Brazil’s Corn Harvest Declines, Yet Remains Second Largest in Nation’s History

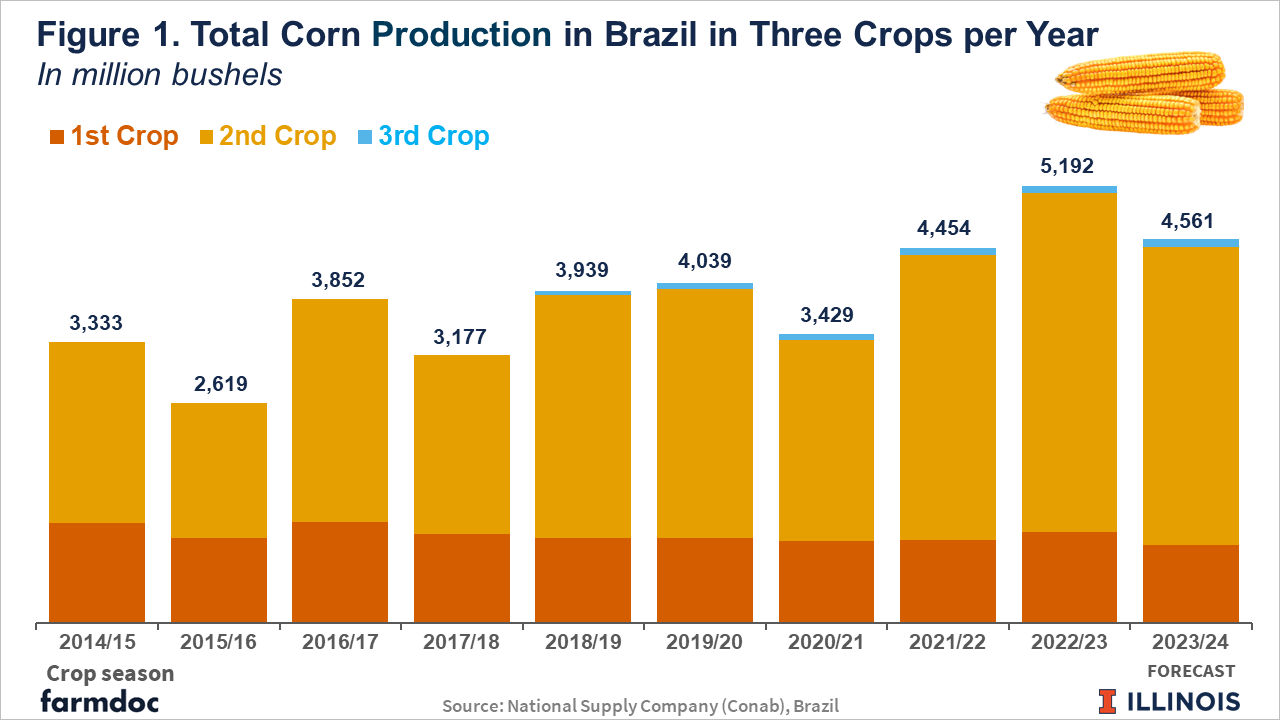

Brazilian farmers are expected to harvest 4,561 million bushels of corn in the 2023/24 season, including the country’s first, second, and third crops. That total would be 12% less than last year’s record harvest, according to the latest report from the National Supply Company (Conab), the country’s food supply and statistics agency. The expected reduction in total corn production is mainly attributed to smaller acreage and lower yields in the second crop, which accounts for about 75% of the national production. Despite weather challenges posed by a year strongly influenced by El Niño, the anticipated total still will be the second-largest crop Brazil has ever produced. This article focuses on the latest estimates for total corn production in Brazil for the 2023/24 crop season, expected supply and demand, and implications for the international market.

Reduced Acreage and Yield Decline

The projected reduction in Brazil’s total corn harvest is a result of two factors: a decrease in planted area caused by low corn prices and a decline in yields caused by adverse weather in critical growing regions (see farmdoc daily, December 12, 2023). The total planted area for the first, second, and third crops is expected to fall by 6.3% to 51.5 million acres, according to the latest report from Conab, released on July 11. Yields have dropped by 6.2% to 88 bushels per acre. As a result, Brazil’s production has decreased to 4,561 million bushels, down 12% from last year’s record crop of 5,192 million bushels (see Figure 1).

