base acre ARC-CO payment.

For soybeans even larger yield losses would be needed with county yields below 66% of benchmark triggering ARC-CO payments. Based on county soybean yields currently reported by FSA, ARC-CO would not trigger payments for soybean base anywhere in Illinois.

ARC and PLC Payment Prospects for 2024

The final column of table 2 reports the PLC effective reference prices, ARC benchmark prices, and USDA’s projections for 2024/25 MYA prices from the August WASDE report. Current USDA projections suggest even lower 2024 MYA prices for corn ($4.20), soybeans ($10.80), and wheat ($5.70). Still, these projections are all above each crop’s 2024 effective reference prices, meaning even lower prices would need to be realized to trigger PLC payments for 2024. The corn and wheat MYA price projections are $0.19 and $0.20 per bushel above the effective reference prices of $4.01 and $5.50, respectively. The soybean MYA projection is $1.54 above the effective reference price of $9.26.

The $4.20 MYA price projection for corn is well below the $4.85 ARC benchmark price for 2024. At that MYA price level, ARC-CO payments would be triggered in counties where yields fell just 1%, or more, below benchmark yield. For soybeans, a $10.80 MYA price for 2024 would imply yields would need to be more than 11% below benchmark to trigger ARC-CO payments. Finally, the wheat MYA projection of $5.70 implies that county yields would need to be at least 6% below benchmark to trigger ARC-CO payments. Much can still change that could impact the 2024 MYA prices. Prices below current USDA projections would result in much higher chances of ARC-CO and, potentially, PLC payments.

Discussion

Lower corn, soybean, and wheat prices experienced during the 2023 marketing year and expected for the 2024 marketing year are resulting in much lower return and income projections for farmers compared with the very high incomes earned in 2021 and 2022. Despite the significant prices declines, support payments from the PLC and ARC programs for 2023 do not seem likely to occur for most farms with corn, soybean, or wheat base acres.

Even with lower price projections for the 2024 marketing year, PLC payments would not occur at current price expectations. ARC-CO payments for 2024 can more likely occur at current price projections for corn if yields are close to benchmark levels, but moderate county yield losses would need to occur for payments to be triggered on soybean and wheat acres.

The greater potential for ARC-CO payments in 2024 stands somewhat in contrast to what continues to look like a relatively low likelihood for significant or widespread crop revenue insurance payments from individual policies in 2024 (see farmdoc daily, August 6, 2024). This illustrates the differences between the ARC commodity programs and crop insurance. While crop revenue insurance policies protect against price declines within the crop year, the ARC program’s benchmark revenue is based on a 5-year recent history of prices. ARC’s price benchmark incorporates the higher prices experienced from 2020 to 2022, while the projected prices for crop insurance have adjusted down more quickly to current market expectations for the crop year.

The timing of when payments would be received through crop insurance vs commodity programs is also important to keep in mind. Crop insurance payments on individual policies, if triggered, would be available before the end of 2024, typically in the late November to December timeframe. Payments from area-based plans, including the SCO and ECO policies, would not be received until mid- to late-June of 2025 after RMA finalizes the area yields used for those products. Payments from ARC or PLC are not received until the marketing year ends. For corn and soybeans, payments for the crop harvested in 2024 would be received in October of 2025.

Summary

Continued price declines have created concerns about farm incomes for 2023 and 2024. The price declines and county yield experience for 2023 suggest that PLC and ARC-CO payments are not likely to be triggered in most areas for corn, soybeans, or wheat. Even lower price expectations increase the prospect for payments for 2024. However, current price projections would not trigger PLC payments and moderate yield losses would be needed to trigger ARC-CO payments on soybean and wheat base.

Even if ARC and/or PLC trigger support for 2024, farmers should remember that payments for corm and soybeans would not be received until October of 2025. Support outside of the commodity or crop insurance programs could occur via ad hoc programs. Recent historical precedent would suggest this is possible, but not guaranteed. Furthermore, much could still change over the course of the 2024 marketing year which does not begin for corn and soybeans until September 1st. Still, given the current price outlook, careful budgeting and cash flow planning for the rest of 2024 and into 2025 will be critical.

Note: For readers who are curious about ARC-CO and PLC payment scenarios for their specific farm and county, a reminder about farmdoc’s Excel based What If Tool that allows users to compute potential ARC and PLC payment outcomes for a range of prices and yields.

References

Paulson, N., G. Schnitkey and C. Zulauf. "Revenue Insurance Payment Scenarios for Corn and Soybeans in 2024." farmdoc daily (14):145, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 6, 2024.

Schnitkey, G., B. Zwilling, N. Paulson, C. Zulauf, B. Rhea and J. Baltz. "Increasing Pessimism About 2024 and 2025 Corn and Soybean Returns." farmdoc daily (14):141, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 30, 2024.

Schnitkey, G., C. Zulauf, K. Swanson, J. Coppess and N. Paulson. "The Price Loss Coverage (PLC) Option in the 2018 Farm Bill." farmdoc daily (9):178, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 24, 2019.

Schnitkey, G., J. Coppess, N. Paulson, C. Zulauf and K. Swanson. "The Agricultural Risk Coverage — County Level (ARC-CO) Option in the 2018 Farm Bill." farmdoc daily (9):173, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 17, 2019.

Zulauf, C., B. Brown, G. Schnitkey, K. Swanson, J. Coppess and N. Paulson. "The Case for Looking at the ARC-IC (ARC-Individual) Program Option." farmdoc daily (9):203, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 29, 2019.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.