Winter Oilseeds as a Response to Biofuels Feedstock Demand

Note: This article was written by University of Illinois Agricultural and Consumer Economics M.S. student Jacob Lionberger and edited by Joe Janzen. It is one of several excellent articles written by graduate students in Prof. Janzen’s ACE 527 class in advanced agricultural price analysis this fall.

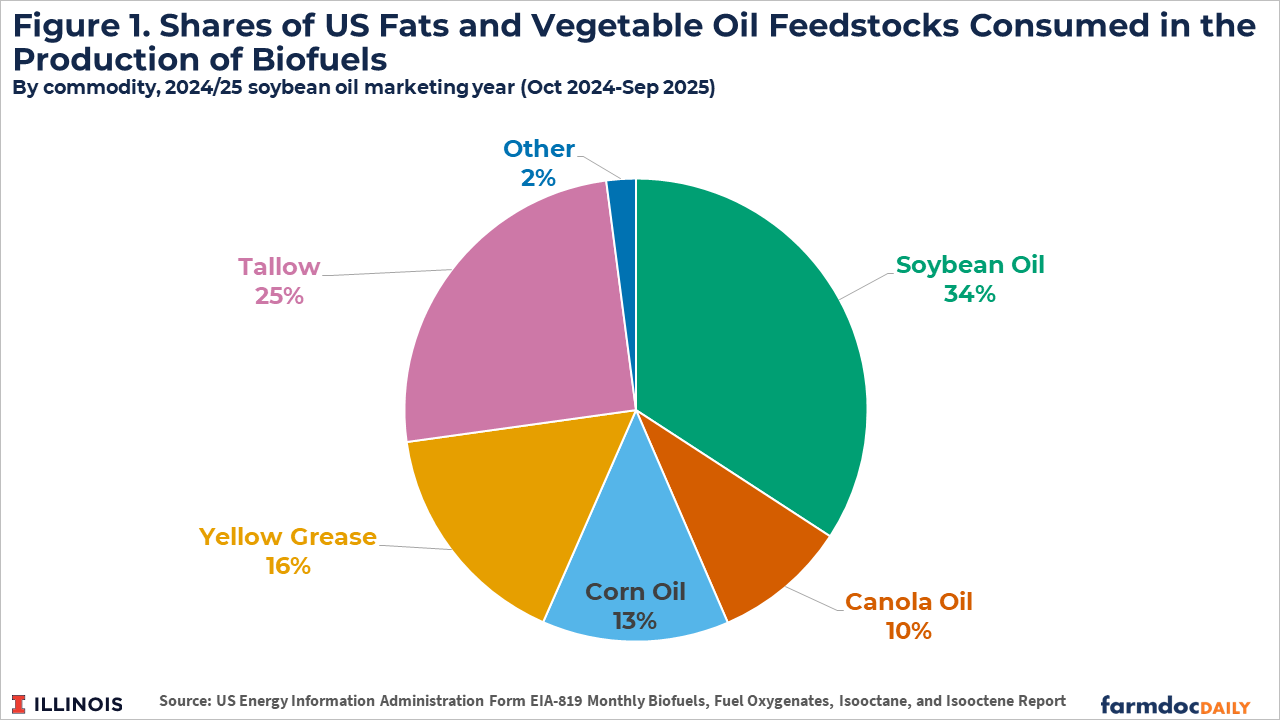

U.S. biodiesel and renewable diesel output has increased significantly in recent years and the outlook for future policy and production is strong (Hubbs and Irwin, 2025). Growth in biomass-based diesel (BBD) fuel output has increased demand for feedstocks including vegetable oils, such as soybean oil, corn oil, canola oil, and waste oils and animal fats, such as yellow grease and tallow. Figure 1 shows the share of different feedstocks in US biofuels production between October 2024 and September 2025, that is the 2024/25 vegetable oil marketing year. The US uses a variety of oils and fats to meet demand for BBD, but soybean oil is the leading feedstock. Yellow grease in the form of used cooking oil may decline as changing US policy may limit incentives to use foreign feedstocks.

Expanded BBD production and reduced use of foreign feedstocks suggest a need to grow more vegetable oil in the US. There are multiple ways to grow the additional feedstock necessary to meet rising demand. Some involve producing more soybean oil. Soybean oil production can increase by processing more soybeans and squeezing more oil out of each bushel. (Janzen, Irwin, and Wang, 2025) However, cropland in the many parts of the country is largely fixed and already highly optimized for food and feed production. If soybean acreage growth is limited, non-soybean alternatives may be necessary to increase vegetable oil output.

