Conservation Tradeoff: Inflation Reduction Act vs. Baseline

The Farm Bill conservation programs are capped either in terms of total funds available or total acres that can be enrolled. This has significant consequences for budget baseline and scoring, or cost estimates, projected by the Congressional Budget Office (CBO). This, in turn, has implications for program implementation and operation, as well as for the farmers seeking assistance with conservation efforts on their farms. CBO’s score of the Farm Bill reported by the House in May further highlighted this matter, presenting a tradeoff for conservation policy that is explored further herein (farmdoc daily, August 8, 2024).

Background

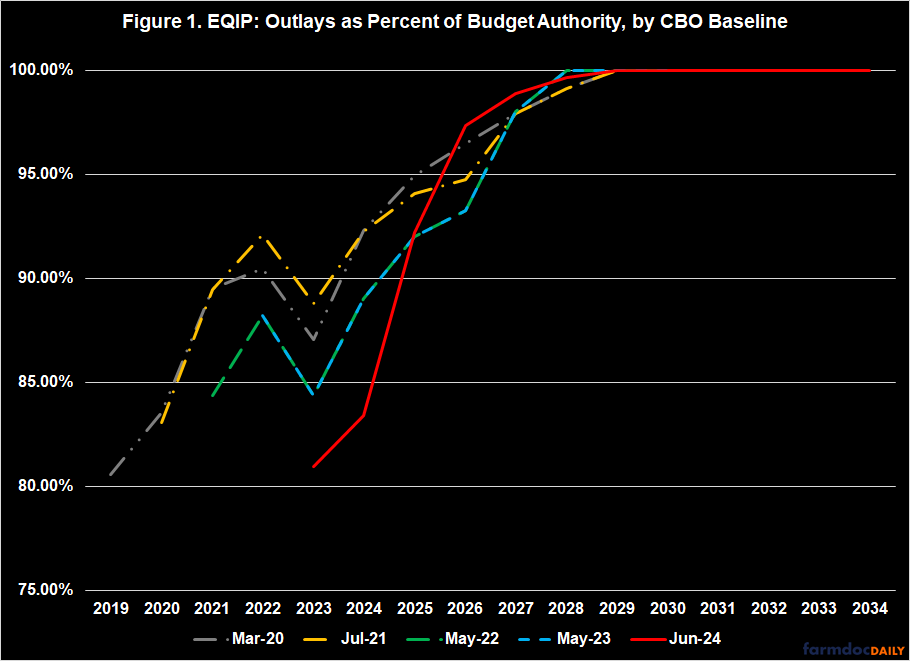

Federal budget policy is full of oddities and complications; CBO baselines and scoring projections, budget authority and outlays (CBO: June 2024; August 2, 2024). In general, budget authority is the total amount that Congress makes available to USDA for the program and outlays represent the amount (or estimated amount) of the budget authority that is spent, or expected to be spent (see, CBO, December 2021). Because it generally takes time to spend budget authority and agencies might not be able to obligate all of it, outlays are projected and estimated at levels lower than budget authority based on the historical rate of spending for the program (see e.g., Saturno, CRS, May 13, 2022). The differences are incorporated in the methodology for projecting baselines and costs of changes proposed in legislation (CBO: April 18, 2023; February 5, 2018). Except for the Conservation Reserve Program (CRP), CBO projects outlays for conservation programs that are less than budget authority in multiple years. Congress authorizes a fixed mandatory amount of funding (budget authority) and CBO projects how much of it will be spent (outlays). For example, the Environmental Quality Incentives Program (EQIP) is authorized $2.025 billion each fiscal year (16 U.S.C. §3841). Figure 1 illustrates this dynamic for EQIP with the outlays as a percentage of the budget authority in the five most recent baseline projections.

