Taking A Closer Look at the Conservation Tradeoff Issues

Today’s article continues the discussion of our exploration of policy design issues for conservation assistance (farmdoc daily, October 10, 2024; August 15, 2024). With the additional conservation funding for the Environmental Quality Incentives Program from the Inflation Reduction Act and the proposed changes in the Farm Bill reported by the House Agriculture Committee, this article takes a closer look at the interaction between budgetary procedures, cost projections, and the allocation among practices eligible for financial assistance.

Background

As discussed previously, the Congressional Budget Office (CBO) scoring of the House provisions—rescinding IRA funding and adding it to EQIP baseline—will eventually provide more financial assistance to farmers for conservation but it will take much longer. Our initial estimate was fiscal year (FY) 2043 to nearly replace all funding available. One reason for this is that IRA funding was front-loaded through FY2026, with authority to spend it all that expires in FY2031. Any funds not spent are lost.

Additionally, a variety of issues arise from CBO scoring which uses outlay projections that are less than the budget authority appropriated by Congress: for EQIP, CBO projects a total of $7.7 billion in outlays for the $8.45 billion in budget authority appropriated, and only $2.6 billion in total outlays for the House Farm Bill’s increase in EQIP baseline (CBO, May 2023 and August 2, 2024; farmdoc daily, August 8, 2024; August 15, 2024; October 10, 2024). This is part of the tradeoff. Another aspect of the tradeoff results from the changes in the House Farm Bill that would remove the limitation on which practices are eligible to receive the additional funding. The House Farm Bill EQIP funding would be available to all practices eligible under EQIP, spreading the smaller additional funding amongst more practices.

Discussion

Complications abound in the CBO score for the House Farm Bill; among them, CBO scored against the May 2023 baseline, providing a score for FY2024 to FY2033. This is because the House Agriculture Committee reported its bill before CBO completed the 2024 baseline in June. This creates a mismatch with the baseline and scoring projections, as well as a further disconnect from reality because FY2024 ended on September 30th and obligations for FY2025 are underway but not included in the scoring.

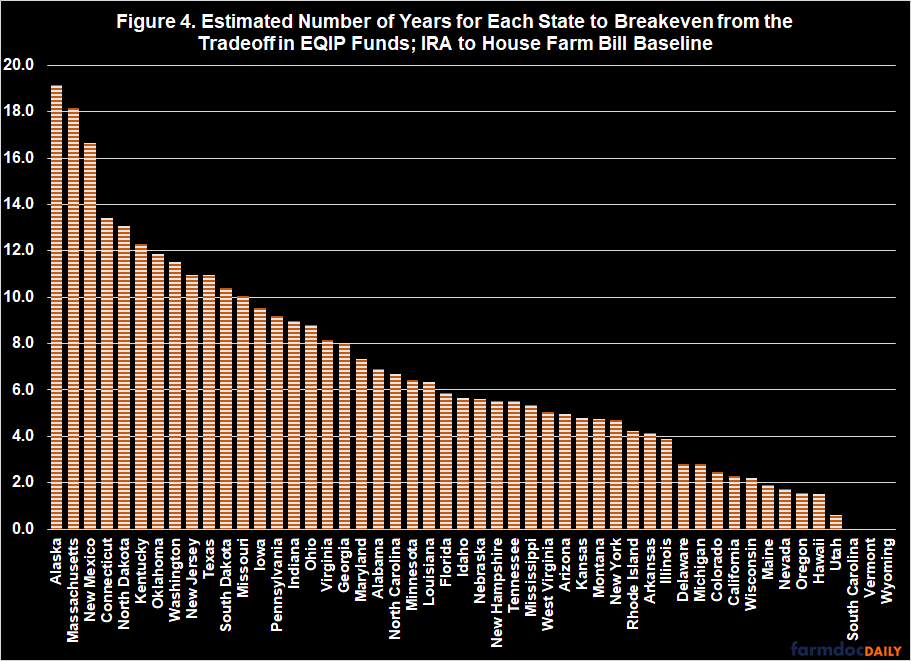

To begin, Figure 1 illustrates a projection of the changes in EQIP funding proposed by the House Farm Bill under the CBO score. As expected, EQIP funding is lost through FY2030 when the IRA appropriations would provide more than the House Farm Bill, but EQIP funding increases beginning in FY2031, the last year IRA funding is available to be spent. In the CBO scoring window that remains (FY2025 to FY2033), EQIP funding would decrease by nearly $3.9 billion overall. The House Farm Bill changes the baseline, however, and one presumption would be that the increase in FY2033 ($587 million) continues through each fiscal year thereafter.

For the analysis in Figure 1 and the remainder of this discussion, note that we used Natural Resources Conservation Service (NRCS) reported data for EQIP during FY2021-2023. This provides multiple years of data that are closely aligned with the FY2023 IRA funds. Using FY2021-2023 data, we calculated the annual share of overall spending for each practice across different states for each year. From these shares by State and practice, we established ranges for the maximum and minimum for each practice code and fiscal year. These shares were then applied to the IRA outlay projections, House outlay increases, and baseline EQIP, to generate projections for future years.

