Relationships between Average Cash Rents and Soil Productivity

We began publishing a formula in 2017 for calculating the average cash rent for a piece of farmland, given that farm’s average productivity index, thereby allowing averages to be stated by productivity, a known factor that impacts the level of cash rent (see farmdoc daily, November 7, 2017). We have updated this formula to reflect the average cash rents for 2025, as reported by the National Agricultural Statistics Service (NASS). An individual can use this formula to calculate the average cash rent for a farm, given the farm’s Productivity Index (PI) and location, where the agricultural reporting district represents the location. Additionally, we outline the approach, updating the one originally published in 2017.

County Cash Rents from NASS

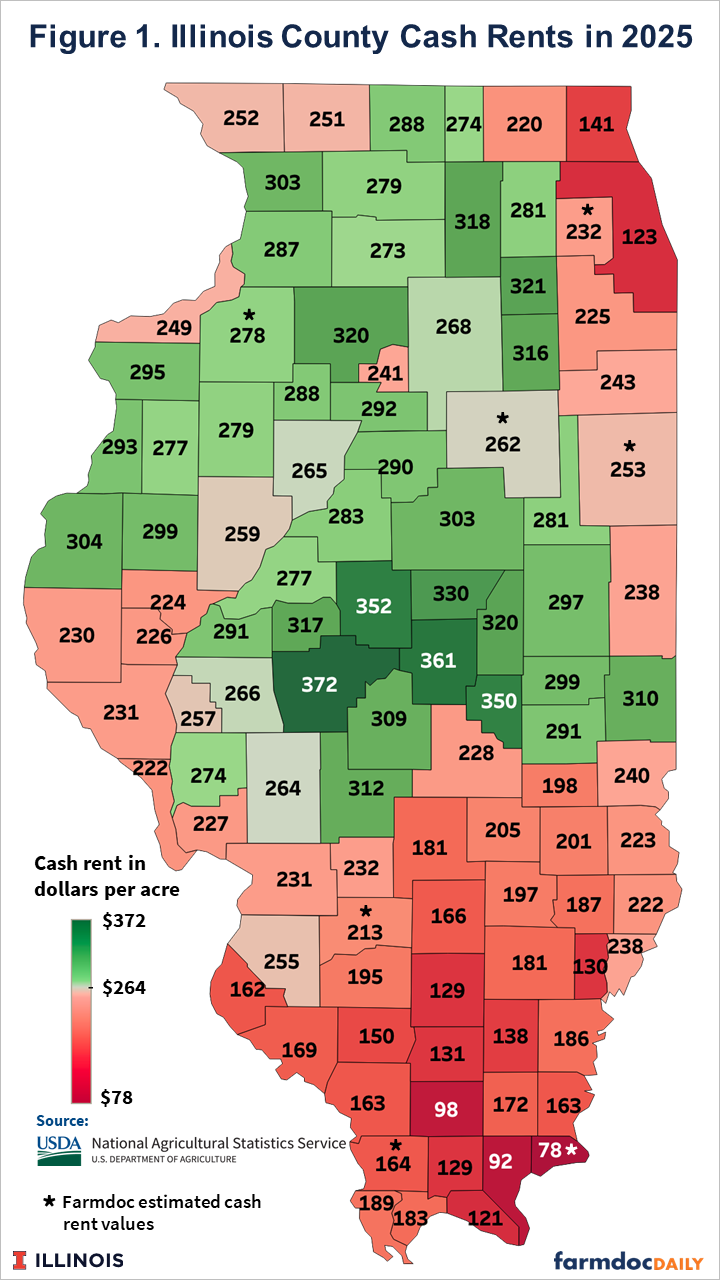

In August, the National Agricultural Statistics Service (NASS) reported the average cash rent by county (see Figure 1). Average rents were available for 95 of Illinois’ 102 counties. For the seven counties without rent data reported by the USDA for 2025 (DuPage, Clinton, Hardin, Henry, Iroquois, Livingston, and Union counties), rents were estimated using the statistical regression model described below. Figure 1 was also included in the farmdoc daily article from September 9, 2025.

Average county rents follow average productivity, with many central and northern Illinois counties having average cash rents above the statewide average, while average rents are lower than the statewide average in most southern Illinois counties.

Cash Rents, Productivity Indexes, and Location

Productivity indexes (PIs) published in Bulletin 811, entitled Optimal Crop Productivity Ratings for Illinois Soils, are often used to quantify the yield potential of Illinois soils. This publication gives PIs for different soil types. Higher PIs are typically associated with higher yields of corn and soybeans.

