PACE and Nitrogen Fertilizer Strategies for 2023

Nitrogen fertilizer prices are high and volatile, leading to concerns about fertilizer costs moving into 2023. Farmers have several tools for managing risks, including the Post Application Coverage Endorsement (PACE), a crop insurance tool reducing the risks associated with applying nitrogen after planting. Herein, we provide background on nitrogen prices, list tools and decisions that impact nitrogen costs and risks, and then discuss strategies for dealing with nitrogen cost variability.

Background

Nitrogen prices have been high since October 2021 and remain volatile. From 2008 to 2021, anhydrous ammonia in Illinois averaged $653 per ton, according to prices in the Illinois Production Cost Report, a publication of the Agricultural Marketing Service (AMS). Between October 2021 and October 2022, ammonia averaged $1,384 per ton, more than double the $653 average from 2008 to 2021. After reaching a high of $1,635 on June 2, 2022, prices declined to $1,153 on August 25. From this low, ammonia price increased by $231 to $1,384 per ton on October 6, 2022.

Increases or decreases of over $200 per ton are possible moving from fall to spring. Since fertilizer prices are highly related to corn and natural gas prices (see farmdoc daily, September 27, 2022, and December 14, 2021), events that cause corn and natural gas prices to change likely will result in ammonia price changes. Moreover, corn and natural gas prices could be influenced by the Ukraine-Russian conflict, with the attendant reduction in natural gas flows from Russia to Western Europe also having heavy influences. Events that could cause increases in corn, natural gas, and anhydrous ammonia prices include:

- Increased tensions over Ukraine-Russia, with the potential for reduced flows of natural gas out of Russia to Western Europe and reduced grain flows out of Ukraine.

- Poor growing conditions in South America leads to lower supplies of grains.

- A cold winter in the United States results in increased use of natural gas.

- Strong economic growth, particularly in China, leads to increased demand for agricultural commodities.

On the other hand, events that could lower corn, natural gas, and anhydrous ammonia prices include:

- Reduced tensions over Ukraine-Russia, leading to increased natural gas out of Russia and grain out of Ukraine.

- Good growing conditions in South America lead to higher supplies of grain.

- A warm winter in the United States reduces the use of natural gas.

- Tepid economic growth with continuing concerns about inflation, a recession, and the health of the global financial system.

Of course, events may be murky, with countering impacts on the agricultural economy. For example, continuing Ukraine-Russia tensions leading to reduced natural gas supplies seems likely, with the resulting impact being higher natural gas and agricultural commodity prices. On the other hand, countering these tensions is the possibility of a global recession, partially attenuated by high natural gas prices, which could lead to lower commodity prices. Much remains uncertain.

While nitrogen prices are high, corn prices also remain high, leading to a projection of profitable corn production (see farmdoc daily, August 2, 2022). Fall 2023 delivery bids suggest cash prices near $6.00 per bushel in fall 2023. A $6.00 corn price leads to profitable production, even given high fertilizer prices.

A significant risk is pricing nitrogen fertilizer and other inputs now, and corn prices reach a lower level in the future. This scenario could result in unprofitable production. Pricing corn as input decisions are made will mitigate this risk.

Tools for Managing Nitrogen Price Risks

In this volatile environment, several tools and decisions will impact risks: Post Application Coverage Endorsement (PACE), nitrogen rates, nitrogen purchase timing, grain hedging, and nitrogen application timing.

