Increasing Pessimism About 2024 and 2025 Corn and Soybean Returns

Current levels of futures contracts suggest that appropriate budgeting prices for 2024 crops production are $4.00 per bushel for corn and $10.50 per bushel for soybeans. Those prices would result in low returns in 2024, far lower than the last low-price period from 2014 to 2019. Much higher costs cause lower 2024 returns. Those budget price forecasts could change with unforeseen events, as does occur in agriculture. Over the next several months, estimates for returns and incomes will solidify. Still, it seems prudent to plan for much lower prices.

Corn and Soybean Prices

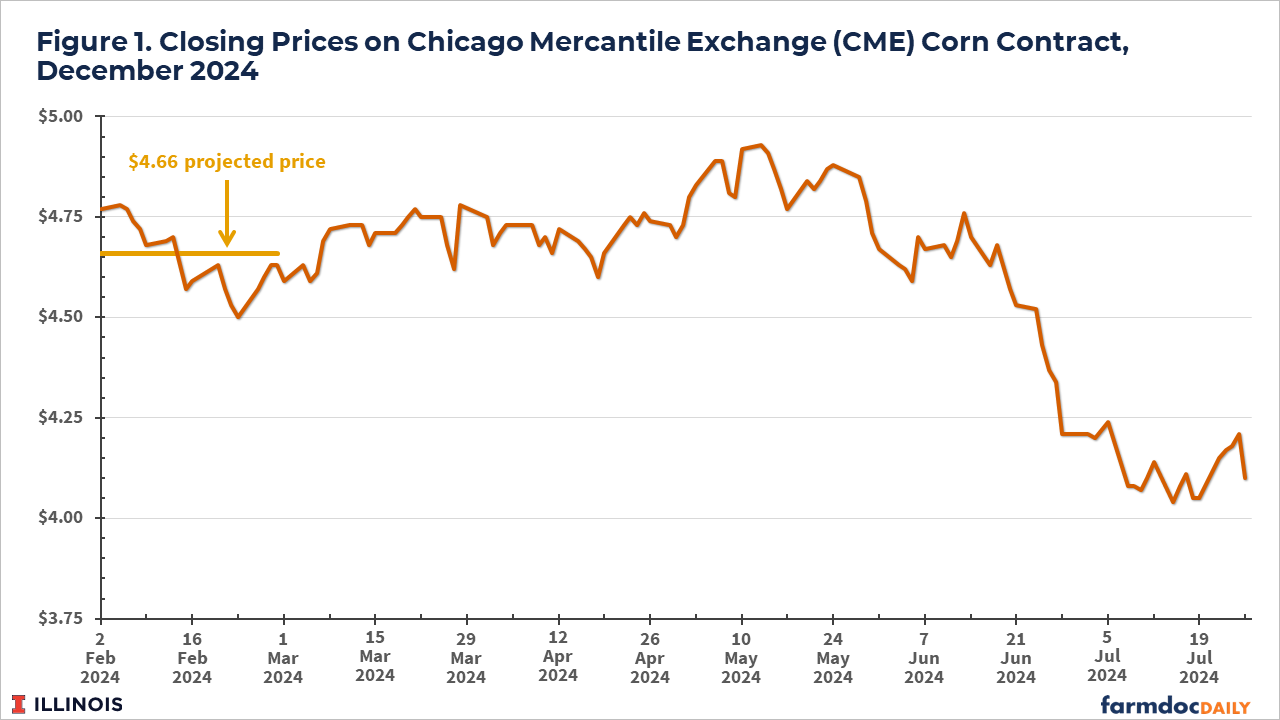

Expectations generally have been for much lower corn and soybeans prices in 2024 compared with the 2021 to 2023. In February, the projected price used to set guarantees on crop insurance was set at $4.66 per bushel for corn. The projected price is the average of February settlement prices of the December corn traded on the Chicago Mercantile Exchange (CME) and represents an unbiased indicator of prices at harvest. The $4.66 projected price is well below the $5.90 projected price for 2022 and $5.91 for 2023.

