Spending Impacts of PLC and ARC-CO in House Agriculture Reconciliation Bill

The House Reconciliation Bill includes changes to statutory reference prices used to trigger payments from the Price Loss Coverage (PLC) program, as well as changes to Agricultural Risk Coverage (see farmdoc daily, May 14, 2025). We evaluate how these changes will impact Federal outlays of the six largest program crops, finding that the proposed changes, if enacted, will increase spending by $29.873 billion from 2025 to 2035. Proportional increases are larger for rice, peanuts, and cotton than for corn, soybeans, and wheat.

Changes in the House Reference Bill for PLC and ARC-CO

The House Reconciliation Bill includes changes to Price Loss Coverage (PLC) and Agricultural Risk Coverage at the County Level (ARC-CO). We estimate the impacts of these changes on Federal outlays and farm payments on a per base acre basis. Not included in this evaluation are estimates of changes to crop insurance programs or to provisions that add base acres (see farmdoc daily, March 14, 2025). The House Bill includes a provision for adding up to 30 million more base acres. In 2024, approximately 244 million acres were enrolled in community title programs. A 30 million increase would be a 12% increase in program acres, likely resulting in a similar increase in Federal outlays. Those provisions will be evaluated in future farmdoc Daily articles.

The House Reconciliation Bill contains four changes to PLC and ARC-CO: 1) Increases in Statutory Reference Prices, 2) Increase in the floor price on corn and seed cotton for PLC payments, 3) Increases in coverage level and maximum payments on ARC-CO, and 4) increases to loan rates.

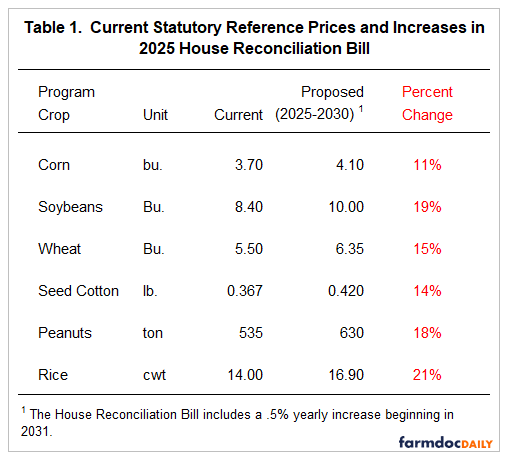

Increases to Statutory Reference Prices: The House Bill increases the statutory reference prices. For the years from 2025 to 2030, statutory reference prices for the major program crops would increase (see Table 1):

- Corn: $3.70 to $4.10 per bushel, an 11% increase,

- Soybeans: $8.40 to $10.00 per bushel, a 19% increase,

- Wheat: $5.50 to $6.35 per bushel, a 15% increase,

- Seed cotton: $.367 to $.420 per pound, a 14% increase,

- Rice: $14.00 to $16.90 per cwt, a 21% increase, and

- Peanuts: $535 to $630 per ton, a 16% increase.

The House Reconciliation Bill also includes provisions to increase the statutory reference prices by 0.5% each year beginning in 2031. The statutory reference price for corn would increase from $4.10 in 2030 to $4.12 in 2031. The statutory reference price for soybeans would increase from $10.00 to $10.05 (for more details, see farmdoc daily, May 14, 2025).

Increase the Floor Price on Corn and Seed Cotton for PLC Payment: For most crops, PLC payment rates equal the effective reference price minus the market year average price (farmdoc daily, September 24, 2019). Payment rates increase until the crop’s marketing loan rate is reached. For base acres of corn, the House Reconciliation Bill increases the floor from the $2.20 market loan rate to $3.30. If the MYA goes below $3.30, the PLC payment rate will not increase.

Seed cotton also has a floor price of $.30 per pound, an increase from the current floor of $.25 per pound. However, seed cotton is a novel crop that is fundamentally different than the other program crops. All commodity title payments use to be administered through upland cotton. Upland cotton was eliminated from PLC and ARC programs to resolve a World Trade Organization dispute with Brazil. The marketing loan program remains for upland cotton. Seed cotton was introduced as a program crop in the Bipartisan Budget Act of 2018. However, the loan program runs through upland cotton. Without a price floor for seed cotton, there would be no limit on PLC payments as exists in other program crops.

ARC-CO Changes: The House Bill would:

- Increase the coverage level on ARC-CO from 86% to 90%. This change would increase the percentage of times that ARC-CO pays.