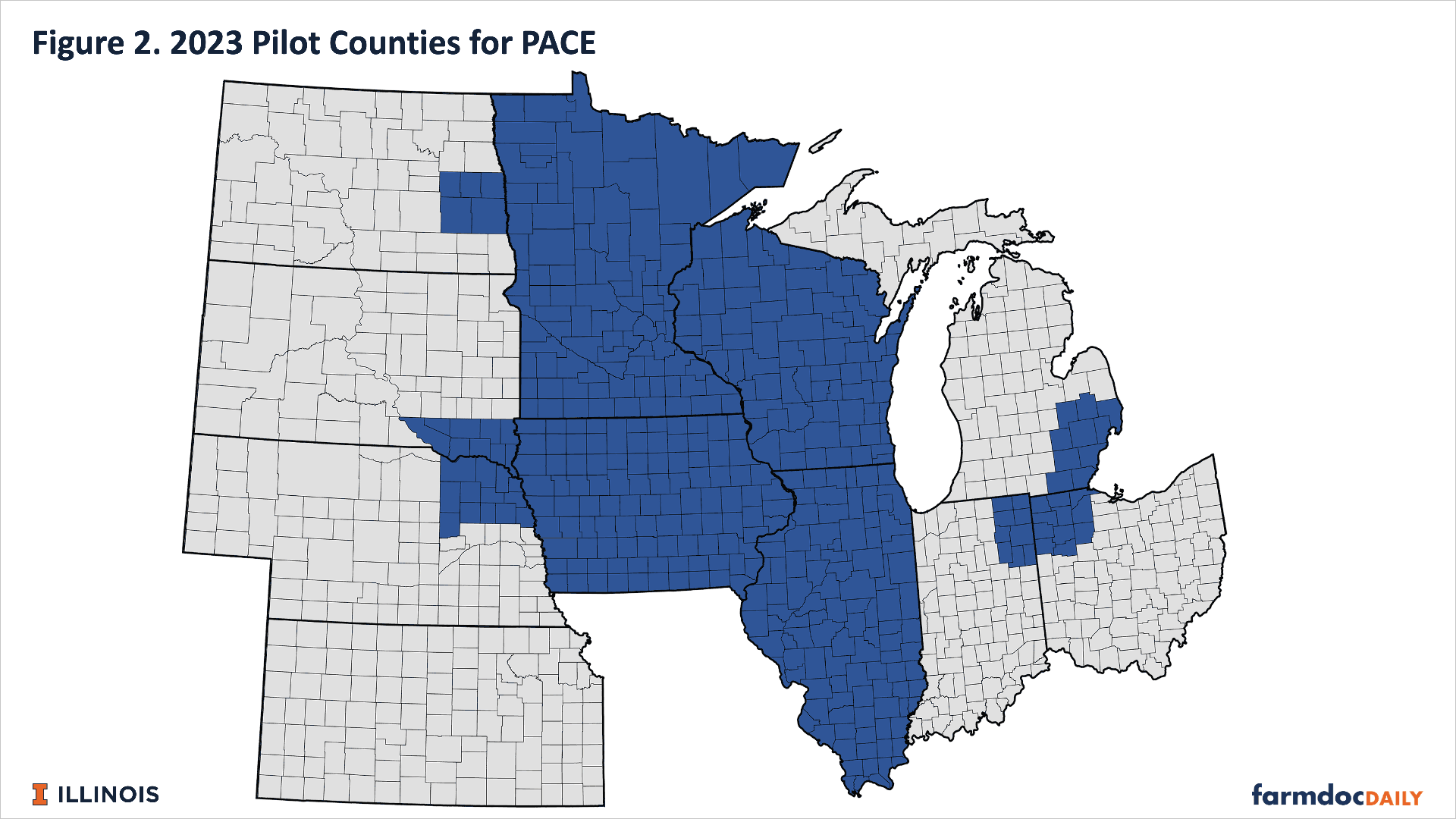

Post Application Coverage Endorsement (PACE): PACE is a crop insurance product that provides indemnity payments if nitrogen can not be applied after planting because of weather events, thereby reducing the risks of waiting to apply nitrogen after planting (see farmdoc daily, January 19, 2022). Costs of premium for PACE range from $1 to $7 per acre, depending on chosen elections. PACE is available in an expanded pilot area, including all counties in Illinois, Iowa, Minnesota, and Wisconsin, and some counties in Ohio, Michigan, Indiana, North Dakota, South Dakota, Nebraska, and Kansas (see Figure 2).

