Generic Base’s Impact on Planted U.S. Acres: A Multi-Commodity Perspective

This article continues discussion of cotton support, a key contemporary farm policy issue (see farmdoc daily, January 28, 2016; March 9, 2017; April 13, 2017; April 20, 2017; April 27, 2017; May 11, 2017). Cotton is not a covered commodity under the ARC (Agriculture Risk Coverage) and PLC (Price Loss Coverage) commodity programs enacted in the 2014 farm bill. This decision was largely in response to a successful World Trade Organization suit by Brazil against U.S. cotton support programs. The 2014 farm bill also converted former cotton base acres into generic base acres. Generic base can receive payments for covered commodities planted on generic base. ARC-CO plus PLC payments to generic base for the 2014-2016 crop years are estimated at just over $1 billion (farmdoc daily, May 11, 2017). Concern exists that generic base payments are affecting farmers’ planting decisions. The concern was discussed in the April 20 article, which focused on peanuts. The discussion is extended to other covered commodities in this article. In particular, a regression analysis finds that the generic base program is likely associated with higher planted acres of other covered commodities as well. The higher plantings of covered commodities are likely increasing the cost of commodity programs, creating winners and losers within the agribusiness community, and causing frictions within the cotton sector.

Covered Commodities Planted on Generic Base

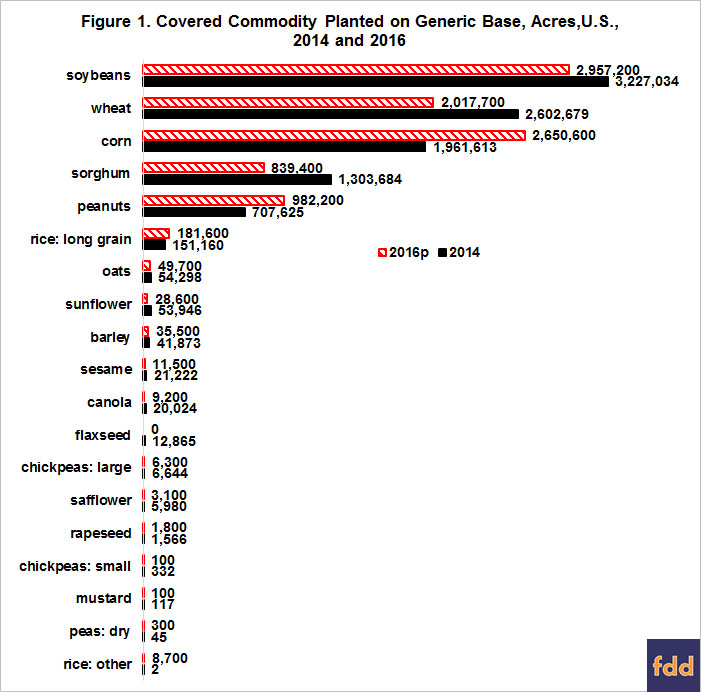

As the April 20, 2017 article noted, the U.S. Department of Agriculture (USDA), Farm Service Agency reports 10.2 and 9.8 million acres of generic base were planted to covered commodities in 2014 and 2016 (see data note 1). The aggregate 0.4 million acre decline masks notable changes for individual covered commodities. Wheat, sorghum, and soybean acres decreased 0.6, 0.5, and 0.3 million while corn and peanut acres increased 0.7 and 0.3 million (see Figure 1). In aggregate, 12 crops had a combined decline of 1.4 million acres while 4 crops had a combined increase of 1.0 million acres.

Net Cash Return to Selected Covered Commodities

Economic theory suggests net return to production is likely to be a factor in acres planted to individual crops, including acres planted on generic base. Cost of production data compiled by the USDA, Economic Research Service reveals that U.S. net cash return is highest for rice, corn, and soybeans, followed by cotton (see Figure 2 and data note 2). The crops listed in Figure 2 are the only ones for which cost of production is compiled. They however account for 99% of the covered commodities planted on generic base.

Impact of Generic Base Payments on Net Cash Return

Figure 2 also presents net cash return after adding in payments from ARC-CO and PLC per generic acre planted to the covered commodity during the 2014 and 2015 crop years (see data note 3). These commodity program payments range from $0.50 for barley to $156.21 per generic base acre for peanuts. Adding them to net cash return alters the rank order of net cash return by crop only for peanuts. Including ARC-CO/PLC payments moves net cash return to peanut production from 7th to 3rd highest among the crops in Figure 2. This finding underscores why so much attention is focused on the relationship between the generic base program and peanut production. However, any program payment to any covered commodity tied to planting on generic base can potentially affect production on generic base by increasing net return to producing the covered commodity on generic base.