Figure 2 shows a map provided by the National Resources Conservation Service (NRCS) of PIs across Illinois, with dark green colors indicating higher PIs and yellow and red colors associated with lower PIs. As expected, the highest PIs are located in east-central, west-central, and northern Illinois. The counties with the highest PIs are Piatt (east central with 138 PI), Macon (east central with 137 PI), Champaign (east central with 136 PI), Logan (east central with 135 PI), and DeKalb (northern with 135 PI). The counties with the lowest average PIs are located in southern Illinois: Williamson (85 PI), Calhoun (89 PI), Johnson (91 PI), Perry (92 PI), and Monroe (94 PI).

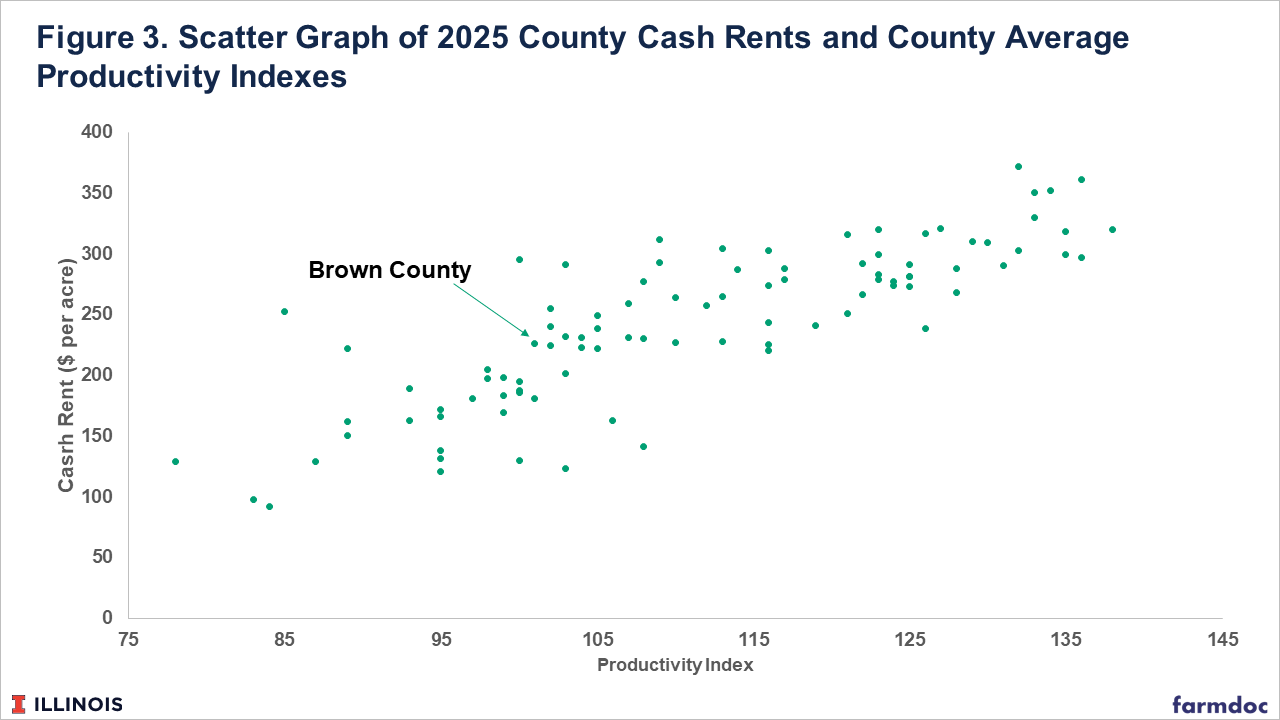

Two sets of variables were used to explain the variability in 2025 cash rents. The first is average county PIs. County PIs are the average for a county of the above map. As expected, average county cash rents are highly related to average county PIs, as illustrated in Figure 3, showing a scatter graph of dots representing counties in Illinois, with a county’s average PIs indicated on the horizontal axis and its cash rent on the vertical axis. For illustrative purposes, Brown County is identified. Brown County has a 101 average PI as indicated on the horizontal axis and a $226 per acre cash rent as indicated on the vertical axis.

