Conservation Tradeoff: EQIP in the Inflation Reduction Act and the House Farm Bill

October 1, 2024, marked the beginning of federal Fiscal Year (FY) 2025. The October 1 to September 30 fiscal year was established by Congress in the Congressional Budget and Impoundment Control Act of 1974 (P.L. 93-344). For FY2025, USDA announced that the Natural Resources Conservation Service (NRCS) would make $7.7 billion available to assist with conservation practices, $5.7 billion from the additional funding in the Inflation Reduction Act of 2022 (USDA Press Release, October 2, 2024; USDA-NRCS, Press Release, October 2, 2024). With Congress in recess for the upcoming November election, any opportunity for Farm Bill reauthorization by the 118th Congress depends on both the outcome of the elections and an anticipated lame duck session thereafter. IRA and Farm Bill conservation funding continue through the uncertainties. This article reviews potential tradeoffs between the two (farmdoc daily, August 15, 2024; August 29, 2024).

Background

The Farm Bill reported by the House Agriculture Committee back in May rescinds the Inflation Reduction Act of 2022 (IRA) investments in conservation programs, while increasing the budget authority for the same four conservation programs, as well as others (H.R. 8467; farmdoc daily, August 15, 2024). In this, a tradeoff between more funding in the short term from the IRA—but only available through fiscal year (FY) 2031—or a smaller increase in program baseline that is permanent. Figure 1 illustrates this for the Environmental Quality Incentives Program (EQIP) using the Congressional Budget Office (CBO) outlay projections for both IRA funding and the House Farm Bill (CBO, August 2, 2024; farmdoc daily, August 8, 2024).

Congress authorized $2.025 billion of budget authority each FY for EQIP (16 U.S.C. §3841), but CBO scores outlays, which are less ($19.69 billion in outlays on $20.25 billion of budget authority, FY2024-2033 (CBO, USDA Mandatory Farm Programs). CBO projects a total of $7.34 billion in additional outlays from the IRA funds in the remaining fiscal years (FY2025 to FY2031; blue bars with yellow borders) and $2.6 billion additional (above baseline) outlays from the House Farm Bill in the remaining years in the budget window (FY2025 to FY2033; orange area). The House Farm Bill would permanently increase EQIP spending, however, it would take 11 fiscal years to equal what CBO projects from the IRA. This is represented in Figure 1 with lighter shades in the years outside of the budget window (FY2034-2043).

Discussion

An important difference between IRA and House Farm Bill funding is the suite of practices eligible. IRA funding is available for only those practices determined to “directly improve soil carbon, reduce nitrogen losses, or reduce, capture, avoid, or sequester carbon dioxide, methane, or nitrous oxide emissions, associated with agricultural production” (P.L. 117-169, Section 21001). The House Farm Bill does not continue this limitation. Additional tradeoffs between the two sources of funding depend on the extent to which the IRA limitation impacts the distribution of conservation financial assistance.

Figure 2 presents recent data for EQIP assistance from the Farm Bill and the IRA as reported by NRCS and downloaded October 7, 2024 (USDA-NRCS, Financial Assistance Program Data). The data for FY2024 is likely incomplete and expected to be updated in the coming months. It is illustrated with a striped pattern to represent the preliminary status.