In this volatile price environment, waiting to apply nitrogen has risk benefits, moving the application decision closer to harvest when some of the price uncertainty associated with corn will be reduced. An assessment of crop conditions can also be made, leading to nitrogen rate adjustments. However, waiting until after planting to apply nitrogen increases the risks of not being able to apply nitrogen due to poor weather. PACE reduces the risk of not being able to apply nitrogen.

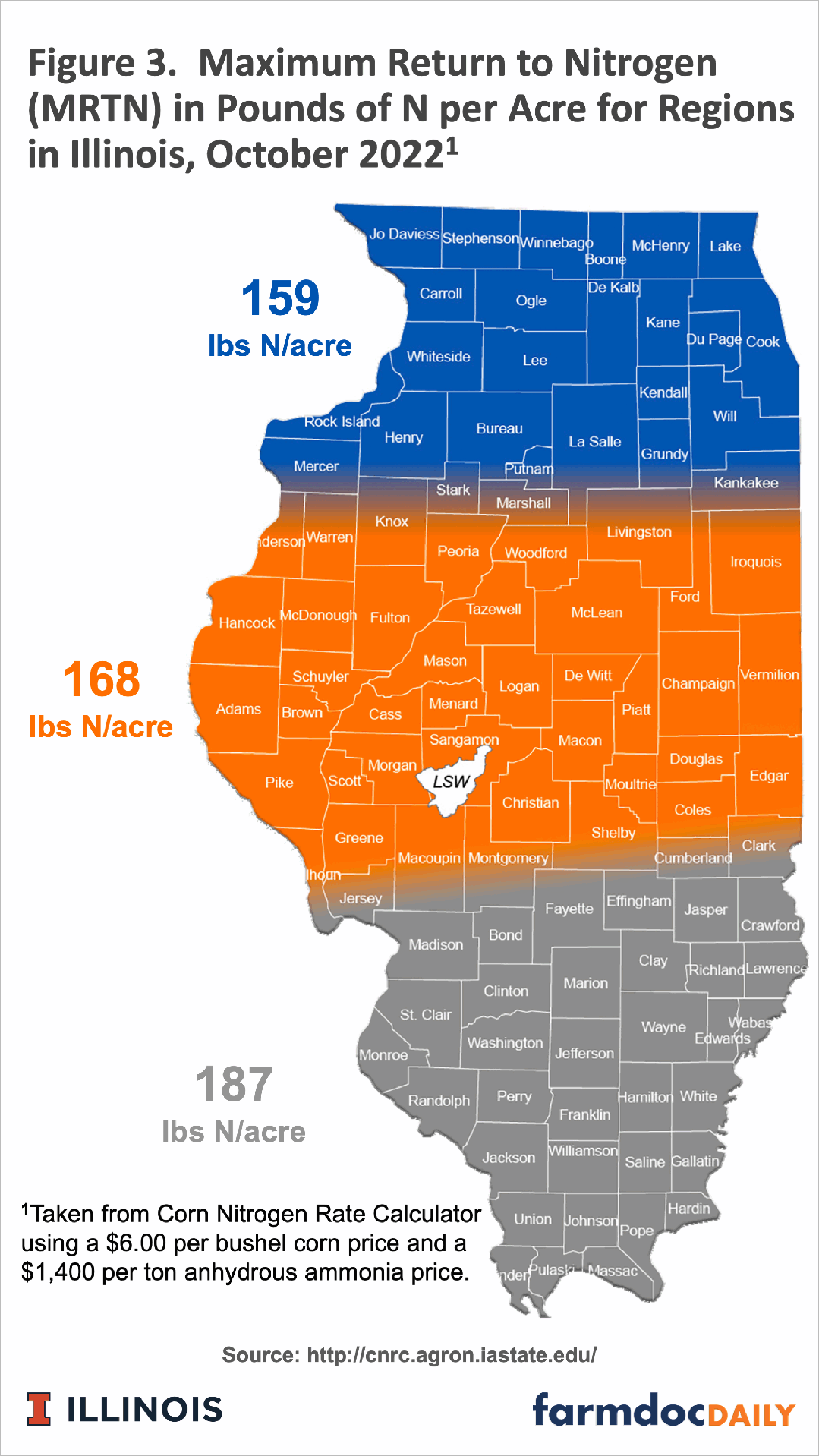

Nitrogen Rates: Universities in midwest states make nitrogen rate recommendations available through the Corn Nitrogen Rate Calculator. Users can enter prices into the online tool, and the tool will give Maximum Return to Nitrogen (MRTN) rates. Based on field trial data, these rates find the nitrogen rate that maximizes profitability.

Figure 2 shows MRTNs for northern, central, and southern Illinois, given a $6.00 corn price and a $1,400 anhydrous ammonia price. MRTNs are stated as actual pounds of nitrogen applied and will have to be adjusted to the particular fertilizer product. For example, anhydrous ammonia is 82% nitrogen. The central Illinois recommendation of 168 pounds of nitrogen translates to 204 pounds of anhydrous ammonia if all nitrogen is applied as anhydrous ammonia.

Note that all of these MRTNs are below 200 pounds of nitrogen per acre. Many farmers have applied more nitrogen than MRTN recommendations. According to data from Precision Conservation Management (PCM), 68% of farmers apply nitrogen above MRTNs, with some of those farmers applying well above those levels (see farmdoc daily, November 12, 2019, and PCM webinar).