- Increase the maximum payment from 10% of benchmark revenue to 12.5%.

Loan Rates Increase: The House Bill would increase the loan rate for the six largest program crops by 10%.

Impact of Total Federal Outlays from Proposed PLC and ARC-CO Changes in House Reconciliation Bill

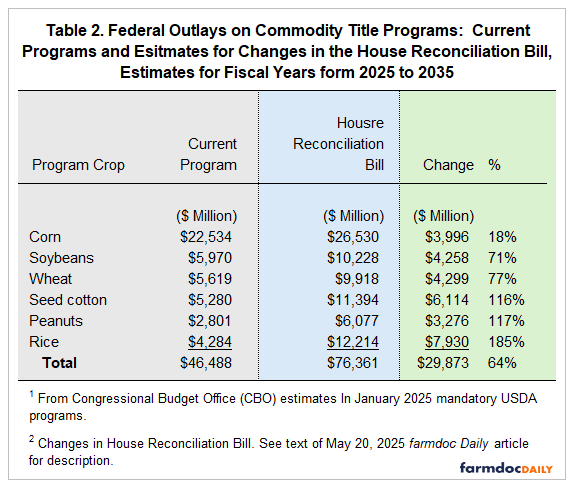

The Congressional Budget Office (CBO) regularly estimates Federal outlays from mandatory farm programs. In its January 2025 report, CBO estimated the spending for the six major program crops at $46.488 billion for the fiscal years from 2025 to 2035 for PLC, ARC-CO, and marketing loan programs (see Table 2). In the January 2025 baseline, the six crops account for 94% of all commodity title spending. For this period, the House Reconciliation process instructed the House Agriculture Committee to come up with $230 billion in spending reductions (see farmdoc daily, May 14, 2025). Any increases in expenditures for commodity title programs must come from cuts to other areas. Sll spending cuts in the House Agriculture Reconciliation bill seem to be focused in the Nutrition title, particularly in the Supplemental Nutrition Assistance Program (SNAP). In effect, the House reduces SNAP spending further than the $230 billion in order to offset the increased costs of assistance to farmers.

Using a stochastic simulation model, we estimated the impacts of the House Proposal on commodity title spending from 2025 to 2035. Our estimates, shown in the second column of Table 2, are that Federal outlays for the six program crops are $76.361 billion, representing a 64% increase in spending on these programs. Estimates in Table 2 have base acres remaining the same between the current and the House Bill.

Corn’s spending increases from $22.534 billion to $26.530 billion, representing an 18% rise, the lowest among the six major program crops (see Table 2). The $3.30 higher floor is estimated to reduce outlays from 2025 to 2035 by $3.465 billion.