Since February, the December CME futures contract has fallen, currently trading near $4.10 per bushel (see Figure 1). This decline in price is consistent with a growing belief that yields in the U.S. will be above trend. Moreover, no significant market surprises have occurred that would either reduce supply or increase demand. In other words, a good supply of corn and roughly stable demand are leading to lowered price expectations.

The current December futures price for corn is consistent with cash prices below $4.00 at harvest, roughly $3.80 per bushel. Given usual price patterns, one expects cash prices to increase over the marketing season, and an average cash price of $4.00 per bushel for 2024 production seems reasonable.

A $4.00 price is well below recent prices. USDA reports the national market year average (MYA) price at $6.00 for 2021 and $6.54 for 2022. The 2023 marketing year will end in August, with a current forecast of $4.65 per bushel. If a $4.00 price occurs for 2024, it would be the lowest since 2019, when the market year average price was $3.56 per bushel.

Futures markets are currently suggesting roughly similar prices for 2025 for corn. The December 2025 futures contract is trading near $4.60, indicating that cash corn prices at harvest in 2025 could be in the low $4.30 range.

A similar story exists for soybeans. The 2024 projected price for soybeans is $11.55 per bushel, well below projected prices in 2022 ($14.33) and 2023 ($13.76). November futures prices have fallen since February, now trading near $10.20 per bushel. Cash price at harvest below $10 per bushel are likely, with an overall 2024 MYA price of $10.50 being an appropriate projection. Futures prices suggest continuing low prices into 2025, with a $10.80 price being an appropriate projection for the 2025 MYA price.

2024 Return Implications

Current markets are pointing to corn prices averaging near $4.00 per bushel and soybeans prices averaging near $10.50 per bushel over the next several years. Overall, the higher prices from 2021 through 2023 appear transitory, and prices are now moving to lower levels (see farmdoc daily, July 9, 2024). We may be again entering a period of lower prices like that from 2014 through 2019. From 2014 to 2019, central Illinois farmers received an average price of $3.64 per bushel for corn and $9.69 for soybeans.

Current market price indicators of $4.00 per bushel for corn and $10.50 for soybeans are above the 2014 to 2019 averages. Still, return levels likely will be much lower than from 2014 to 2019 because of higher costs. According to Illinois Farm Business Farm Management (FBFM) data, non-land costs for corn averaged $587 per acre from 2014 to 2019 (see Revenue and Costs for Illinois Grain Corps here). Those non-land costs increased to a projected $772 per acre, an increase of $185 per acre. Non-land costs for soybeans increased from an average of $363 per acre in 2014 to 2019 to a projected $512 per acre in 2024, an increase of $149 per acre. Cash rents increased from an average of $277 per acre from 2014 to 2019 to a projected $359 per acre in 2024, an increase of $82 per acre.