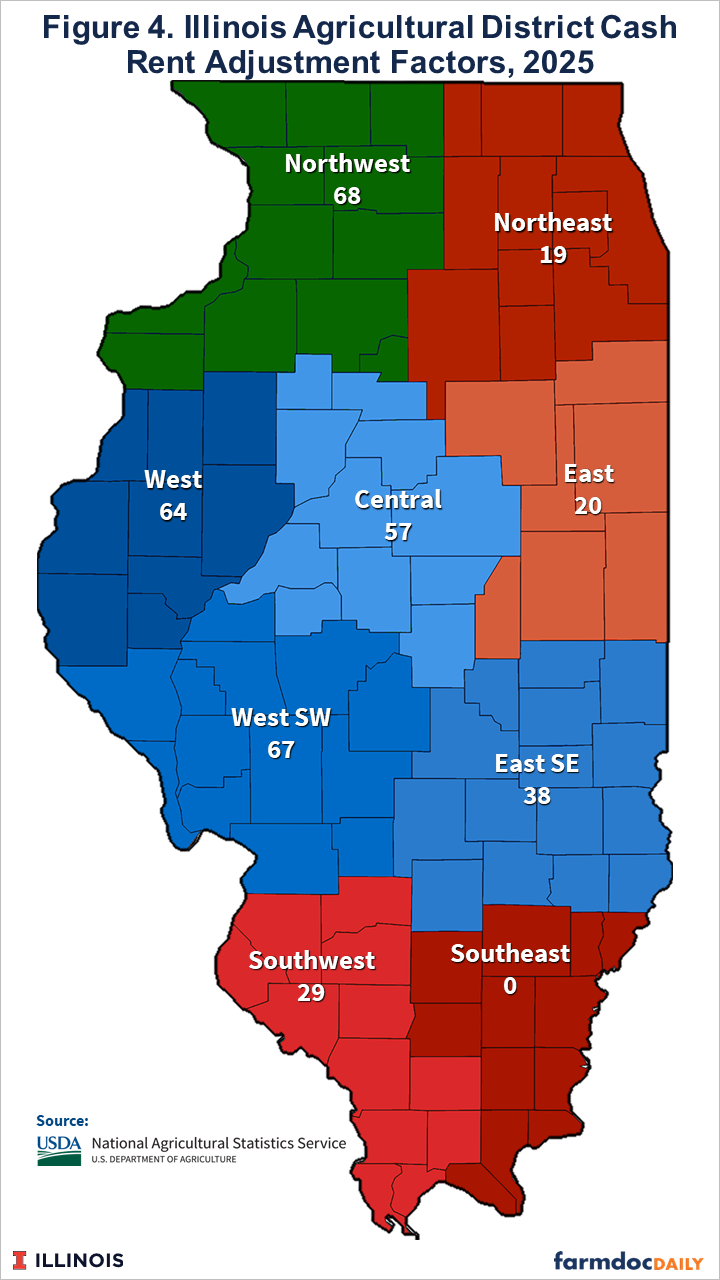

The second set of variables are related to location, as represented by Agricultural Districts (ADs). ADs are specified by the U.S. Department of Agriculture and contain counties of roughly similar agricultural characteristics (see Figure 4). The ten ADs are included to capture any difference in rents caused by geographical area. A host of factors could cause rents to vary by region. Weather varies from northern to southern Illinois, with the northern region experiencing more stable and less variable crop production conditions. Competitive pressures among farmers for rented land may vary across Illinois. Locations and the number of grain outlets and input suppliers could also influence profits and thus the cash rent that is paid.

Quantifying the Average Cash Rent for PI and Location in the State

The two sets of variables – PI and ADs – explain 80% of the variability in average 2025 county rents. The equation estimating average cash rent is:

Estimated average cash rent = -156 + (3.21 x PI) + AD adjustment

The estimated AD adjustments are shown in Figure 4.

The above equation can be used to arrive at the 2025 average rent for a piece of farmland adjusted for PI and location. To illustrate, take a farm with a PI of 134 located in Champaign County. Champaign County is in the East AD. The adjustment factor for the East AD is $20 (see Figure 4). Given this information, the estimated average cash rent for this farm is $294 per acre (-156 + 3.21 x 134 PI + $20 AD adjustment).

Interpreting the Average Cash Rent

Actual 2025 rents may vary from the average rents estimated using the above equation. In the above example, the Champaign County farm with a 134 PI had a suggested average cash rent of $294 per acre. For parcels in Champaign County with a 134 PI, there will be a few rents that exceed $350 per acre. Other rents will be below $230 per acre.

There are several reasons why cash rents vary from one parcel to another. Some of the differences will be related to the attributes of the farmland, including:

- Size of fields within the parcel. Farms that have larger fields will generally be preferable and receive higher cash rents. Small parcels with fields below 40 acres in size could receive lower cash rents.

- Farms with excellent drainage will typically receive higher cash rents than those with drainage issues.