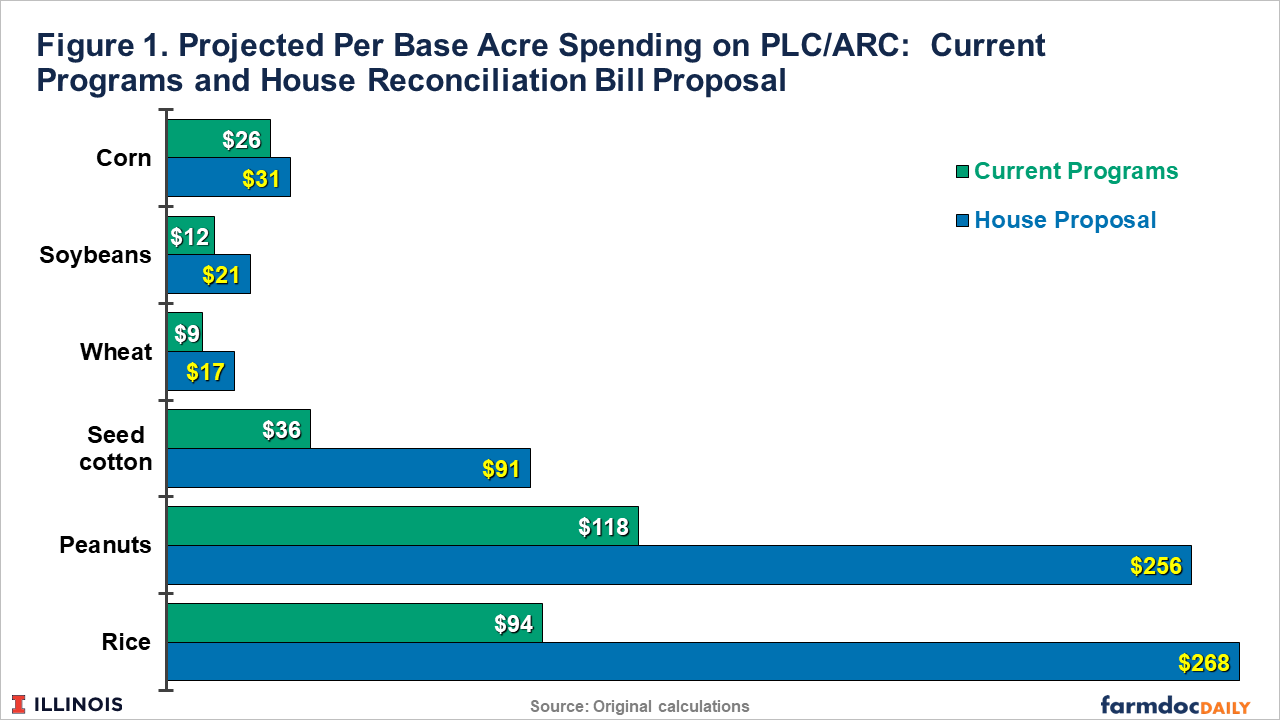

The other program crops experience significantly higher increases than corn: 71% for soybeans, 77% for wheat, 116% for seed cotton, 117% for peanuts, and 185% for rice (see Table 2). Figure 1 shows average yearly base acre spending for each program crop for the commodity year from 2025 to 2033. Per base acre spending increases across program crops were estimated as:

- Corn: Spending increases from $26 per base acre under the current program to $31 per base acre.

- Soybeans: Spending increases from $12 per base acre under the current program to $21 per base acre.

- Wheat: Spending increases from $9 per base acre under the current program to $17 per base acre.

- Seed cotton: Spending increases from $36 per base acre under the current program to $91 per base acre.

- Rice: Spending increases from $118 per base acre under the current program to $256 per base acre.

- Peanuts: Spending increases from $94 per base acre under the current program to $268 per base acre.

There is a disparity in commodity title spending across program crops, which increases if the House Reconciliation Bill becomes law. Much of the increased disparity is due to the significant variation in statutory reference prices across program crops. The base acres of peanuts and rice have much higher relative statutory reference prices than all other program crops. Soybeans have the lowest relative statutory reference prices. Those relationships are not new and have existed throughout the recent history of farm bills (see farmdoc daily, November 7, 2023). While the proposal brings the reference price for soybeans closer to its market prices than was historically the case, the proposed changes would widen those differences across crops, and the justification for the differences in statutory reference prices is not evident.