Discussion

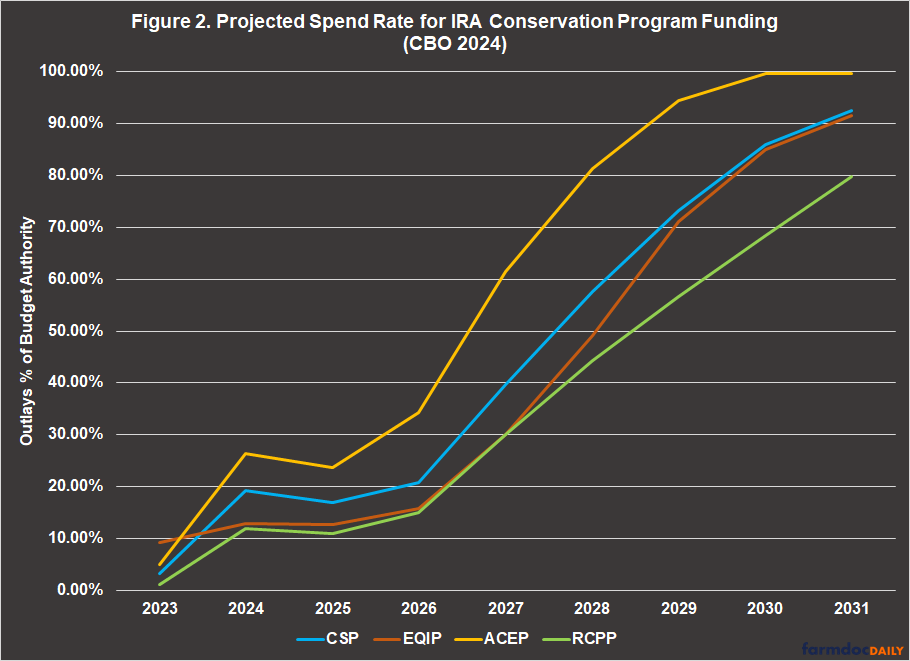

Congress appropriated additional funds for four Farm Bill conservation programs in the Inflation Reduction Act of 2022: Environmental Quality Incentives Program (EQIP, $8.45 billion); Conservation Stewardship Program (CSP, $3.25 billion); Agriculture Conservation Easement Program (ACEP, $1.4 billion); and Regional Conservation Partnership Program (RCPP, $4.95 billion) (P.L. 117-169). The total amount appropriated constitutes the total additional budget authority for each program and equals $18.05 billion for FY2023 through FY2026 (see, farmdoc daily, August 1, 2024). Congress allowed USDA until FY2031 to spend (or obligate) all appropriated funds (or budget authority). In the June 2024 baseline, CBO projected total outlays from the IRA budget authority of $16.1 billion through FY2031, about $1.95 billion less than (or 89% of) the total amount appropriated by Congress. Figure 2 illustrates the spend rate for the additional IRA funds by program. CBO projects that USDA will spend all ACEP funds, 92.5% of the CSP funds, 92% of the EQIP funds, and 80% of the RCPP funds by FY2031. Importantly, any funds not obligated by the end of FY2031 are lost and cannot be spent after September 30, 2031.

The differences between outlays and budget authority have little direct impact on farmers or for USDA. CBO’s projections of outlays are not controlling on USDA obligations of budget authority and do not limit or constrain USDA spending. But these projections do matter for Congressional scorekeeping, what a program costs and how much an offset is worth. This, in turn, has direct consequences on program design and funding.

The House Farm Bill proposes to rescind the remaining IRA conservation investments while also increasing the budget authorities for those and other conservation programs (H.R. 8467; farmdoc daily, August 8, 2024). In effect, the House Farm Bill increases baseline conservation spending and uses the remaining IRA funds as the offset. The challenge, however, is that CBO scoring comes with costs in terms of the funds available as an offset and presents a tradeoff for conservation policy. If Congress does nothing to the IRA, USDA will have $18.05 billion available to pay to farmers for conservation through FY2031. After that fiscal year, however, any remaining conservation budget authority is lost and unobligated funds cannot be spent; also, only the baseline amounts authorized by Congress in the Farm Bill are then available—the additional funds in the IRA do not alter or impact the Farm Bill baseline.

In a sense, the offset comes with a cost—something akin to an ATM transaction fee for withdrawing the funds—that could equal billions of the total funds available. The CBO score for rescinding the IRA appropriation is limited to $11.7 billion (over 10 years), or 65% of the total budget authority and 73% of the projected outlays. On the other side of the equation, increasing the baseline for conservation funds is permanent and will continue until Congress either changes the budget authority or the budget rules. CBO estimates that the House Farm Bill would increase conservation budget authority by $12.9 billion and increase outlays by $9.9 billion compared to the May 2023 baseline (FY2024-2033). The tradeoff for conservation policy is giving up temporary funds in the near-term for more funding over the longer time horizon. The risks, however, are that future farm bills could reduce those amounts or that unspent IRA funds are lost.

Further complicating this tradeoff, budget rules operate on ten-year budget windows (e.g., FY2024 to FY 2033) and include costs in the five years after the House Farm Bill expires, known as the outyears—fiscal years included in the CBO score but not the Farm Bill authorization. The House Farm Bill also changes the authorization date for the conservation programs from FY2031, as amended by the IRA, to FY2029. CBO estimates that the House Farm Bill will have added a total of $4.725 billion in budget authority for conservation programs, including EQIP, CSP, ACEP, and RCPP, by FY2029. By the end of the ten-year scoring window (FY2033), the House Farm Bill will have added a total of $12.9 billion in total budget authority for all conservation programs. The additional budget authority, however, continues into perpetuity (or until Congress changes its budget rules) and will thus be available after the last year of the ten-year score.

