Comparing Price Policy Directions in the 2018 Farm Bill Debate

Historically, much of the farm program debate has been driven by concerns about low crop prices and a regional dispute about the best policy for addressing those concerns. This was a prominent feature of the debate that produced the 2014 Farm Bill; the Senate and Midwest sought revenue-based assistance, while the House and South sought to preserve fixed-price based assistance. As the current effort to reauthorize the farm bill progresses, this specific policy debate continues but in a much lower crop price environment. This article compares particular policy concepts for farm programs by reviewing at two versions of reference prices used for Price Loss Coverage payments: the version reported by the House Ag Committee and a recently-introduced bill by Senators John Thune (R-SD) and Sherrod Brown (D-OH), both members of the Senate Ag Committee.

Background

Out of the heated and difficult Congressional debate that produced the Agricultural Act of 2014, farmers were given a choice between the Price Loss Coverage Program (PLC) and the Agriculture Risk Coverage (ARC). PLC is a traditional fixed-price policy, triggering payments when market year average (MYA) prices are below a statutorily-fixed reference price. ARC is a revenue-based program triggering payments when actual revenues (prices multiplied by yields) are below 86% of an historic benchmark revenue (5-year Olympic moving average of prices and yields). ARC is available using county average yields by crop or individual farm yields for all crops with base on the farm; both versions used national MYA prices. Most of the base acres for corn and soybeans elected ARC-CO while almost all of the base acres for peanuts and rice elected PLC; wheat base acres were split between the two programs (farmdoc daily, June 16, 2015).

PLC in the House Ag Committee Bill

The farm bill reported by the House Ag Committee continued the current farm programs Agriculture Risk Coverage, county level coverage (ARC-CO) and Price Loss Coverage (PLC) (for more detail, see farmdoc daily, April 26, 2018). Most notable about the House Ag Committee bill is that it appears designed to encourage farmers to elect PLC over ARC-CO. First, farmers who elected ARC-CO for a crop’s base acres are ineligible for area-wide crop insurance coverage on the crop; a notable conflation of Title I program support and crop insurance that could serve as a disincentive to elect ARC-CO. Second, PLC is revised to provide for an effective reference price and PLC payments are triggered when the marketing year average (MYA) price for the commodity in any crop year is below the effective reference price.

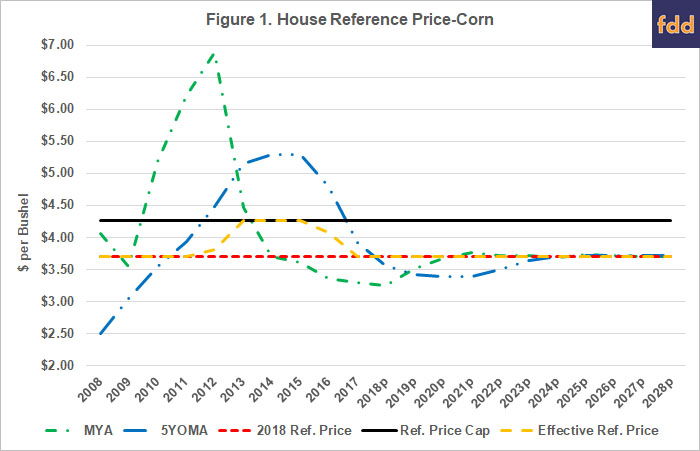

The effective reference is the higher of the statutory reference price or 85% of the 5-year Olympic moving average of MYA prices (reference price escalator), not to exceed 115% of the reference price (reference price cap). This provision would permit an increase to the price-based coverage if farmers experience multiple years of higher MYA prices (up to 115% of the reference price) but the price coverage would never fall below the statutory reference prices. To illustrate how this would work, Figure 1 charts the components for corn as if it were in place from the 2008 Farm Bill through 2028. Historic prices are from USDA-NASS Quick Stats and price forecasts are from the CBO April 2018 Baseline (farmdoc daily, April 12, 2018).