Analysis of Generic Base Payments

A regression analysis is used to explain the percent change in acres of a covered commodity planted on generic base during the 2016 vs. 2014 crop years. These percent changes are calculated using the data presented in Figure 1, and are reported in Table 1. One explanatory variable is the net cash return to producing the covered commodity. A second explanatory variable is the ratio of ARC-CO/PLC payments per generic base acre planted to the covered commodity in the 2014 and 2015 crop years relative to the aforementioned net cash return. The data for the explanatory variables are reflected in Figure 2, and also presented in Table 1. The first explanatory variable measures the market return to producing the covered commodity; the second measures the increase in net cash returns resulting from generic base payments to the crop. Before interpreting the results, it should be underscored that this analysis involves only 8 observations and thus has limited statistical power. So, its results should be used with caution and only as an indicator of likely impacts.

Consistent with economic theory, both explanatory variables are significant (see Table 2). Statistical confidence in this finding is 98% for both variables. Both variables have a positive coefficient, which means that more generic base acres are planted to the crop in response to increases in net cash returns from the market for the crop and increases in commodity program payments for the crop (see data notes 4 and 5). The two variables explain 77.8% of the observed variation in the percent change in acres of a covered commodity planted on generic base.

Summary Observations

- This article finds support for the concern that the generic base program is affecting farmers’ planting decisions.

- Most discussions of this concern have focused on peanuts. This article finds support for this focus, but also finds that the generic base program is likely affecting plantings of other crops.

- Increased planting of a covered crop increases supply, which lowers price, which increases program cost. This increase in program cost is in addition to the estimated $1 billion in payments to covered commodities planted on generic base in 2014-2016.

- The generic base program is likely creating winners and losers within the South’s agribusiness community. Payments to covered commodities planted on generic base are likely encouraging farmers to plant crops other than cotton, hurting both suppliers of cotton inputs and processors of cotton. In contrast, agribusiness suppliers and output processors serving other crops benefit from more acres planted to these crops.

- The generic base program is also creating a disconnect between the economic well-being of potential growers of cotton, many of whom are at least partially protected by generic base payments, and the cotton agribusiness community, which is being hurt by the same payments.

Data Notes

- Data for the 2016 crop year are preliminary.

- Net cash return is examined because the focus is acreage change over a short period of time, the 2014 to 2016 crop years. Net return above all costs would become the focus if the period of time was long enough for producers to more likely make specialized investments needed to enter or notably expand production of a crop. Net cash return equals gross value of production minus operating costs plus the costs of hired labor, taxes and insurance, and general farm overhead. All values are from the USDA cost of production data. Because gross value of production is largely unknown at the time planting decisions are made, the average value for the 2015 and 2016 crop years are used as am estimate of expected value for 2016.

- Per acre commodity payment data for the 2014 and 2015 crop years are used as an estimate of payments for the 2016 crop year. Payments are largely unknown at the time of planting decisions since they depend in part on the U.S. price for the crop year.

- Several alternative specification of the two explanatory variables were examined. Commodity program payments were significant with 95% statistical confidence in each specification.

- Use of regional as opposed to U.S. average data was examined. A number of issues existed, including that the regions for which cost of production data are reported do not align with state lines. To align cost of production and generic base program payment data at a regional level would take considerably more time than was available for this article. A regional analysis would be a useful extension of this national analysis.

References

Coppess, J., G. Schnitkey, C. Zulauf, and N. Paulson. "The Cottonseed Conundrum." farmdoc daily (7):77, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign. April 27, 2017.

Coppess, J., C. Zulauf, G. Schnitkey, and N. Paulson. "Beneath the Label: A Look at Generic Base Acres." farmdoc daily (7):68, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign. April 13, 2017.

Paulson, N., G. Schnitkey, J. Coppess, and C. Zulauf. "Have Generic Acres Impacted Planting Decisions?" farmdoc daily (7):73, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign. April 20, 2017.

U.S. Department of Agriculture, Farm Service Agency. "ARC/PLC Program" and "ARC/PLC Program Data." May 2017. https://www.fsa.usda.gov/programs-and-services/arcplc_program/arcplc-program-data/index and https://www.fsa.usda.gov/programs-and-services/arcplc_program/index

U.S. Department of Agriculture, Economic Research Service. Commodity Costs and Returns. May 2017. https://www.ers.usda.gov/data-products/commodity-costs-and-returns/

Zulauf, C., G. Schnitkey, J. Coppess, and N. Paulson. "Farm Safety Net Support for Cotton in Perspective." farmdoc daily (7):87, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign. May 11, 2017.

Zulauf, C., G. Schnitkey, J. Coppess, and N. Paulson. "ARC-CO and PLC Payments for 2014 and 2015: Review, Comparison, and Assessment." farmdoc daily (7):44, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 9, 2017.

Zulauf, C., G. Schnitkey, J. Coppess, and N. Paulson. "Cottonseed and U.S. Oilseed Farm Program Issues." farmdoc daily (6):18, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign. January 28, 2016.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.