The Financial Efficiency of Illinois Grain Farms: Operating Expense Ratio

In our previous article (see farmdoc daily, March 10, 2025), we examined trends in median interest expense ratios across different farm sizes. Although larger grain farms have historically reported higher interest expense ratios, all farm sizes exhibited similar trends over the past two decades. We now extend our analysis on financial efficiency by examining trends in the operating expense ratio for grain farms across Illinois over the twenty-one-year period from 2003 to 2023 using data from Illinois Farm Business Farm Management (FBFM).

The operating expense ratio measures the share of a farm’s returns that are used to cover day-to-day operating expenses, excluding interest and depreciation. It is calculated by dividing total operating expenses excluding interest and depreciation by gross farm returns. According to the Farm Financial Scorecard developed by the Center for Farm Financial Management, a farm with an operating expense ratio that is greater than 80% is categorized as vulnerable, a ratio between 60% and 80% is categorized as cautionary, and a ratio that is less than 60% is categorized as strong.[1] Therefore, a lower operating expense ratio indicates greater financial efficiency, as more farm income is available for other uses after covering operating costs.

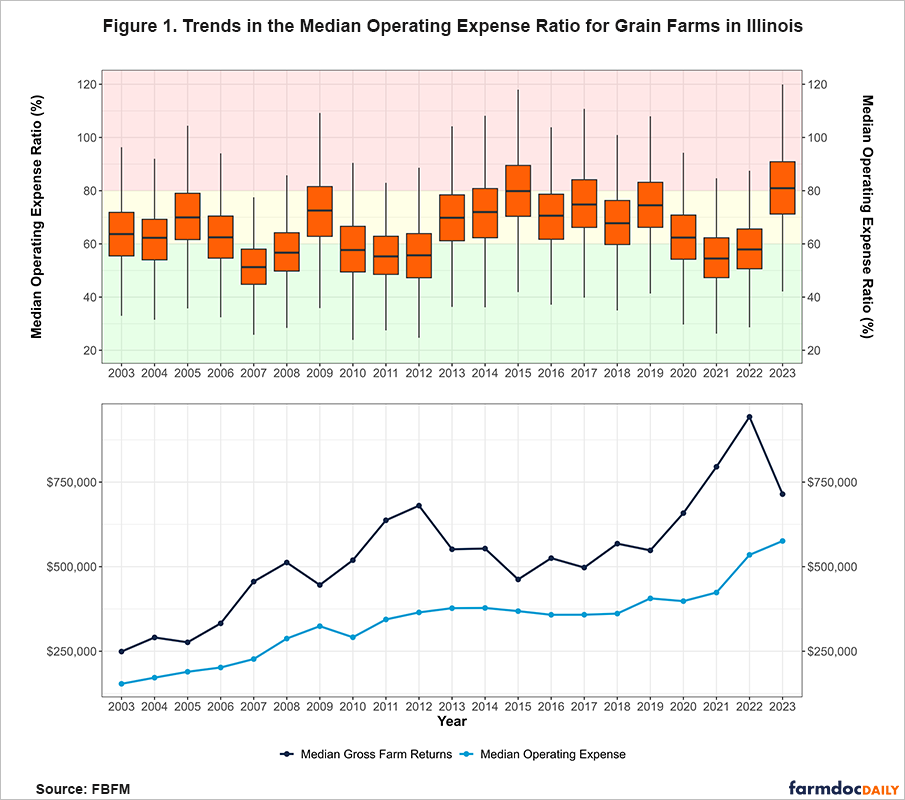

In our figure below, we use the color-coding system from the Farm Financial Scorecard to indicate the category the value of the operating expense ratio falls under. The region shaded in red indicates a vulnerable ratio, yellow represents a cautionary ratio, and green indicates a strong ratio. Each year’s data is summarized using box-and-whisker plots in the top panel of the figure to show how spread out the operating expense ratios are across our sample of grain farms.[2] The components of the boxplot consist of the (1) minimum (lowest value) or 0th percentile, (2) first quartile or 25th percentile, (3) median or 50th percentile, (4) third quartile or 75th percentile, and (5) maximum (highest value) or 100th percentile. The orange-shaded box represents the middle 50% of values—half the data is inside it—with its bottom edge marking the first quartile (25% of data falls below this point) and its top edge marking the third quartile (75% of data falls below this point). The thick line inside the box is the median (50th percentile), the exact middle value. Half the data is smaller, and half is larger. The lines extending out from the box (whiskers) extend to the minimum and maximum values of the data, showing the overall range of the operating expense ratio across grain farms, excluding extreme values. Lastly, the bottom panel of the figure shows the median gross farm returns and median operating expense excluding interest and depreciation. While the median operating expense ratios shown in the boxplots cannot be directly calculated by dividing the median operating expense by median gross farm revenue in a given year, observing the trends of these two measures can still help explain the relative changes in the median operating expense ratio from 2003 to 2023.