To arrive at the effective reference price, Figure 1 tracks MYA prices and the 5-year Olympic moving average of MYA prices (5YOMA). The escalator provision for the reference price equals 85% of that price up to the cap of 115% of the statutory reference price ($3.70 per bushel). As Figure 1 illustrates, the high price years would have increased the PLC reference price for corn in each of the years 2012 through 2016, hitting the cap ($4.26 per bushel) in 2013, 2014 and 2015. For most of the remaining crop years, however, the reference price would equal the statutorily-fixed price, especially under CBO projections.

The impact of this provision depends most on the level of the crop’s statutorily-fixed reference price. For example, compare Figure 1 with Figure 2 below. Figure 2 illustrates the same components of the effective reference price for the newly created covered commodity, seed cotton (farmdoc daily, February 14, 2018). For most years, the seed cotton statutory reference price ($0.3670 per pound) is above MYA prices and the 5-year Olympic moving average of MYA prices. The higher statutory reference price relative to market prices results in only a single year in which the effective reference price would have adjusted upward; in 2011, it would have increased to $0.3852 per pound.

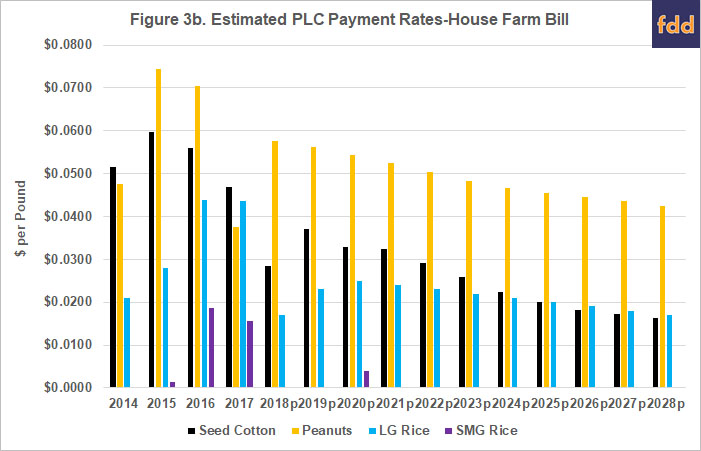

Ultimately the effective reference price determines whether a payment is triggered (i.e., MYA below effective reference price) and it determines the payment rate (i.e., the difference between the MYA and the effective reference price). The payment rate multiplied by the program yields determines the amount paid on 85% of the crop’s base acres. To provide further information about how this proposed provision in the House farm bill would operate, Figures 3a and 3b contain the estimated payment rate for each year for these crops beginning with the 2014 farm bill period through 2028. These figures add to the earlier discussion about the ability for Congress to effectively determine the size of payments under the 2014 farm bill for each of the crops depending largely on where it set reference prices relative to recent market prices (farmdoc daily, May 10, 2018 and May 3, 2018). These figures add further to the question of equity among crops and that this situation will likely continue with the proposed House farm bill. In particular, cotton, peanuts, and rice continue to receive large estimated payments while corn and soybeans receive little to no estimated deficiency payments after the 2014 farm bill ends. Thus, the proposed change in the House farm bill to the setting of reference prices only marginally addresses the equity issue of differentially set reference prices across these 6 crops.

Proposed Revisions in the Thune-Brown Bill in the Senate

The Senate Ag Committee has yet to release draft text or mark up its version of the farm bill. To provide some measure of comparison, however, two members of the committee have introduced a bill that would revise farm program policy. On April 25, 2018, Senators John Thune (R-SD) and Sherrod Brown (D-OH) introduced a bill designed to improve the Agriculture Risk Coverage (ARC) program (Steever, April 26, 2018; Thune Press Release, April 25, 2018; Brown Press Release, April 25, 2018). While the bill emphasizes improvements to ARC, it also revises the calculation for reference prices in PLC. Given its role in the debate under current price scenarios, this difference in directions for price-based commodity policy–calculation of reference prices in PLC–will be explored further as a comparison to the direction taken thus far in the House. Analysis of the impact of proposed changes to ARC will be explored in a future article.