Over-applications will increase fertilizer costs. Take, for example, an application rate of 220 pounds of actual nitrogen, 52 pounds above the MRTN of 168 pounds per acre for central Illinois. If ammonia costs $1,400 per ton, the 52 pounds of additional nitrogen has a cost of $52 per acre, exceeding the $8 expected return in central Illinois (see farmdoc daily, August 2, 2022). Fertilizer response analysis indicates minimal to no yield response from this application above MRTN, suggesting that profits could be increased by cutting nitrogen rates to the MRTN.

Reducing nitrogen rates is prudent in this high-price environment. If a farmer is unwilling to reduce nitrogen applications to MRTNs over an entire field, experimentation will be worthwhile. Take one field and plant strips with the usual rates and the MRTN. At harvest, evaluate whether yields are high enough at the usual rate to justify the additional costs of nitrogen.

Nitrogen Purchase Timing: Nitrogen fertilizer can be purchased before it is applied. Many fertilizer outlets now offer the ability to price anhydrous ammonia for fall applications. Other outlets offer opportunities to price nitrogen solutions for spring delivery. In addition, it is possible to purchase nitrogen and store it on the farm if those facilities exist.

Pricing nitrogen at several points will result in an average farm price that is closer to the average price for the season. Spreading sales has risk management benefits, just as spreading grain pricing points during the year has risk management benefits.

Grain Hedging: The window for pricing 2023 corn has already opened and will technically continue until the end of the 2023 marketing year in August 2024. While not impacting nitrogen costs, pricing grain can reduce risks. Both corn and nitrogen price are currently high. Corn prices near $6.00 per bushel will result in profitable production, given that corn yields are close to the trend and expenses are near current projections. Pricing corn as fertilizer is purchased reduces the chance of having high input costs and lower corn prices.