The first crop (from the summer corn cycle) is expected to be 923 million bushels, down 14% from the last season (see Figure 1). In most states, yields have decreased because of adverse weather as a result of El Niño. One exception was the southernmost state of Rio Grande do Sul, which, despite good yields on average, was affected by catastrophic floods at the end of May, when the harvest for the first season ended. The flooding damaged the crops still in the field and prevented farmers from completing the harvest there (see farmdoc daily, June 11, 2024).

More than 70% of the harvest of the second crop (winter crop cycle), also known as safrinha, had been completed by the second week of July. Production is expected to decrease by 12% to 3,543 million bushels because of decreased acreage from low prices and reduced yields as a result of unfavorable weather. Hot conditions have hurt the crops in Paraná, the southernmost safrinha corn state, as well as in Mato Grosso do Sul. On the other hand, in Mato Grosso, Brazil’s main producer of corn, yields have been considered excellent.

The outlook for the third corn crop — officially included in Conab projections since the 2018/19 crop season — is 95 million bushels, surpassing the prior cycle by 12% (see Figure 1). The third crop corn planting season has just been completed. Third crop corn primarily is grown in the Northern and Northeastern Brazilian states of Bahia, Sergipe, Alagoas, Pernambuco, and Roraima. It is harvested mostly from September to December. Despite representing only 2% of total corn production, third crop corn plantings have the potential for continued growth.

Conab and the U.S. Department of Agriculture (USDA) differ slightly in their projections of corn production in Brazil in the current crop season. Conab estimates the crop at 4,561 million bushels while, in its report of July 12, the USDA projected the crop would be 4,802 million bushels. Differences in forecasting methods may explain the USDA-Conab divergence, similar to what has been observed in soybean production in Brazil (see farmdoc daily, April 23, 2024). Some private analysts also estimate different numbers. Agroconsult, a private Brazilian consultancy, recently raised its forecast for the 2023/24 corn crop to 4,960 million bushels, closer to that of the USDA.

Brazilian Exports are Projected to Fall

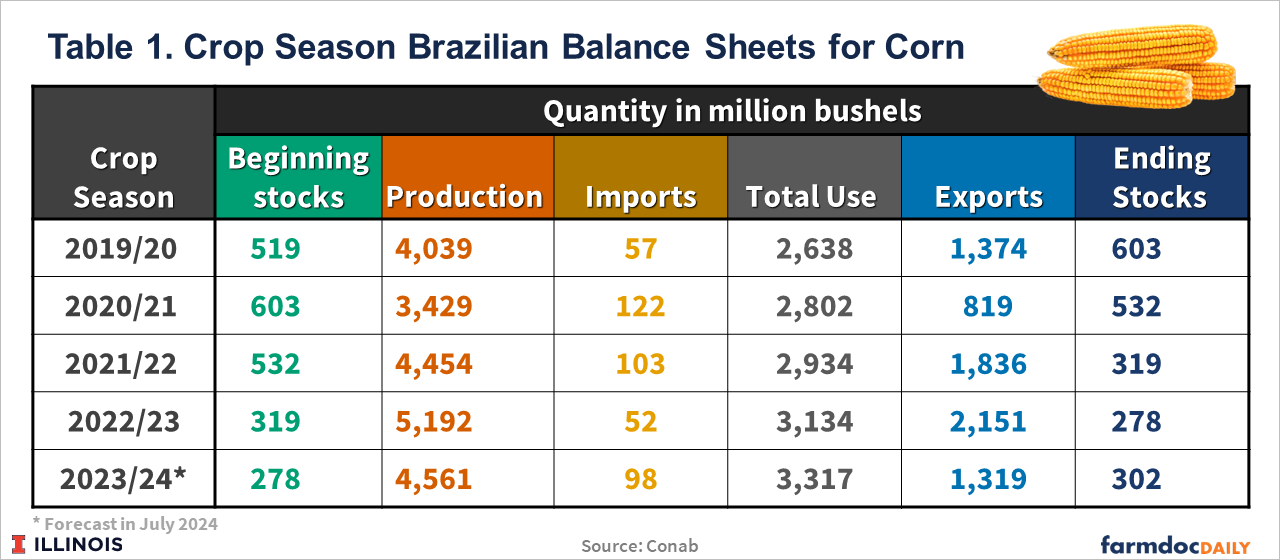

After overtaking the United States last year as the world’s top corn exporter, Brazil is expected to reduce its shipments in 2024. Brazilian corn exports are forecast at 1,319 million bushels from January to December, a 38% decrease from the record shipments of 2,151 million bushels in the same period last year (see Table 1). As a result, the United States should reclaim its title of the world’s largest corn exporter after having lost that position to Brazil last year when China opened its market to Brazilian corn (see farmdoc daily, March 12, 2024). Table 1 shows the latest balance sheets for corn, released by Conab on July 11.

