Spending Impacts of House Proposal for Commodity Title Changes

The House Agriculture Committee released its proposal for the next farm bill. As expected, the House Proposal increases statutory reference prices for all covered commodities but with significant differences across commodities. The result is that some program crops will have much higher statutory reference prices and larger expected payments per base acre than other program crops. Base acres in rice, peanuts, and seed cotton gain much more than corn, soybeans, and wheat. Counties in the South and the Delta region gain much more than the rest of the United States. A conservative estimate of increased commodity title spending is over $30 billion.

House Proposal

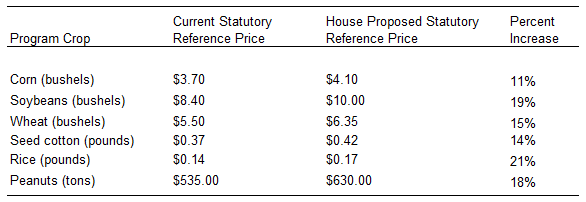

Proposed changes to statutory reference prices in the House Proposal are:

Higher statutory reference prices relative to Market Year Average (MYA) prices will increase expected payments from Price Loss Coverage (PLC), one of two commodity title programs farmers can choose from (see farmdoc daily, September 24, 2019, September 17, 2019). Statutory reference prices also impact payments for Agriculture Risk Coverage (ARC). The House’s proposed reference price changes magnify existing disparities in expected payments per base acre.

