The Relationship between Biodiesel and Soybean Oil Prices

In a farmdoc daily article almost five years ago (November 2, 2012), we argued that, “…the new era of higher crop prices could be extended well into the future as a result of the RFS for advanced biofuels that in all likelihood can only be met with a rapid expansion in biodiesel production.” In the same article, we projected that over 3 billion gallons of biodiesel production would be needed in the future to meet the RFS mandates and this would require over 20 billion pounds of feedstock. The article concluded with this statement, “The new price era, then, would not be extended by rising corn demand, but by rising vegetable oil demand.” In essence, we argued that a boom in biodiesel production would cause a boom in the price of the main feedstock–soybean oil–which would in turn support soybean prices.

Our 2012 projection of the amount of biodiesel needed to comply with the RFS mandates in the future turned out to be reasonably accurate. For example, we recently estimated the total amount of biomass-based diesel (biodiesel + renewable diesel) supplied in the U.S. and needed for RFS compliance in 2016 was 2.8 billion gallons (farmdoc daily, July 19, 2017). Therefore, the U.S. did in fact have the boom in biodiesel production that we foresaw five years ago. As highlighted above, this naturally leads to the question of the impact of the biodiesel boom on soybean oil prices. This is a question much on the minds of market participants and policymakers in recent years. The purpose of today’s article is to provide a careful analysis of the short- and long-term relationship between biodiesel and soybean oil prices. This continues the recent series of farmdoc daily articles (July 12, 2017; July 19, 2017; July 26,2017; August 9, 2017; August 16, 2017; August 23, 2017; August 30, 2017) that examine the role that biodiesel (or biomass-based diesel) plays with respect to compliance with RFS mandates.

Analysis

We start by examining patterns in short-run (weekly) soybean oil prices and biodiesel prices. Soybean oil is the main feedstock used to make biodiesel in the U.S. Figure 1 plots the weekly soybean oil and biodiesel price at Iowa plants from January 26, 2007 through August 25, 2017. It is readily observed that, outside of the three spikes in 2011, 2013, and 2016, soybean oil and biodiesel prices at the plant appear to be highly correlated. We have argued in several previous farmdoc daily articles (e.g., March 1, 2017) that biodiesel prices were pushed up substantially in the three spike years due to diesel blenders racing to take advantage of the $1 per gallon biodiesel tax credit before it expired. To more formally examine the correlation of soybean oil and biodiesel prices outside of the spike years, we provide a scatterplot of 2014, 2015, and 2017 (to date) weekly prices in Figure 2. The R2 of 0.8034 confirms that soybean oil and biodiesel prices are indeed highly correlated outside of years when the tax credit is set to expire. It is also interesting to observe that the estimated intercept and slope coefficients are quite close to the simple breakeven relationship we have used in previous farmdoc daily articles (e.g., March 1, 2017). The slope of that breakeven relationship is 7.55, corresponding to an assumed conversion rate of 7.55 pounds of soybean oil per gallon of biodiesel, and the intercept of 0.60 reflects a $0.60 per gallon return for all other cost categories, including fixed costs.

