Revised Illinois Crop Budgets for 2026

Revision to Illinois crop budgets show improved return prospects due to slight increases in projected prices based on recent market information and significant federal support from the Farmer Bridge Assistance and ARC/PLC programs. Due to the bridge program payments, return projections for 2025 are now slightly above break-even levels in northern and central Illinois but remain negative in southern Illinois. Updated 2026 crop budgets, which include expectations for significant ARC/PLC payments, suggest another year of negative average returns to corn-soybean rotations. The 2026 projections are similar to 2025 projections before the inclusion of the bridge payments.

Summary of Budget Revisions

Projected budgets for the 2025 and 2026 crop years have been updated from the August 2025 release to reflect more current market conditions (see farmdoc daily from August 19, 2025 for a summary of the August budgets) . The 2026 Crop Budgets and Historic Revenue and Costs publications have been updated in the Management section of the farmdoc website. Budgets are provided for 2026 corn, soybean, and wheat production in northern, central, and southern Illinois. For the revenues and costs publication, historic averages are provided for each region based on grain farms enrolled in Illinois FBFM for 2019-2024, while farmdoc projections are provided for 2025 and 2026. While small changes were made across various revenue and cost categories, the most impactful updates include:

- Updated price projections for both 2025 and 2026. Prices for 2025 reflect current market information including USDA’s January WASDE report, while 2026 budget prices reflect recent futures market activity and fall delivery cash grain bids. Compared with the August budget release, projections for 2026 corn and soybean prices are both increased by $0.10 per bushel to $4.25 and $10.40, respectively. Price projections for the 2025 crop were increased to $4.10 for corn and $10.20 for soybeans, up from $3.95 and $10.15 in the August budget release.

- Projected yields for 2025 remain above trend in northern and central Illinois while corn and soybean yields in southern Illinois are projected below trend. Trend yields are used for all regions for the 2026 crop year.

- Projections for commodity program (ARC/PLC) payments for both the 2025 and 2026 crop years are updated to reflect current price and yield expectations.

- Payments from the Farmer Bridge Assistance (FBA) program are added to 2025 budget projections (see farmdoc daily article from January 6, 2026 for more details). These payments increase 2025 return projections by $44 per acre for corn, $31 per acre for soybeans, and $39 per acre for wheat.

2025 Return Projections

Slightly higher prices combined with FBA payments and ARC/PLC payment projections result in improved return projections for 2025 relative to August projections.

For corn, per acre returns improved by $70 per acre or more across each region of Illinois. Return projections on cash rented farmland for corn in northern Illinois are now marginally positive at $12 per acre. Return projections remain negative for central (-$8 for high productivity, -$24 for low productivity) and southern Illinois (-$48 per acre).

For soybeans, per acre return projections improved by $40 per acre or more across each region of Illinois. Return projections on cash rented farmland for soybeans in Illinois are now above break-even, ranging from $17 per acre in southern Illinois to $61 per acre on high-productivity farmland in central Illinois.

