Controlling Costs with Lower Crop Revenues: Machinery Costs

This is the fourth in a five part series in controlling costs on grain farms. Previous posts are available here, here, and here.

Capital expenditures on grain farms increased over the past several years. These higher capital expenditures are one of the main factors leading to higher machinery-related costs that are occurring on grain farms. Now that crop revenues have declined, capital expenditures on grain farms also need to decline. In addition, other measures may be required to lower machinery-related costs.

Power Costs on Grain Farms

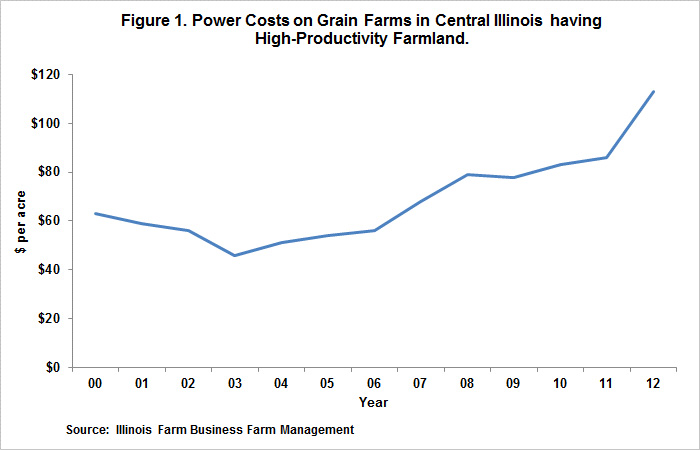

Illinois Farm Business Farm Management (FBFM) reports machinery-related costs as power costs. Power costs include machinery hire (payment for field operations such as spraying), utilities, repairs, fuel and oil, and depreciation. Between 2000 and 2006, power costs on central Illinois farms with high-productivity farmland were relatively stable, averaging $57 per acre across those years (see Figure 1). Since 2006, power costs have increased dramatically: $56 per acre in 2006, $68 in 2007, $79 in 2008, $78 in 2009, $83 in 2010, $86 in 2011, and $113 in 2012. Between 2006 and 2012, power costs increased by $57 per acre, a doubling of power costs over the period.

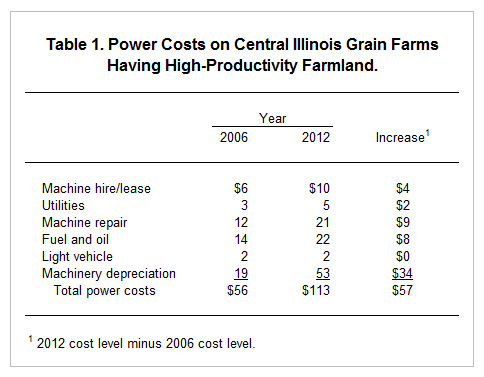

Table 1 shows how the components of power costs changed between 2006 and 2012. Except for light vehicle, all cost categories increased. Between 2006 and 2012, machine hire costs increased by $4 per acre, utility costs increased by $2 per acre, machinery repairs increased by $9 per acre, fuel and oil increased by $8 per acre, and machinery depreciation increased by $34 per acre. By far, the cost with the largest increase was depreciation, accounting for 60% of the $57 power cost increase between 2006 and 2012.

The increase in machinery purchases is fundamentally related to higher capital purchases, which on grain farms are predominately machinery purchases. In the early 2000s, capital purchases averaged near $40 per acre. In 2011 and 2012, capital purchases averaged over $100 per acre (see the farmdoc Daily post Planning for a Lower Revenue 2013).

A number of factors may have attributed to the increase in capital expenditures. Global Positioning System and variable rate technologies were introduced in recent years, likely leading to purchases of new equipment. Equipment prices also rose dramatically during the past six years. While these were important factors, likely the most important factor was higher commodity prices. Since 2006, commodity prices increased from 1975-2005 levels, with particularly high commodity prices occurring between 2010 and 2012. These higher prices then resulted in higher incomes, with higher incomes providing funds for machinery purchases. Moreover, there was a desire to shelter income from taxes, leading to machinery purchases because the purchase price of equipment could provide large amounts of taxable income reduction through accelerated depreciation methods and section 179 expensing.

Machinery depreciation results from these higher capital expenditures. Capital expenditures are not expensed immediately, but are “depreciated” over time to match the services offered by the machine. The machinery depreciation numbers presented above are based on economic depreciation mehtods. Economic methods contrasts to tax depreciation, which have offered options to more quickly expense capital expenditures through accelerated depreciation methods and section 179 expensing. Generally, economic methods more closely match the life and services offered by equipment. As a result of using economic methods, machinery depreciation will remain high for a number of years because of previous high levels of capital expenditures.

Reducing Power Costs

Now that crop revenues have decreased, reducing capital expenditures from over $100 per acre level back near $40 per acre range is important. Previous experience suggests that lower capital expenditures may be difficult (see a Federal Reserve study authored by Henderson and Kauffman for more detail). During the 1970s, farm incomes increased, leading to increases in capital expenditures. When farm incomes declined in the 1980s, a commensurate decline in capital expenditures did not occur immediately The lagged response of lowering capital expenditures contributed to some of the financial stress occurring in the 1980s.

Other measures to lower power costs include:

- Making sure that a combine is used over the proper amount of acres. Combine costs often are the lowest when a combine is used to harvest between 3,000 and 4,000 acre.

- Making sure that the proper amount of equipment is maintained. All equipment owned by a farm should be used fully. Often, differences in equipment costs between farms are related to the number of tractors that exist on a farm.

- Making sure that only needed tillage practices are performed. After harvesting, tillage is often the highest cost field operations. Limiting the number of tillage operations will lower power costs.

Summary

Machinery related costs increased between 2006 through 2012. Now that crop revenues have decreased, the elevated capital expenditure levels occurring from 2010 through 2012 need to be reduced. Other means of lowering machinery costs also may have to be undertaken.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.