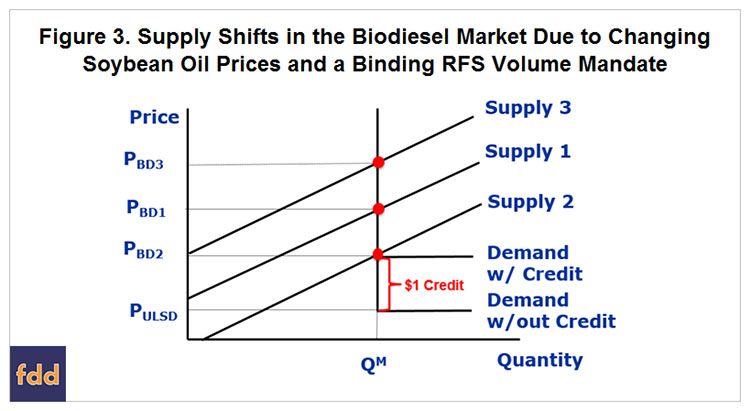

While there is clearly a significant and positive correlation between soybean oil and biodiesel prices at the weekly horizon, there is a well-known saying that “correlation does not necessarily imply causation.” Without additional information we cannot say whether soybean oil prices determine biodiesel prices, biodiesel prices determine soybean oil prices, or both are determined simultaneously. There is in fact a good reason to expect that soybean oil prices determine biodiesel prices at the weekly horizon, not the other way around as is commonly argued. We can illustrate the logic of this assertion using Figure 3, which shows the same conceptual model of the biodiesel market that we have been using in recent weeks to analyze the role of biodiesel in complying with the RFS mandates (farmdoc daily, August 23, 2017). Note that our earlier analysis applied to all biomass-based diesel (biodiesel + renewable diesel). To avoid adding unnecessary detail to the discussion, we use the term “biodiesel” but assume it could also apply to the broader category of biomass-based diesel.

To begin, we assume in Figure 3 that the RFS biodiesel mandate is fixed within the year. This reflects the statutory requirement that RFS mandates be fixed on an annual basis and typical EPA practice in implementing the mandates. Note that the vertical component of the demand curve is fixed at the weekly horizon as a result. We also assume that the horizontal component of the demand curve changes with the energy-adjusted price of ultra-low sulphur diesel and whether the $1 per gallon biodiesel tax credit is in place. Lastly, we assume that the supply curve shifts due to changing soybean oil prices, with supply curve 2 shifting down to reflect a lower soybean oil price than the base case 1 and supply curve 3 shifting up to reflect a higher soybean oil price. Since soybean oil makes up over 80 percent of the variable operating costs for a representative biodiesel plant, this is a reasonable assumption. With this set-up, so long as supply does not shift to the right of supply curve 2, the price of biodiesel is completely determined by shifts in the supply curve. More specifically, when the RFS biodiesel mandate is binding and fixed, the demand for biodiesel is fixed over a wide range of prices, which means that any variation in biodiesel prices within this range must be due to shifts in the supply curve. Since shifts in the supply curve are due to changes in soybean oil prices, we can say that soybean oil prices drive, or “cause,” biodiesel prices over a wide range of possible biodiesel prices. The only exception to this chain of logic is if soybean oil prices are low enough to shift supply to the right of supply curve 2, which would effectively “unbind” biodiesel demand (assuming the tax credit is in place).

The above analysis suggests that the direction of causality at a weekly horizon likely runs from soybean oil prices to biodiesel prices, but empirical evidence that confirms this prediction is needed before we can confidently reach this conclusion. Fortunately, which series leads the other can be tested empirically using a statistical procedure called “Granger causality.” This procedure is based on a regression of variable y on its own lagged values and the lagged values of the variable x and a regression of variable x on its own lagged values and the lagged values of y. If lagged values of x are statistically significant in the y regression but lagged values of y are not significant in the x regression, than it can be concluded that variable x leads, or “Granger causes,” variable y.

Standard Granger causality regressions were estimated using the weekly soybean oil and biodiesel prices data over 2014, 2015, and 2017 to date, with the following results:

- (1) BD(t) = 0.248 + 0.555 BD(t-1) + 3.462 SO(t-1) R2=0.898, and

- (2.874) (8.001) (5.770)

- (2) SO(t) = 0.009 + 0.009 BD(t-1) + 0.885 SO(t-1) R2=0.924,

- (1.018) (1.33) (14.611)

where BD(t) is the biodiesel price in current week, BD(t-1) is the biodiesel price in the previous week, SO(t) is the soybean oil price in current week, and SO(t-1) is the soybean oil price in the previous week. The figures in parentheses are t-statistics, with a value approximately greater than two in absolute value indicating statistical significance. It is no surprise that the previous week’s price of biodiesel in (1) is significantly related to this week’s biodiesel price and the previous week’s price of soybean oil in (2) is significantly related to this week’s soybean oil price. This reflects the well-known persistence in the level of commodity prices in the short-term. The truly interesting results are generated by the cross-product terms. In particular, the previous week’s soybean oil price in (1) is significantly related to this week’s biodiesel price, while last week’s biodiesel price in (2) is not significantly related to this week’s soybean oil price (estimating the regressions using price changes rather than price levels or with additional lags does not change the results). This means that soybean oil prices lead, or “Granger cause,” biodiesel prices but biodiesel prices do not lead soybean oil prices. In practical terms, this means that soybean oil prices drive biodiesel prices over a weekly horizon, just as predicted by our conceptual model.

