Decline and Fall of Crop Prices; Perspectives for Policy Design, Not Panic

The marketing year for corn and soybeans is ending with steep declines in market prices, falling due to the expectations for bumper crops (see, farmdoc daily, August 19, 2024; USDA, August 12, 2024; Hanrahan, August 13, 2024; Hanrahan, July 10, 2024). Farmers have been here before; low crop prices are one of the primary risks that farmers must manage to survive and succeed. Because declining crop prices present real challenges to farm income, panic is not an option for farmers. Panic is, however, a worn-out ploy of political actors that might tempt some because Congress is unlikely to reauthorize the Farm Bill this year. This article offers perspectives on falling prices for reasoned policy design and deliberation, neither downplaying nor diminishing the real-world challenges that result from falling crop prices.

Background

Futures prices for the major row crops have been falling over the course of this crop year as generally favorable growing conditions in much of the country have created expectations for a bumper harvest, possibly record production (see, farmdoc, markets; see, farmdoc daily, August 19, 2024; USDA, August 12, 2024; Hanrahan, August 13, 2024; Hanrahan, July 10, 2024). Falling crop prices are one of the primary risks that farmers must manage to survive and succeed. Low prices present real challenges to farm income; they are arguably most problematic when basic input costs (e.g., seed, chemicals, fertilizer, fuel, and cash rent) that farmers sink into the ground with planted seeds remain high after prices fall (see e.g., farmdoc daily, July 30, 2024; July 9, 2024; June 25, 2024; June 18, 2024; May 1, 2024; April 30, 2024; April 26, 2024; September 26, 2023). Importantly, farmers have a range of marketing options available with which to manage price risks to farm incomes, such as whether to sell the crop promptly after harvest (for cash and likely at the lowest price point) to storing it for marketing throughout the post-harvest months (see e.g., farmdoc daily, September 9, 2020; December 8, 2023; December 15, 2023; December 18, 2023; January 5, 2024; January 12, 2024; see also, Janzen, Paulson, Tsay, 2023, Leibold, Hofstrand, and Wisner, March 2022).

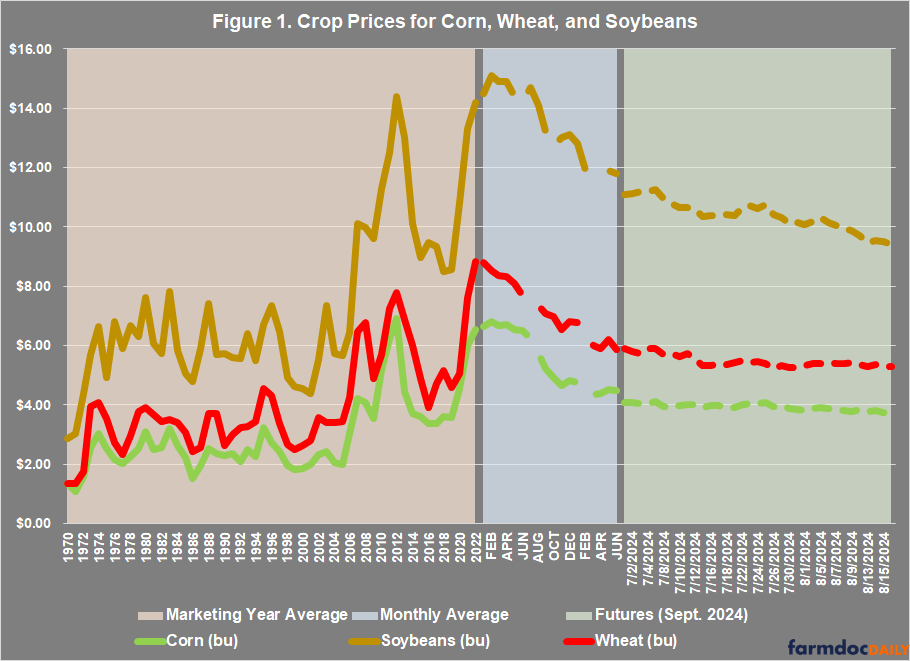

For perspective, Figure 1 illustrates crop prices for corn (green), soybeans (brown), and wheat (red), representing over 70% of the total acres planted to all field crops in the U.S. From 1970 to 2022, Figure 1 illustrates the Marketing Year Average (MYA) for these crops; MYA is the national average price received by farmers during the marketing year, which runs from September to August for corn and soybeans, and from June 1 to May 31 for wheat (see, 7 U.S.C. §1301). From January 2023 to June 2024, Figure 1 next presents the monthly average prices received by farmers as reported by USDA (USDA-NASS, Quick Stats). Finally, Figure 1 illustrates the futures prices for the September 2024 contract for these crops from July 1 to August 16, 2024 (see, farmdoc, markets).

