Price Loss Coverage: Evaluation of Proportional Increase in Statutory Reference Price and a Proposal

The next farm bill is currently being debated, and one proposal receiving attention is to increase statutory reference prices by the same percentage for all program crops. Doing so has predictable results. Proportionally raising statutory reference prices would be expected to pay more to those crops already receiving large Price Loss Coverage (PLC) payments: rice, peanuts, and — to a lesser extent — seed cotton. Increasing the reference price would have little impact on soybeans, a program crop that has received no PLC payments since the inception of the PLC program. Soybeans, corn, and wheat would likely benefit more from improving ARC than from increasing reference prices. In addition, we propose a modification to PLC that would make effective reference prices more aligned with historical market prices. This proposal likely has appeal to soybeans, corn, and wheat.

Market Year Average Prices

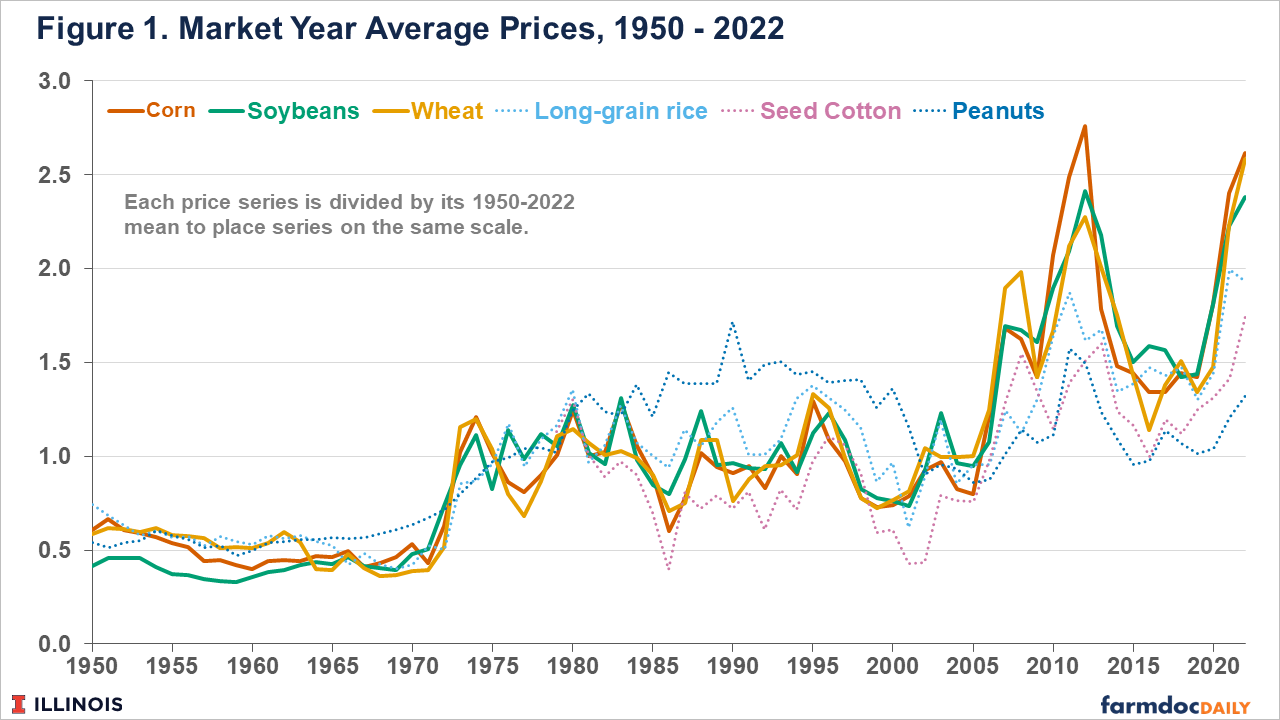

Figure 1 shows market year average (MYA) prices for soybeans, corn, wheat, seed cotton, long-grain rice, and peanuts. MYA prices are used in payment determination for commodity title programs — Price Loss Coverage (PLC) and Agriculture Risk Coverage (ARC). Figure 1 shows these prices from 1950 to 2022. Each price series is divided by its average price over the 1950-2022 period to place each series on the same scale.

There are remarkable similarities across all series. All prices reached a higher level in the early 1970s as exports became increasingly important. Except for rice, all price series reached a new plateau level in the mid-2000s, after Congress enacted the Renewable Fuel Standard (RFS) resulting in corn used for ethanol. This was coupled with continued strong export demand for soybeans. While demand factors vary across the crops, all the crops must compete for land, resulting in equilibrating forces causing their prices to move together. Moreover, it is fairly common for commodity series to reach plateaus around which prices do vary (see farmdoc daily, March 29, 2011, February 27, 2013, May 31, 2022, September 27, 2023). From 2006 to 2020, prices for all the crops have not trended up or down but varied around an average. Due to higher costs and other factors, some believe prices have reached a new higher plateau.

