Crop Insurance, Premium Subsidies, and Soybean-Corn Disparity

Relative to total premium, soybeans and corn receive smaller payments from the US crop insurance program than other large acreage US field crops. Concern is growing over this disparity (for example, farmdoc daily, January 17, 2023 and September 4, 2024). The disparity exists even after a major review of ratings implemented in 2011. Moreover, raising premiums subsidies, as has occurred historically several times with more proposed in the new farm bill (farmdoc daily, May 27, 2025 and June 10, 2025 farmdoc daily), will disadvantage soybeans and corn relative to other crops. A new approach is needed, specifically, new products that reduce the total insurance premium (farmer paid plus subsidy), especially for soybeans and corn. Joint soybean-corn insurance is one such product. It is estimated that joint soybean-corn insurance has the potential to increase net indemnities paid to soybeans and corn by 13% with no increase in Federal premium subsidies.

Payment Performance, 1989 – 2024

Crop insurance data are available electronically for the 1989-2024 crops from the US Department of Agriculture, Risk Management Agency (USDA, RMA) Summary of Business. Data were collected for individual farm yield and yield-price revenue products, the only ones offered before the Crop Insurance Act of 2000. Crop insurance payment performance is measured as a ratio: ((indemnities paid to farms minus premiums farms paid) divided by total premium). Total premium, which is farm-paid premium plus Federal premium subsidy, is a monetary measure of the losses due to the risks being insured.

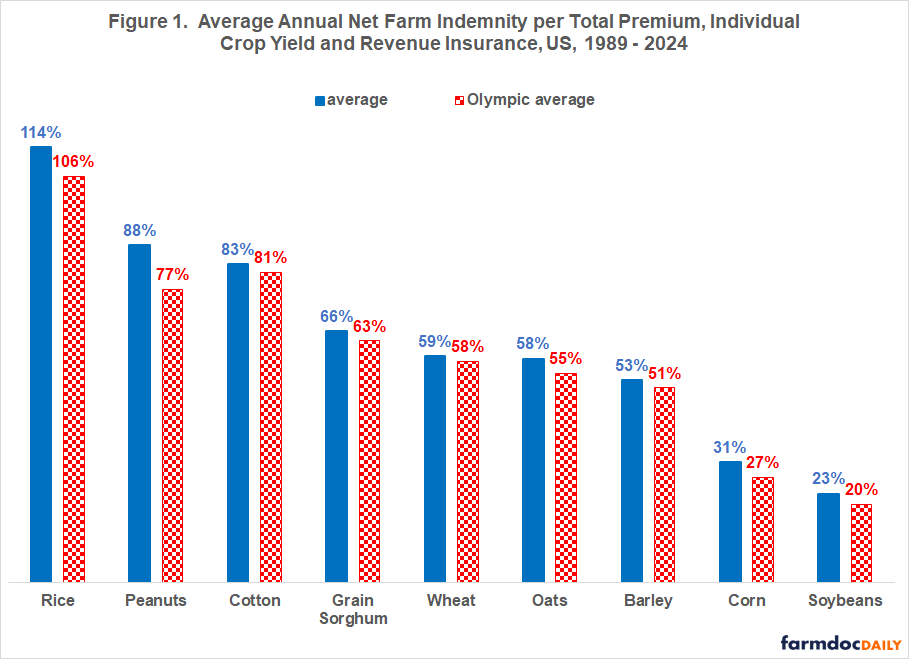

The 1989-2024 crop year ratios of net farm indemnity to total premium for soybean and corn individual farm insurance products averaged 23% and 31%, respectively (see Figure 1). The next lowest ratio is 53% for barley, creating a notable gap of at least 20 percentage points that underscores the difference between soybeans and corn and the other crops in this study. The highest ratio is 114% for rice.

An Olympic average is also calculated. Removing the low and high ratios in part addresses that large weather risk events occur differentially across crops. Soybeans and corn continue to clearly have the lowest ratios. As expected since downside yield impact of poor weather exceeds the upside yield impact of excellent weather, the Olympic average is less than the common average for all crops. Illustrating the potential impact of individual years, the two averages for peanuts and rice differ by 11 and 8 percentage points, respectively.