In the simplest terms, farmers sell their harvested crops based on futures prices. The prices the farmer received are used to calculate national monthly average prices and the MYA. It is the MYA that Congress designed into the calculations for farm program payments in the Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC) programs (see, 7 U.S.C. §§9011, 9016, and 9017).

Discussion

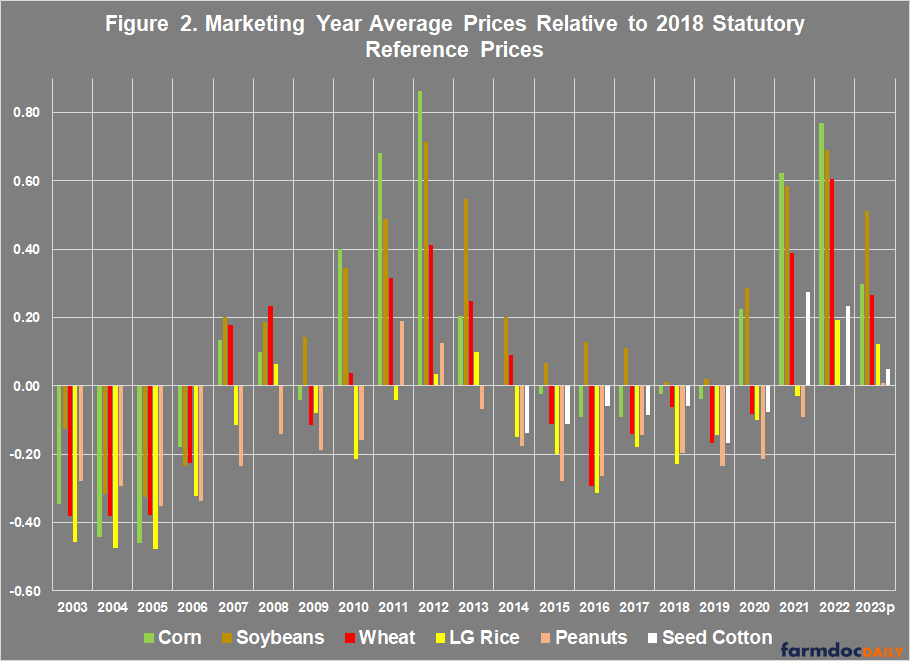

The current drop in crop prices exposes fundamental flaws in farm policy design, particularly PLC. Congress has designed PLC using a fixed threshold for payments—the effective reference price—to be made when MYA prices are below the threshold. This design creates a single nationwide price. It is a one-size-fits-all policy design—a national MYA compared to a single fixed reference price—for all farmers with base acres of each program crop. Figure 2 provides a measure of the performance of this policy design since it was recreated in the 2002 Farm Bill, illustrating MYA prices from 2003 to 2023 relative to the 2018 statutory reference prices for the major program crops; note that the data for seed cotton is limited because Congress created that program crop in 2018 (see e.g., farmdoc daily, February 14, 2018; May 13, 2021). This offers an apples-to-apples comparison for crops with different prices and units of production (yield): when the bars are negative, MYA prices are below the 2018 reference prices; the further from zero, the greater the difference between MYA and the 2018 reference prices.

Congress also uses the MYA for ARC payment calculations (e.g., in the actual revenue calculations as multiplied by county average or whole farm average yields, and in the 5-year Olympic moving averages used for the benchmark). For both programs, using the MYA delays payments by a year. For budget reasons, Congress has further shifted payments until after October 1 or the beginning of the federal fiscal year. For the farmer, this means that any payments for lower prices or revenues are not received until a year or more after harvest. Note that USDA estimates that almost all of the harvested corn and soybean crops have been marketed by June (88% and 92%, respectively) of each year (see, USDA-ERS, “Season-Average Price Forecasts”; Hart, January 2021). A consequence of this is that the recent downturn in prices is less likely to impact the 2023 MYA and trigger payments this fall because monthly average prices, while falling, have remained above the reference prices (see e.g., farmdoc daily, August 13, 2024; USDA-FSA, “ARC/PLC Program Data”).