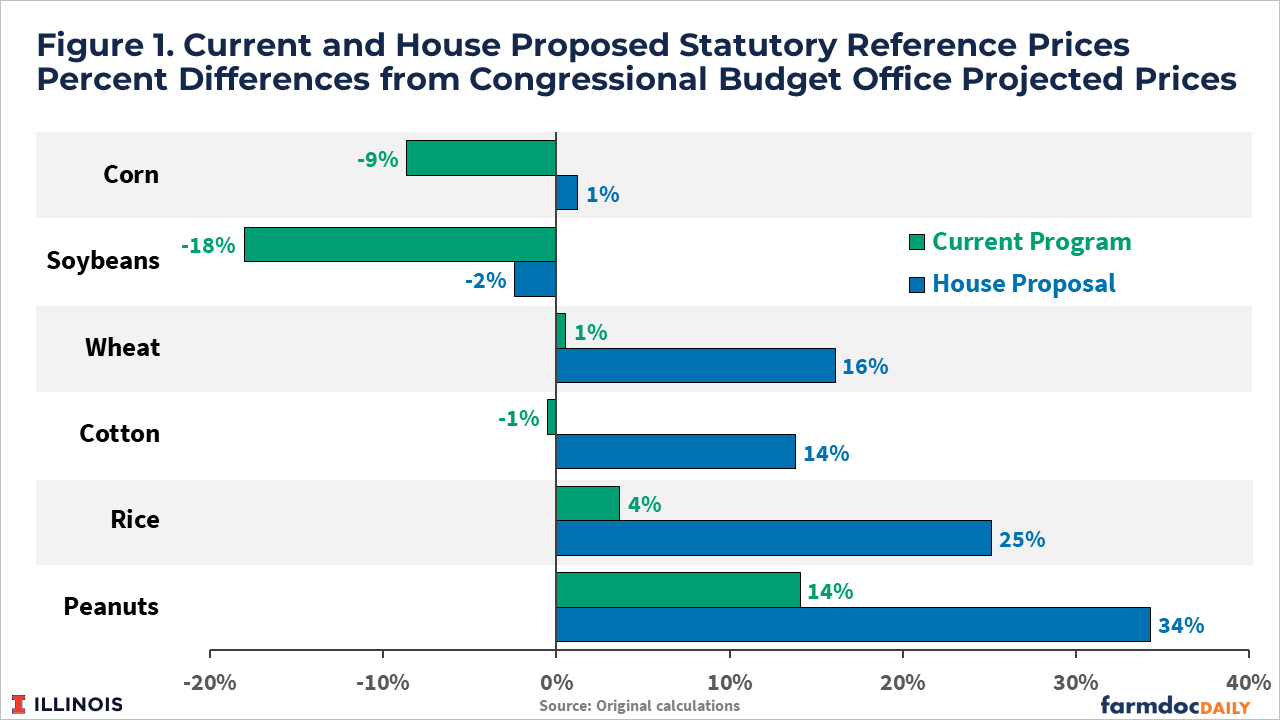

Figure 1 shows statutory reference prices relative to projected prices. Projected prices come from the Congressional Budget Office (CBO)’s February 2024 estimates of mandatory spending on Program Crops (CBO, February 2024). In preparing this graph, we used CBO projections of Market Year average (MYA) prices from 2028 to 2034. Economic models cause price estimates to move toward a long-run average. In Figure 1, this long-run average is represented by 2028 to 2034 average prices. CBO is projecting a $4.05 MYA price for corn from 2028 to 2034. The current $3.70 statutory price is 9% below the $4.05 projected MYA price (i.e., -9% in Figure 1). The $4.10 proposed statutory price is 1% higher than the $4.05.

The rank order of proposed statutory reference price to projected price is (see Figure 1):

- Peanuts has the highest proposed statutory reference price relative to projected prices at 34% above projected price (see Figure 1),

- Rice at 25% above projected price,

- Wheat at 16% above projected price,

- Seed cotton at 14% above projected price,

- Corn at 1% above projected price, and

- Soybeans at -2% below projected price.

Note that rice and peanuts have particularly high relative statutory prices under the House Proposal. Those high relative statutory prices would result in farmers with base acres in those crops receiving large expected payments per base acre.

Proposed changes to Agriculture Risk Coverage (ARC) are:

- Increase the coverage level from 86% to 90%, and

- Increase the maximum payment from 10% of benchmark revenue to 12.5% of benchmark revenue.

Those changes will increase the likelihood of ARC payments, as well as the size of expected payments. Under CBO projections, ARC enrollment is higher for soybeans and corn, so that program will benefit soybeans and corn the most.