The top panel of Figure 1 illustrates trends in the median operating expense ratio over the past 21 years. This ratio has fluctuated between 51.25% and 81.32%, typically falling within the strong (<60%) and cautionary (60–80%) categories in most years. A ratio of 81.32% (vulnerable) means that for every $100 in gross farm returns, $81.32 was spent on operating expenses. Unsurprisingly, the median operating expense has been less variable compared to median gross farm returns. From 2003 to 2012, median gross farm returns rose faster than median operating expenses, with the exception of brief dips in 2005 and 2009. However, median operating expense plateaued from 2012 to 2018. At the beginning of this period, the median operating expense ratio rose, increasing from 55.7% (strong) in 2012 to 80.5% (vulnerable) in 2015. The rise in the ratio was driven by declines in gross farm returns while operating expenses remained relatively steady. Consequently, a larger proportion of farm returns was used for operating expenses during this period. Thereafter, median gross farm returns began to trend higher while operating expenses continued to remain flat, driving the median ratio lower, and improving the financial efficiency of the median grain farm.

Then, median gross farm returns rose sharply from 2019 to 2022, rising from $548,180 to $942,912. Notably, while the lowest average net farm income since the 1980s was reported in 2015, the highest income on record occurred in 2022. Despite initial improvements in the median operating expense ratio—from 74.6% (cautionary) in 2019 to 54.4% (strong) in 2021—the ratio has since been on the rise. The ratio increased to 57.9% (strong) in 2022, before jumping to 81.3% (vulnerable) in 2023. In that year, median gross farm returns declined to $714,481 while median operating expense rose to $575,928.

Conclusion

In conclusion, our analysis of the operating expense ratio for Illinois grain farms over the past two decades demonstrates the relationship between gross farm returns and operating expenses. While the median operating expense ratio has generally been within the strong (<60%) and cautionary (60-80%) categories in most years, recent trends indicate a further deterioration in farm financial efficiency. The sharp decline of gross farm returns in 2023, coupled with a sustained rise in operating expenses, has led to a substantial increase in the operating expense ratio, rising from 57.9% (strong) to 81.3% (vulnerable). Financial efficiency should always be measured and monitored as operating expenses or gross farm returns can change significantly from year to year.

Acknowledgment

The authors would like to acknowledge that data used in this study comes from the Illinois Farm Business Farm Management (FBFM) Association. Without Illinois FBFM, information as comprehensive and accurate as this would not be available for educational purposes. FBFM, which consists of 5,000+ farmers and 70 professional field staff, is a not-for-profit organization available to all farm operators in Illinois. FBFM field staff provide on-farm counsel along with recordkeeping, farm financial management, business entity planning and income tax management. For more information, please contact our office located on the campus of the University of Illinois in the Department of Agricultural and Consumer Economics at 217-333-8346 or visit the FBFM website at www.fbfm.org.

Notes

[1] The Farm Financial Scorecard adheres to the guidelines set by the Farm Financial Standards Council

[2] Outliers (extreme values) of the operating expense ratio are not presented in our figure.

References

Mashange, G. and B. Zwilling. "The Financial Efficiency of Illinois Grain Farms: Interest Expense Ratio by Farm Size." farmdoc daily (15):45, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 10, 2025.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.