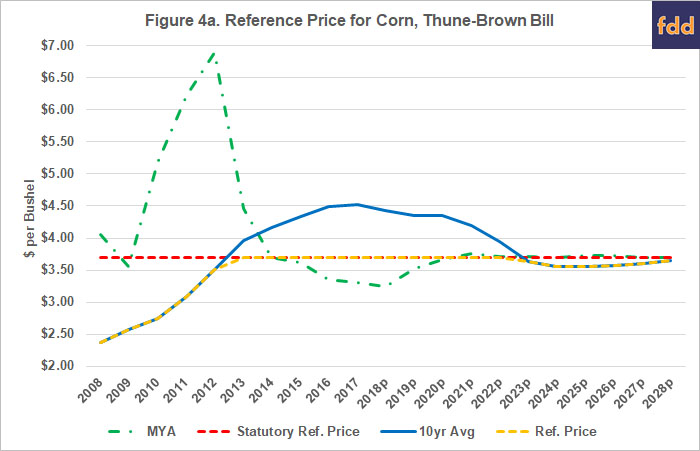

The reference prices for Price Loss Coverage (PLC) in the Thune-Brown bill are equal to the lesser of the statutorily-fixed prices continued from the 2014 Farm Bill or the average of the marketing year average (MYA) over the most recent 10 crop years. In other words, the 10 year average of MYA prices becomes the effective reference price and results in a reduced reference price used to trigger and calculate PLC payments if the statutory reference price is above the 10-year average. This feature impacts each commodity differently depending on the relationship between the statutory reference prices fixed in the 2014 Farm Bill and the 10-year average MYA prices. Figures 4a and 4b illustrate this by comparing the reference prices under the Thune-Brown bill for corn and seed cotton, including application of the reference prices back to 2008.

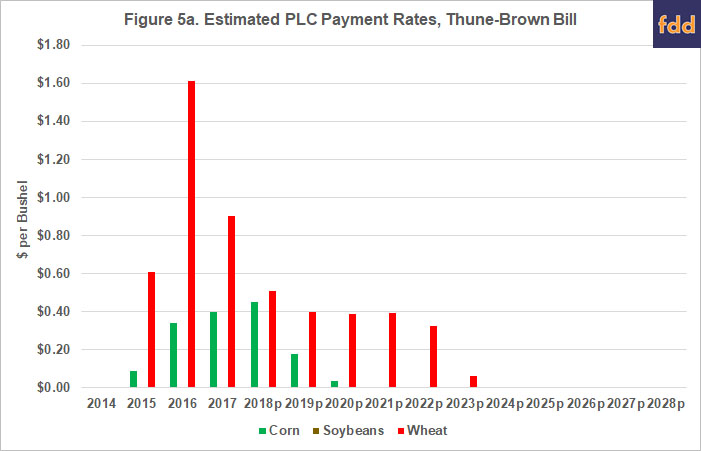

Comparing these figures, the higher reference for seed cotton relative to MYA and 10-year average MYA prices results in the cap on the reference price operating each year. For corn, the cap appears to operate only in the out-years of CBO price projections, reducing the reference price beginning in 2023. The impact of the cap on reference prices can be further illustrated by the estimated payment rates (difference between the reference price and MYA prices) used to calculate PLC payments (with program yields and 85% of base acres). Figures 5a and 5b provide the estimated PLC Payment rates under the Thune-Brown reference price cap concept.