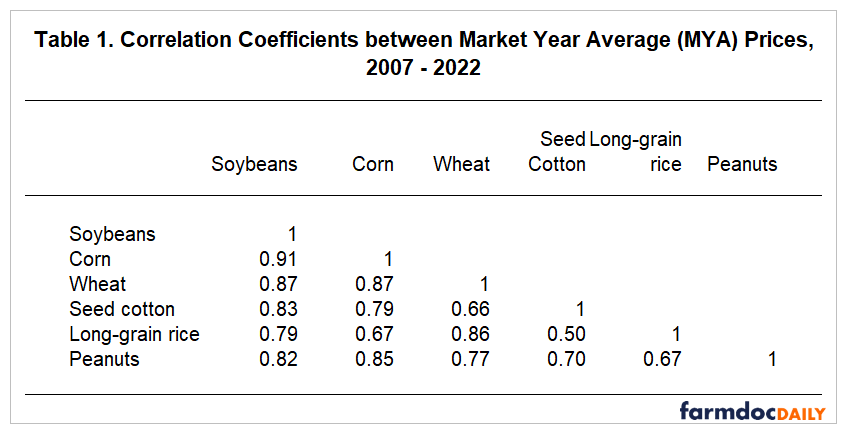

Given the similarities, there are strong correlations between the prices. Table 1 shows correlation coefficients for the price series from 2006 to 2022. Soybeans’ correlation coefficient with other crops is .91 with corn, .87 with wheat, .83 with seed cotton, .79 with long-grain rice, and .82 with peanuts (see Table 21). From 2006 to 2022, the lowest cross-correlation is .50 between long-grain rice and seed cotton (see Table 1).

Historic and Forecast PLC Payments

Raising statutory reference prices would tend to increase payments from PLC. PLC pays when the MYA price is below the effective reference price. The effective reference price is the higher of:

- the statutory reference price, and

- 85% of the five-year Olympic average of the 5-previous prices, lagged one year, capped at 1.15 of the statutory reference price (see farmdoc daily, June 29, 2022).

From 2014 to 2022, the statutory reference price was used for PLC payments for all crops shown in Table 1.

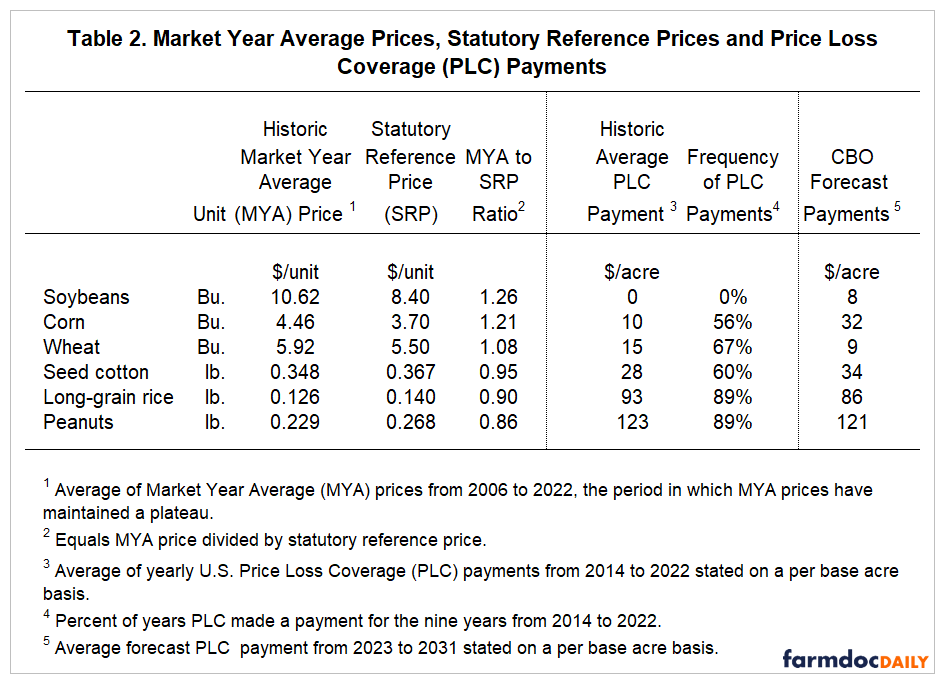

Even though the price series have similarities, PLC payment series differ dramatically across the crops. From 2014 to 2023 — the period in which PLC has existed — average payments ranged from $0 per base acre for soybeans to $123 per base acre for peanuts (see Table 2). The frequency of payments has also varied. Soybeans have never had a payment. On the other hand, long-grain rice and peanuts received payments in 89% of the years.