At best, this design approximates the losses a farmer may have received while marketing the harvested crop, although payments are decoupled from actual production and the farmer may not have produced and sold the crop for which payments are made (see e.g., farmdoc daily, May 16, 2024; July 18, 2024). In other words, if payments are made, they are made a year after harvest, possibly on crops that were not planted, harvested, or sold. Payment calculations use a one-size-fits-all national average price per crop and, in the case of PLC, compares that to a price threshold fixed in statute by Congress years earlier. Considering the critical flaws in this policy design it may be surprising that the recent Farm Bill reauthorization has been blocked largely due to demands to double down on this design and increase reference prices; a bet expected to cost over $30 billion during the next ten years but that will not help farmers at all with the current decline in crop prices (see e.g., farmdoc daily, August 8, 2024; June 6, 2024; May 21, 2024). This begs many questions about farm policy design, not the least of which being whether Congress could or has considered alternative designs that might work better for farmers.

Almost the entire history of American farm policy has been an effort to fix thresholds for paying farmers when prices are considered low. Today’s reference prices are rooted in the fixed (90%) parity loan rates first enacted during World War II and the target prices created in 1973 that were recreated in 2002 (Coppess, 2018). The most notable early exception to this policy design was the Agricultural Adjustment Act of 1938 in which Congress enacted a flexible loan rate design that calculated lower percentages of parity when crops were in surplus (P.L. 75-430).

The parity policy design was also notable for incorporating production or input costs into the calculation. Parity loan rates were based on a ratio between crop prices and production costs that was compared to an earlier period of prices and costs, mostly the 1909 to 1914 (pre-World War I) years. This design proved problematic on many levels and eventually gave way to the fixed target price design first enacted by Congress in the 1973 Farm Bill. The parity loan rates were used to support prices on the harvested crop, while target prices and reference prices were used to trigger direct payments to farmers when prices were below the fixed levels; USDA calculated the parity prices, while Congress writes in target/reference prices but doesn’t use costs in the calculations (see e.g., farmdoc daily, May 29, 2024).

The many failings of the parity design include the substantial challenges inherent in using costs to calculate farm payments (see e.g., farmdoc daily, May 16, 2019; September 15, 2022; September 22, 2022; October 6, 2022). The primary costs of production are for seeds, chemicals (herbicides, insecticides, and fungicides), fertilizers, and for cash rent; fuel costs can also be included here, although fuel usage would not be exclusive to crop production. These costs are mostly booked prior to planting, sometimes well in advance of planting, or incurred during the growing season. Because payments are made more than a year after any costs are incurred on a crop that may or may not have been planted, tying payments to these costs in some form or fashion could keep costs high while prices fall, which has long been recognized as presenting the potential for bad medicine that could harm farmers rather than help (see e.g., farmdoc daily, August 31, 2023; May 16, 2024; July 18, 2024). For example, large payments in October could influence input prices booked in the fall, such as fertilizer and cash rents, because input companies and landlords have less reason to adjust to the lower prices. The more the payments are connected to costs, the bigger this problem would be. It could be particularly troublesome in the wake of the recent spike in costs if it kept them elevated as prices decline.