Payment Performance, 2011 – 2024

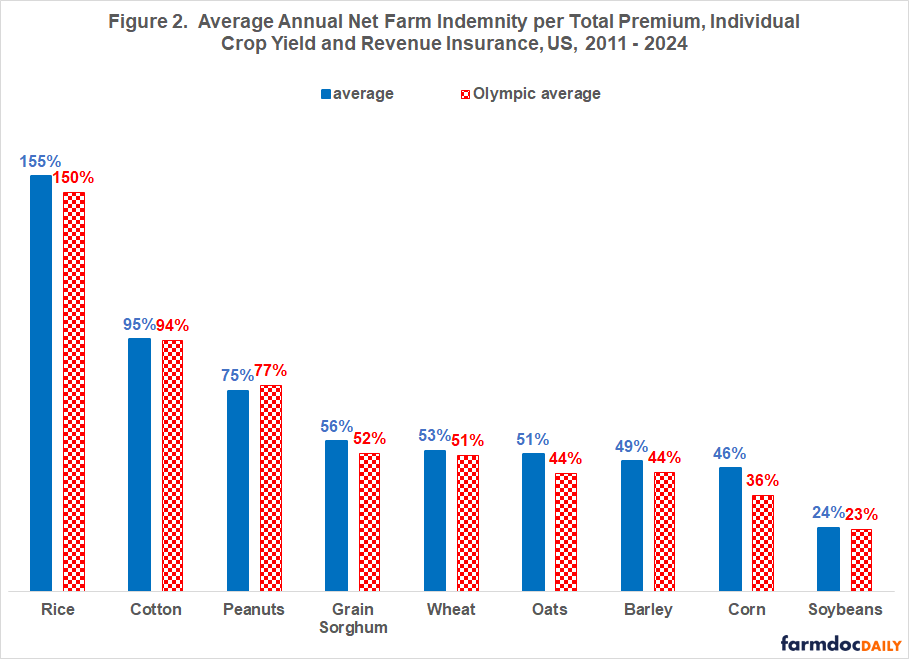

RMA implemented a major rating review and consolidation of individual farm insurance products starting with the 2011 crop year. Thus, as another sensitivity test, crop year average payment ratios were calculated for the 2011-2024 crops. Again, the ratios are lowest for soybeans and corn (see Figure 2). The soybean payment ratio differs little between the two periods; however, the corn ratio is notably higher over 2011-2024, particularly when 2012 is included. Excluding 2012 reduces the corn ratio by 10 percentage points (46% to 36%). Payment ratios for barley, grain sorghum, oats, peanuts, and wheat are notably lower over 2011-2024. In contrast, payment ratios for rice and cotton are notably higher over 2011-2024. The spread between low and high ratio across the nine crops is larger post 2010.

Policy Discussion

Federal premium subsidies for purchasing crop insurance have been raised numerous times over the last 50 years, both through legislation, such as the Crop Insurance Act of 2000 (O’Donoghue, July 2014, page 9) and through administrative action, such as recently for the Enhanced Coverage Option (ECO) (farmdoc daily February 11, 2025).

This study finds mixed evidence that the soybean-corn disparity within crop insurance has disappeared as premium subsidies have been raised. Given the persistence of this disparity, it is not surprising that concern is growing over the disparity.

The current farm bill debate remains focused on raising premium subsidies, specifically for basic and optional insurance land units and SCO (Supplemental Coverage Option) (farmdoc daily May 14, 2025). The May 27, 2025 farmdoc daily found that higher subsidies for basic and optional units are unlikely to reduce the soybean-corn disparity since they are used less often for soybeans and corn than other crops. The June 10, 2025 farmdoc daily reach the same conclusion with regard to higher premium subsidies for SCO.

A different approach is needed. One option is to introduce products that reduce total premiums for soybeans and corn while maintaining current premium subsidy dollars. Percent premium subsidy for the new product increases without increasing Federal spending on premium subsidies.