The relationship between the statutory reference prices and average market prices explains differences in PLC payments. For soybeans, the average MYA price was 10.62, and its statutory reference price was $8.40 (see Table 2). The ratio of the average MYA price and the statutory reference price was 1.26 (=10.62/8.40), meaning that the average MYA price was 26% higher than the statutory reference price. While the soybeans ratio was above 1.0, long-grain rice and peanuts had ratios significantly below 1.0: .90 for long-grain rice and .86 for peanuts (see

Similar PLC payment results are expected in the future. The May 2023 Baseline for Farm Programs from the Congressional Budget Office (CBO) were used to calculate the average PLC payment forecast (see Table 2). For the commodity years 2023 to 2031, CBO projects peanuts to have an average PLC payment of $121 per acre and $86 per acre for long-grain rice, the highest of the six crops shown in Table 2. Those two crops had the highest historical payments, $93 for long-grain rice and $123 per base acre for peanuts. CBO is projecting average PLC payments of $8 per base acre for soybeans, the lowest of the crops in Table 1. Soybeans have also had the lowest historical payments. The rank order of historic PLC payments per base acre is almost identical for the CBO forecast and historical payments (see Table 2).

Increasing Statutory Reference Prices by the Same Percentage

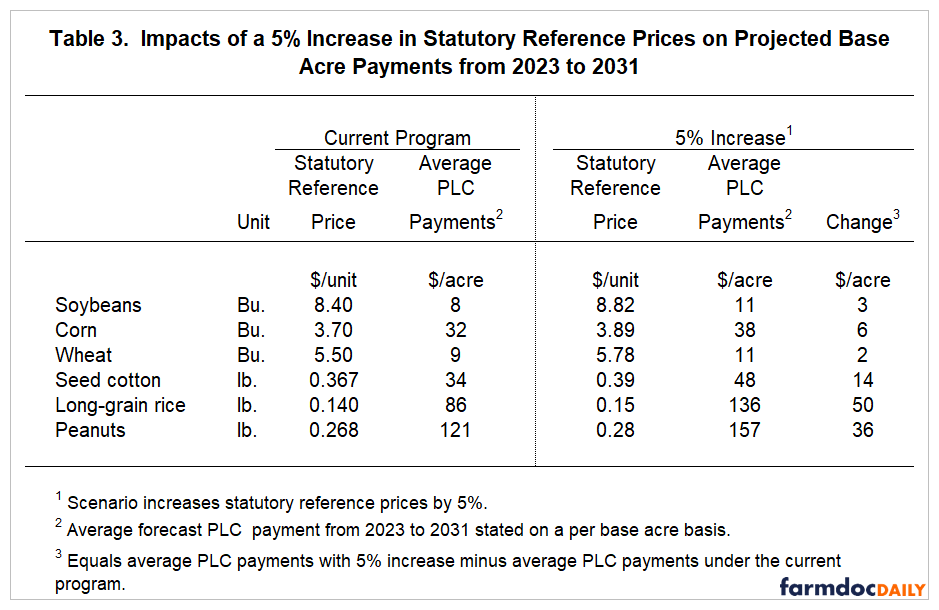

One proposal receiving attention is to increase statutory reference prices for all commodities by the same percentage. This proposal would continue the historic payment relationships between program crops, providing additional subsidies to peanuts and long-grain rice and less for soybeans. To illustrate, we calculated the average payments resulting from a 5% increase in all reference prices from 2013 to 2031 using a simulation model parameterized using historical prices and set to mimic the long-run prices of the May 2023 CBO forecast. Table 3 shows the results.

All statutory reference prices would increase by 5%, causing soybeans’ statutory reference price to increase from $8.40 to $8.82 (see Table 3). Soybeans’ average PLC payment is forecast to grow from $8 per base acre under the current $8.40 statutory price to $11 per base acre with an $8.82 reference price. Overall, PLC payments to soybeans are projected to increase by $3 per base acre under a 5% statutory price increase. Long-grain rice PLC payments are expected to grow from $86 per base acre to $136 per base acre, an increase of $50 per base acre. Peanuts would increase from $121 per base acre to $157 per base acre, a $36 increase.