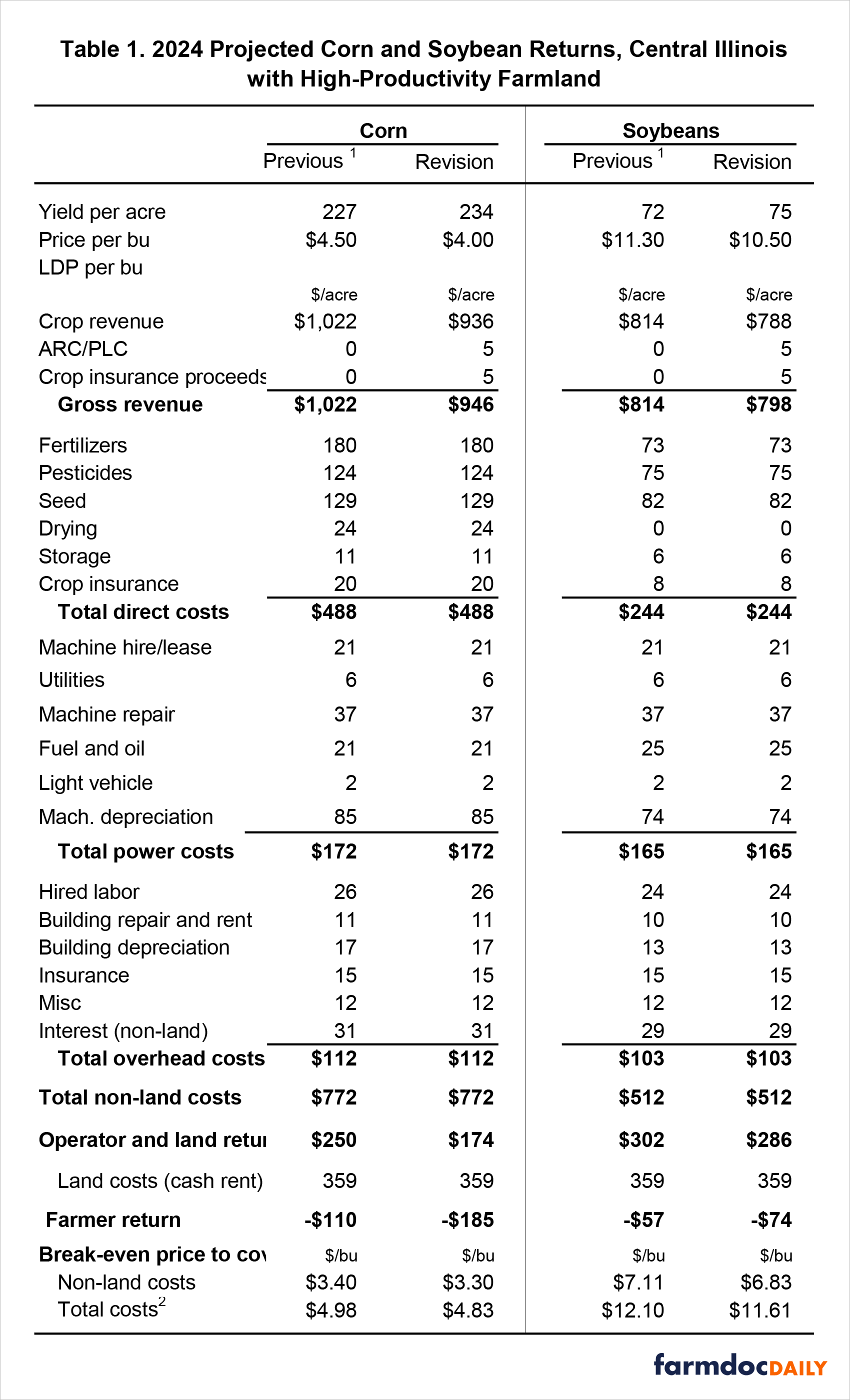

We revised prices and yields in the central Illinois high-productivity budgets (see farmdoc daily, June 25, 2024) to reflect lower prices, higher yields, and some Price Loss Coverage (PLC) and Agriculture Risk Coverage (ARC) payments. Corn prices were lowered from $4.50 per bushel to $4.00 per bushel (see Table 1). Growing conditions have been good across Illinois, leading to an increase in yield from 227 bushels per acre to 234 bushels per acre. Soybean prices are reduced from $11.30 per bushel to $10.50 per bushel, while yields are increased from 72 bushels per acre to 75 bushels per acre. Also included are $5 of PLC/ARC payments. If those payments occur, they will be received in October 2025. Based on current crop conditions, crop insurance payments likely will be minimal in 2024. We also added $5 per acre to reflect modest crop insurance payments. On revenue products, lower prices likely will be offset by higher yields.

Those changes cause farmer returns from cash rent farmland to decrease. For corn, farmer return decreases from -$100 per acre to -$185 per acre (see Table 1). Soybean returns decrease from -$57 per acre to -$74 per acre. Most of central Illinois is in a 50% corn and 50% soybean rotation, leading to an overall net farmer return of -$129 per acre on cash rented land.