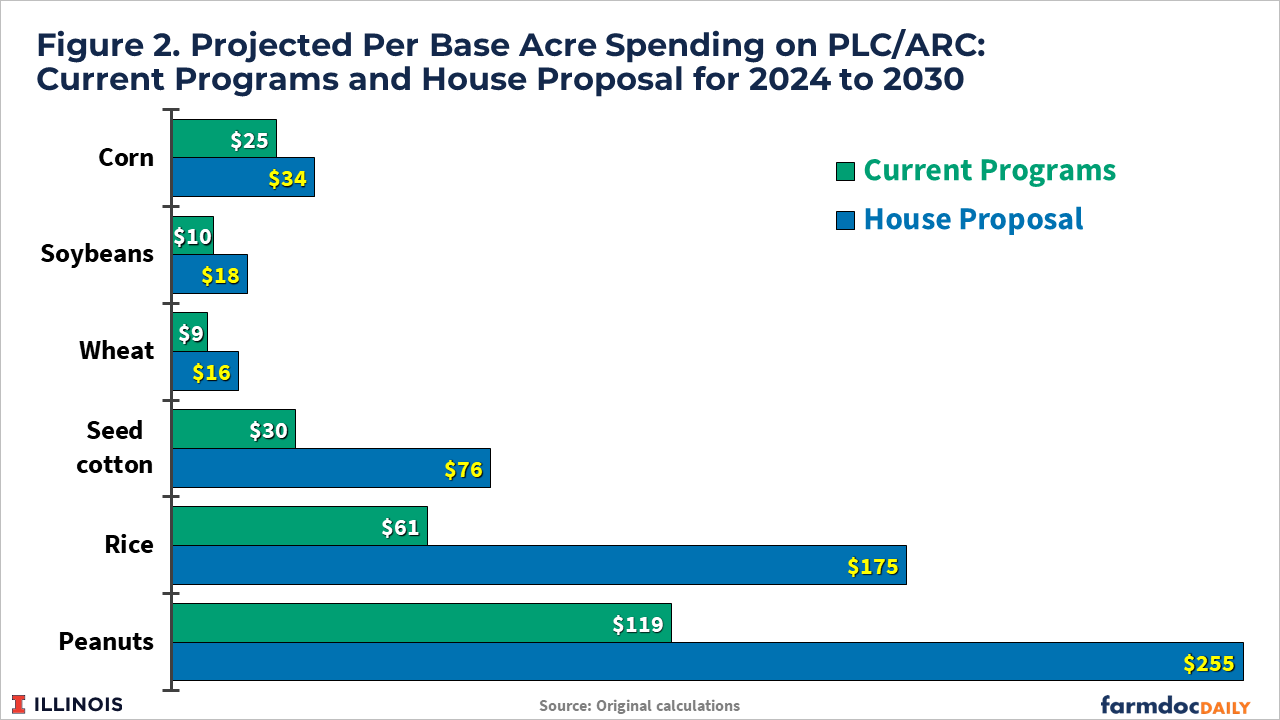

Impacts on Commodity Title Spending

Using a stochastic simulation model, we estimated the impacts of the House Proposal on commodity title spending from 2024 to 2032. We selected the years through 2032 because those years will impact baseline spending changes made by the CBO. We report averages across those years and program choices (see Figure 2). For corn, the projected payment under the current program is $25 per base acre, representing a weighted average of PLC and ARC payments from 2024 to 2032. The $25 is the same as obtained from the February 2024 CBO estimates of mandatory spending. The House program results in an increase to $36 per base acre.

Spending across base acres in program crops are:

- Corn: PLC/ARC spending increases from $25 per base acre under the current program to $34 per base acre, an increase of 36%.

- Soybeans: PLC/ARC spending increases from $10 per base acre under the current program to $18 per base acre, an increase of 80%.

- Wheat: PLC/ARC spending increases from $9 per base acre under the current program to $16 per base acre, an increase of 78%.

- Seed cotton: PLC/ARC spending increases from $30 per base acre under the current program to $76 per base acre, an increase of 153%.

- Rice: PLC/ARC spending increases from $61 per base acre under the current program to $175 per base acre, an increase of 187%.

- Peanuts: PLC/ARC spending increased from $119 per base acre under the current program to $255 per base acre, an increase of 114%.

The largest spending increases over current projections are for peanuts and rice because the base acres of peanuts and rice will have much higher relative statutory reference prices if the House Proposal becomes law.

Overall, the House Proposal would dramatically increase spending on the commodity title programs. Under current programs, CBO estimates total PLC/ARC spending to be $41 billion from 2024 to 2033 or $4.1 billion annually. Our estimates suggest that would increase by at least $31 billion to $72 billion for the period, or a 77% increase. That total spending estimate is conservative in that it does not include the voluntary update to base acres included in the House Proposal. Given current rules, that increase would require a decrease in spending from other farm bill programs to offset the increase (see farmdoc daily, May 16, 2024, May 14, 2024).

Commentary

The House’s proposed reference price changes magnify existing disparities in expected payments per base acre. Under current programs, the range from the highest to lowest program crops is $110 per acre ($119 for peanuts – $9 for wheat). That range would increase to $239 per acre ($255 for peanuts – $16 for wheat), or more than doubling of the range in payments.

Much of the increased disparity is because statutory reference prices vary so much across program crops. The base acres of peanuts and rice have much higher relative statutory reference prices than those of all other program crops. Soybeans have the lowest relative statutory reference prices. Those relationships are not new and have existed throughout the recent history of farm bills (see farmdoc daily, November 7, 2023). While the proposal does make the reference price for soybeans much closer to its market prices than was historically the case, the proposed changes would increase those differences across crops and the justification for the differences in statutory reference prices is not evident.