A 5% increase would benefit long-grain rice and peanuts the most. Those crops would gain $50 and $36 per base acre, respectively. Seed cotton would be next with a $14 per base acre gain. Soybeans, corn, and wheat would increase the lowest amounts: $3 per base acre for soybeans, $6 for corn, and $2 for wheat. Interestingly, the gains for rice ($50) and peanuts ($36) exceed the entire estimated payment for soybeans ($11) and wheat ($11).

A Proposal: Change the Effective Price Mechanism

Proportionally raising statutory reference prices will provide more aid to peanuts, rice, and seed cotton than to soybeans, corn, and wheat. Because of these differential impacts, raising reference prices likely are not the only change that can be made to the farm bill. A solution may be to improve the Agriculture Risk Coverage program by increasing the coverage level up from 86% of gross revenue or increasing the payment limit above 10% of expected revenue. Another alternative is to change the PLC program by allowing the 85% of the Olympic average for the effective reference price to have a larger range in which to operate.

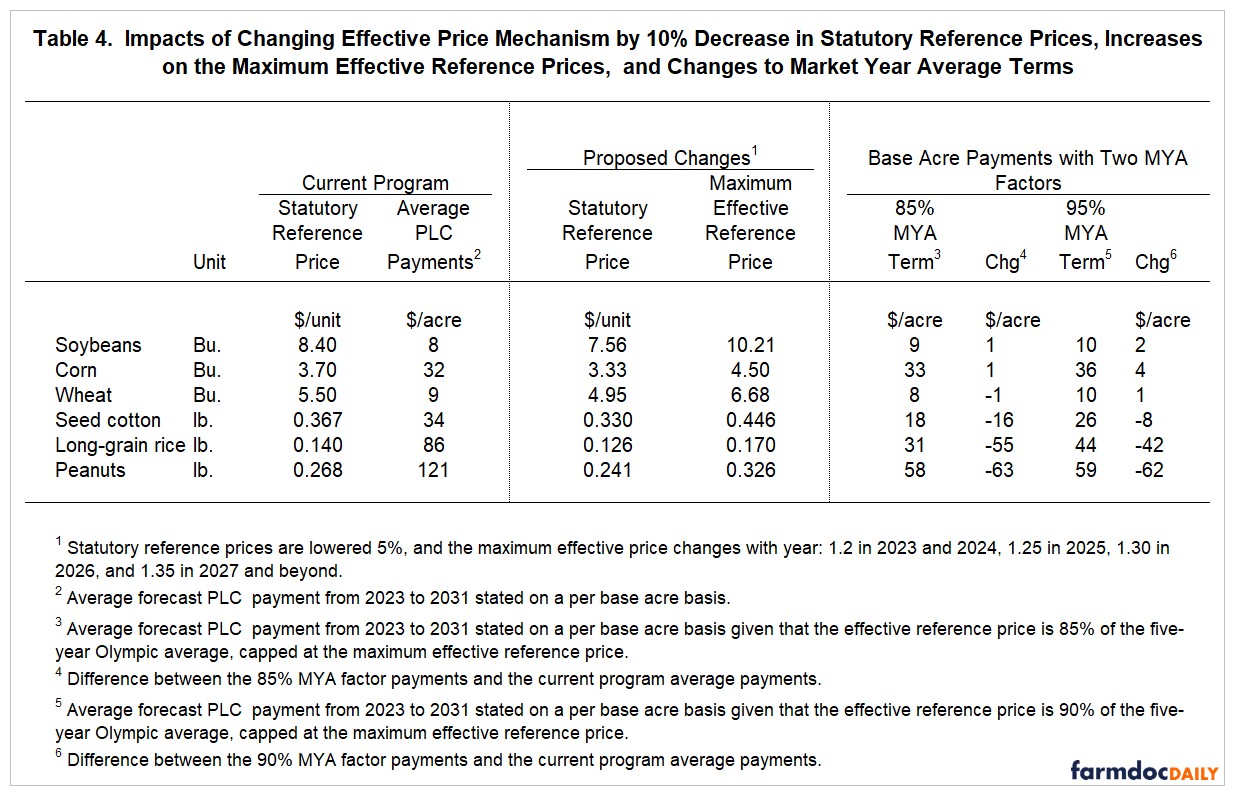

To illustrate, we changed the PLC program while maintaining average projected payments to be roughly the same for soybeans, corn, and wheat. These changes consisted of:

- Statutory reference prices are decreased by 10%, resulting in statutory reference prices of $7.56 per bushel for soybean, $3.33 per bushel for corn, $4.95 per bushel for wheat, $.330 per pound for seed cotton, $.126 for long-grain rice, and .241 for peanuts (see Table 4). The lower statutory reference prices would negatively impact peanuts, long-grain rice, and seed cotton.

