Setting the Holiday Tables: How Do Consumers Say Food Prices Will Affect Their 2025 Holiday Meals?

Introduction

The holiday season is in full swing, with Thanksgiving leftovers still in many refrigerators and the upcoming winter holidays on many consumers’ minds. The holidays bring large increases in food spending for both food at home and food away from home (Sinclair and Zeballos, 2025). Consumers’ decisions during this season can have important implications for farmers and ranchers.

Over the past few years, persistent inflation has affected consumers’ food decisions, including their holiday meals (e.g., farmdoc daily December 7, 2022; December 2023; May 19, 2025). This year, estimates of Thanksgiving meal costs generally showed that prices were slightly lower than in previous years (e.g., Ayoub and Parum, 2025; Swanson et al., 2025) and retailers have vowed to compete for consumers’ Christmas business (e.g., McKevitt, 2025).

In this article, we discuss how US consumers say they’re setting their holiday tables this year, using results from the 15th wave of the Gardner Food and Agricultural Policy Survey (GFAPS), conducted in November 2025. First, we review what protein sources respondents say they’re serving for their holiday meals, finding that demand for many holiday favorites (e.g., turkey) remain strong, and despite recent concerns with beef prices (e.g., Polansek et al., 2025), demand has increased. Second, we review respondent concerns with and responses to food prices. We find that over 60% of respondents who typically celebrate a winter holiday meal expect food prices to affect their plans. Finally, as some government nutrition programs experienced significant upheaval during the recent federal government shutdown (e.g., Mulvihill and Lieb, 2025), we review how respondents who use nutrition programs say their meals will be affected. Of those who use nutrition programs, over 80% said they expect food prices to affect their holiday meals.

Methods

GFAPS is conducted online quarterly. Today, we share results from Wave 15 (conducted in November 2025). Each quarter, a new panel of approximately 1,000 participants is recruited via Qualtrics to work to match the US population in terms of gender, age, annual household income, and US census region.

This wave, participants were first asked about what winter holidays they typically celebrate (e.g., Thanksgiving, Christmas, Hanukkah, New Years). For each holiday they traditionally celebrated, respondents were asked whether they typically celebrate this holiday with a meal. Nearly all (95.6%, n=958) respondents reported celebrating a winter holiday with a meal.

The most common holidays reported were Thanksgiving and Christmas. For those who reported typically celebrating these holidays with a meal (Thanksgiving, n=762; Christmas, n=808), respondents were asked about what types of protein sources they planned to serve at these meals. Options included: turkey; non-turkey bird (e.g., duck, goose, game hen); beef (e.g., prime rib, steak); pork (e.g., ham); lamb, fish or other seafood, non-meat protein (e.g., tofu, beans); I do not plan to have any proteins; or, other. To reflect that some consumers serve multiple protein sources at holiday meals, respondents could select multiple sources.

Additionally, all respondents who celebrated a winter holiday with a meal (n=958) were asked about whether they expected food prices to impact their holiday meals. Respondents could select yes or no. Those who expected food prices to affect their meals were then asked about what behaviors (if any) they expected to change due to food prices. Respondents could select one of thirteen options (e.g., shop for deals on holiday ingredients; shop ahead of time for holiday ingredients to spread out the cost; reduce the number of foods served at holiday meals; reduce the number of guests at holiday meals; plan to cancel the holiday meal completely). Respondents could select multiple options. Respondents could also select “other” or “none”.

Finally, in this article, we compare how participants and non-participants in food and nutrition assistance programs (e.g., SNAP, WIC, free or reduced-price school meals) differ in holiday meal plans. Here, 33.7% of those who celebrated winter holiday meals (n=323) indicated their household participated in a nutrition assistance program.