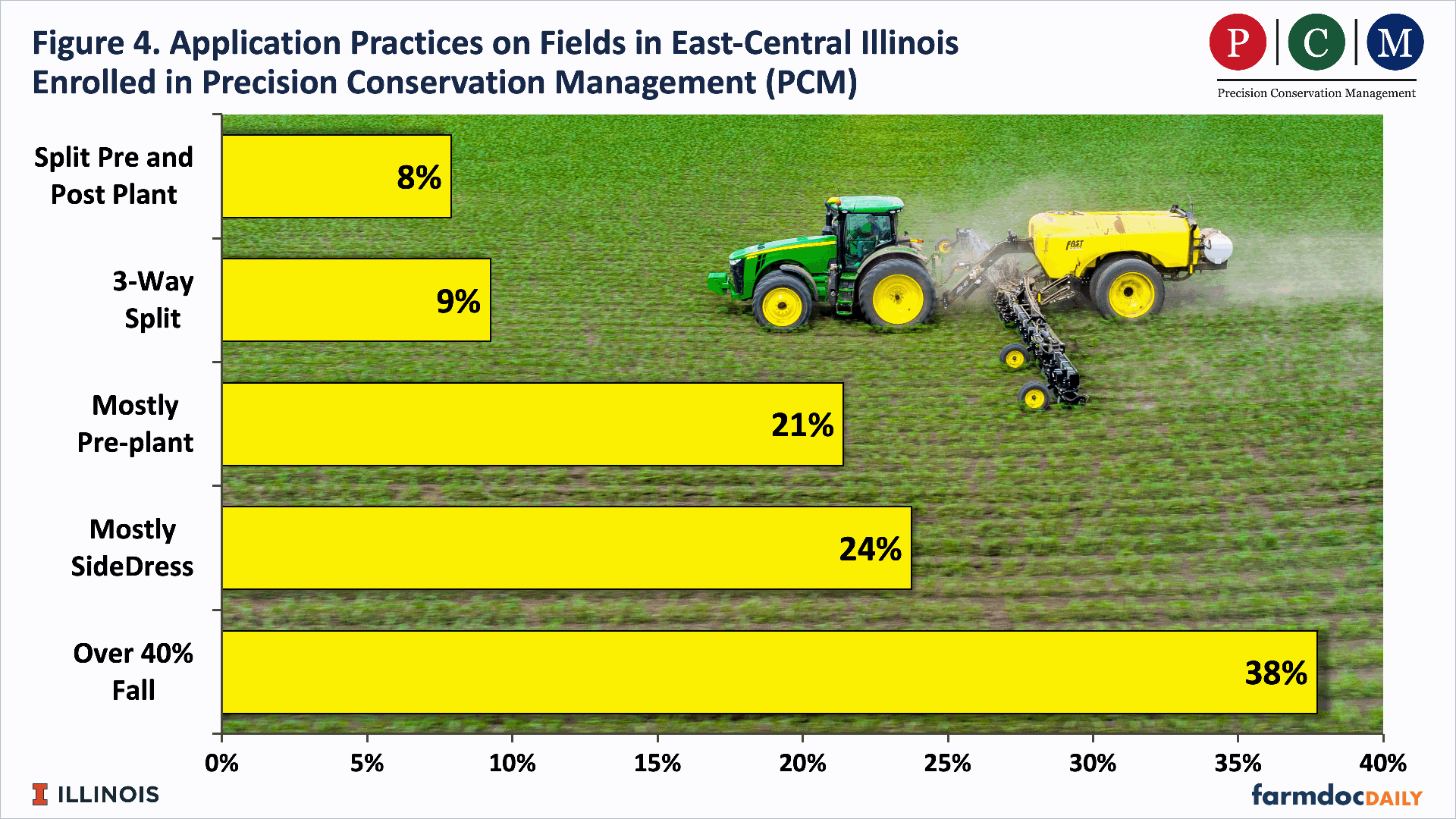

Application Timing: Farmers have four times when nitrogen can be applied: 1) fall, 2) spring before planting, 3) at planting on the planter, and 4) side dress after planting. According to data from Precision Conservation Management (PCM), farmers in east central Illinois are reasonably divided in how nitrogen is applied (see Precision Conservation Management). Fields within PCM are categorized according to four “benchmarks” of how farmers typically apply nitrogen (see farmdoc daily, November 12, 2019):

- Mostly fall applications: To be included in this benchmark, PCM fields had to receive 40% or more of their nitrogen in the fall. Most of this nitrogen comes in the form of anhydrous ammonia applications. Within PCM fields, 38% of fields are mostly fall-applied (see Figure 4).