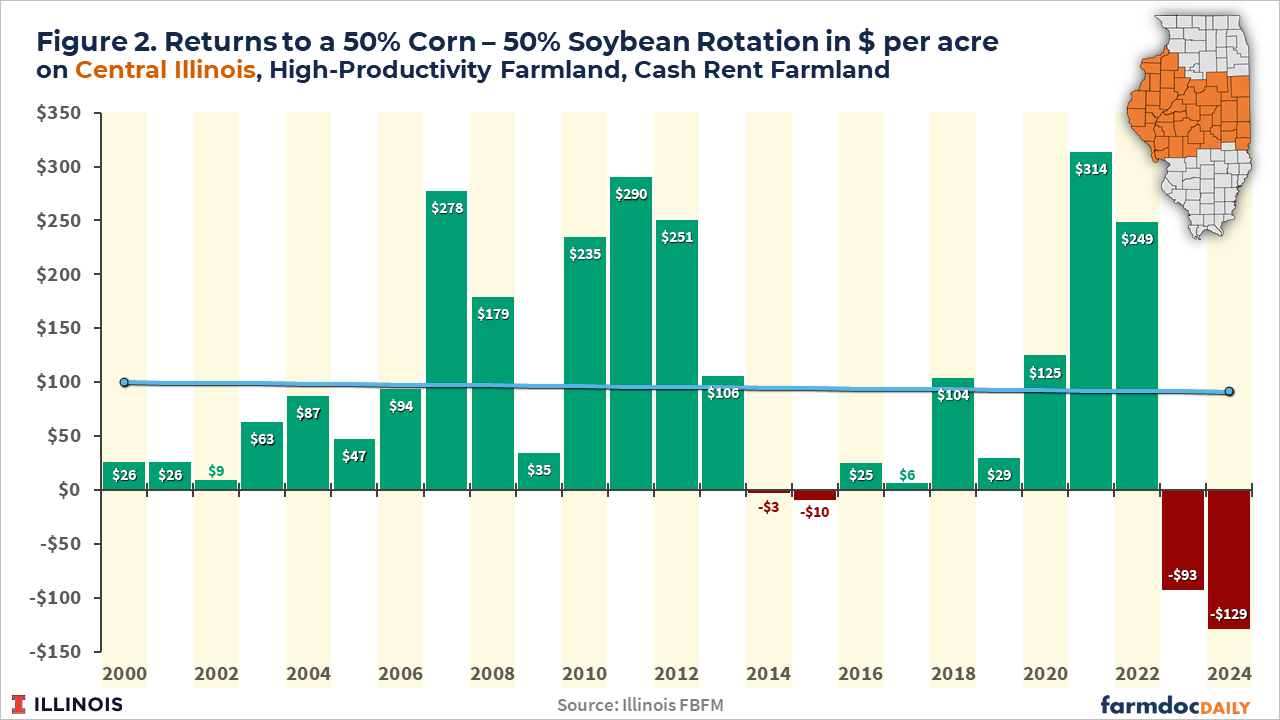

A -$129 per acre return would be the lowest since comparable records began in 2000. Over the entire 2000 to 2023 period, farmland returns averaged $90 per acre, but there is a great deal of variability across years. High return periods occurred

- between 2007 and 2012, the period in which prices were higher because of the increased use of corn in ethanol and

- in 2021 and 2022 because of various factors (see farmdoc daily, July 9, 2024).

Negative returns occurred after both high-price periods. Returns were -$3 in 2013 and -$10 in 2015. The 2014 projected returns are more negative at -$129 per acre.

Potential Positive Upsides

Some unanticipated events could increase prices, as happens in agriculture. As a reminder of possibilities, corn prices were approaching $3.00 per bushel in the summer of 2020, the beginning of the COVID pandemic. Then, a Derecho storm hit central Iowa in August, extending into northern Illinois, taking the top end off of U.S. yields. It also became evident that the China swine herd was being rebuilt after being severely impacted by African Swine Fever. Those two events began a period of higher prices, which were further fueled by the Ukraine-Russia conflict and lackluster yields across the world. Something similar could happen in late 2024, but those events are difficult to anticipate and seem unlikely.