Geographical Implications

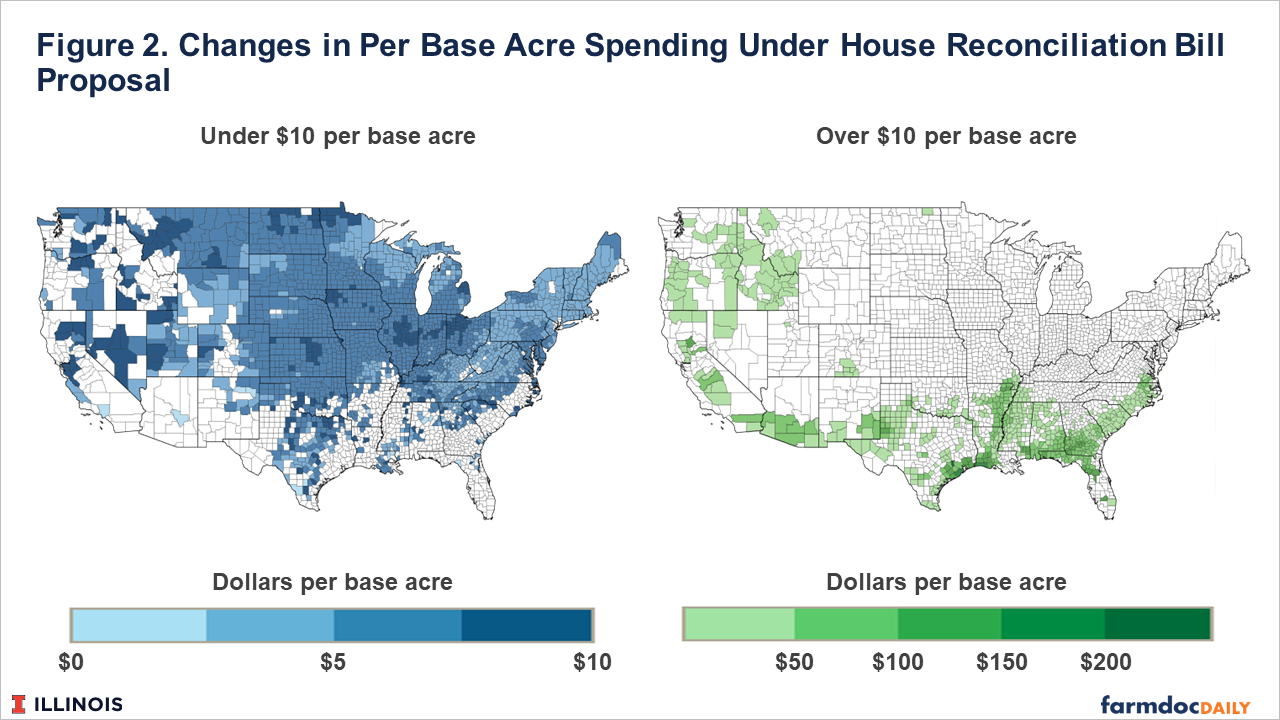

The proposal would have differential impacts across the United States. Figure 2 shows the average change in expected payments per base acre in all counties. Farmers with base acres in counties in the southern United States and the Delta region would gain more relative to farmers in the other areas. Those increases occur because the base acres for rice, peanut, and seed cotton are concentrated in the southern states.

The sheer size of spending differences is large. For example, many moderately sized farms will have 500 base acres in one of the program crops. On a national average basis, 500 base acres of different crops will result in large differences in expected support. Under the House proposal, 500 base acres of a given crop is projected to have payments per year of:

- Corn: $15,500 per year

- Soybeans: $10,500 per year

- Wheat $8,500 per year

- Seed cotton: $45,000 per year

- Rice: $128,000 per year, and

- Peanuts: $134,000 per year.

Note that 500 base acres of peanuts and rice have more than eight times the size of payments as for corn, soybeans, and wheat.

Commentary

Higher spending on commodity title programs would occur if the House Agriculture Reconciliation Bill were to become law. Farmers with base acres of crops historically grown in southern regions of the US would gain much more from this proposal than would other farmers in the country. The House Agriculture Committee appears to be intent on providing additional benefits by increasing statutory reference prices for southern crops more than for corn, soybeans, and wheat. In addition, the House Agriculture Committee chose to implement a floor price on PLC payments for corn, a major Midwest crop, which is likely to result in savings under the CBO’s estimation procedures. If the program generates savings for corn, then a similar floor would generate CBO savings for the other crops. Beyond the presumed budget savings, there is no apparent justification for adding a floor price only to corn base acres.

The House Bill’s proposed changes would generate significantly higher Federal outlays for commodity title spending, at the same time as the House Agriculture Committee was instructed to come up with $230 billion in savings. All of the savings in the legislation appear to come from cuts to Nutrition programs, particularly the Supplemental Nutrition Assistance Program (SNAP). That move pits Democrats against Republicans, and agricultural interests against food assistance interests. Whether that is a sound move politically is questionable and could have significant implications for farm bill negotiations now and in the future.

References

Coppess, J., C. Zulauf, G. Schnitkey, N. Paulson and B. Sherrick. "Reviewing the House Agriculture Committee’s Reconciliation Bill." farmdoc daily (15):89, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 14, 2025.

Kalaitzandonakes, M., B. Ellison, T. Malone and J. Coppess. "Consumers’ Expectations about GLP-1 Drugs Economic Impact on Food System Players." farmdoc daily (15):49, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 14, 2025.

Schnitkey, G., N. Paulson, C. Zulauf and J. Coppess. "Price Loss Coverage: Evaluation of Proportional Increase in Statutory Reference Price and a Proposal." farmdoc daily (13):203, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 7, 2023.

Schnitkey, G., C. Zulauf, K. Swanson, J. Coppess and N. Paulson. "The Price Loss Coverage (PLC) Option in the 2018 Farm Bill." farmdoc daily (9):178, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 24, 2019.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.