Results

What’s for Dinner? What Protein Sources US Consumers Say They’re Serving for Holiday Meals

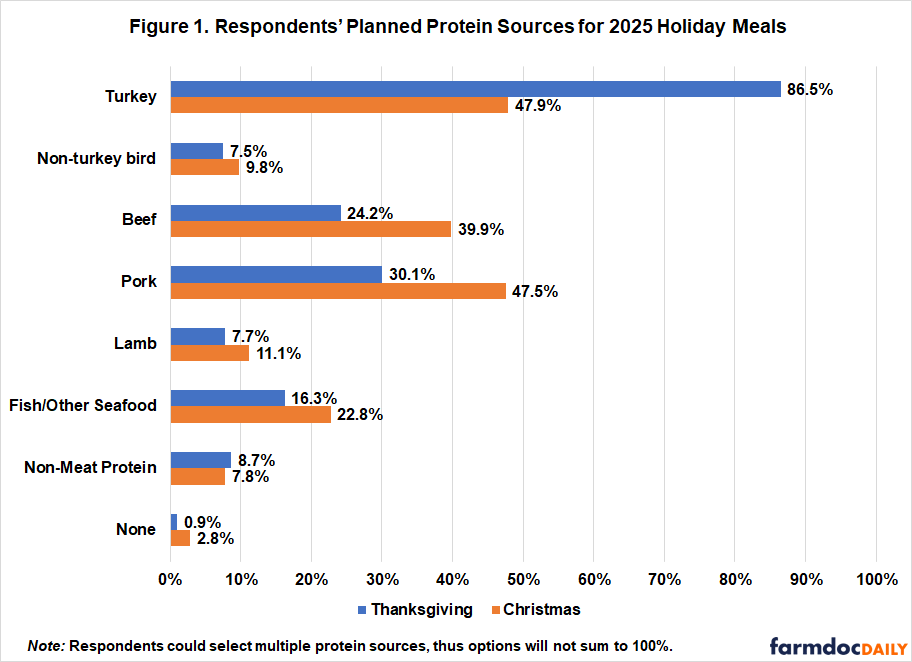

Of those respondents who typically celebrate Thanksgiving with a meal, the most commonly reported protein source was turkey. A whopping 86.5% of those who celebrate Thanksgiving with a meal said they planned to serve turkey (see figure 1). Turkey production was valued at $3.69 billion in 2024 (USDA ERS, 2025), and demand for the protein source, especially whole birds, is highly seasonal due to the holidays (USDA ERS, 2019; Bir, et al., 2020).

Beyond turkey, 30.1% said they planned to serve pork at their Thanksgiving meal and 24.2% said they planned to serve beef at their Thanksgiving meal. Fewer said they planned to serve fish or seafood (16.3%), a non-meat protein (e.g., tofu, beans) (8.7%), lamb (7.7%), or a non-turkey bird (e.g., duck, goose, game hen) (7.5%). Only 0.9% said they did not plan to serve a protein source at their Thanksgiving meal.

Of those respondents who typically celebrate Christmas with a meal, turkey (47.9%), pork (47.5%), and beef (39.9%) were the most common protein sources. 22.8% said they planned to serve fish or seafood, 11.1% said they planned to serve lamb, and 9.8% said they planned to serve a non-turkey poultry option. Only 7.8% said they planned to serve a non-meat protein and 2.8% said they did not plan to serve any protein at their Christmas meal.

While there has been particular concern relating to beef prices, demand for beef remains high (e.g., Earnest, 2025; Speer, 2025; Polansek, et al., 2025). We do not find evidence that beef prices have dampened demand or consumer interest in serving beef at their holiday meals. Relative to prior years, we find that holiday plans to serve beef increased for both Thanksgiving (18.8% in 2023 vs. 24.2% in 2025) and Christmas (34.4% in 2023 vs. 39.9% in 2025) (farmdoc daily, November 2023; December 2023).

Holiday Blues? US Consumers’ Responses to Food Price Concerns

We find that this year, 69.0% of respondents said they expect food prices to affect their meal plans. This is in line with concerns with food price inflation specifically during the 2022 and 2023 winter holiday seasons (61.1% and 67.9%, respectively) (farmdoc daily, December 7, 2022; December 2023).