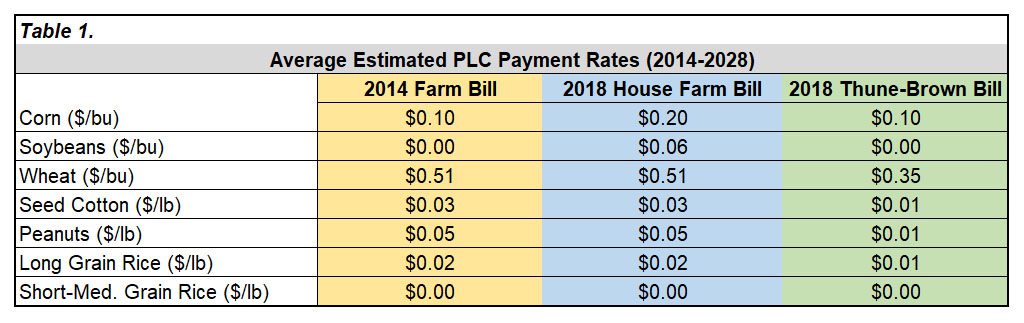

There are two initial conclusions from Figures 5a and 5b, especially as compared to the estimated payment rates in 3a and 3b. First, the payment rates under CBO price projections eventually reduce as the 10-year average MYA falls below the statutory reference price and, thus, PLC payments would be expected to phase out for all commodities. This is in stark contrast to payment expectations under the House bill. Second, the payment rates are generally lower for all commodities except wheat in 2015 through 2022. Table 1 provides a final comparison using the average payment rates from 2014 through 2028 based on estimates for the 2014 Farm Bill reference prices, the House bill effective reference prices and the Thune-Brown bill reference prices.

Concluding Thoughts

The bottom line of this particular policy disagreement can be most clearly understood by comparing the estimated PLC payment rates in the House version (Figures 3a and 3b) to the estimated PLC payment rates in the Thune-Brown version (figures 5a and 5b). Both versions of the program would’ve triggered payments in the years after 2014 as prices fell, but the House version would have triggered larger payments for seed cotton, peanuts and long grain rice. Moreover, the Thune-Brown bill payment rates adjust to the lower price scenario and payments would eventually end; the House bill would continue making payments every year throughout the baseline years for wheat, seed cotton, peanuts and long grain rice. The optimist looks at these competing versions for farm policy and sees the green shoots of compromise; a compromise that could produce a subtle shift in policy towards more market-oriented assistance with better transparency as well as improvements that produce more equitable and fair treatment among farmers. The pessimist sees another counterproductive dispute between nearly irreconcilable visions for farm policy. Continued progress through Congress may deliver answers on which view wins in the coming months.

References

Coppess, J., C. Zulauf, G. Schnitkey, and N. Paulson. "Continued Review of Fixed Price Farm Policy." farmdoc daily(8):80, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 3, 2018.

Coppess, J., G. Schnitkey, C. Zulauf, and N. Paulson. "Initial Review of the House 2018 Farm Bill." farmdoc daily(8):75, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 26, 2018.

Coppess, J., G. Schnitkey, C. Zulauf, and N. Paulson. "Reviewing the CBO Baseline for 2018 Farm Bill Debate." farmdoc daily(8):65, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 12, 2018.

Coppess, J., N. Paulson, C. Zulauf, and G. Schnitkey. "Farm Bill Round 1: Dairy, Cotton and the President's Budget." farmdoc daily (8):25, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 14, 2018.

Schnitkey, G., J. Coppess, N. Paulson, and C. Zulauf. "Perspectives on Commodity Program Choices under the 2014 Farm Bill." farmdoc daily(5):111, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 16, 2015.

Steever, T. "Thune-Brown Bill Said to Improve ARC," Brownfield Ag News, April 26, 2018, https://brownfieldagnews.com/news/thune-brown-bill-said-to-improve-arc/

U.S. Senator John Thune, Press Release, "Thune, Brown Introduce Bipartisan Legislation to Improve the Agriculture Risk Coverage Program," April 25, 2018, https://www.thune.senate.gov/public/index.cfm/2018/4/thune-brown-introduce-bipartisan-legislation-to-improve-the-agriculture-risk-coverage-program

U.S. Senator Sherrod Brown, Press Release, "Brown, Thune Introduce Bipartisan Legislation to Improve the Agriculture Risk Coverage Program," April 25, 2018, https://www.brown.senate.gov/newsroom/press/release/brown-thune-introduce-bipartisan-legislation-to-improve-the-agriculture-risk-coverage-program

Zulauf, C., J. Coppess, G. Schnitkey, and N. Paulson. "Comparing ARC-CO and PLC Payment Profiles, 2014-2016 Crops." farmdoc daily(8):85, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 10, 2018.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.