This article examines the potential for winter oilseed production to meet biofuels feedstock demand. Winter oilseeds can expand vegetable oil production in places like Illinois and elsewhere in the central Corn Belt without substantial impacts on corn and soybean production as winter oilseeds may be grown on acres that typically sit idle between fall harvest and spring planting. One example is CoverCress, a novel oilseed developed from domesticated field pennycress in a joint venture between Bayer (the seed and chemical maker), Bunge (a major oilseed trader and processor), and Chevron (an integrated energy company). Another is winter canola. While canola is a significant crop in other parts of the US, winter canola production is just emerging in the central Corn Belt, supported by a joint venture between Bunge, Chevron, and Pioneer (a major seed company) that has targeted farmers in Illinois, Kentucky, and Missouri. Both CoverCress and winter canola are planted in the fall and harvested in spring before a second crop, typically soybeans or wheat, is planted.

Winter oilseeds like CoverCress and winter canola are attractive sources of BBD feedstock in part because they have higher oil content than soybeans which is typically 18-20%. With biofuels feedstock demand the primary driver, generating relatively more oil (and less meal as a co-product) makes these crops more attractive to processors. CoverCress indicates seed yields around 1,500 pounds per acre; at 33% oil content, this produces 500 pounds of oil per acre. For winter canola, promotional materials suggest producers in the region can expect yields of 55 bushels per acre in Illinois. Canola typically has roughly 40% oil content, so an acre of winter canola could be expected to produce about 1,100 pounds of oil. Because of both their relatively high oil content and the timing of their production, winter oilseeds may increase total vegetable oil output rather than shifting output among crops, even if subsequent soybean crops suffer a yield penalty.

Winter Oilseed Acreage in the Central Corn Belt

Currently, winter oilseed acreage in central Corn Belt states like Illinois, Indiana, Kentucky, and Missouri is limited. In 2025, CoverCress had approximately 6,000 commercial acres, according to company sources. Winter canola acreage was larger, but still small compared to major row crops. USDA Risk Management Agency data show 27,727 acres of canola insured in Illinois, Indiana, Kentucky, and Missouri, of which 91% were in Kentucky and almost 9% were in Illinois. For comparison, the USDA National Agricultural Statistics Service estimates the US planted 81.1 million acres of soybeans in 2025, with more than 10.3 million acres of soybeans in Illinois alone. In addition, the US is estimated to have planted almost 2.4 million canola acres this year.

While winter oilseeds remain a small part of the crop acreage mix in the central Corn Belt, proponents aim for expansion in response to a continued BBD boom. For example, CoverCress aims to expand to 300,000 acres by 2030, with a long-term acreage goal of up to 3 million acres as processing capacity, market access, and farmer adoption increase. At the oil output numbers above, the short-run acreage target is expected to produce 150-318 million pounds of oil per year, depending on the mix of Covercress and winter canola. The long-run acreage target would produce 1.5 billion to 3.2 billion pounds per year. While these targets remain small relative to US soybean oil use for biofuels, which was 11.8 billion pounds in the 2024/25 marketing year according to Energy Information Administration data, winter oilseeds can still contribute meaningful oil volumes to serve biofuels feedstock demand.

Profitability of Winter Oilseed Production

Farm profitability plays a central role in adoption of winter oilseeds. Production economics for these crops differ from traditional cash crops due to their timing, management requirements, and market structure. Net returns may vary widely across farms and regions, reflecting differences in management practices, farm cost structures, soils, field conditions during early spring, and proximity to buyers. There are hard to measure benefits from growing a winter oilseed crop related to added agronomic values of reducing erosion and enhancing nutrient retention through continuous ground cover. The potential to realize soil health and weed suppression benefits while also generating revenue is part of the appeal of winter oilseeds, but these benefits may be difficult to quantify.

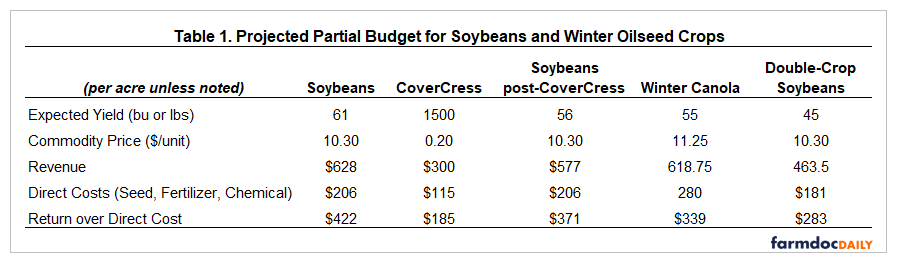

Table 1 presents a partial budgeting projection to evaluate the profitability of winter oilseeds based on figures provided by the companies involved (Bunge, 2025 and CoverCress, 2025) and 2026 University of Illinois crop budgets (Paulson, et al, 2025). Numbers are generally based on existing corn-soybean production systems in Southern Illinois. These sources suggest adding winter oilseeds is expected to decrease soybean yields to varying degrees. Winter oilseeds add costs, but these costs are generally offset by higher revenue.