We now extend the analysis to a longer annual horizon. We do this because an increase in the annual RFS biodiesel mandate could be a big enough increase in demand for soybean oil that the price of soybean oil increases. Since changes of this magnitude happen only once a year, the feedback effect of biodiesel prices on soybean oil prices is swamped over a weekly horizon by the much more frequent changes in other variables that drive soybean oil prices. By matching the time horizon of the empirical analysis to the annual frequency of changes in RFS biodiesel mandates there is a better chance of picking up an impact of biodiesel prices on soybean oil prices

Figure 4 plots annual average soybean oil and biodiesel price at Iowa plants over 2011 through 2017 to date. At this level of aggregation, soybean oil and biodiesel prices appear to be even more correlated. The three spike years in terms of biodiesel prices (2011, 2013, and 2016) are not as obvious due to the scaling, but close inspection of the plot shows a clear rise in biodiesel prices relative to soybean oil prices in 2011 and 2016. Figure 5 provides a scatterplot of the annual average soybean oil and biodiesel prices, and as indicated by the R2 of 0.9388 the correlation is very high. The strength of the correlation is somewhat surprising since the three spike years are included in the sample of seven years. The estimated intercept and slope coefficients are also in range of those from the simple breakeven relationship mentioned earlier despite the extremely small sample.

If “correlation does not necessarily imply causation” at the weekly time horizon, then this should be doubly true at the annual horizon because we know that the biodiesel mandate has increased each year over 2011-2017, and in some years, substantially. The situation is represented in Figure 6, which is the same model as in Figure 3, except the RFS biodiesel mandate increases from QM to QM*. In this scenario, it is not possible to a priori establish the direction of causality because both the supply and demand curves are shifting. Consequently, the soybean oil and biodiesel prices may both drive each other in a classic simultaneous manner.

From the perspective of Granger causality, simultaneous determination of soybean oil and biodiesel prices would result in the cross-product terms in both regressions being significant. That is, soybean oil prices would drive biodiesel prices and biodiesel prices would simultaneously drive soybean oil prices. The estimated Granger Causality regressions at the annual horizon over 2011 through 2017 are as follows:

- (3) BD(t) = 1.243 – 0.836 BD(t-1) + 13.756 SO(t-1) R2=0.826, and

- (1.579) (-1.130) (2.033)

- (4) SO(t) = 0.063 – 0.018 BD(t-1) + 0.936 SO(t-1) R2=0.847.

- (0.750) (-0.232) (1.288)

Before discussing the estimation results, it must be emphasized that the results should be treated extremely cautiously due to the very small sample size of seven observations. This is substantially fewer observations than typically recommended for this type of test. Despite the obvious limitation, the similarity of the annual results to the weekly results is striking. In particular, the previous year’s soybean oil price in (3) is significantly related to this year’s biodiesel price, while last year’s biodiesel price in (4) is not significantly related to this year’s soybean oil price. The statistical significance and size of the coefficient on lagged soybean oil prices in (3) is rather remarkable considering the tiny sample size, and provides clear evidence that the annual variation in supply shifts due to changing soybean oil prices has more than outweighed the annual variation in demand shifts due to changing RFS biodiesel mandates.

In sum, the Granger Causality regression results suggest that changes in the RFS biodiesel mandates have not had any impact on soybean oil prices in the short- or long-term. A simple way of looking at the same issue is found in Figure 7. Here, we plot total U.S. biomass-based supply (biodiesel + renewable diesel) on an annual basis versus the annual average soybean oil price for 2011 through 2017 to date. The total biomass-based supply was first presented in the farmdoc daily article of July 19, 2017. This total jumped from 1 billion gallons to around 2.5 billion gallons, a gain of about 150 percent, while soybean oil prices declined from around $0.50 to $0.30 per pound, a drop of almost 40 percent. It is an understatement to say this is counter-intuitive, given the feedstock implications of such a large increase in biomass-based diesel supply. Assuming all of the feedstock was soybean oil, this would represent approximately 11 billion gallons of added soybean oil usage (1.5 billion gallons x 7.55 pounds of soybean oil per gallon) in eight years. For perspective, that is equivalent to soybean oil production from approximately 22 million acres of soybeans (based on 11 pounds of soybean oil per bushel and 45 bushels of soybeans per acre) Of course, not all of the feedstock used to meet the rising demand for biomass-based diesel was soybean oil, probably in the range of 50-60 percent. Regardless, the amount of soybean oil needed to fulfill the RFS mandates has increased sharply since 2011.