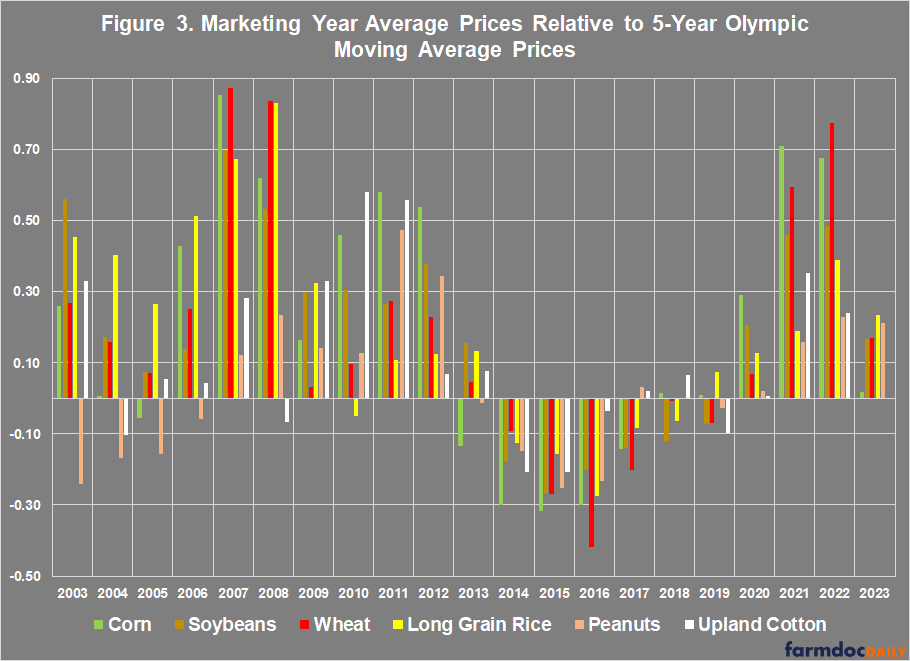

By comparison, Congress created ARC in the 2014 Farm Bill which provides payments using a revenue threshold set at 86% of the five-year Olympic moving average (dropping the highest and lowest) of marketing year average prices and either county average yields or individual whole farm yields (P.L. 113-79). The ARC program was preceded by revenue assistance programs in the 2008 Farm Bill (P.L. 110-234). Congress also added a limited adjustment to the reference price (85% of the five-year Olympic moving average of marketing year average prices up to 115% of the statutory reference price) in the 2018 Farm Bill (P.L. 115-334; see also, farmdoc daily, October 5, 2023; July 6, 2022; June 29, 2022; February 21, 2019). Figure 3 provides a measure of the performance of the Olympic moving average design by comparing MYA prices from 2003 to 2023 to the five-year Olympic moving average used in the ARC benchmark and effective reference price calculations. Negative bars are years in which the MYA was lower relative to the 5-year Olympic moving average. Note that upland cotton prices are used due to the change in cotton policy during this timeframe.