For this discussion we used the maximum share for each practice, state, and fiscal year to make the projections. Figure 2 illustrates the projections from the House Farm Bill by state. Note that Vermont and South Carolina are the only states projected to gain funding overall. This is because NRCS reported no funds for Vermont from the IRA FY2023 EQIP allocations and a minimal amount in South Carolina. Both received funding from the Farm Bill funds in FY2021-2023

The chart in Figure 3 provides further perspectives on the projected losses by State in Figure 2. Here, the projections for changes in funding are presented by practice for those that gain or lose more than $10 million in funding over the years projected (FY2025-2033). What drives losses at the state level are due the loss of funds in the near term as a result of CBO scoring and budget rules. Those losses are allocated to the states based on the FY2021-2023 practice allocations, altering the amounts a state gains or loses depending on its previous allocations. This further demonstrates that the tradeoff isn’t just the changes in funding from IRA to baseline, but also how those funds are allocated among the practices, which impacts funding allocations by State.

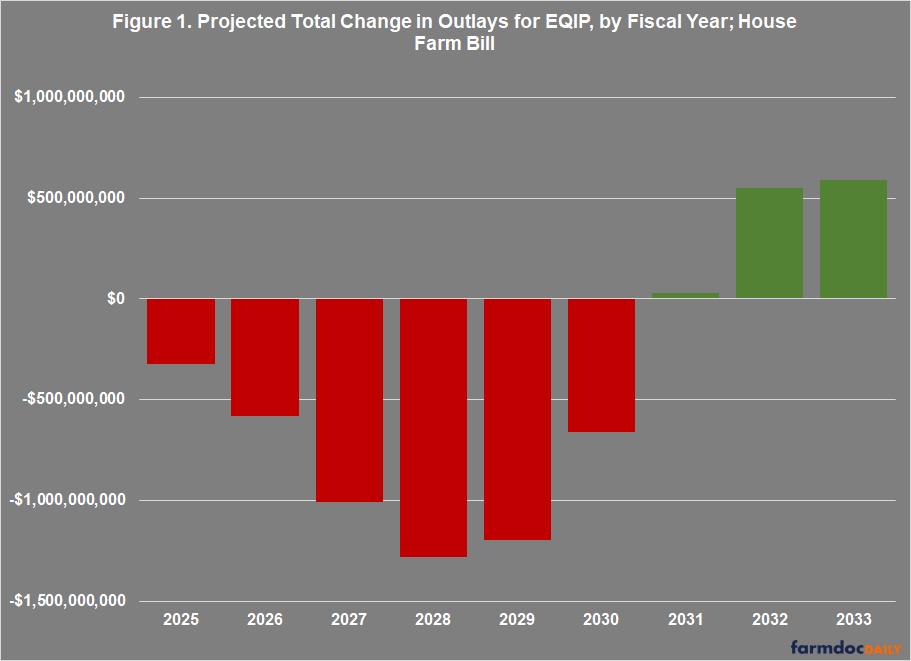

Again, the losses are due in part to the CBO scoring of outlays between the IRA and the new baseline, as well as the scoring window. Eventually, if all funds continue each State would make up the losses. With that in mind, Figure 4 projects the number of years it would take to offset the funding lost in the CBO score using the final year of projected funding (FY2033). If that final year of funding continued, these are the different years likely necessary for the State to break even from the tradeoff. Note that this comparison doesn’t apply to three states: South Carolina and Vermont are projected to receive increased funding from the House Farm Bill, while Wyoming is projected to continue losing funding in the last year based on this method.

Concluding Thoughts

The exploration of the tradeoffs in conservation funding discussed herein and in previous articles helps highlight matters of policy design. Using the Environmental Quality Incentives Program funding in the Congressional Budget Office scoring of the Inflation Reduction Act and the House Farm Bill, we project changes in funds and years to make up losses by State using recent funding allocation shares. The tradeoffs for farmers seeking conservation funding are temporal, in that IRA funds are frontloaded and available through FY2031, while less baseline funds are available in the near term, but the increases will carry into perpetuity. In addition, moving from the IRA’s more limited subset of eligible practices to the Farm Bill’s more expansive set of practices will have some impacts on State funding scenarios. Shifting EQIP funds from the former to the latter introduces additional complexities at the state level, affecting both the total available funding and the range of supported practices, as well as their distribution over time. This multifaceted dynamic offers perspectives on policy design questions for practice-based conservation financial assistance to farmers.

References

Congressional Budget Office, Cost Estimate. H.R. 8467, as ordered reported by the House Committee on Agriculture, August 2, 2024. https://www.cbo.gov/system/files/2024-08/hr8467.pdf.

Congressional Budget Office, “Details About Baseline Projections for Selected Programs: USDA Mandatory Farm Programs.” May 2023. https://www.cbo.gov/system/files/2023-05/51317-2023-05-usda.xlsx.

Coppess, J. "Conservation Tradeoff: Inflation Reduction Act vs. Baseline." farmdoc daily (14):150, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 15, 2024.

Coppess, J. "Reviewing the Congressional Budget Office Score of the House Farm Bill." farmdoc daily (14):147, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 8, 2024.

Coppess, J. and Y. Peng. "Conservation Tradeoff: EQIP in the Inflation Reduction Act and the House Farm Bill." farmdoc daily (14):185, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 10, 2024.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.