Farmland Returns in 2015

(A YouTube video related to this farmdoc daily article is available here.)

Farmland returns in 2015 are projected for central Illinois farms having high-productivity farmland. Projected operator and land returns are lower in 2015 than in any year from 2010 to 2014. Cash rents at average levels result in projected 2015 losses to farmers. Overall, 2015 average cash rents would have to decrease by $67 per acre before operator and land returns exceed cash rents. Projected share rents are lower in 2015 than in recent years. Projections of gross revenue and non-land costs are used to arrive at the above return levels.

Gross Revenues

Figure 1 shows yearly per acre gross revenues for corn and soybeans grown in central Illinois on high-productivity farmland. Also shown is a line giving a “blend” average with 55% of revenue coming from corn and 45% from soybeans, the average percent of corn and soybeans planted in 2014. Figure 1 contains actual values from Illinois Farm Business Farm Management (FBFM) for 2000 through 2014. Figure 1 also includes a projection for 2015 based on:

- A $3.75 per bushel corn price and a 196 bushels per acre corn yield, giving $735 of crop revenue. Gross revenue also includes $60 of ARC payments and $20 of crop insurance. In 2015, gross revenue is projected at $815 per acre. Note that the $3.75 price is higher than current forward bids for fall delivery, leading to these estimates being relatively optimistic compared to current market prices.

- A $9.50 per bushel soybean price and a 57 bushels per acre soybean yield, giving $542 per acre of crop revenue. ARC payments are projected at $42 per acre and crop insurance at $6 per acre. Gross revenue is projected at $590 per acre. Similar to the corn price, the $9.75 soybean price is higher than current forward bids for fall delivery, leading to these estimates being relatively optimistic compared to current market prices.

Given the above projections, 2015 blend gross revenue is projected at $714 per acre, $26 lower than the $740 revenue in 2014 (see Figure 1). Lower 2015 gross revenues result from lower projected yields. In central Illinois, yields were exceptional in 2014 with average yields of 220 bushels per acre for corn and 62 bushels per acre for soybeans. A 196 bushels per acre corn yield and 57 bushels per acre soybean yield are used in 2015 projections.

Obviously, both 2015 prices and yields are not known at this point, leading to uncertainty concerning possible gross revenues. In an April 28th farmdoc daily article, historical yield and price changes were used to gain an understanding of possible 2015 gross revenues. This historical analysis suggests gross revenues can vary from $679 per acre up to $996 per acre, with gross revenues in low to mid $800 per acre being most likely.

A wide range of prices will result in revenues in the low to mid-$800 range. In this article, a $3.75 corn price results in $815 of gross revenue. In a previous farmdoc daily article (April 21, 2015), a $4.25 price resulted in $863 per acre of gross revenue. The $4.25 price scenario had higher crop revenue than the $3.75 price scenario. But the $4.25 price scenario results in lower ARC and crop insurance payments. Lower ARC and crop insurance payments then partially offset higher crop revenue. Negative correlations between prices and yields also contribute to a strong likely of revenues in the low to mid-$800 range.

Corn gross revenue from 2010 to 2013 averaged $1,052 per acre (farmdoc daily, April 21, 2015). Note that the highest revenue from the historical analysis was $996 per acre (farmdoc daily, April 28, 2015), below the $1,052 average from 2010 to 2013. From a historical perspective, price and yield changes more pronounced than those from 1975 to 2014 would have to occur for gross revenues to exceed $1,000 per acre. This suggests that chances of average revenues above $1,000 are very small.

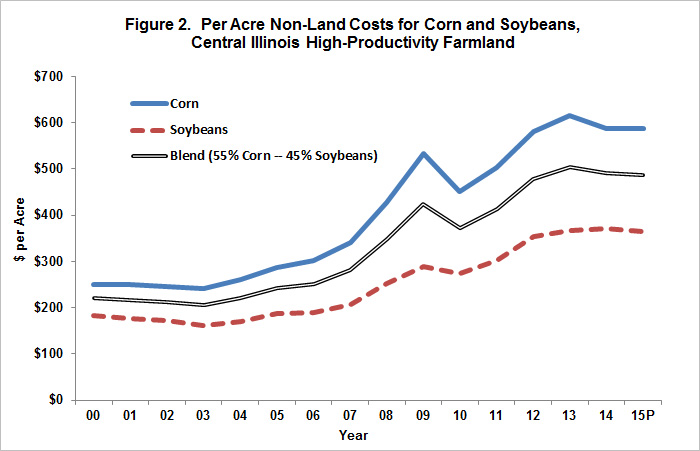

Non-Land Costs

For corn, non-land costs increased from $302 per acre in 2006 to $615 per acre in 2013 (see Figure 2). In 2014, costs decreased slightly due to lower fertilizer costs. While some costs such as fuel costs are projected to decrease in 2015 (farmdoc daily, May 5, 2015), there will not be large non-land cost decreases. Input prices for fertilizer, seed, and chemicals in 2015 are the same or higher as in 2014. Before significant non-land costs occur, costs reductions must occur in one of the “big 4” cost items: fertilizer, seed, chemicals, and machinery depreciation (farmdoc daily, September 16, 2014). Therefore, non-decreasing fertilizer, seed, and chemical costs signal that non-land costs in 2015 will be near the same levels as in 2014. Unusual pest pressures or grain harvest moistures could alter costs somewhat.