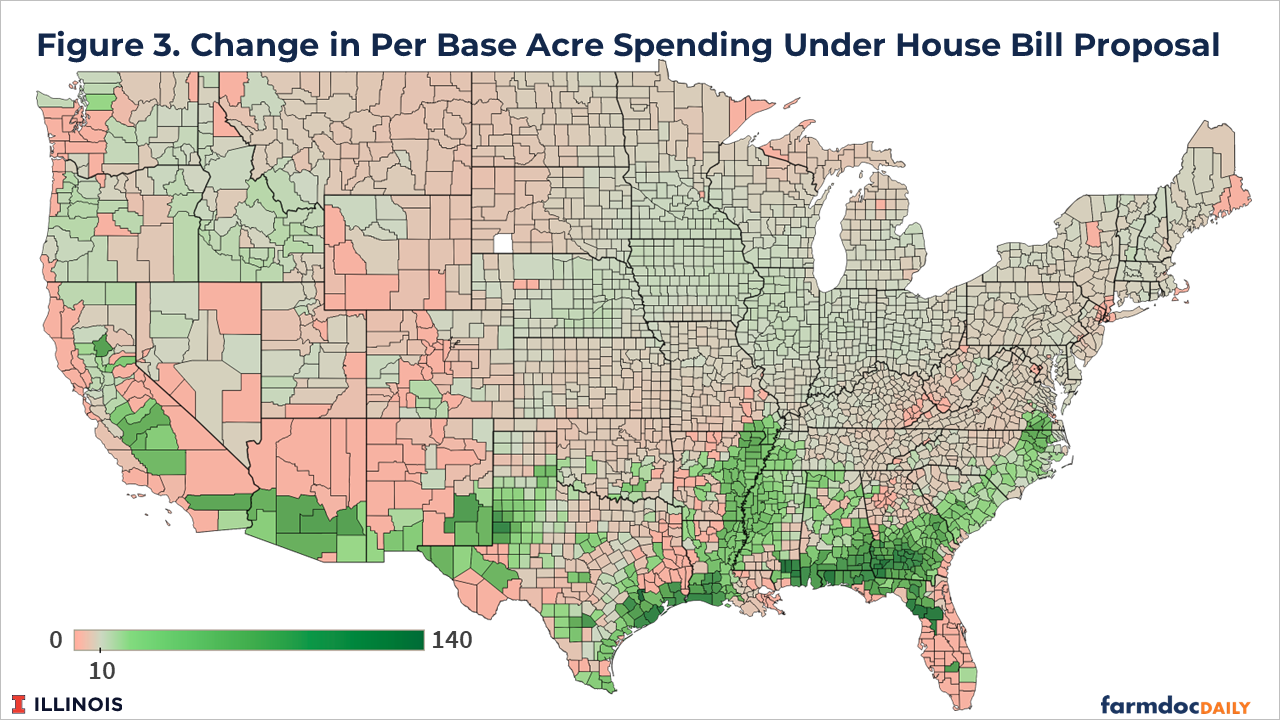

The Proposal would have differential impacts across the United States. Figure 3 shows the average change in expected payments per base acre in all counties. Farmers with base acres in counties in the southern United States and Delta region would gain more relative to farmers in other regions. Those increases occur because the base acres for rice, peanut and seed cotton are concentrated in the southern states.

The commodity title makes payments on base acres and not planted acres. Over time, the planting decisions by farmers and the lack of mandatory base acre updates have resulted in base acres that do not match planted acres (see farmdoc daily, May 7, 2024). Enrolled base acres in rice and peanuts are much higher than planted acres. The House Proposal would make any effort to update base acres more problematic. Costs would be expected to increase significantly with a voluntary update, such as the one included in the House Proposal. Mandatory updates would have much lower impacts on program costs but become more politically unacceptable because those farmers with rice and peanut base acres would resist the changes as it would lower their payments and the value of those base acres would create strong resistance to any changes that resulted in fewer peanut and rice base acres. Based on recent planting decisions, any mandatory update would be expected to result in fewer peanut and rice acres because farmers currently have significantly more base acres of those crops than they have planted them.

Summary

The House Proposal for the Commodity Title would significantly increase commodity title spending. Farmers with base acres of the Southern crops (peanuts, rice, and cotton) would have much higher increases in payments than farmers with base acres of those program crops grown in most of the country. The House Proposal would increase payments more for southern and Delta states than for other regions.

References

Congressional Budget Office. CBO’s February 2024 Baseline for Farm Programs, accessed May 21, 2024. https://www.cbo.gov/system/files/2024-02/51317-2024-02-usda.pdf

Coppess, J., G. Schnitkey, N. Paulson, B. Sherrick and C. Zulauf. "Reference Price Disparities & Why It Matters to Farmers." farmdoc daily (14):93, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 16, 2024.

Schnitkey, G., C. Zulauf, K. Swanson, J. Coppess and N. Paulson. "The Price Loss Coverage (PLC) Option in the 2018 Farm Bill." farmdoc daily (9):178, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 24, 2019.

Schnitkey, G., C. Zulauf, N. Paulson, J. Coppess and B. Sherrick. "Base Acre Updating in the Next Farm Bill." farmdoc daily (14):87, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 7, 2024.

Schnitkey, G., J. Coppess, N. Paulson, C. Zulauf and K. Swanson. "The Agricultural Risk Coverage — County Level (ARC-CO) Option in the 2018 Farm Bill." farmdoc daily (9):173, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 17, 2019.

Schnitkey, G., N. Paulson, C. Zulauf, J. Coppess and B. Sherrick. "Statutory Reference Prices and the Next Farm Bill." farmdoc daily (14):91, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 14, 2024.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.