Brazilian corn exports are projected to fall because of weaker demand from China and competition from the United States and Argentina. After a very poor 2023 harvest under a third consecutive La Niña, Argentine farmers have seen better results in the current crop season, although initial record projections were tempered by the emergence of corn stunt disease (see farmdoc daily, May 28, 2024). The Buenos Aires Grain Exchange reported an expected production of 1,830 million bushels of corn, a 26% increase from last year, but 20% lower than the 2,224 million bushels anticipated earlier in the growing season.

China has been the main destination for Brazil’s corn exports in 2024, accounting for 20% of all shipments. Chinese corn imports reached 815 million bushels from October 2023 to May 2024, with 583 million bushels of that total coming from Brazil. Most of the remaining 232 million bushels came from the United States and Ukraine (USDA, 2024). Currently, Brazil is the leading supplier of corn to China, but Argentina has the potential to take over this position. Cargoes of Argentine corn have been shipped to China, marking the first such exports in 15 years. In June, Argentina completed steps to obtain approval from Beijing to access the Chinese market for its corn, following an agreement on sanitary requirements last year.

Conab projects that 3,317 million bushels of corn from the 2023/24 harvest will be consumed within Brazil throughout 2024 (see Table 1). This represents an increase of 6% over the previous harvest, indicating a growing domestic demand for corn. Currently, about 50% of Brazilian corn production is dedicated to animal feed, and 12% is used by ethanol plants. The remainder is available for export. Ethanol plants capable of utilizing corn as a feedstock are increasing in numbers in Brazil. This expansion is mainly occurring in the Center-West states, such as Mato Grosso, where second crop corn production continues to increase, and logistics issues create incentives to find more local uses for the corn.

Final Considerations

Despite a projected 12% decrease from last year’s record harvest, Brazil’s total corn production is expected to reach 4,561 million bushels, the second-best result in history. The harvest of the second crop, known as safrinha, is underway with more than 60% having been completed by the second week of July. The anticipated reduction in Brazilian corn exports, coupled with increasing competition from Argentina and the United States, highlights the shifting landscape of global corn trade – with the United States likely reclaiming the title of the world’s largest corn exporter for 2024.

References

Cabrini, S., J. Colussi and N. Paulson. "Spread of Corn Stunt Disease Lowers Production Expectations in Argentina." farmdoc daily (14):100, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 28, 2024.

Colussi, J., N. Paulson, G. Schnitkey and C. Zulauf. "Catastrophic Floods in Southern Brazil: Implications for Agricultural Sector." farmdoc daily (14):109, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 11, 2024.

Colussi, J., N. Paulson, J. Janzen and C. Zulauf. "U.S. Dominance in Corn Exports on the Wane Due to Brazilian Competition." farmdoc daily (14):50, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 12, 2024.

Colussi, J., N. Paulson, G. Schnitkey and C. Zulauf. "Brazil Cuts Its Soybean and Corn Production Projections for 2024." farmdoc daily (13):225, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 12, 2023.

Conab, Companhia Nacional de Abastecimento. Acompanhamento Safra Brasileira de Grãos, Brasília, DF, v.11 – Safra 2023/24, n.10, p. 1-120, July 2024. https://www.conab.gov.br/info-agro/safras

Janzen, J., J. Colussi and S. Irwin. "What Explains the Disparity between USDA and Conab over Brazil’s Soybean Crop Size?" farmdoc daily (14):77, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 23, 2024.

U.S. Department of Agriculture (USDA), Foreign Agricultural Service. Grain: World Markets and Trade. U.S. China Imports of Major Feed Grains at Record for Oct-May period. July 12, 2024. https://apps.fas.usda.gov/psdonline/circulars/grain.pdf

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.