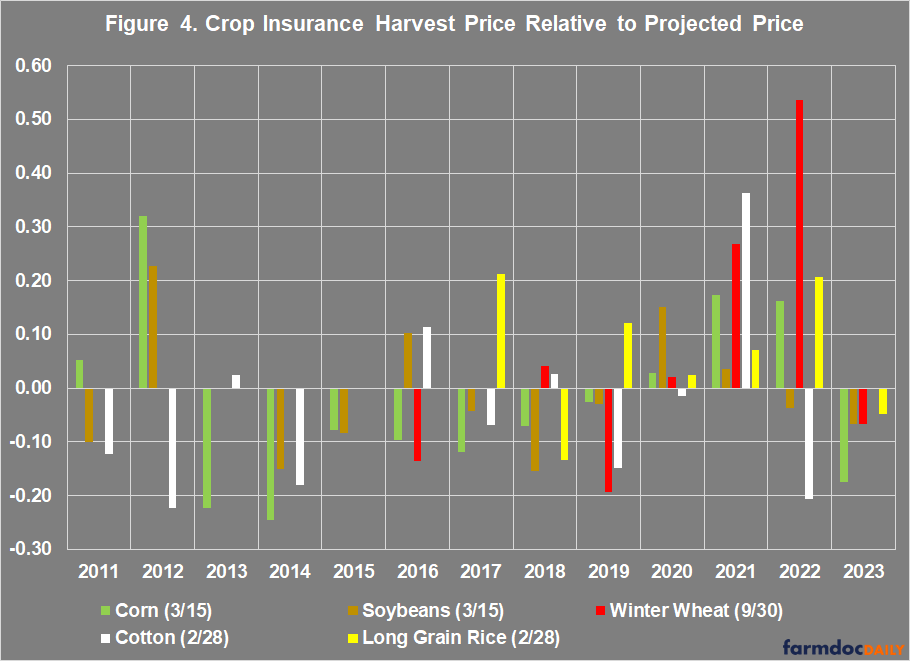

Finally, crop insurance represents the most notable exception to the fixed-price policy design. Congress created crop insurance in the 1938 Act to help with wheat production risks, adding revenue-based policies in the 1990s and the Agriculture Risk Protection Act of 2000 (P.L. 103-354; P.L. 106-224; see also, GAO/RCED 98-111; Glauber, 2013; Goodwin and Ker, 1998). Unlike ARC and PLC, crop insurance uses averages of futures prices to establish a projected price and harvest price for each crop (USDA-RMA, Commodity Exchange Price Provisions; Price Discovery). In general, this provides some level of in-season price risk management with possible assistance for price declines during the growing season, between planting decisions and harvest (see e.g., farmdoc daily, March 4, 2024; February 13, 2024; November 1, 2023; October 10, 2023). Figure 4 compares the harvested price relative to the projected price for select crops as reported by USDA’s Risk Management Agency in the Price Discovery tool (USDA-RMA, Commodity Exchange Price Provisions; Price Discovery). Negative bars indicate years in which the harvest price was less than the projected price.

Concluding Thoughts

Crop prices are on a steep downward trend at the end of the marketing year, largely the result of expectations for huge harvests. At the same time, Congress has made no progress on reauthorizing the Farm Bill and an extension of current policies appears the most probable outcome. The confluence of the two exposes fundamental flaws in farm policy design and the political demands that have contributed to the impasse. When crop prices were high, the demand was for an increase in the reference price thresholds used to trigger and calculate program payments; now that prices are falling, political pressure for the same increase in reference prices is likely to be ratcheted up. While panic is not an option for farmers, it is a well-worn political ploy; stoking it provides tactical means for avoiding scrutiny and stifling deliberation, seeking to drown out Madison’s “mild voice of reason” in order to achieve narrow factional ends (Madison, The Federalist, No. 42; farmdoc daily, January 5, 2023). This decline and fall of market prices expose critical shortcomings in farm policy design, as well as the tactics deployed in service of these one-size-fits-all designs, neither of which have adjusted to the changing circumstances.

Low crop prices are one of the primary risks that farmers must manage to survive and succeed. Price risk is second only to the in-season weather risks to crop production and both present real challenges to farm income. Perspectives on the myriad shortcomings of farm policy design neither downplay nor diminish real-world challenges for farmers. Payments are decoupled and delayed, made long after any costs are incurred or a crop harvested and sold; significant payments, moreover, are made on crops that were not planted. Given price trends, one of the worst things a policy could do would be to prolong the inflated costs farmers sink into the ground with the planted seed—cost risks that could outlast payments. Designing policies that help farmers in the short term without harming them in the long run is a difficult task. Neither farmers nor taxpayers are well-served by anything that makes it more difficult and contributes to furthering flawed policy designs or making them worse.

References

Coppess, J. "Budgetary Dissonance and the 2024 House Farm Bill." farmdoc daily (14):106, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 6, 2024.

Coppess, J. "Considering Congress, Part 3: A “Republican Remedy” to the Mortal Disease." farmdoc daily (13):2, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 5, 2023.

Coppess, J. "Considering Policy Reversion: The Parity Paradox." farmdoc daily (9):90, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 16, 2019.

Coppess, J. "Farm Bill 2023: Don’t Look Now, but Reference Prices Will Increase." farmdoc daily (13):182, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 5, 2023.

Coppess, J. "Farm Bill 2024: A Mid-Summer’s Review." farmdoc daily (14):133, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 18, 2024.

Coppess, J. "Reviewing the Congressional Budget Office Score of the House Farm Bill." farmdoc daily (14):147, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 8, 2024.

Coppess, J. and J. Hutchins. "Farm Bill 2023: Is There Bad Medicine in Base Acres and Reference Prices?" farmdoc daily (13):158, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 31, 2023.

Coppess, J., G. Schnitkey, N. Paulson, B. Sherrick and C. Zulauf. "Reference Price Disparities & Why It Matters to Farmers." farmdoc daily (14):93, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 16, 2024.

Coppess, J., J. Janzen, C. Zulauf, G. Schnitkey, K. Swanson, N. Paulson and J. Baltz. "Mulling Over Margin, Part 1: Introduction and Historical Background." farmdoc daily (12):142, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 15, 2022.