- Mostly pre-plant: Mostly pre-plant fields have the majority of their nitrogen applications prior to planting in the spring. Within PCM, 21% of fields had applications fall in this benchmark.

- Mostly side dress: Fields in this benchmark apply the majority of their nitrogen post-plant. About 21% of the fields are in this benchmark.

- Split pre-plant and side dress: Eight percent of the farms split applications between pre-plant and side-dress.

- 3-Way split: Nine percent of the farms split nitrogen applications into three of the above four timing periods: 1) Fall, 2) Pre-plant, 3) At planting, and 4) Sidedress.

Risk Management Strategies

General principles for the use of the above tools are:

- Using rates near MRTNs increases expected profits and reduces risks. The MRTNs are designed to maximize profits. Given that nitrogen prices are determined once nitrogen is applied, the remaining risk comes from the revenue side. Lower costs tend to reduce risks, particularly when large revenue gains do not occur with increased costs.

- Spreading sales reduces risks. Multiple pricing points cause the average price to be closer to the average price for the season, thereby missing the highs and lows during a season.

- There is a risk advantage to delaying some of the fertilizer applications until after planting. Rates can be adjusted for current prices and growing conditions. The use of PACE can mitigate risks associated with applying nitrogen after planting.

Fall applications: Special consideration exists if most of the fertilizer is fall applied. In these cases, several suggestions include:

- Price corn. By applying nitrogen, the decision to plant corn has been made, and production costs have been incurred. Pricing corn would seem to be a prudent strategy as corn prices now allow for profitability.

- Reduce fall rates to below MRTN and apply remaining nitrogen after planting. This practice will spread pricing points across time. It will also delay the final nitrogen rate decision till later in the growing season when conditions are less uncertain. The PACE insurance product is available to mitigate the risks associated with not being able to apply after planting.

Spring and side-dress applications: Farmers who apply most of their nitrogen in the spring before or after planting may wish to price some of the nitrogen input now, thereby spreading sales across multiple pricing points.

Concluding Comments

Nitrogen fertilizer prices are volatile again, which will likely continue until global financial conditions become more certain and the Ukraine-Russia conflict moves closer to resolution. In this environment, farmers can reduce risk by applying near MRTN rates, spreading fertilizer purchases across time, and applying a portion of nitrogen after planting. PACE is a crop insurance product that can reduce the risks of waiting until after planting to apply nitrogen.

References

Colussi, J. and G. Schnitkey. "Investments in Brazilian Grain Transportation Shrink U.S. Logistical Advantage." farmdoc daily (12):8, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 19, 2022.

Corn Nitrogen Rate Calculator. Iowa State University Agronomy Extension and Outreach, 2022. http://cnrc.agron.iastate.edu/

Precision Conservation Management, https://www.precisionconservation.org/

Schnitkey, G., K. Swanson, C. Zulauf and J. Baltz. "2023 Crop Budgets: Higher Costs and Lower Returns." farmdoc daily (12):113, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 2, 2022.

Schnitkey, G., N. Paulson, C. Zulauf, K. Swanson and J. Baltz. "Fertilizer Prices, Rates, and Costs for 2023." farmdoc daily (12):148, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 27, 2022.

Schnitkey, G., N. Paulson, C. Zulauf, K. Swanson and J. Baltz. "Nitrogen Fertilizer Prices Above Expected Levels." farmdoc daily (11):165, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 14, 2021.

Sellars, S., L. Gentry, G. Schnitkey and D. Lattz. "Cost and Returns from Different Nitrogen Application Timing in Illinois." farmdoc daily (9):213, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 12, 2019.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.