To better understand how food prices may affect holiday meals, we asked respondents who expect prices to affect their meals what behaviors, if any, they expect to change due to food prices. Table 1 shows these results. The two most commonly reported strategies were shopping for deals on ingredients (45.5%) and shopping ahead of time to spread out ingredient costs (42.1%). These are common strategies for consumers managing food prices. GFAPS found these were also the most common strategies reported as responses to food price inflation during the 2022 and 2023 winter holiday seasons (farmdoc daily, December 7, 2022; December 2023). Beyond shopping for deals and shopping early, over 25% of those who expected food prices to affect their holiday meals said they will reduce the number of foods served, the amount of food served, and change the types of food served. Particularly relevant to stakeholders in the livestock industry, 24.5% of those who expect their holiday meals to be affected by food prices reported they will reduce the amount of meat served. The least common strategies were to cancel the meal completely (9.4%) or to ask guests to pay a portion of the grocery bill (10.9%). Meal cancelations amongst those concerned about food prices were slightly higher this year than in previous years (farmdoc daily, December 7, 2022; December 2023).

Table 1. How Respondents Who Expect Food Prices to Affect Their Holiday Meal Plan to Respond

| Shop for deals on holiday ingredients | 45.5% |

| Shop ahead of time for holiday ingredients to spread out the cost | 42.1% |

| Reduce the number of foods served at holiday meals | 30.1% |

| Reduce the amount of food served at holiday meals | 29.7% |

| Change the types of foods served at holiday meals | 26.3% |

| Reduce the amount of meat served at holiday meals | 24.5% |

| Reduce amount purchased from restaurants for holiday meals | 21.9% |

| Increase the amount of foods guests bring for the holiday meal | 20.9% |

| Increase use of a food bank or food pantry to get ingredients for holiday meals | 20.7% |

| Reduce the number of guests at holiday meals | 20.0% |

| Increase use of government food assistance to get ingredients for holiday meals | 19.8% |

| Ask guests to pay a portion of the grocery bill for holiday meal | 10.9% |

| Plan to cancel the holiday meal completely | 9.4% |

| Other | 1.1% |

Note: Potential responses were only asked of those who expect food prices to affect their holiday meal (n=661). Respondents could select multiple strategies, thus options will not sum to 100%.

While the majority of respondents expected food prices to affect their holiday meal this year, the concern was much higher for respondents who utilize nutrition programs. We find that 82.4% of respondents who reported utilizing a nutrition program (e.g., SNAP, WIC, free or reduced-price school meals) expected food prices to affect their holiday meals, compared to 62.2% of those who do not use nutrition assistance programs.

While many of the responses to prices described were reported at similar rates across respondents who use and do not use nutrition assistance programs, three responses were significantly more likely to be reported by those using nutrition assistance programs than those who do not. Specifically, those who use nutrition assistance programs were significantly more likely to report increasing use of a food bank or food pantry to get ingredients for holiday meals (30.5% versus 14.2%), increase use of government food assistance to get ingredients for holiday meals (31.2% versus 12.2%), and ask guests to pay a portion of the grocery bill for holiday meal (13.9% versus 8.9%). These results are in line with recent reports that food pantries have seen increased demand associated with temporary lapses in SNAP and the holiday season (e.g., Ebanks, 2025).

Conclusions

The holiday season, which brings substantial increases in food spending for both food at home and food away from home (Sinclair and Zeballos, 2025), is here. Consumers’ decisions at restaurants and grocery stores during this season have implications for farmers and ranchers. In this article, we review results from the most recent wave of the GFAPS, conducted in November 2025, evaluating what proteins consumers say they’re serving for major winter holidays and how consumers feel about holiday meal food prices.

First, we find that demand for many holiday favorites (e.g., turkey) remains strong, and despite recent discussions of beef prices (see e.g., Earnest, 2025; Speer, 2025; Polansek, et al., 2025), a larger share of consumers report planning to serve beef at their holiday meals relative to prior years. Second, we find that 69.0% of respondents who typically celebrate a winter holiday meal expect food prices to affect their plans. The most common ways consumers planned to adapt to high prices were shopping for deals and shopping early. Finally, as some nutrition programs experienced significant upheaval during the federal government shutdown (e.g., Mulvihill and Lieb, 2025), we review how respondents who use nutrition programs say their meals will be affected. Of those who use any nutrition program, over 82.5% said they expect food prices to affect their holiday meals. These households are more likely to seek out food banks to help manage the costs of their holiday meals, which are struggling to keep up with consumer demand (Ebanks, 2025).