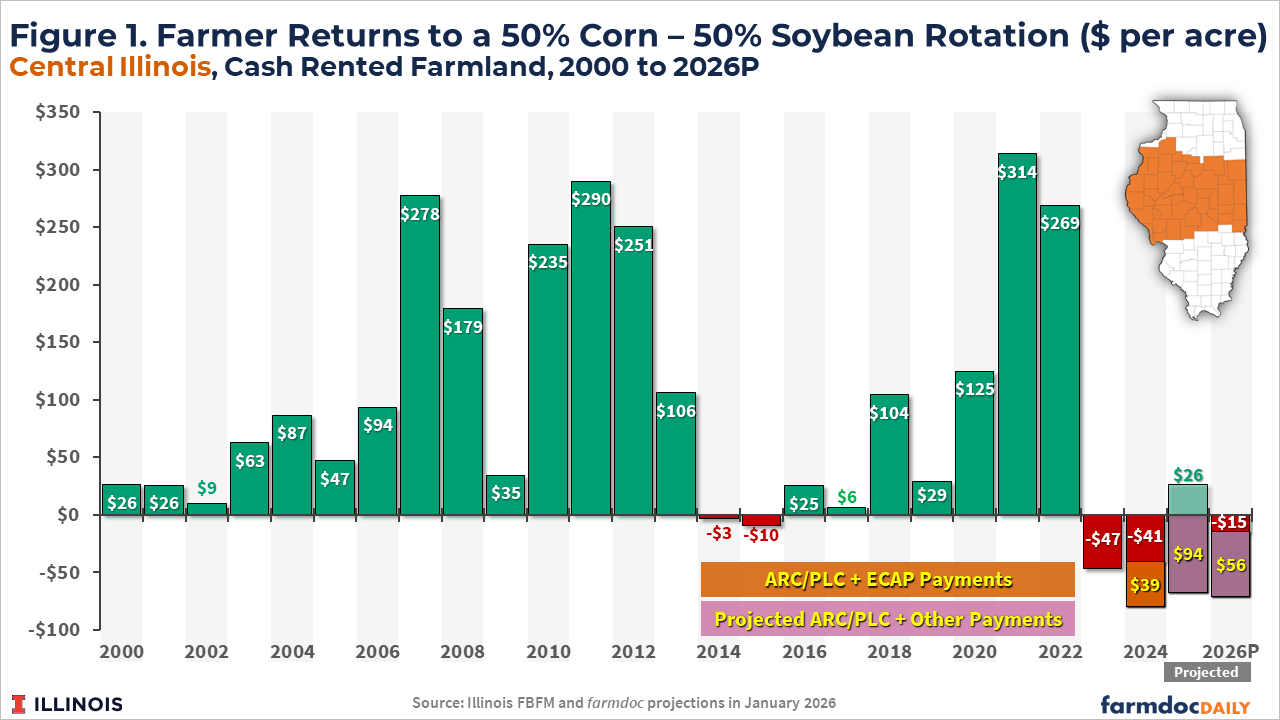

While return projections have improved since late summer, they remain below longer-term averages. Moreover, 2025 return projections would be negative without the federal support provided through the FBA and current expectations for ARC/PLC payments that won’t arrive, if they are triggered, until October. Figure 1 illustrates this for high-productivity farmland in central Illinois where FBA plus ARC/PLC support for 2025 is expected to total $94 per acre, on average, for a 50-50 corn-soy rotation. This results in a return projection of $26 per acre but would otherwise be -$68 per acre without the FBA and expected ARC/PLC payments.

2026 Crop Budgets

Return projections for 2026 have improved marginally compared with our August 2025 budgets. Table 1 provides updated corn and soybean budgets for all four Illinois regions.

Average return projections remain negative across all regions on cash rented corn acres. Soybean return projections on cash rented farmland for 2026 are marginally positive for northern and central Illinois regions but remain marginally negative for southern Illinois. Corn minus soybean returns range from -$55 per acre for northern Illinois to around -$80 per acre for central and southern Illinois, suggesting a potential shift towards more soybean acres for 2026.

Overall, current projections for the 2026 crop year are similar to those for 2025 without FBA program support (see figure 1 for central Illinois, high-productivity farmland). While prices are expected to be marginally higher in 2026 than in 2025, they are offset by small increases in overall costs with yields at trend levels. Break-even prices to cover all costs (non-land plus land) without government support are in the $4.70-$4.90 range for corn and $10.80-$11.25 range for soybeans, well above current market prices and pricing opportunities for the 2026 crop.

Summary

Small increases in projected prices and significant federal support payments for 2025 result in higher return projections for corn and soybean acres in Illinois. The FBA payments, in addition to the significant ARC/PLC support expected for 2025, may result in returns close to or slightly above break-even levels for corn-soybean rotations in northern and central Illinois.

Production costs in 2026 are projected to increase slightly from 2025 levels and, despite the potential for significant ARC/PLC support for 2026, average return projections for the 2026 crop year are negative for corn across all regions. The expected ARC/PLC payments imply projected returns on soybean acres are just above break-even in northern and central Illinois, and negative in southern Illinois. This suggests negative average returns for corn-soybean rotations in 2026 and the potential for continued calls for additional ad hoc assistance.

Acknowledgment

The authors would like to acknowledge that data used in this study comes from the Illinois Farm Business Farm Management (FBFM) Association. Without Illinois FBFM, information as comprehensive and accurate as this would not be available for educational purposes. FBFM, which consists of 5,000+ farmers and 70 professional field staff, is a not-for-profit organization available to all farm operators in Illinois. FBFM field staff provide on-farm counsel along with recordkeeping, farm financial management, business entity planning and income tax management. For more information, please contact our office located on the campus of the University of Illinois in the Department of Agricultural and Consumer Economics at 217-333-8346 or visit the FBFM website at www.fbfm.org.

References

Paulson, N., G. Schnitkey, J. Coppess and C. Zulauf. "Farmer Bridge Assistance Program Payment Rates." farmdoc daily (16):3, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 6, 2026.

Paulson, N., G. Schnitkey, B. Zwilling and C. Zulauf. "2026 Illinois Crop Budgets." farmdoc daily (15):150, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 19, 2025.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.