- Increase the cap on the effective reference price from 1.15 of the statutory reference price to 1.20 in 2023 and 2024, 1.25 in 2025, 1.30 in 2026, and 1.35 in 2027 and beyond. After 2027, the maximum effective prices is 1.35 the statutory reference price, or $10.21 per bushel for soybeans, $4.50 per bushel for corn, $6.68 per bushel for wheat, $.446 per pound for seed cotton, $.170 per pound for long-grain rice, and $.326 per pound for wheat.

The above changes will allow 85% of the Olympic average to determine the effective reference prices under a larger set of pricing scenarios. If the moving average term for the effective reference price remains at 85% of the five-year Olympic average, the impacts on soybeans, corn, and wheat average payments are about the same as currently projected by CBO. Soybeans’ average payment moves from $8 per base acre under the current program to $9, an increase of $1 per base acre (see Table 4). Corn’s average payment increases by $1 per acre, and wheat decreases by $1 per acre. While having the same expected payments, there are reasons some producers may prefer this modification to the status quo. The maximum effective reference prices are raised, potentially providing a stronger safety net if MYA prices increase.

Peanuts, long-grain rice, and seed cotton expected payments decline by $63 per base acre, $55 per base acre, and $16 per base acre, respectively. While decreasing, long-grain rice and peanuts remain among the program crops receiving the largest projected PLC payments per base acre.

Additional Federal funds may exist to strengthen the commodity title program. If this is the case, increasing the moving average term from 85% to 90% will increase payments. The revised program then becomes: 1) reduce statutory reference prices by 10%, 2) increase maximum reference prices C1.20 in 2023 and 2024, 1.25 in 2025, 1.30 in 2025 and 1.35 in 2027), and 3) having .90 on the five-year Olympic average price). Relative to the current program, expected payments per base acre for soybeans would increase relative to the current program by $2 per base acre for soybeans, $4 per base acre for corn, and $1 for wheat (see Table 4). Expected payments per base acre for other crops would decline: -$8 for seed cotton, -$42 for long-grain rice, and -$62 for peanuts.

Commentary

Changes to the effective price mechanism described above would leave projected PLC payments for soybeans, corn, and wheat relatively unchanged. Peanuts, long-grain rice, and seed cotton payment projections would decline. For political reasons, splitting PLC programs across crops may be needed:

- Soybeans, corn, and wheat could move to lower statutory reference prices by 10% and increase upper payment limits on the effective reference price.

- Peanuts, long-grain rice, and seed cotton could maintain their current statutory and maximum effective prices.

Then, if funds are available, further improvements with budgetary impacts could be made. The moving average term could be increased to 90% thereby increasing expected payments.

Overall, though, there are advantages to moving to making the effective reference price more tightly tied to historic prices. Adjustments will automatically occur if and when prices change to different plateau levels. There are reasons to believe that MYA prices have reached new, higher plateaus, with a primary driver being higher production costs. If this is the case, allowing a wider range of effective reference prices will allow the PLC program to adapt to the new, higher price regime.

Summary

A straight percentage increase in statutory reference prices will further advantage peanuts and rice while having little impact on soybeans. As a result, changes to other commodity title programs likely are needed. Possibilities include improving ARC by increasing the coverage level above 86% of expected revenue and increasing the maximum payment above 10% of expected revenue. The PLC program could be improved by increasing the range of prices under which the moving average of previous prices determines the effective reference price, or increase the percentage of the moving average which calculated the effective reference price. So doing also allows for a more market-oriented PLC program where effective reference prices may adjust to potential new realities. That likely would be particularly beneficial for soybeans, corn, and wheat.

References

Irwin, S. and D. Good. "A New Era in Crop Prices?" farmdoc daily (1):27, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 29, 2011.

Irwin, S. and D. Good. "The New Era of Crop Prices — A Five-Year Review." farmdoc daily (3):38, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 27, 2013.

Irwin, S. and D. Good. "The New Era of Crop Prices: A 15-Year Review." farmdoc daily (13):176, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 27, 2023.

Schnitkey, G., C. Zulauf, N. Paulson, K. Swanson and J. Baltz. "Are Long-Run Prices Still $4 for Corn, $10 for Soybeans, and $5.50 for Wheat?" farmdoc daily (12):79, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 31, 2022.

Zulauf, C., G. Schnitkey, K. Swanson, N. Paulson and J. Coppess. "Effective Reference Price – Past and Future." farmdoc daily (12):97, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 29, 2022.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.