So, we are left with a major riddle as to how U.S. biodiesel requirements could increase so sharply and soybean oil prices could decline so much. The answer has to be in the supply of soybean oil. A key insight is that soybean oil and soybean meal are joint products produced in fixed proportions when soybeans are crushed. Traditionally, meal used in animal feed rations has been by far and away the most important source of the value of a bushel of soybeans. As almost everyone knows there has been an enormous boom in soybean exports to China to provide soybean meal in feed rations for its burgeoning livestock herds (mainly pork and chickens). What is less appreciated is the supply of soybean oil that has been produced as part of the “soybean meal” boom in China. Figure 8 illustrates the potential scale of the increase in global soybean oil supply from this boom. We computed the volume of soybean oil produced assuming every bushel of China’s soybean imports was crushed into meal and oil. Since 2011, China’s potential production of soybean oil from its soybean imports alone has increased over 14 billion gallons. This exceeds the increase in total soybean oil requirements computed above for the RFS biodiesel mandates. Of course, this simplistic analysis does not take into account the adjustments that could have taken place with China’s domestic soybean production and crushing, as well as in other parts of the world. The point still stands though : China’s soybean import boom has been so large that the resulting increase in global soybean oil supplies has allowed the U.S. boom in biodiesel production to take place without causing a corresponding boom in soybean oil prices.

Implications

Biodiesel production and consumption in the U.S. boomed in recent years due to rising RFS mandate requirements. In a result that many will find quite surprising, we find no evidence that the boom in biodiesel led to a boom in soybean oil prices, the main biodiesel feedstock. For example, total biomass-based diesel supply in the U.S. (biodiesel + renewable diesel) jumped from 1 billion gallons in 2011 to around 2.5 billion gallons in 2017, a gain of about 150 percent, while at the same time soybean oil prices declined from around $0.50 to $0.30 per pound, a drop of almost 40 percent. The reason for this surprising state of affairs is China’s soybean import boom, which paralleled the U.S. biodiesel boom. Since soybean oil is a joint product that is produced in a fixed proportion when soybeans are crushed, China’s “soybean meal” boom necessarily also produced a huge quantity of soybean oil. In essence, China’s soybean import boom has been so large that the resulting increase in global soybean oil supplies has allowed the U.S. boom in biodiesel production to take place without causing a corresponding boom in soybean oil prices. It is important to recognize this does not necessarily mean that the boom in biodiesel production had zero impact on soybean oil prices. The RFS-driven boom in biodiesel production in all likelihood played a role in preventing the decline in soybean oil prices during recent years from being even more severe.

References

Granger causality. In Wikipedia. Last modified on July 30, 2017, at 04:04, and retrieved September 7, 2017, from https://en.wikipedia.org/wiki/Granger_causality.

Irwin, S. "The Profitability of Biodiesel Production in 2016." farmdoc daily (7):38, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 1, 2017.

Irwin, S. and D. Good. "Projecting Biodiesel RINs Prices under Different Policies." farmdoc daily (7):159, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 30, 2017.

Irwin, S. and D. Good. "How to Think About Biodiesel RINs Prices under Different Policies." farmdoc daily (7):154, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 23, 2017.

Irwin, S and D. Good. "Biomass-Based Biodiesel Prices--How Much Does Policy Matter?" farmdoc daily (7):149, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 16, 2017.

Irwin, S. and D. Good. "EPA Interpretation of the "Inadequate Domestic Supply" Waiver for Renewable Fuels Ruled Invalid: Where to from Here?" farmdoc daily (7):144, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 9, 2017.

Irwin, S and D. Good. "Revisiting the Estimation of Biomass-Based Diesel Supply Curves." farmdoc daily (7):135, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 26, 2017.

Irwin, S and D. Good. "Filling the Gaps in the Renewable Fuels Standard with Biodiesel." farmdoc daily (7):130, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 19, 2017.

Irwin, S and D. Good. "The EPA's Renewable Fuel Standard Rulemaking for 2018--Still a Push." farmdoc daily (7):125, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 12, 2017.

Irwin, S and D. Good. "The Biofuels Era - A Changing of the Guard?" farmdoc daily (2):214, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 2, 2012.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.