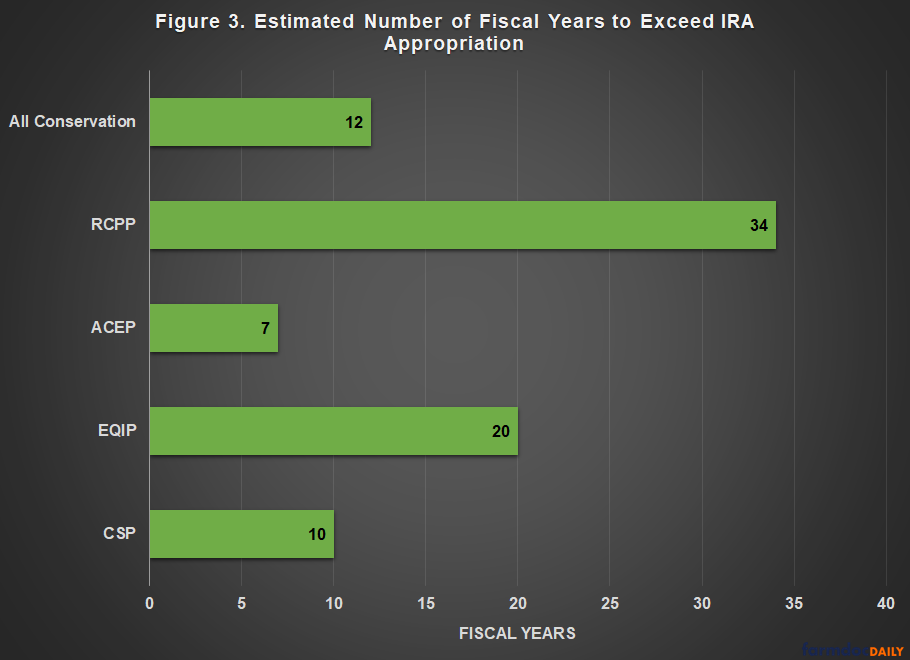

With sufficient time, the increased budget authority in the House Farm Bill would be expected to exceed the budget authority appropriated in the IRA. Figure 3 illustrates the estimated number of fiscal years necessary for the increases to budget authority in the House Farm Bill to exceed the IRA budget authority for each of the programs that received IRA funding, as well as for all conservation programs that received increases in the House Farm Bill. The tradeoff looks different for ACEP (7 fiscal years) and CSP (10 fiscal years) than for EQIP (20 fiscal years) and RCPP (34 fiscal years).

Concluding Thoughts

The Congressional Budget Office cost estimate for the House Farm Bill highlights a tradeoff for conservation policy. The additional funding for four conservation programs that was appropriated in the Inflation Reduction Act is used as an offset for increasing the permanent budget authority for those and other conservation programs. It exchanges more funding available to farmers for conservation that is temporary and expires in FY2031 for lesser funding initially but that doesn’t expire, although it will require many fiscal years to exceed the IRA funding.

For farmers, this obscure issue can have actual consequences because the longer time horizon of funding is more uncertain, requiring Congress to reauthorize those levels in future farm bills. More importantly, the total funding that may become available a decade or more into the future does not account for the increasing costs of conservation practices in the near term, nor the impacts of inflation over time (see e.g., farmdoc daily, May 23, 2024). The tradeoff begs an arguably more fundamental question as to why it is necessary at all, while further exposing the very different treatment of conservation policy by Congress. Conservation programs are capped, while farm program payments and crop insurance are not; the House Farm Bill limits conservation funding increases based on the CBO score of the savings from ending the IRA investments but does not similarly limit the increased costs ($43 billion) in farm program payments. The challenges embedded in this matter extend beyond the House Farm Bill but are made worse by it. At the very least, it is difficult to expect farmers to prioritize conservation if Congress does not.

References

Congressional Budget Office, Cost Estimate. H.R. 8467, as ordered reported by the House Committee on Agriculture on May 23, 2024. August 2, 2024. https://www.cbo.gov/system/files/2024-08/hr8467.pdf

Congressional Budget Office. “CBO Describes Its Cost-Estimating Process.” April 18, 2023. https://www.cbo.gov/publication/59003

Congressional Budget Office. “How CBO Prepares Cost Estimates.” February 5, 2018. https://www.cbo.gov/publication/53519

Congressional Budget Office. “Introduction to Budget Authority.” May 13, 2022. https://crsreports.congress.gov/product/pdf/IF/IF12105

Congressional Budget Office. Common Budgetary Terms Explained. December 2021. https://www.cbo.gov/publication/57660

Coppess, J. "Reviewing the Congressional Budget Office Score of the House Farm Bill." farmdoc daily (14):147, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 8, 2024.

Coppess, J. "Policy Design Case Study: EQIP and the Inflation Reduction Act." farmdoc daily (14):143, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 1, 2024.

Coppess, J. and I. Majumdar. "An Inflation Question Not Asked: What About Conservation?" farmdoc daily (14):98, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 23, 2024.

Congressional Budget Office. Baseline Projections. June 2024. https://www.cbo.gov/system/files/2024-06/51317-2024-06-usda.pdf

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.