Consumer Concerns about Food Prices: Tariffs are Crowding Out Inflation

The most recent Consumer Price Index report shows that food prices at the grocery store are declining, driven by a large drop in egg prices (BLS, 2025; USDA-ERS, 2025; farmdoc daily, May 19, 2025). At the same time, there continues to be uncertainty related to the impact of tariffs (actual and proposed). In this post, we use data from the May 2025 wave of the Gardner Food and Agricultural Policy Survey (GFAPS) to explore how households view the two issues and to what extent they say inflation and tariffs are impacting buying behavior.

Methodology

GFAPS is a quarterly survey of approximately 1,000 U.S. households that is designed to match the U.S. population in terms of gender, age, income, and geographic region. The survey consists of several tracked measures as well as ad hoc questions on timely topics relevant to food and agricultural policy.

For this post, we consider tracked measures related to perceptions of food affordability and inflation. Specifically, each wave consumers are asked “To what extent do you agree or disagree that our food system produces food that is affordable?” Response options range from 1=strongly agree to 5=strongly disagree. For inflation, we asked consumers to what extent inflation has impacted them in the last month where 0=not affected and 10=highly affected). We also asked about the impact of inflation in the last month on specific spending categories, such as groceries, eating out, housing, childcare, and transportation using the same scale. Consumers were then asked about inflation expectations for the future – “In three months from now, do you expect inflation to get worse, better, or stay about the same?”

Starting in wave 12 (February 2025) of GFAPS, we also included questions related to tariffs. We asked consumers how they expect tariffs to impact food prices (response range from 1=Increase prices I pay for food to 5=Decrease prices I pay for food) as well as how worried they are about tariffs impacting food prices (response options were very worried; somewhat worried; not very worried; and not at all worried). We also asked consumers whether tariffs have caused them to: purchase larger amounts of items than initially planned (stockpiling); purchase items earlier than initially planned; and put off purchasing items that they had originally planned to buy. For each question, response options were yes/no.

Results

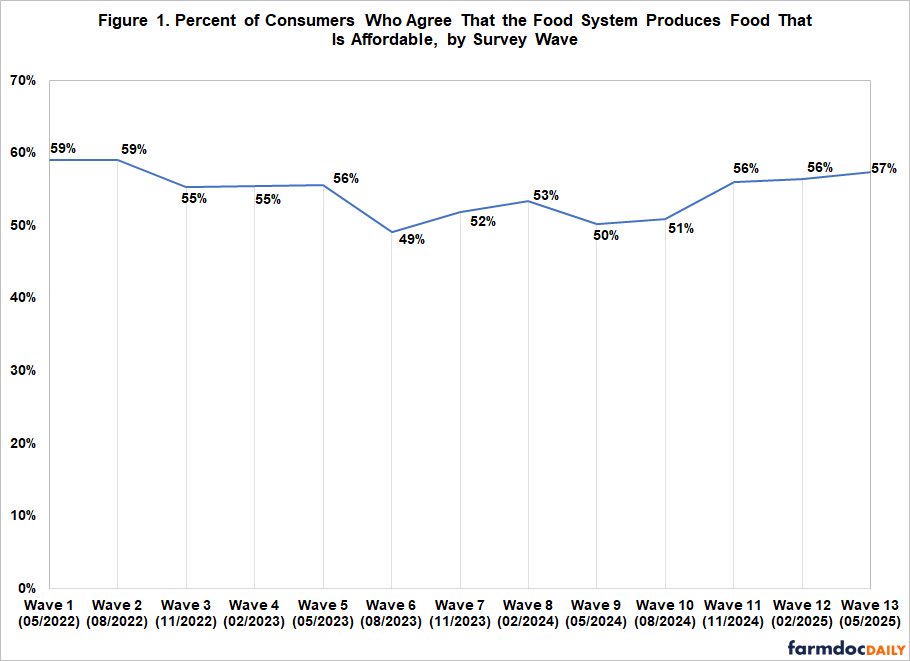

Figure 1 presents consumer perceptions of food affordability by survey wave. In wave 13 (May 2025), we can see that perceptions of affordability continue to trend upward slightly, up from a low of 49% in wave 6 (August 2023). This wave, 57% of consumers agreed that our food system produces food that is affordable.

Consumers also reported that they are being less impacted by inflation in wave 13 (May 2025), with a mean rating of 6.4 (Table 1). This is the lowest rating we have seen in GFAPS since wave 5 (May 2023).

| Table 1. Mean Reported Impact of Inflation on Consumers by Survey Wave | |

| Survey Wave | Mean Impact of Inflation (0=not affected; 10=highly affected) |

| Wave 3 (November 2022) | 6.8 |

| Wave 4 (February 2023) | 7.0 |

| Wave 5 (May 2023) | 6.4 |

| Wave 6 (August 2023) | 6.9 |

| Wave 7 (November 2023) | 6.9 |

| Wave 8 (February 2024) | 6.8 |

| Wave 9 (May 2024) | 7.0 |

| Wave 10 (August 2024) | 6.9 |

| Wave 11 (November 2024) | 6.9 |

| Wave 12 (February 2025) | 6.8 |

| Wave 13 (May 2025) | 6.4 |

Further, Table 2 shows that, on average, consumers reported the impacts of inflation were easing across most spending categories – with the exception of childcare.

| Table 2. Mean Reported Impacts of Inflation* on Spending Categories by Survey Wave | |||

| Spending Category | Mean Impact Wave 11 (November 2024) |

Mean Impact Wave 12 (February 2025) |

Mean Impact Wave 13 (May 2025) |

| Groceries | 7.21 | 7.19 | 6.81 |

| Eating Out | 6.44 | 6.32 | 6.21 |

| Housing | 5.62 | 5.34 | 5.10 |

| Childcare | 3.41 | 3.46 | 3.42 |

| Transportation | 5.61 | 5.51 | 5.22 |

| *For each category, respondents were asked to what extent inflation had impacted them in the last month, where 0=not affected and 10=highly affected. | |||

While the impact of inflation decreased from previous waves, expectations for inflation over the next three months remained similar to results from wave 12 (farmdoc daily, March 6); 35% of respondents expected inflation to get better; 37% expected inflation to get worse; and 28% expected inflation to be about the same.