The federal government could institute an ad hoc disaster assistance program. A continuation of the Economic Relief Program (ERP) seems likely, given its prevalence in recent years (see farmdoc daily, June 6, 2022). Essentially, ERP offers a top-up of the coverage level of crop insurance. However, those programs likely will not fill the gap. Like crop insurance, ERP protects against within-year declines in revenue. One of the income issues now is the decline in price over the years. For example, the projected cost for corn fell from $5.91 to $4.66. An extension of the ERP program will do nothing to cover this $1.25 fall in price. An alternative ad hoc disaster assistance program could arise. It is, after all, an election year.

Summary and Implications

Budgeting for $4.00 corn and $10.50 soybean prices seems appropriate for 2024. Slightly higher price expectations – $4.30 for corn and $10.80 for soybeans – are accurate estimates of market-driven estimates for 2025. Using these prices will result in negative returns for most cash-rented farms. Depending on a farm’s debt position, owned farmland could still provide positive cash flows. Returns and farm income will come into clearer focus in the next several months.

Most farm operations have strong financial positions, with relatively low debt and high working capital (see farmdoc daily, March 13, 2024, March 22, 2024, April 24, 2024, and April 26, 2024). However, the low returns that are expected will quickly erode that position, particularly the working capital position. Some farms may need to make changes to their operations to avoid severe losses of liquidity.

The price and return outlook suggest downward adjustments in cash rental rates. However, cash rents typically have lags in moving downward when prices fall. Still, the severity of income declines may dictate that cash rents will come down for specific tracts, particularly it the farms operating those tracts currently have lower working capital levels.

Some have suggested that farming is a boom to bust business. Long periods of low incomes like those from 2014 to 2019 need to be survived to gain financial resources from higher price and income periods like those in 2021 and 2022. We may have now entered another extended period of low prices again. Time will tell.

Acknowledgment

The author would like to acknowledge that data used in this study comes from Illinois Farm Business Farm Management (FBFM) Association. Without their cooperation, information as comprehensive and accurate as this would not be available for educational purposes. FBFM, which consists of 5,000 plus farmers and 70 plus professional field staff, is a not-for-profit organization available to all farm operators in Illinois. FBFM field staff provide on-farm counsel with computerized recordkeeping, farm financial management, business entity planning and income tax management. For more information, please contact the State FBFM Office located at the University of Illinois Department of Agricultural and Consumer Economics at 217-333-8346 or visit the FBFM website at www.fbfm.org.

References

Mashange, G. and B. Zwilling. "Liquidity Trends for Illinois Farms: Comparing Farms by Gross Farm Returns from 2003-2022." farmdoc daily (14):58, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 22, 2024.

Mashange, G. and B. Zwilling. "Liquidity Trends for Illinois Farms: A Regional Comparison of Current Ratios from 2003-2022." farmdoc daily (14):51, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 13, 2024.

Mashange, G. and B. Zwilling. "Solvency Trends for Illinois Grain Farms." farmdoc daily (14):78, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 24, 2024.

Mashange, G., G. Schnitkey and B. Zwilling. "Solvency Trends for Illinois Grain Farms: The Distribution of Debt-to-Asset Ratios by Gross Farm Returns." farmdoc daily (14):80, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 26, 2024.

Schnitkey, G. and N. Paulson. “Revenue and Costs for Illinois Grain Crops.” Illinois Farm Management Handbook, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, published June 25, 2024.

Swanson, K., G. Schnitkey, C. Zulauf, J. Coppess and N. Paulson. "The Continuation of Disaster Programs in U.S. Agriculture: Emergency Relief Program." farmdoc daily (12):83, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 6, 2022.

Schnitkey, G., N. Paulson and C. Zulauf. "Corn and Soybeans Economics in 2024 and 2025: Back to the New (Old) Normal?" farmdoc daily (14):126, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 9, 2024.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.