Coppess, J., J. Janzen, K. Swanson, N. Paulson, C. Zulauf and G. Schnitkey. "Mulling Over Margin, Part 2: the “Elusive” Cost of Production." farmdoc daily (12):146, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 22, 2022.

Coppess, J., N. Paulson, G. Schnitkey and C. Zulauf. "Farm Bill Round 1: Dairy, Cotton and the President’s Budget." farmdoc daily (8):25, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 14, 2018.

Coppess, Jonathan. The Fault Lines of Farm Policy: A Legislative and Political History of the Farm Bill (Lincoln: University of Nebraska Press, 2018). https://www.nebraskapress.unl.edu/nebraska/9781496212542/the-fault-lines-of-farm-policy/.

Franken, J. and J. Janzen. "Insights for Supply, Ending Stocks, and Prices from FSA Acreage Data." farmdoc daily (14):152, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 19, 2024.

Glauber, Joseph W. "The growth of the federal crop insurance program, 1990—2011." American Journal of Agricultural Economics 95, no. 2 (2013): 482-488. https://www.jstor.org/stable/23358421.

Goodwin, Barry K., and Alan P. Ker. "Revenue insurance: a new dimension in risk management." Choices 13, no. 4 (1998): 24-27. https://www.jstor.org/stable/43625070.

Hanrahan, R. “Grain prices hitting lowest levels since 2020.” Successful Farming, July 10, 2024. https://www.agriculture.com/grain-prices-hitting-lowest-levels-since-2020-8675761

Hanrahan, R. “USDA Projects Record Soybean, Corn Yields.” Farm Policy News, August 13, 2024. https://farmpolicynews.illinois.edu/2024/08/usda-projects-record-soybean-corn-yields/

Hart, Chad E. “USDA’s Season-Average Commodity Prices.” Iowa State University, Extension and Outreach, Ag Decision Maker, File A2-15. Updated January 2021. https://www.extension.iastate.edu/agdm/crops/html/a2-15.html.

Janzen, J. "Post-Harvest Grain Marketing: Comparing Observed Prices and Marketing Outcomes." farmdoc daily (14):9, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 12, 2024.

Janzen, J. "Post-harvest Grain Marketing: Do Farmers Reap the Benefits?" farmdoc daily (14):4, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 5, 2024.

Janzen, J. "Post-Harvest Grain Marketing: How Important Is It?" farmdoc daily (13):223, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 8, 2023.

Janzen, J. "Post-harvest Grain Marketing: Store and Ignore Versus Market Responsive Farms." farmdoc daily (13):228, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 15, 2023.

Janzen, J. and J. Coppess. "Mulling Over Margin, Part 3: Chasing the Cost of Production Across Regions." farmdoc daily (12):152, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 6, 2022.

Janzen, Joseph P., Nicholas D. Paulson, and Juo‐Han Tsay. "Commodity storage and the cost of capital: Evidence from Illinois grain farms." American Journal of Agricultural Economics 106, no. 2 (2024): 526-546. https://doi.org/10.1111/ajae.12436.

Leibold, Kelvin, Don Hofstrand, and Robert Wisner. “Crop Marketing Terms.” Iowa State University, Extension and Outreach, Ag Decision Maker, File A2-05. Updated March 2022. https://www.extension.iastate.edu/agdm/crops/html/a2-05.html.

Madison, James. “The Powers Conferred by the Constitution Further Considered.” The Federalist No. 42. January 22, 1788. Available from the Library of Congress, https://guides.loc.gov/federalist-papers/text-41-50#s-lg-box-wrapper-25493406.

Mashange, G., G. Schnitkey and B. Zwilling. "Solvency Trends for Illinois Grain Farms: The Distribution of Debt-to-Asset Ratios by Gross Farm Returns." farmdoc daily (14):80, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 26, 2024.

Paulson, N., C. Zulauf and G. Schnitkey. "ARC and PLC Payment Prospects for 2023 and 2024." farmdoc daily (14):149, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 13, 2024.

Paulson, N., C. Zulauf and G. Schnitkey. "Trends in Input Costs for Corn and Soybean Production in Illinois." farmdoc daily (14):82, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 30, 2024.