Broadly Table 1 shows that winter oilseeds can substantially increase per acre revenues and returns over direct costs. However, adoption of winter oilseeds may be slowed by several practical challenges that are hard to incorporate into the budgeting exercise above. Timely fall planting and early spring harvest are essential, which can be difficult in years with delayed corn or soybean harvests or wet spring conditions. These demands introduce additional time constraints for farms that already manage narrow fieldwork windows or challenging soil conditions. Financial considerations also matter contract prices and delivery terms vary, crop insurance options remain limited, and margins can be thin depending on yield performance and hauling distance. Management factors play a role as well, including a learning curve for growers new to the crop and logistical requirements that can significantly influence net returns. These operational, financial, and management factors must be considered to determine whether winter oilseeds would be an appropriate fit in a grower’s operation.

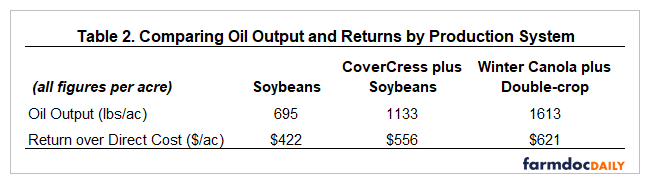

Winter oilseeds grown in corn-soybean rotations promise to increase and diversify cropping revenues, even if they decrease soybean production. Table 2 shows that per-acre returns over direct costs are higher for systems that incorporate winter oilseeds. Perhaps the leading advantage of winter oilseeds is that they substantially increase per-acre oil output, which is important in meeting future biofuels feedstock demand.

Supply Chain Concerns

Processing capacity remains one of the most important factors shaping the development of winter oilseed markets. Because they are still relatively new, especially novel crops like CoverCress, there are currently a limited number of crush plants capable of processing. As production expands into new regions, transportation and delivery systems will need to scale alongside acreage. Continued coordination between buyers and farmers will be essential for supporting successful long-term growth of winter oilseeds. Although oil represents the primary value stream for renewable fuel production, the co-product soybean meal also plays a significant role in overall profitability. Broader utilization of the meal would strengthen crush economics by adding an additional revenue source.

Winter oilseeds can grow oil production to compliment soybeans in the U.S. commodity system. Soybeans will continue to dominate oilseed acreage due to its well-developed markets and established processing infrastructure. Winter oilseeds instead allow producers to increase total annual oil output without requiring new cropland or substantially displacing existing crops used for food or feed. Production of CoverCress, winter canola, and other winter oilseeds in the central Corn Belt can broaden the feedstock base, reduce reliance on a single commodity, and ease pressure on soybean oil markets as BBD production expands. The long-run outlook appears positive, but tempered; winter oilseeds are a supplement, not a replacement for existing vegetable oil production.

Conclusion

The expansion of BBD production in the US continues to create demand for vegetable oils. Because traditional oilseed acreage is unlikely to expand significantly, the United States faces feedstock constraints that could limit biofuel growth or raise costs. Winter oilseeds such as CoverCress and winter canola grown in the central Corn Belt provide an option for increasing oil output on existing cropland, supplementing rather than replacing the nation’s primary oilseed crops.

Winter oilseeds may help to solve the biofuels feedstock demand puzzle, but face agronomic, economic, and logistical barriers. Farmer adoption depends on both profitability and operational fit, while processors require sufficient volume and co-product value to justify infrastructure investment. Based on their existing scale in the region– there are thousands of winter oilseed acres but millions of soybean acres – winter oilseeds should be viewed as supplement not a replacement for existing feedstocks. Winter oilseeds can add supply flexibility to the vegetable oil market at a time when the ability to adjust supply is growing more valuable. As renewable fuel targets and incentives increase, even modest supplemental supplies may help improve market stability, support renewable fuels use goals, and create new opportunities for farmers.

References

Bunge. Winter Canola Profitability Calculator. Retrieved December 17, 2025, from https://www.bungeag.com/winter-canola-profitability-calculator/

CoverCress Inc. “CoverCress | Profitability meets sustainability — Made simple with one smart crop.” Retrieved October 21, 2025, from https://www.covercress.com/

Hubbs, T. and S. Irwin. "Rewriting the RFS Playbook: Revised RVOs Backload Projected Biomass-Based Diesel Production and Feedstock Use into 2027." farmdoc daily (15):217, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 24, 2025.

Janzen, J., S. Irwin and Y. Wang. "The Soybean Industry Response to the Renewable Diesel Boom, Part 2: Squeezing More Oil from the Soybean Crush." farmdoc daily (15):165, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 10, 2025.

Paulson, N., G. Schnitkey, B. Zwilling and C. Zulauf. "2026 Illinois Crop Budgets." farmdoc daily (15):150, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 19, 2025.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.