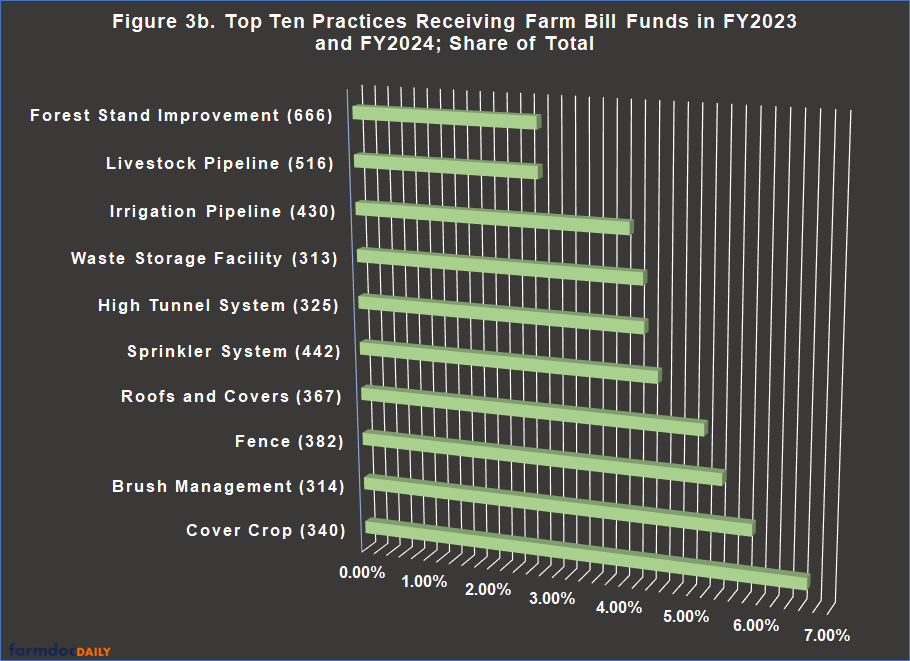

For farmers seeking to adopt conservation, the data presents good news: FY2023 ($1.56 billion) and the preliminary total in FY2024 ($1.7 billion) constitute the highest levels of EQIP assistance; to date, farmers have received over $1.05 billion in additional EQIP conservation assistance from the IRA. NRCS also reports financial assistance for a total of 107 practices in FY2023 and FY2024 from the IRA funding. This compares to a total of 161 practices that have received financial assistance from Farm Bill funds in those two fiscal years. The funds are also allocated among practices differently. Figures 3a and 3b illustrate the top 10 practices receiving financial assistance from IRA and Farm Bill funds in FY2023 and FY2024, respectively.

Figure 4 further compares the financial assistance for EQIP practices between IRA and Farm Bill funds. The top 25 practices receiving financial assistance from IRA funds are ranked in order by share of the total in FY2023 and FY2024. For each, the share of the total FY2023 and FY2024 Farm Bill funds is also presented, as well as the Farm Bill ranking in brackets next to the practice code. While many of the practices are in the top 25 for both IRA and Farm Bill funds, the rankings and distribution of financial assistance among them differ notably.

Concluding Thoughts

USDA’s Natural Resources Conservation Service continues to improve transparency on conservation program operation, timely reporting data on the financial assistance paid to farmers by practice and at different levels of geographic aggregation (USDA-NRCS, Financial Assistance Program Data). Among other things, this transparency allows for comparisons of the policy design differences between the Farm Bill and the Inflation Reduction Act funding. Such comparisons, in turn, offer insights into potential tradeoffs for conservation policy in any Farm Bill reauthorization negotiations. The House Agriculture Committee proposes rescinding the remaining IRA budget authority coupled with an increase in the permanent baseline budget authority for those conservation programs and others. As discussed herein, the tradeoff is between the larger amount of funding that is available to farmers immediately but temporarily ($7.34 billion through FY2031 in the Congressional Budget Office projections), versus a smaller amount that is permanently authorized. Based on the score for the House Farm Bill, it would take to FY2043 before those increases equal the entire projected spending on EQIP from the IRA funds. In addition, the IRA limits the practices eligible for its funding, but the House Farm Bill does not. To the extent that this alters the distribution of financial assistance among practices, moving from the IRA to the baseline would also involve tradeoffs that would likely impact which farmers in which states benefit and alter distributions across the country. Analysis of the potential impacts will be explored in a future article.

References

Congressional Budget Office, Cost Estimate. H.R. 8467, as ordered reported by the House Committee on Agriculture, August 2, 2024. https://www.cbo.gov/system/files/2024-08/hr8467.pdf

Coppess, J. "Back to Policy Design: The Inflation Reduction Act’s Conservation Assistance." farmdoc daily (14):158, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 29, 2024.

Coppess, J. "Conservation Tradeoff: Inflation Reduction Act vs. Baseline." farmdoc daily (14):150, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 15, 2024.

Coppess, J. "Reviewing the Congressional Budget Office Score of the House Farm Bill." farmdoc daily (14):147, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 8, 2024.

NRCS Financial Assistance Program Data, updated quarterly. https://www.farmers.gov/data/financial-assistance-overview

USDA Press Release. “$7.7 Billion Available for Climate-Smart Practices on Agricultural Lands as Part of Investing in America Agenda.” October 2, 2024. https://www.nrcs.usda.gov/news/77-billion-available-for-climate-smart-practices-on-agricultural-lands-as-part-of-investing-in

USDA Press Release. “Biden-Harris Administration Makes up to $7.7 Billion Available for Climate-Smart Practices on Agricultural Lands as Part of Investing in America Agenda.” October 2, 2024. https://www.usda.gov/media/press-releases/2024/10/02/biden-harris-administration-makes-77-billion-available-climate

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.