Paulson, N., G. Schnitkey and B. Sherrick. "2023 Harvest Prices and Revenue Insurance Payments for Corn and Soybeans." farmdoc daily (13):200, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 1, 2023.

Paulson, N., G. Schnitkey and B. Sherrick. "Potential Crop Insurance Payments for 2023." farmdoc daily (13):185, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 10, 2023.

Paulson, N., G. Schnitkey and C. Zulauf. "Revised 2024 Illinois Crop Budgets." farmdoc daily (14):118, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 25, 2024.

Paulson, N., G. Schnitkey and C. Zulauf. "Where Might Nitrogen Fertilizer Prices Be Headed?" farmdoc daily (14):114, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 18, 2024.

Paulson, N., G. Schnitkey, C. Zulauf and R. Batts. "First Look at Crop Insurance Decisions for 2024." farmdoc daily (14):30, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 13, 2024.

Paulson, N., G. Schnitkey, C. Zulauf, J. Colussi and J. Baltz. "The Rising Costs of Corn Production in Illinois." farmdoc daily (13):175, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 26, 2023.

Schnitkey, G., B. Zwilling, N. Paulson, C. Zulauf, B. Rhea and J. Baltz. "Increasing Pessimism About 2024 and 2025 Corn and Soybean Returns." farmdoc daily (14):141, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 30, 2024.

Schnitkey, G., J. Coppess, N. Paulson, B. Sherrick and C. Zulauf. "Spending Impacts of House Proposal for Commodity Title Changes." farmdoc daily (14):96, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 21, 2024.

Schnitkey, G., N. Paulson and C. Zulauf. "Corn and Soybeans Economics in 2024 and 2025: Back to the New (Old) Normal?" farmdoc daily (14):126, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 9, 2024.

Sherrick, B., G. Schnitkey and N. Paulson. "Crop Insurance Decisions for 2024." farmdoc daily (14):44, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 4, 2024.

U.S. Dept. of Agric., Economic Research Service. “Season-Average Price Forecasts.” Updated August 13, 2024. https://www.ers.usda.gov/data-products/season-average-price-forecasts/.

U.S. Dept. of Agric., Farm Service Agency. “ARC/PLC Program Data.” https://www.fsa.usda.gov/programs-and-services/arcplc_program/arcplc-program-data/index.

U.S. Dept. of Agric., NASS, “Crop Production.” August 12, 2024. https://downloads.usda.library.cornell.edu/usda-esmis/files/tm70mv177/4b29cz98b/9593wm26b/crop0824.pdf.

U.S. General Accounting Office. “Crop Revenue Insurance: Problems with New Plans Need to Be Addressed.” GAO/RCED-98-111. April, 1998. https://www.gao.gov/assets/rced-98-111.pdf.

Zulauf, C. "Lessons from Marketing Crops for 25 Years." farmdoc daily (13):229, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 18, 2023.

Zulauf, C. and S. Kim. "Corn vs. Soybean Storage at the US Market Level, 1974-2017." farmdoc daily (10):163, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 9, 2020.

Zulauf, C., G. Schnitkey, J. Coppess and N. Paulson. "Are Changes in Cost of Production and Statutory Reference Prices Related in the House Agriculture Committee 2024 Farm Bill?" farmdoc daily (14):101, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 29, 2024.

Zulauf, C., G. Schnitkey, K. Swanson, J. Coppess and N. Paulson. "2024 Farm Bill Dilemma, 1981 Farm Bill, and 2018 Farm Bill Price Support Adjustments." farmdoc daily (12):101, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 6, 2022.

Zulauf, C., G. Schnitkey, K. Swanson, N. Paulson and J. Coppess. "Effective Reference Price – Past and Future." farmdoc daily (12):97, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 29, 2022.

Zulauf, C., G. Schnitkey, N. Paulson and E. Richer. "Fungicides Use in a Lower Price Environment." farmdoc daily (14):83, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 1, 2024.

Zulauf, C., J. Coppess, G. Schnitkey, N. Paulson and K. Swanson. "2018 Farm Bill Reference Price Escalator for 2019 Market Year." farmdoc daily (9):31, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 21, 2019.

Zulauf, C., K. Swanson, G. Schnitkey and N. Paulson. "The Evolving US Cotton Safety Net." farmdoc daily (11):77, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 13, 2021.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.