References

Ayoub, S. and F. Parum, “Thanksgiving Dinner Cost Analysis: Moderate Decline.” American Farm Bureau Federation. November 19, 2025. https://www.fb.org/market-intel/thanksgiving-dinner-cost-analysis-moderate-decline

Bir, C. L., N.J. Olynk Widmar, M.K. Davis, M.A. Erasmus, and S. Zuelly. (2020). “Willingness to pay for whole turkey attributes during Thanksgiving holiday shopping in the United States.” Poultry Science, 99(5), 2798–2810. https://doi.org/10.1016/j.psj.2019.12.047

Ebanks, G. “At some food banks, surging demand means a struggle to feed families.” CNN Business. November 27, 2025. https://www.cnn.com/2025/11/27/business/thanksgiving-food-banks-strained

Earnest, B. “U.S. Beef Attracts More Customers Than It Can Handle.” CoBank. August 25, 2025. https://www.cobank.com/knowledge-exchange/animal-protein/us-beef-attracts-more-customers-than-it-can-handle

Kalaitzandonakes, M., B. Ellison and J. Coppess. "Inflation on Holiday Menus: How US Consumers Are Responding to Rising Food Prices This Holiday Season, Gardner Survey Panel 3, Part 2." farmdoc daily (12):184, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 7, 2022. https://farmdocdaily.illinois.edu/2022/12/inflation-on-holiday-menus-how-us-consumers-are-responding-to-rising-food-prices-this-holiday-season-gardner-survey-panel-3-part-2.html

Kalaitzandonakes, M., J. Coppess and B. Ellison. "Eat, Drink, and Be Merry? How US Consumers Expect Inflation to Impact their Holiday Meals." farmdoc daily (13):227, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 14, 2023. https://farmdocdaily.illinois.edu/2023/12/eat-drink-and-be-merry-how-us-consumers-expect-inflation-to-impact-their-holiday-meals.html

Mashange, G. and M. Kalaitzandonakes. "Inflation and Food Price Update: May 2025." farmdoc daily (15):92, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 19, 2025. https://farmdocdaily.illinois.edu/2025/05/inflation-and-food-price-update-may-2025.html

McKevitt, F. “Grocery price rises slow as retailers roll out festive deals.” Kantar. November 11, 2025. https://www.kantar.com/uki/inspiration/fmcg/2025-wp-grocery-price-rises-slow-as-retailers-roll-out-festive-deals

Mulvihill, G. and D.A. Lieb. “States scramble to send full SNAP food benefits to millions of people after government shutdown ends.” November 13, 2025. https://apnews.com/article/government-shutdown-snap-food-states-6cef598c92000bdff8384a9da1bfd23c

Polansek, T., T. Hunnicutt, and C. Pitas. “Trump says his administration is working on lowering beef prices.” Reuters. October 17, 2025. https://www.reuters.com/business/trump-says-his-administration-is-working-lowering-beef-prices-2025-10-16/

Sinclair, W. and E. Zeballos. “From holiday feasts to new-year savings, U.S. food sales shift with the seasons.” US Department of Agriculture’s (USDA) Economic Research Service (ERS). https://ers.usda.gov/data-products/charts-of-note/chart-detail?chartId=110900

Speer, N. “Beef demand signal loud and clear.” Beef Magazine. November 23, 2025. https://www.beefmagazine.com/market-news/beef-demand-signal-loud-and-clear

Swanson, M., R. Wenzel, and C. Schmidt. “Wells Fargo Thanksgiving Report.” Wells Fargo. 2025. https://www.wellsfargo.com/com/insights/agri-food-intelligence/thanksgiving-food-report/

USDA (US Department of Agriculture). Economic Research Service. “Turkey Sector: Background & Statistics.” November 18, 2025. https://www.ers.usda.gov/newsroom/trending-topics/turkey-sector-background-statistics

USDA (US Department of Agriculture). Economic Research Service. “Talking Turkey.” December 11, 2019. https://www.usda.gov/about-usda/news/blog/talking-turkey

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.