Mid-Year Update on the Competitiveness of Ethanol in Gasoline Blends

The plunge in crude oil and gasoline prices since last summer raised the question of whether ethanol could remain competitive in gasoline blends. The issue was addressed in three farmdoc daily articles in late 2014 and early 2015 (November 12, 2014; December 4, 2014; January 30, 2015). In the first article (November 12, 2014), we concluded that: “Recent market history also suggests the ethanol/CBOB price ratio is not likely to move above 1.0 for any length of time and that market adjustments to maintain the competitive position of ethanol are likely to be rapid. Higher ethanol production and lower ethanol prices have proven quite effective in the past at maintaining ethanol’s place in gasoline blends and are likely to continue to do so in the future.” Markets have now had a full six months to adjust to the drop in crude oil and gasoline prices, which should be long enough to roughly approximate full adjustment. The purpose of today’s article is to examine the accuracy of the prediction made last fall that ethanol prices would rapidly adjust to maintaining its competitive position.

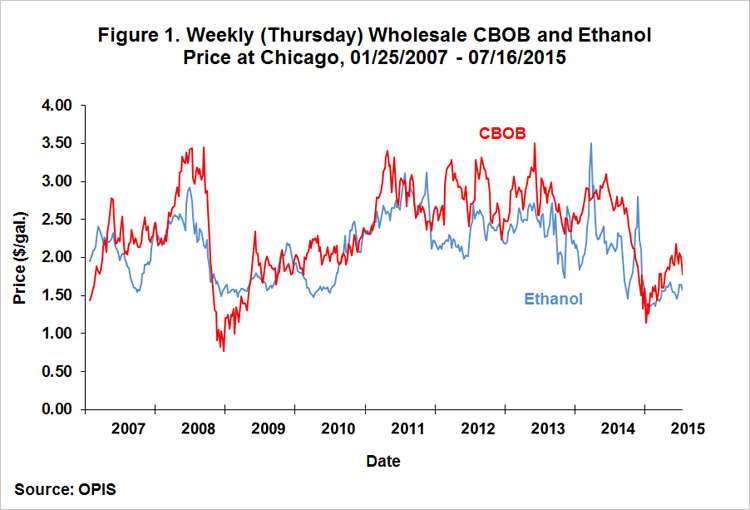

We begin with Figure 1, which presents the weekly wholesale price of CBOB gasoline at Chicago and wholesale ethanol price going back to early January 2007. Outside of the spike in ethanol prices last fall, ethanol prices clearly adjusted downward as CBOB prices dropped. Even as CBOB prices recovered rather impressively during the first half of 2015, ethanol prices largely moved sideways. The market adjustments can be seen even more clearly in Figure 2, which shows the ratio of wholesale ethanol to CBOB prices at Chicago. Exactly as predicted, the spike in ethanol prices relative to CBOB prices last fall did not last long. By late December 2014, the ratio was back under 1.0 and well-below the assumed break-even level of 1.1. Due to the upward trend in CBOB prices and range-bound ethanol prices, the ratio continued to decline through the first half of 2015. The ratio reached a bottom of 0.68 in mid-June, near the lows for the entire period. In the last month the ratio recovered to 0.88, slightly above the average (0.86) since 2012.

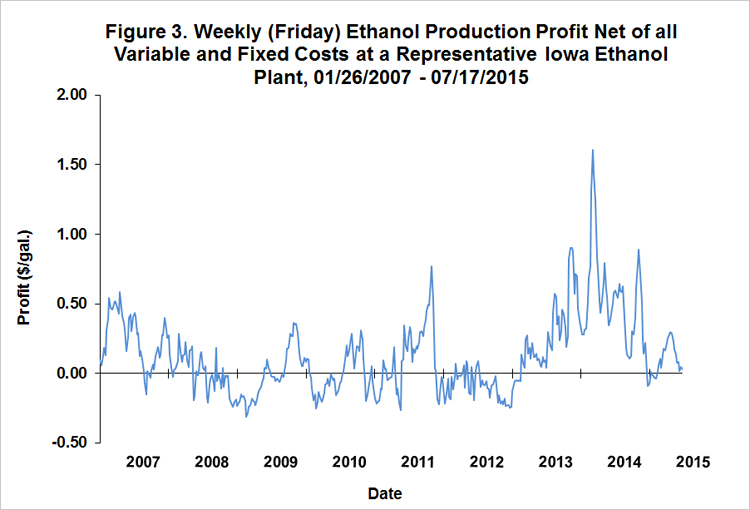

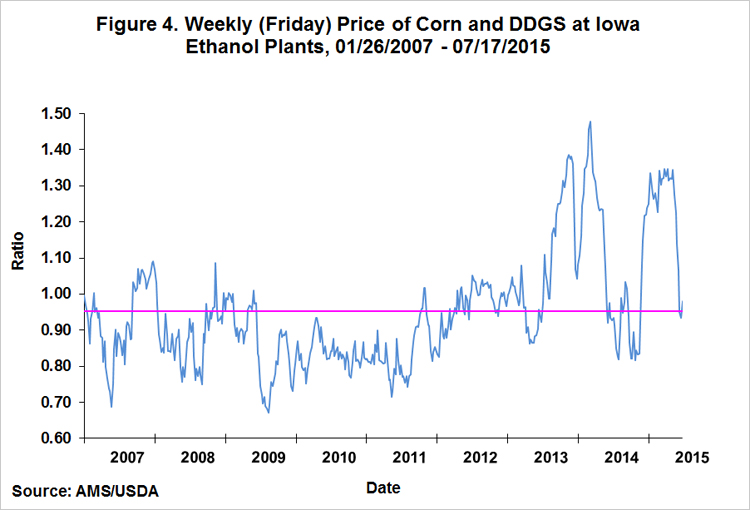

Ethanol prices have now fully adjusted to the much lower prices of crude oil and gasoline. As shown in Figure 3, the adjustment has not been without pain for ethanol producers. Profits largely evaporated during the adjustment process. There was a brief recovery this spring associated with relatively strong DDGS prices (farmdoc daily, March 12, 2015). However, as demonstrated in Figure 4, DDGS prices have fallen sharply in recent weeks, which has driven profits back to break-even levels.

Implications

Crude oil and gasoline prices plunged starting in the summer of 2014. Ethanol prices have now fully adjusted to the large decline, thus maintaining the competitive position of ethanol in gasoline blends. As expected, the spike of ethanol prices above gasoline prices last fall did not last long. The adjustment has been far from painless for ethanol producers. Production profits have been driven back to breakeven levels as ethanol prices declined, ending a period of unprecedented profits for the ethanol industry. A key question is whether this portends a return to the era of low ethanol production profits that existed from 2007-2012.

References

Irwin, S., and D. Good. "Ethanol Production Profits: The Risk from Lower Prices of Distillers Grains." farmdoc daily (5):46, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 12, 2015.

Irwin, S., and D. Good. "Further Evidence on the Competitiveness of Ethanol in Gasoline Blends." farmdoc daily (5):17, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 30, 2015.

Irwin, S., and D. Good. "How Much Will Falling Gasoline Prices Affect Ethanol and Corn Demand?" farmdoc daily (4):232, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 4, 2014.

Irwin, S., and D. Good. "Do Falling Gasoline Prices Threaten the Competitiveness of Ethanol?" farmdoc daily (4):219, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 12, 2014.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.