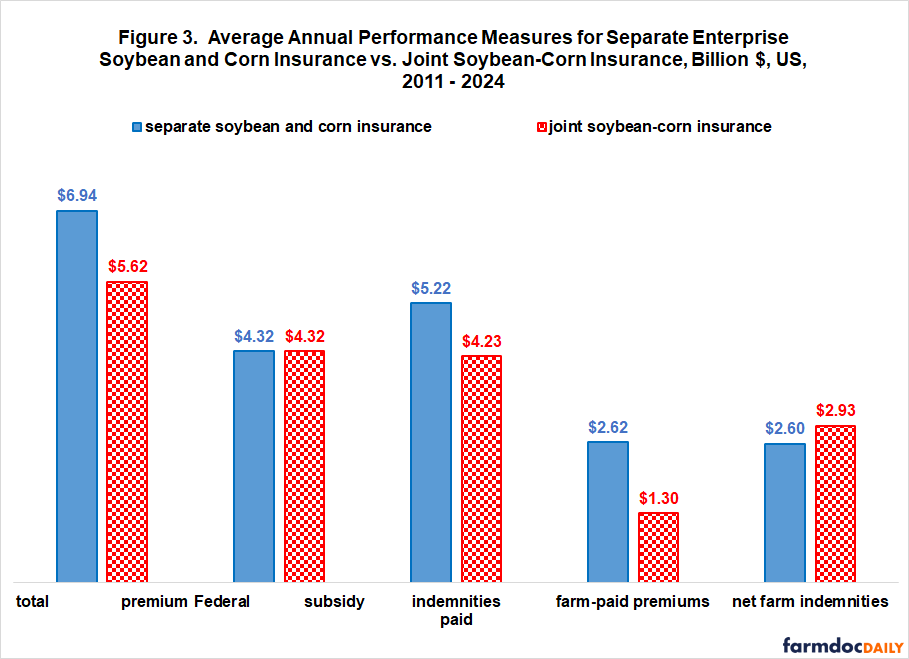

Joint soybean-corn insurance is such a product. The November 27, 2024 farmdoc daily found it would reduce soybean-corn indemnities and, assuming actuarial fairness, total premiums by 19% relative to separate soybean and corn insurance.

Assuming a 19% reduction in indemnities and total premiums, the same premium subsidy dollars, and all enterprise unit corn and soybean acres in joint insurance; net farm indemnities would have been 13% higher for joint vs. separate soybean and corn insurance since 2011, the first year current combo polices were offered (see Figure 3). A higher percent subsidy can be justified for joint insurance because farms bear a larger share of risk since high output of one crop can offset low output of the other crop.

The ratio of net farm indemnities to total premium for joint soybean-corn insurance would have been 52%, which eliminates the soybean-corn disparity with barley, oats, grain sorghum, and wheat (see Figure 2).

References

Coppess, J., C. Zulauf, G. Schnitkey, N. Paulson and B. Sherrick. "Reviewing the House Agriculture Committee’s Reconciliation Bill." farmdoc daily (15):89, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 14, 2025.

O’Donoghue, E. J. July 2014. The Effects of Premium Subsidies on Demand for Crop Insurance, ERR-169, U.S. Department of Agriculture, Economic Research Service.

Schnitkey, G., C. Zulauf, N. Paulson and J. Baltz. "Crop Insurance for Soybeans: The Low Loss Ratio Concern." farmdoc daily (13):8, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 17, 2023.

Schnitkey, G., N. Paulson and C. Zulauf. "Enhanced Coverage Option for 2025." farmdoc daily (15):26, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 11, 2025.

Schnitkey, G., B. Sherrick, C. Zulauf, N. Paulson and J. Coppess. "The House Reconciliation Bill Proposal for SCO: Income Support for High-Risk Farmland." farmdoc daily (15):106, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 10, 2025.

Schnitkey, G., C. Zulauf, N. Paulson and J. Coppess. "Impacts of Premium Support Increase of Basic and Optional Units in House Reconciliation Bill." farmdoc daily (15):96, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 27, 2025.

US Department of Agriculture, Risk Management Agency. April 2025. Summary of Business. https://www.rma.usda.gov/en/Information-Tools/Summary-of-Business

Zulauf, C. and G. Schnitkey. "MultiCrop Insurance." farmdoc daily (14):216, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 27, 2024.

Zulauf, C. and G. Schnitkey. "Crop Insurance as a Payment Program." farmdoc daily (14):160, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 4, 2024.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.