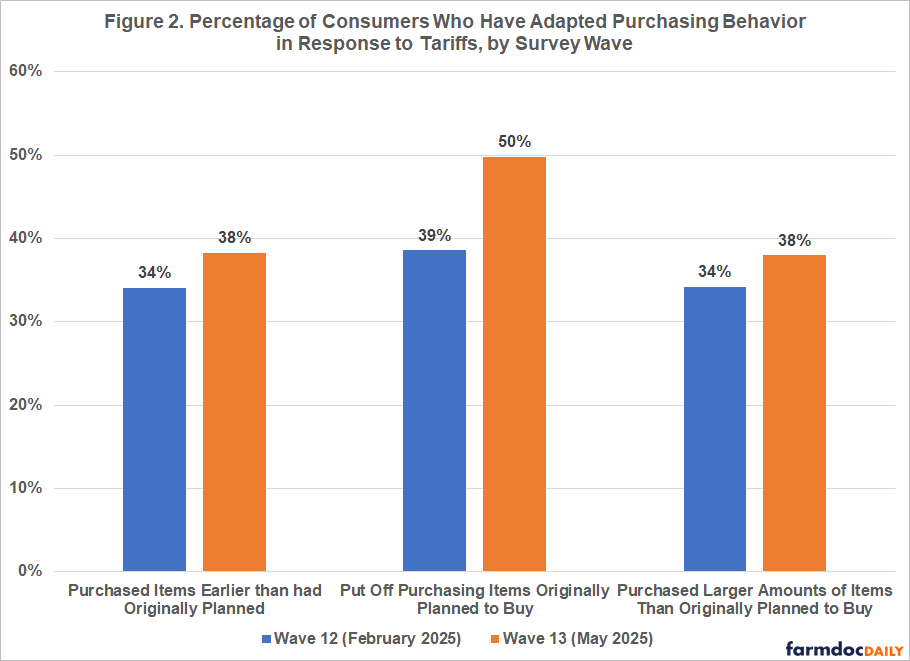

While consumers appear to be experiencing some relief from inflation, concern about tariffs remains high. We find that in the most recent wave of GFAPS (May 2025), 79% of respondents expected tariffs to increase or somewhat increase the prices they pay for food, and 77% indicated they are somewhat or very worried about how tariffs will impact food prices. Consumers also reported adjusting their purchasing behavior in response to tariffs. Figure 2 shows that, compared to wave 12 (February 2025), the share of respondents who reported engaging in stockpiling behavior, purchasing items earlier than planned, and putting off purchases increased. The latter experienced the biggest change in behavior, with 50% of respondents indicating they put off a purchase, an 11 percentage-point increase from February 2025.

Conclusions

Results from the May 2025 wave of the GFAPS suggest that consumers may be feeling some relief on the inflation front. Perceptions of food affordability slightly increased and the reported impact of inflation decreased. Despite this, consumers are still facing much uncertainty around tariffs. Reported concern levels remain unchanged from February 2025, and more consumers are adapting purchasing behaviors. In particular, half of participants reported putting off a purchase, which aligns with reports of reduced consumer spending (e.g., Rugaber and D’Innocenzio, 2025; Robb, 2025; Wallace, 2025; Coggins, Adams, and Alldredge, 2025). Such behaviors, if persistent, can have negative impacts on the economy. However, the news is changing regularly in regard to tariffs, so consumer sentiment may change quickly as well. The Gardner Food and Agricultural Policy Survey will continue to monitor public perceptions around food price affordability.

References

Bureau of Labor Statistics (BLS). 2025. “Consumer Price Index Summary.” U.S. Bureau of Labor Statistics, June 11, https://www.bls.gov/news.release/cpi.nr0.htm.

Coggins, B., C. Adams, and K. Alldredge. 2025. “An update on US consumer sentiment: In response to tariffs, most consumers plan to adjust spending.” McKinsey & Company, May 30, https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/the-state-of-the-us-consumer.

Kalaitzandonakes, M., J. Coppess and B. Ellison. "Consumer Concerns about Tariffs and Food Prices." farmdoc daily (15):43, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 6, 2025.

Mashange, G. and M. Kalaitzandonakes. "Inflation and Food Price Update: May 2025." farmdoc daily (15):92, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 19, 2025.

Robb, G. 2025. “There are early signs consumers are starting to pull back on spending, Fed’s Williams says.” Morningstar, May 9, https://www.morningstar.com/news/marketwatch/20250509340/there-are-early-signs-consumers-are-starting-to-pull-back-on-spending-feds-williams-says.

Rugaber, C., and A. D’Innocenzio. 2025. “Consumers cut spending by most in four years last month.” PBS News, February 28, https://www.pbs.org/newshour/economy/consumers-cut-spending-by-most-in-four-years-last-month.

U.S. Department of Agriculture – Economic Research Service (USDA-ERS). 2025. “Food Price Outlook – Summary Findings.” U.S. Department of Agriculture, May 23, https://www.ers.usda.gov/data-products/food-price-outlook/summary-findings.

Wallace, A. 2025. “Consumers are saving more and spending less as Trump’s tariffs loom.” CNN, March 28, https://edition.cnn.com/2025/03/28/economy/us-pce-spending-inflation-february.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.