- High-risk farms. High-risk areas often are near creeks and rivers that are prone to flooding. Farms that have high-risk areas will likely receive lower rents.

- Farms with varying soil types. Having similar soils throughout a field makes it easier for the farmer to manage. Fewer soil types in a field will result in higher cash rents.

- Farms with topography. A great deal of topography on a farm can result in lower cash rents. Farms that require contour planting are more challenging to manage. Farms could also have low spots that will collect water in high-moisture years. Those low spots could result in drowned outs and low yields.

- Farms near grain delivery points and input suppliers. Lower costs can occur for farms near grain delivery points and input suppliers, resulting in higher cash rents.

- Obstructions in the fields. Fields that have obstructions that need to be “farmed around” will be less preferred and may receive lower rents. Obstructions can include waterways, farmsteads, electrical power lines, wind turbines, and cell towers.

- Shape of the fields. Generally, square and rectangular fields are preferred to those with irregular boundaries.

The desires of the landowner also play a role in determining the cash rent level. Those landowners who place no land use restrictions on the farmer and have fewer concerns about the long-term sustainability of the farmland can expect to receive a higher cash rent. Landowners who desire conservation practices can expect lower cash rents.

Cash rents are also influenced by the services offered by the farmer. Some farmers provide a great deal of maintenance to the property, including upkeep of waterways and other conservation structures. Additional services may lower the cash rent.

Finally, some landowners are greatly concerned that farmers generate a sufficient income from the property, with a “sufficient” income being somewhat ambiguous. Other landowners are not concerned with the level of return going to the farmer. Those landowners not concerned about the farmer return often receive higher cash rents than those that do care about the farmer return.

Finding the PI for a Farm

Using the equation above to estimate an average cash rent requires finding the average PI for a farm. Many landowners already know the PI for the farm. In these cases, it is relatively straightforward to arrive at the estimated rent using the above formula.

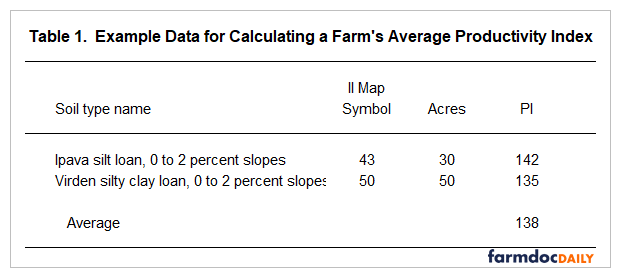

In other cases, the landowner does not know the PI but has a list of acres and soil types on the farm. In this case, the farmer can find the PIs by soil type in Table S2 in Bulletin 811. As an example, take the example farm in Table 1 that has 80 acres in Ipava silt loam soil type, and 50 acres in Virden silty clay loam. The PIs for the two fields are in Bulletin 811: 142 for Ipava silt loam and 135 for Virden silty clay loam. Note that finding the PI in Table S2 is aided by having the “Il Map Symbol” which for the two cases are 43 for Ipava silt loam and 50 for Virden silty clay loam. Given these soil types and acreages, this farm has an average PI of 138:

138 = (142 PI for Ipava x 30 acres + 135 PI for Virden x 50 acres) / 80 acres

In some cases a landowner will not have the PI or soil types for a farm. These can be obtained online using a Web Soil Survey tool. Landowners or farmers can locate a farm as an “area of Interest” within the tool. Once identified, soil types for that “Area of Interest” will be detailed.

Previous Years’ Estimates

The formulas for earlier years are available in these farmdoc daily articles:

- 2017: farmdoc Daily, November 7, 2017

- 2020: farmdoc Daily, September 15, 2020

- 2021: farmdoc Daily, September 7, 2021

- 2022: farmdoc Daily, September 13, 2022

- 2023: farmdoc Daily, September 5, 2023

- 2024: farmdoc Daily, September 3, 2024

Summary

A procedure, updated to 2025 conditions, is provided that will give an estimate for an average cash rent based on a PI and location. Estimates can be computed from an equation that is based on the statistical relationship between average county cash rents in 2025, average PI by county, and the agricultural district (AD) of the county in Illinois. As always, actual cash rents for an individual farm can vary considerably from averages for the farm’s county.

References

Paulson, N., G. Schnitkey, C. Zulauf and J. Baltz. "Considerations for Setting 2026 Cash Rents." farmdoc daily (15):164, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 9, 2025.

Schnitkey, G. "Determining the Average Cash Rent Based on Productivity Index." farmdoc daily (7):205, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 7, 2017.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.