Operator and Land Returns

Operator and land return equal gross revenue minus non-land cost, representing the return that can be split between the landowner and farmer. If operator and land return is $300 per acre and cash rent is $250, the farmer will have a $50 return ($300 operator and land return – $250 cash rent).

Operator and land return in 2015 for the blend acre is projected at $226 per acre, $16 per acre lower than the 2014 return of $249 per acre (see Figure 3). The 2015 return is $257 per acre lower than the average 2010-13 operator and land return of $483 per acre. Obviously, lower returns mean there is less to split between farmers and landowners in 2014 and 2015 as compared to 2010 through 2013.

Cash Rents, Share Rents, and Farmer Returns

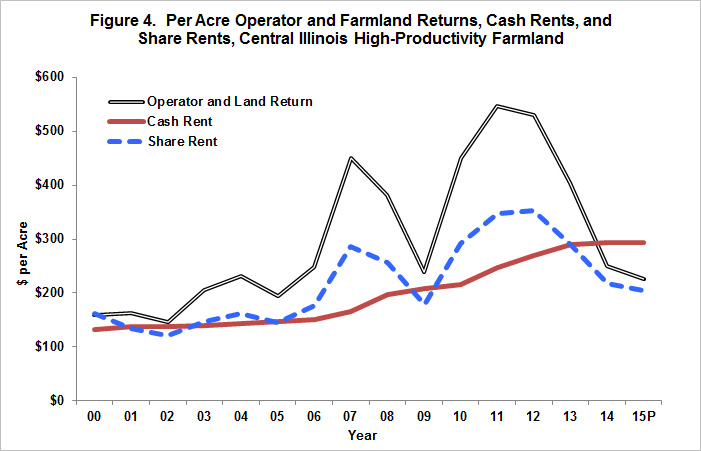

Figure 4 shows average cash rents for high-productivity central Illinois farmland. There is a considerable range in cash rents around these averages. Some cash rents can be over $100 higher than these averages (farmdoc daily, September 10, 2013). Rents above averages also imply cash rents below the average.

From 2006 through 2014, average cash rents increased from $150 per acre up to $293 per acre. Even given these increases, operator and land returns were above cash rents prior to 2014 (see Figure 4). In 2014, operator and land return was below average cash rent, meaning that farmers faced losses at average cash rent level. In 2015, the operator and land return is projected at $226 per acre. If the 2014 average cash rent of $294 per acre remains the same in 2015, farmers will face losses of $67 per acre in 2015.

Also shown in Figure 4 is an inputted share rent based on a 50-50 share of gross revenue and direct costs, plus a $25 per acre supplemental rent paid by the farmer to the landowner. Share rents were higher than average cash rents from 2010 through 2013, but below average cash rents in 2014 and 2015. In 2015, returns to a share rent landowners are projected at $205 per acre, leaving the farmer a $21 per acre return.

Share rent arrangements automatically adjust to changes in prices, yields, and direct costs. As a result, the lower commodity prices in 2014 and 2015 led immediately to lower share rents. Interestingly, share rents arrangement’s landowner return averaged higher than cash rent returns from 2010 through 2014. The average share rent from 2010 to 2014 was $266 per acre, $40 lower than the average cash rent of $226 per acre.

Average cash rents lagged increases in share rents between 2010 and 2013, providing support for a lagged relationship between returns and average cash rents. Of course, not all cash rents lagged returns. For example, rents set by professional farm managers have been higher than average cash rents (see farmdoc daily, September 10, 2013 for more detail). Now that share rent returns have turned down, average cash rents likely will decrease in future years, particularly if commodity prices do not rebound or non-land costs do not decrease.

Summary

Farmland returns are projected to be lower in 2015 than in recent years. If projections hold, farmers will face losses under many cash rental situations. Share rents will continue to decline in 2015 from 2014 levels.

If prices do not rebound significantly, there will be pressures to reduce cash flows for the 2016 year. Farmers will need to reduce one or more of the following costs: fertilizer, seed, chemical, and cash rents. If these costs do not decrease and commodity prices remain at their current levels, expectation will be that farmers will face losses in 2016 on cash rent farmland.

References

Schnitkey, G. "Diesel Fuel Prices and Fuel Costs on Illinois Farms." farmdoc daily (5):82, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 5, 2015.

Schnitkey, G. "2015 Gross Revenues for Corn: Likely Characteristics of Low, Middle and High Revenue Years." farmdoc daily (5):77, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 28, 2015.

Schnitkey, G. "Projected 2015 Corn Revenue with Comparisons to Revenues from 2010 to 2014." farmdoc daily (5):73, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 21, 2015.

Schnitkey, G. "Will Non-Land Costs Decrease in 2015?" farmdoc daily (4):178, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 16, 2014.

Schnitkey, G. "2013 County Cash Rents: Levels, Variability, and 2014 Cash Rent Decisions." farmdoc daily (4):172, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 10, 2013.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.